Live Feed

Today, January 14, 2026

16:19

U.S. Federal Reserve Governor Nellie Liang stated that the spread of stablecoins will further solidify the U.S. dollar's dominant role in the global financial system.

15:30

The Sui team has announced that its mainnet is currently experiencing network delays, which it is actively working to resolve. The team explained that the issue may limit the use of decentralized applications (dApps) such as Slush and SuiScan. Transaction processing speeds may also become significantly slow or temporarily restricted as a result.

15:27

Project Eleven, a company developing solutions to protect the Bitcoin network from quantum computing, has raised $20 million in a Series A funding round led by Castle Island Ventures. The round, which included participation from Coinbase Ventures and Quantonation, valued the company at $120 million. Project Eleven is focused on building quantum-resistant tools and cryptographic standards to safeguard Bitcoin's core Elliptic Curve Cryptography (ECC) from potential threats posed by quantum computers.

15:20

According to news reports, the U.S. Supreme Court did not issue a ruling on the legality of President Donald Trump's universal global tariffs during a scheduled opinion session on Wednesday, Jan. 14.

15:13

According to CoinNess market monitoring, BTC has risen above $97,000. BTC is trading at $97,040.94 on the Binance USDT market.

14:57

Major exchanges have seen $104 million worth of futures liquidated in the past hour. In the past 24 hours, $768 million worth of futures have been liquidated.

14:57

Philadelphia Federal Reserve Bank President Anna Paulson said that a modest additional interest rate cut could be appropriate in the latter half of 2026 if the economy performs in line with expectations, according to Walter Bloomberg.

