Live Feed

Today, January 20, 2026

12:36

World Liberty Financial (WLFI) is facing controversy after its team passed a governance proposal for its USD1 stablecoin while holders of locked tokens were restricted from voting, Cointelegraph reported. During the vote, the top nine addresses associated with the team exercised approximately 59% of the total voting power. The project's whitepaper also specifies that token holders are not entitled to protocol revenue, with 75% of net profits allocated to an entity linked to the Trump family and the remaining 25% to an entity connected to the Witkoff family. WLFI has previously applied for a banking license to manage the issuance, custody, and exchange of USD1.

12:30

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

12:29

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

12:04

Brevis, a Zero-Knowledge (ZK) verification computing platform, has announced a partnership with stablecoin protocol USD8 to establish a decentralized insurance compensation system. USD8 is a stablecoin protocol with a built-in DeFi insurance function that allows users to accumulate points based on the duration they hold assets. In the event of a hack or de-pegging at a major DeFi protocol, users can receive compensation based on their accumulated points. Brevis plans to use its decentralized marketplace, ProverNet, to calculate these points via ZK proofs, replacing the need for traditional centralized servers. This partnership aims to meet the criteria of the walk-away test, a concept highlighted by Ethereum founder Vitalik Buterin that describes a system capable of functioning without its original operators. USD8 is targeting a beta launch in the second quarter.

12:00

Plume, a blockchain focused on regulated real-world assets (RWA), has announced the integration of the nBASIS Vault with the Gate DEX Wallet. This allows users to deposit assets directly into the nBASIS Vault from the wallet to participate in RWA-based yield opportunities without external bridging.

Plume explained that the integration aims to lower the barrier to entry for DeFi users by providing a streamlined process for deposits, yield generation, and reward tracking. The nBASIS Vault offers on-chain exposure to institutional-grade crypto basis and cash-and-carry strategies using the Superstate USCC Fund, with a base annual yield of around 3.6%. To commemorate the launch, a $20,000 incentive pool will be distributed to participants as a bonus APR during a promotional campaign.

11:56

Trend Research, a subsidiary of LD Capital, withdrew 9,939 ETH ($30.85 million) from Binance, deposited the funds into the crypto lending protocol Aave, and subsequently borrowed 20 million USDT, according to a report from Onchain Lens. The firm currently holds a total of 636,815 ETH.

11:41

BlackRock's U.S. preferred stock ETF, PFF, has invested $380 million in preferred stock issued by Strategy (MSTR), CoinDesk reported. The fund holds $210 million worth of Strategy's STRC preferred stock, which represents 1.47% of its portfolio and is its fourth-largest holding. PFF also holds an additional $170 million in other Strategy preferred stocks, such as STRF and STRD, as well as MSTR common stock.

11:10

Portugal's gambling regulator has ordered the cryptocurrency prediction market platform Polymarket to halt its operations in the country within 48 hours, CoinDesk reported. The agency stated that it had identified over $120 million in wagers on the platform related to the outcome of the Portuguese presidential election, warning that betting on domestic political issues is illegal.

Separately, Hungarian authorities also recently blocked access to Polymarket's domain, citing illegal gambling activities. That restriction will remain in place until the regulators complete their review. Polymarket currently faces access restrictions in approximately 30 countries, including Singapore, Russia, Belgium, Italy, and Ukraine.

11:09

Trend Research, a subsidiary of LD Capital, has borrowed an additional 30 million USDT from the crypto lending protocol Aave and deposited the funds into Binance, AmberCN reported. The move comes as the price of Ethereum (ETH) has once again fallen below the firm's average purchase price. Trend Research began accumulating ETH through on-chain loans in November 2025 and currently holds 626,000 ETH, valued at $1.94 billion. The firm's average purchase price for its holdings is $3,186, with an estimated unrealized loss of $50 million.

10:56

The Hash Ribbons indicator, an on-chain metric that analyzes changes in the Bitcoin hash rate to identify market bottoms, has flashed a buy signal. According to Cointelegraph, crypto data analyst OnChainMind stated that the signal appeared during the recovery phase following miner capitulation, a pattern that has historically preceded strong bull markets. The analyst noted that after the signal appeared last July, BTC rallied by approximately 25%. However, some analysts emphasized that for Bitcoin to enter a strong uptrend, it must successfully defend the $90,000 level.

