Live Feed

Today, January 1, 2026

22:27

a16z Crypto has presented its outlook for the digital asset sector, predicting that this year will mark a significant turning point for blockchain applications. The firm highlighted that stablecoins are set to become a core element of global finance, anticipating major shifts in payments, privacy, and blockchain use cases.

21:45

The Flow (FLOW) Foundation is moving forward with a two-stage recovery plan following a hack that resulted in a $3.9 million loss, Cointelegraph reported. The foundation has reportedly abandoned its initial plan for a network rollback due to community opposition and will instead burn the tokens that were created without authorization. Currently, the Flow network has normalized its non-EVM chain, Cadence, and plans to restore its EVM chain within a few days. The report added that the hacker is believed to have stolen 150 million FLOW, approximately 10% of the total supply, and deposited the funds on an exchange suspected to be Binance. The assets were then swapped for BTC and withdrawn. This could potentially lead to scrutiny of the exchange's anti-money laundering and know-your-customer compliance procedures.

21:08

The U.S. Federal Reserve is likely to hold interest rates steady in January as it considers preemptive measures to prevent a liquidity drain, CoinDesk reported. According to the minutes from the December Federal Open Market Committee (FOMC) meeting, the Fed is weighing the purchase of short-term Treasury bills and an expansion of its repo facility. The minutes noted that current liquidity pressures are building faster than during the 2017-2019 quantitative tightening period, prompting the Fed to consider buying $220 billion in short-term Treasurys. The market is now focused on the first FOMC meeting of the year on Jan. 27-28, with the CME FedWatch Tool indicating an 85.1% probability of a rate hold. The prevailing analysis suggests the Fed will prioritize liquidity management over rate cuts.

20:08

Bitcoin's upward momentum could be constrained by activity in the options market, according to an analysis by Cointelegraph. The report notes that as yields on cash-and-carry strategies—which involve buying spot assets while shorting futures—have fallen below 5% annually, investors are increasingly turning to covered calls. This strategy, which involves holding spot BTC while selling call options to generate income, can offer annual returns between 12% and 18% but may suppress the asset's price ceiling.

Evidence of this trend can be seen in Bitcoin's implied volatility (IV) for contracts throughout 2025, which has decreased from 70% to around 45%. Cointelegraph suggests this decline indicates that consistent selling of call options by institutional players has reduced overall market volatility. However, the analysis also points out that there is significant buying demand for call options to counter the selling pressure, and demand for put options to hedge against downside risk remains robust. This dynamic is ultimately viewed as a sign of a maturing market as institutional capital enters to profit from volatility.

19:47

Ethereum (ETH) founder Vitalik Buterin said on X that the dApp ecosystem must be developed to counter failures in centralized infrastructure, such as the recent Cloudflare outage. The incident in November paralyzed approximately 20% of websites globally. Buterin argued that to prevent such events, dApps that are not subject to external pressures must become foundational infrastructure for society. He noted that the crypto industry's ideal of decentralization is being eroded for the sake of convenience and urged the sector to regain its technical independence. Buterin also suggested that the introduction of related futures products could be discussed for the ETH network to enhance the predictability of gas fees.

18:17

The 10 largest cryptocurrency hacks of 2025 resulted in approximately $2.2 billion in losses, according to a report by crypto media outlet The Block. The incidents are summarized below.

1. Bybit, Feb. 21, $1.4 billion: Private key theft and phishing, attributed to the Lazarus Group.

2. Cetus, May 22, $223 million: Liquidity drain exploiting fake tokens and a logic error.

3. Balancer (BAL), Nov. 3, $128 million: Exploitation of a calculation bug in a stablecoin pool.

4. Bitget, April 20, $100 million: Flaw in a market-making bot's logic and price manipulation.

5. Phemex, Jan. 23, $85 million: Hot wallet private key leak.

6. Nobitex, June 18, $80 million: Hot wallet hack and internal data breach.

7. Infini, Feb. 24, $49.5 million: Misuse of smart contract admin privileges.

8. BtcTurk, Aug. 14, $48 million: Hot wallet private key leak.

9. CoinDCX, July 19, $44.2 million: Server intrusion.

10. GMX, July 9, $42 million: Exploitation of a vulnerability in a liquidity provider pool's smart contract.

17:19

Whale Alert reported that 500 million XRP has been locked in escrow at Ripple.