14:47

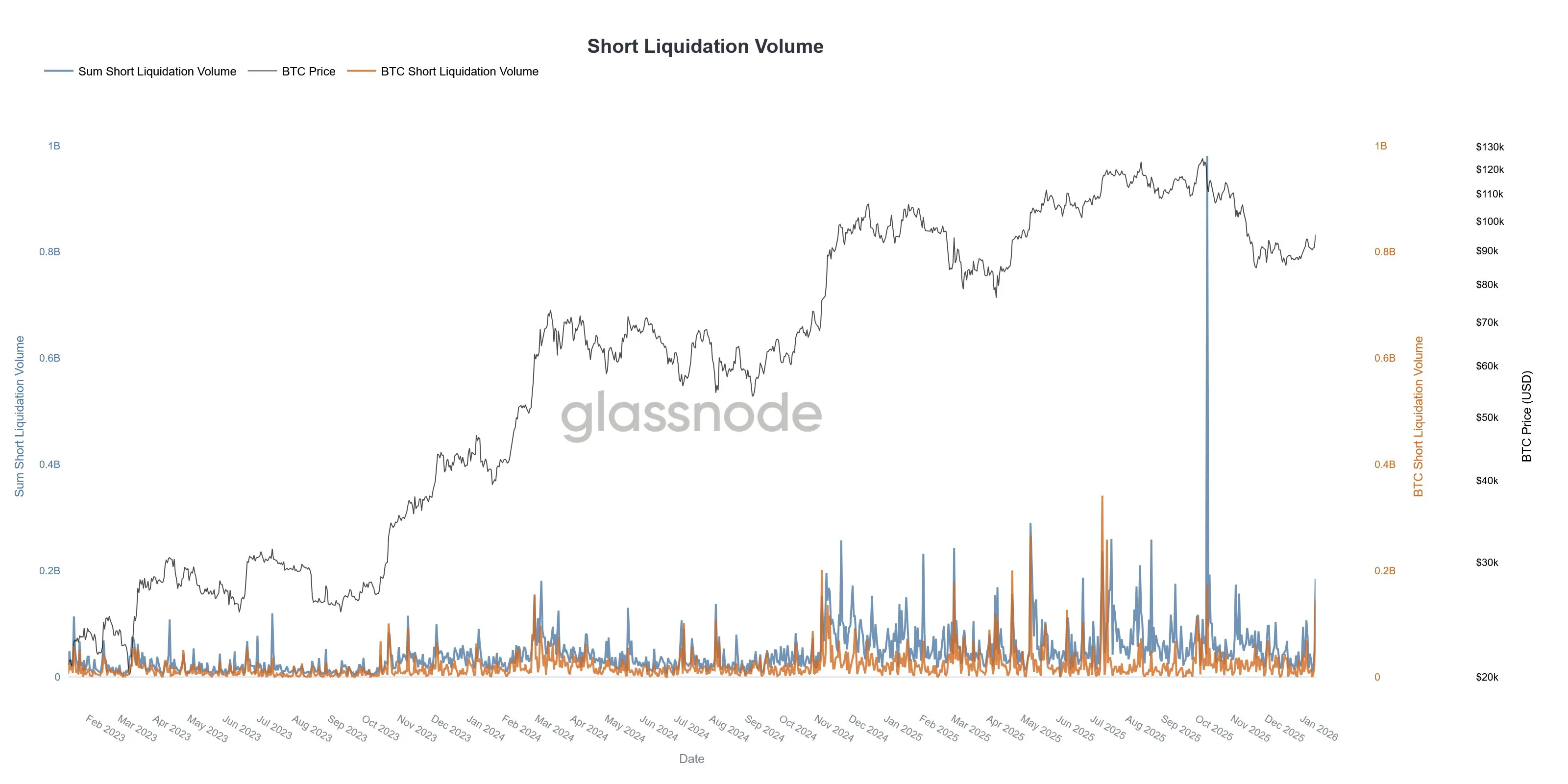

Recent market volatility has triggered the largest short liquidation event across the top 500 cryptocurrencies by market capitalization since the major market crash on Oct. 10, 2025, according to an analysis by Glassnode.

14:43

According to CoinNess market monitoring, BTC has risen above $96,000. BTC is trading at $96,000 on the Binance USDT market.

14:37

The Rhode Island legislature has introduced a bill to exempt small transactions from income tax in an effort to reduce the tax burden associated with everyday Bitcoin use, according to CryptoBriefing. The proposed legislation would make Bitcoin sales and transactions of up to $5,000 per month tax-free and exempt up to $20,000 in annual transactions from income tax. The bill, which defines Bitcoin as a decentralized digital currency based on blockchain technology, aims to provide tax incentives that encourage residents and local businesses to use the cryptocurrency for daily transactions.

14:29

Noise, a developer of a social media trend prediction market platform, has secured $7.1 million in a funding round led by Paradigm. Other participants included Pikement Capital, Anagram, and Kaito AI. The platform allows users to bet on which online topics, such as specific trends, brands, or narratives, will maintain lasting influence, with the goal of measuring their cultural value. Noise has previously tested its betting service using social media data from Kaito and plans to officially launch on the Base blockchain within the next few months.

14:17

Chicago-based derivatives exchange and clearinghouse Bitnomial is launching the first regulated Aptos (APT) futures product in the United States, The Block reported. Trading will initially be available to institutional investors, with plans to later offer the product on its subsidiary retail platform, Botanical. Bitnomial is the first regulated, crypto-native spot and derivatives exchange and clearinghouse in the U.S.

14:08

Web3 infrastructure provider Crossmint has obtained a Crypto-Asset Service Provider (CASP) license from Spain's National Securities Market Commission. The license, certified under the EU's Markets in Crypto-Assets (MiCA) regulation, allows the company to offer its stablecoin infrastructure services across all 27 EU member states. With the CASP license, Crossmint plans to provide services including fiat-to-crypto exchange, cryptocurrency custody, wallets, and cross-blockchain asset transfers.

14:05

Mantra (OM) is undergoing a restructuring that includes layoffs due to cost-related issues, The Block reported. On X, Mantra CEO John Patrick Mullin stated that the company could no longer sustain its current cost structure following the market crash in April of last year, a prolonged market downturn, and intensified competition. While the exact number of layoffs has not been disclosed, the cuts are reportedly focused on the development, marketing, and human resources departments. The total value locked (TVL) in the Mantra ecosystem is currently around $860,000, an 81% decrease from its peak of $4.51 million in February of last year. According to CoinMarketCap, OM is trading at $0.07949, up 2.46% over the past 24 hours.

13:31

The U.S. Producer Price Index (PPI) for November rose 0.2% month-over-month, meeting market expectations, the Department of Labor announced. The PPI is often seen as a leading indicator for the Consumer Price Index (CPI). Separately, the previously delayed October PPI figures were also released, showing a 0.1% month-over-month increase, below the consensus forecast of 0.3%.