10:53

Know Your Customer (KYC) procedures are essential for preventing insider trading in prediction markets, Messari Research Analyst Austin Weiler said in an interview with Cointelegraph. He explained that platforms with KYC can proactively block certain users, such as government officials, from accessing political or geopolitical markets. While acknowledging that KYC cannot stop insiders from sharing information with third parties, Weiler described it as a crucial barrier against the abuse of authority. He noted that on-chain prediction markets without KYC have no way to determine if a user is an insider. Weiler added that Polymarket currently applies KYC selectively to its U.S. users, whereas Kalshi enforces a strict KYC policy.

10:39

Lambda256, the blockchain subsidiary of Dunamu, is launching business ventures related to Security Token Offerings (STO) and stablecoins, Edaily reported. The company announced that its STO solution was used to build a digital asset platform for fintech firm Credo Partners. The Credo Partners system is designed to issue various securities—including investment contracts, unlisted securities, and those based on real-world assets (RWA)—as security tokens. The platform has been designated as an innovative financial service under the regulatory sandbox program of South Korea's Financial Services Commission.

10:27

Binance has announced it will list AIA/USDT perpetual futures at 11:15 a.m. UTC on Jan. 20. The contract will support up to 20x leverage.

10:07

Whale Alert reported that 91,914 ETH has been transferred from an unknown wallet to Coinbase. The transaction is valued at about $284 million.

10:01

The yield on the U.S. 10-year Treasury note has climbed to 4.27%, its highest level in four months, creating downward pressure on risk assets including Bitcoin, according to CoinDesk. The media outlet attributed the increase to threats of European tariffs by U.S. President Donald Trump, which has raised the possibility of European nations selling off their U.S. Treasury holdings. As the 10-year Treasury yield is a global benchmark for borrowing costs, its rise can lead to higher rates for mortgages, corporate loans, and auto loans, straining the broader economy. The analysis noted that the cryptocurrency market has also experienced a downturn in response to the yield volatility sparked by these geopolitical risks.

09:53

Bitcoin's failure to break out of its multi-month trading range has raised the possibility of a further price decline. According to Cointelegraph, Daan Crypto Trades analyzed that BTC has fully returned to the $84,000-$94,000 range it maintained for the past two months, identifying the 2026 opening price of around $87,000 as a potential support level. Separately, Keith Alan, co-founder of the crypto market data platform Material Indicators, noted that a death cross has occurred between the 21-week and 50-week moving averages. He stated that this pattern has historically preceded the formation of long-term market bottoms and suggested a rebound could occur near the 100-week moving average at approximately $86,000.

09:48

Mind Network, a Fully Homomorphic Encryption (FHE) infrastructure protocol, has announced the launch of its x402z testnet, a solution designed to support payments between autonomous AI agents. According to an official post on X, the x402z layer utilizes FHE technology to enable on-chain transaction verification without publicly disclosing the details. The system is built on Mind Network's FHE validation network and the ERC-7984 token standard, which was co-developed with open-source cryptography developer Zama.

Users can participate by connecting a wallet to the official Mind Network website. On the testnet, they can swap standard test tokens for ERC-7984-based tokens to hold encrypted assets and simulate payment processes for AI services. Mind Network stated that complete transparency can undermine the competitiveness of AI systems, emphasizing that an infrastructure allowing AI agents to make autonomous payments while maintaining business confidentiality will become an essential feature.

09:41

The DeFi protocol Makina has been exploited for approximately $5 million from its DUSD/USDC pool, according to blockchain security firm CertiK. The attacker used a flash loan to manipulate an oracle before draining the entire pool. Makina, a protocol with a total value locked (TVL) of $100.49 million, has not yet officially acknowledged the incident but stated that an investigation is underway. The protocol is advising its liquidity providers to withdraw their funds.