16:17

While altcoin exchange-traded funds (ETFs) are launching rapidly in the United States, they are unlikely to achieve the same level of growth as their Bitcoin counterparts, according to a recent analysis. The Block reported that Ben Slavin, Global Head of ETFs at BNY Mellon, acknowledged accelerating launches and confirmed investor demand for altcoin ETFs. However, Slavin stated it would be difficult for these funds to hold a significant portion of their underlying assets' circulating supply, unlike Bitcoin ETFs, which hold around 7%. He predicted that because altcoin ETFs are sensitive to market trends, short-term demand will fluctuate with price, but long-term investor interest will continue to grow.

Separately, Ripple Labs President Monica Long explained that although more than 40 crypto ETFs have launched this year, their share of the U.S. ETF market remains minimal. She suggested that wider adoption of crypto ETFs could accelerate market participation from corporations and institutions. Long added that large corporations are showing increased interest in financial strategies that use digital assets and in investments in tokenized assets.

16:01

Charles Schwab CEO Rick Wurster stated in a Schwab Network interview that the macroeconomic environment will become more favorable for Bitcoin, despite the recent market downturn. He cited factors such as quantitative easing, the U.S. Federal Reserve's bond-buying program, and weak demand for U.S. Treasurys as key drivers.

13:42

Losses from 26 major cryptocurrency hacking incidents in December totaled approximately $76 million, according to blockchain security firm PeckShield. The figure represents a decrease of over 60% from the $194.27 million lost in November.

13:30

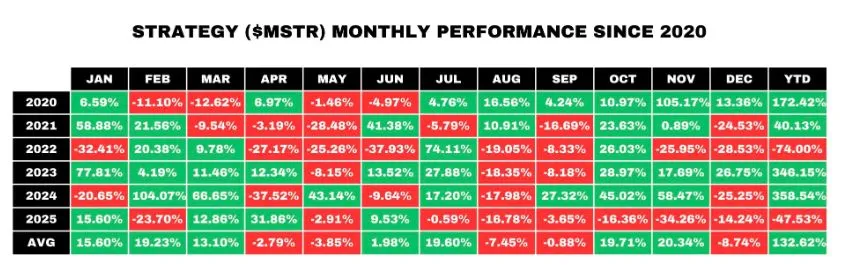

Strategy (MSTR) has recorded its first six-month consecutive stock price decline since adopting its Bitcoin treasury strategy in 2020, CoinDesk reported. Citing monthly return data shared by cryptocurrency analyst Chris Millhas, the report noted that MSTR's stock fell continuously from July to December of last year, with particularly sharp drops in August (-16.78%), October (-16.36%), November (-34.26%), and December (-14.24%). In contrast, Bitcoin's performance was more resilient over the same period, with a six-month decline of 27.36%. Millhas observed that while Strategy's stock has historically rebounded quickly after major drops, the current prolonged decline is an exception, suggesting a potential structural repricing of the company's value.

12:28

Binance Alpha announced it will add AIAV on Jan. 2. The platform is an on-chain trading hub within the Binance Wallet that focuses on listing early-stage coins.

11:45

Tron founder Justin Sun has purchased 13.25 million LIT for $33 million, according to on-chain analyst MLM. The funds were part of a $38 million withdrawal from a $200 million deposit Sun had made in Lighter, a decentralized perpetual futures exchange. This latest acquisition brings his holdings to approximately 5.32% of LIT's circulating supply and 1.33% of its total supply. The analyst also noted that Sun previously bought 1.66 million LIT with 5.2 million USDC late last year. According to CoinMarketCap, LIT is currently trading at $2.58, down 5.72%.

11:03

Cryptocurrency analyst Marzell noted on X that a dead cross and a head and shoulders pattern have simultaneously appeared on Dogecoin's (DOGE) three-day chart. The dead cross pattern occurs when the 200-day moving average (MA) falls below the 50-day MA. Marzell suggested that if these patterns fully form, DOGE could fall to as low as $0.08.

The analyst added that the downward trend is accelerating due to waning interest in the spot DOGE ETF launched last November and a decline in open interest in the futures market. This has fostered a risk-averse sentiment among investors, leading to sustained selling pressure.

According to CoinMarketCap, DOGE is currently trading at $0.1203, down 1.99%.

10:06

Whale Alert reported that 400,000,000 USDT has been transferred from HTX to Aave. The transaction is valued at about $399 million.