13:03

The amount of staked Ethereum (ETH) has surpassed 36 million tokens, representing nearly 30% of the total supply and valued at approximately $118 billion, The Block reported. This new high exceeds the previous record of 29.54% of the supply staked, which was set last July. The Block attributed the increase primarily to active participation from institutions such as Bitmine (BMNR). It also highlighted the growing entry of institutional asset managers, noting that Morgan Stanley is preparing to launch an ETF that includes staking rewards. The publication suggested that as the circulating supply becomes increasingly locked, price volatility could rise during periods of increased demand.

12:44

Tokenized gold accounted for approximately 25% of the growth in the real-world asset (RWA) tokenization market in 2025, Cointelegraph reported, citing a study by CEX.IO. According to the report, the market capitalization of tokenized gold surged 177% over the year, rising from $1.6 billion to $4.4 billion, while an additional 115,000 new wallets were created. Annual trading volume reached $178 billion, making it the second-largest category among global gold investment products. The report noted that the market for tokenized gold grew about 2.6 times faster than that of physical gold and outperformed most major spot gold exchange-traded funds, indicating that gold trading liquidity is increasingly moving to on-chain markets.

11:50

Decentralized perpetual futures exchanges (Perp DEXs) are rapidly eroding the market share of centralized exchanges (CEXs) with their lower fees and greater transparency, Cointelegraph reported, citing a recent Delphi Digital report. According to CoinGecko data, the market share of Perp DEXs grew from just 2.1% in January 2023 to 11.7% by November of the same year. Cumulative trading volume also more than tripled over the course of last year, surging from $4.1 trillion to $12.09 trillion.

Delphi Digital projects that these platforms could evolve beyond simple exchanges into comprehensive financial hubs that act as brokerages, custodians, banks, and clearinghouses. The report noted that Hyperliquid (HYPE) recently built its own lending service, and predicted that competition will accelerate as newer entrants like Aster (ASTER) and Lyra (LIT) join the market.

11:45

A portfolio allocating 15% to gold and Bitcoin significantly outperforms the traditional 60/40 stock-and-bond strategy, according to an analysis by Bitwise. The Block reports that the Sharpe Ratio for the gold and Bitcoin-allocated portfolio is 0.679, nearly three times that of the standard model.

Bitwise noted that this finding supports the effectiveness of Ray Dalio's proposed 15% hedge against a decline in the U.S. dollar's value. The asset manager explained that gold serves a defensive role during market downturns while Bitcoin provides upward momentum during recovery periods, a combination that simultaneously lowers volatility and secures profit opportunities.

11:44

Japanese listed company Metaplanet will be able to issue new shares to purchase more Bitcoin if its stock price increases by another 5%, Coindesk reported. Reaching a price of 637 yen would enable the company to issue up to 210 million new shares, with the proceeds expected to be used primarily for BTC acquisitions. Metaplanet currently holds 35,102 BTC.

11:24

Bybit has announced it will delist the USDT spot trading pairs for six assets—MEMEFI, RACA, ART, SPEC, XCAD, and MYRO—at 8:00 a.m. UTC on Jan. 21.

11:03

Bitwise's Chainlink (LINK) spot ETF, under the ticker CLNK, is scheduled to begin trading on NYSE Arca on Jan. 15, according to Solid Intel. The U.S. Securities and Exchange Commission (SEC) approved the listing on Jan. 6.

10:02

Bitcoin has been showing strength during U.S. market trading hours, a reversal from late last year when selling pressure was concentrated in that same period, CoinDesk reported. According to data from Velo, BTC has gained approximately 8% during U.S. hours and 3% during European hours year-to-date, while experiencing a slight decline during Asian trading hours. CoinDesk noted that this trend is not necessarily driven by U.S. investors, as prices have sometimes risen even with a negative Coinbase Premium, suggesting the influence of broader global investor activity.

09:49

France's Financial Markets Authority (AMF) has warned that it will order companies without a European Union Markets in Crypto-Assets (MiCA) license to cease operations starting in July. According to Cointelegraph, of the roughly 90 crypto firms registered with French authorities, about 40% have no intention of obtaining a license, while another 30% have not responded to official inquiries. France has granted licenses to only a few companies since the full implementation of MiCA.

09:16

An anonymous whale address beginning with 0x46DB0 has withdrawn 2,000 ETH, valued at $6.65 million, from the OKX exchange, according to on-chain analyst ai_9684xtpa. Since Dec. 5 of last year, the address has withdrawn a total of 53,451.6 ETH ($177 million) from exchanges. The whale's average entry price is $3,125.13, resulting in an estimated unrealized profit of $11.06 million.