09:40

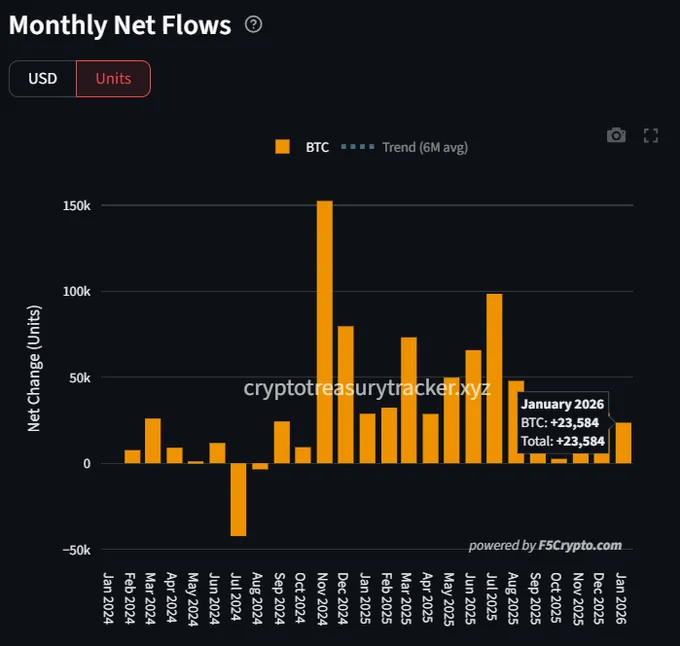

Companies holding cryptocurrency reserves have continued to accumulate Bitcoin, Santora (formerly IntoTheBlock) reported via X. These firms have purchased a total of 23,000 BTC so far this month, bringing their total holdings to 1,913,908 BTC, which accounts for 9.5% of the circulating supply.

09:28

Whale Alert reported that 500,000,000 USDC has been transferred from an unknown wallet to Binance. The transaction is valued at about $500 million.

09:25

Bitcoin is approaching an optimal entry point for dollar-cost averaging (DCA) as it nears its 720-day moving average of $86,000, according to an analysis by BeInCrypto. The outlet noted that BTC has traded below most of its moving averages since November of last year and is now approaching this final support line, a zone that has historically served as an ideal DCA opportunity.

The analysis also highlighted two other bullish signs. First, network growth has slowed to a multi-year low. While this may appear negative in the short term, such periods of stagnation have often preceded major rallies. Second, exchange data indicates a sharp decline in selling pressure from large holders. Monthly BTC deposits to exchanges from this cohort have fallen from $8 billion in late November 2025 to a current level of $2.74 billion.

However, BeInCrypto cautioned that macroeconomic uncertainties, such as the potential resumption of tariff wars amid geopolitical tensions, remain a key variable for the market.

09:01

South Korea's ruling Democratic Party has decided not to include regulations on cryptocurrency exchange ownership in its proposed Digital Asset Basic Act, Hankyung TV reported. The bill is also set to address the introduction of a won-backed stablecoin. Following a closed-door meeting of the party's Digital Asset Task Force today, chairman Lee Jeong-mun said there was a general consensus that including the ownership rules would be problematic due to timing and legislative strategy. Previously, South Korea's Financial Services Commission had considered a plan to limit a single major shareholder's stake in a crypto exchange to 20%.

08:04

OKX has announced the delisting of seven spot tokens: ULTI, GEAR, VRA, DAO, CXT, RDNT, and ELON. The exchange will remove the USD trading pairs for these assets on Jan. 27 between 8:00 a.m. and 10:00 a.m. UTC. The corresponding USDT pairs will be delisted on Jan. 30 during the same time frame.

06:59

The Abstract Chain blockchain network has entered the top 10 networks by revenue, with a total value locked (TVL) of $30.68 million. This places its revenue above that of established chains such as Avalanche (AVAX) and Near Protocol (NEAR).

In a statement, Abstract Chain noted that while many networks have high TVL, they often generate low revenue. The project emphasized that the velocity of capital and the level of activity on its applications are more critical metrics. Abstract Chain stated it has an industry-leading Revenue Generation Ratio relative to its TVL, arguing that a protocol's value is determined by how productively its assets are used, not just accumulated. The project cited Hyperliquid and pump.fun as key examples of this principle.

06:55

Major exchanges have seen $104 million worth of futures liquidated in the past hour. In the past 24 hours, $280 million worth of futures have been liquidated.