09:37

Nate Geraci, CEO of asset management firm Novadius Wealth Management, said on X that this year will be a turning point for cryptocurrencies to be fully integrated into mainstream finance. He noted that the trend began last year with the U.S. Securities and Exchange Commission's lawsuit against Ripple (XRP), which ultimately concluded with the listing of an XRP spot ETF. Geraci added that this was followed by the successive launches of spot ETFs for Solana (SOL), Hedera (HBAR), and Litecoin (LTC), as well as a crypto index ETF that includes various assets such as ADA, SUI, DOT, and LINK.

08:18

Dragonfly Managing Partner Haseeb Qureshi predicts that Bitcoin will surge more than 69% to surpass $150,000 this year, according to The Daily Hodl. He explained that while BTC is expected to reach a new all-time high, its market dominance will likely decline, paving the way for a significant altcoin rally. Qureshi added that recently launched blockchain networks are poised to underperform expectations, whereas Ethereum and Solana are likely to deliver stronger-than-anticipated results.

06:54

Bitcoin's failure to rally at the end of 2025, the year following its April 2024 halving, signals a potential breakdown of its traditional four-year cycle theory, Cointelegraph reports. The cryptocurrency concluded the year more than 30% below its all-time high of $126,080, set on Oct. 6, according to CoinGecko data. This performance breaks a historical pattern where BTC reached new highs in the year following the 2012, 2016, and 2020 halvings. Vivek Sen, founder of Bitgrow Lab, stated that the four-year cycle is now officially over due to Bitcoin's year-end decline.

06:41

U.S. spot cryptocurrency ETFs recorded total net inflows of $31.77 billion in 2025, Cointelegraph reported, citing data from Farside Investors. Spot BTC ETFs attracted $21.4 billion, while ETH spot ETFs saw $9.6 billion in inflows. Spot SOL ETFs have registered $765 million in inflows since their launch. BlackRock's IBIT demonstrated a dominant lead over its competitors, securing $24.7 billion in annual inflows. Meanwhile, Glassnode noted that demand for spot BTC and ETH ETFs has slowed over the past month, expecting a modest start to 2026.

06:21

The following are the long/short position ratios for BTC perpetual futures over the past 24 hours on the world's top three cryptocurrency futures exchanges by open interest:

Overall: 50.92% long / 49.08% short

1. Binance: 49.77% long / 50.23% short

2. OKX: 49.17% long / 50.83% short

3. Bybit: 49.16% long / 50.84% short

05:38

South Korean crypto exchange Bithumb announced that it will list Tether Gold (XAUT) for trading against the South Korean won (KRW) at 7:00 a.m. UTC today.

04:36

U.S. spot Ethereum ETFs recorded a total net outflow of $72.11 million on July 31, reversing course just one day after posting net inflows, according to data compiled by TraderT. The outflows included $31.98 million from the Grayscale Ethereum Mini ETF, $21.56 million from BlackRock's ETHA, $14.1 million from VanEck's ETHV, $2.25 million from Franklin Templeton's EZET, and $2.22 million from Fidelity's FETH.

04:24

U.S. spot Bitcoin ETFs recorded a total net outflow of $348.34 million on Dec. 31, reversing the net inflows seen just one day prior, according to data compiled by TraderT. Outflows were led by BlackRock's IBIT with $99.30 million, followed by Ark Invest's ARKB ($76.53 million), Grayscale's GBTC ($69.09 million), and Fidelity's FBTC ($66.58 million). Other funds also saw outflows, including Bitwise's BITB ($13.76 million), Grayscale's Bitcoin Mini Trust ($11.24 million), VanEck's HODL ($6.79 million), and Franklin Templeton's EZBC ($5.05 million).

04:13

Bitcoin skeptic and gold bull Peter Schiff noted that if Strategy had been included in the S&P 500, its 47.5% decline in 2025 would have ranked it as the sixth-worst performer in the index. Schiff criticized Michael Saylor's long-standing argument that buying Bitcoin is the best corporate strategy, a path Strategy has followed. He argued that this approach has ultimately led to the destruction of shareholder value.

04:02

South Korean crypto exchange Upbit announced it will list Tether Gold (XAUT) with trading pairs for BTC, USDT, and the Korean won (KRW) at 6:30 a.m. UTC on Jan. 1.