Live Feed

Today, January 14, 2026

11:24

Bybit has announced it will delist the USDT spot trading pairs for six assets—MEMEFI, RACA, ART, SPEC, XCAD, and MYRO—at 8:00 a.m. UTC on Jan. 21.

11:03

Bitwise's Chainlink (LINK) spot ETF, under the ticker CLNK, is scheduled to begin trading on NYSE Arca on Jan. 15, according to Solid Intel. The U.S. Securities and Exchange Commission (SEC) approved the listing on Jan. 6.

10:02

Bitcoin has been showing strength during U.S. market trading hours, a reversal from late last year when selling pressure was concentrated in that same period, CoinDesk reported. According to data from Velo, BTC has gained approximately 8% during U.S. hours and 3% during European hours year-to-date, while experiencing a slight decline during Asian trading hours. CoinDesk noted that this trend is not necessarily driven by U.S. investors, as prices have sometimes risen even with a negative Coinbase Premium, suggesting the influence of broader global investor activity.

09:49

France's Financial Markets Authority (AMF) has warned that it will order companies without a European Union Markets in Crypto-Assets (MiCA) license to cease operations starting in July. According to Cointelegraph, of the roughly 90 crypto firms registered with French authorities, about 40% have no intention of obtaining a license, while another 30% have not responded to official inquiries. France has granted licenses to only a few companies since the full implementation of MiCA.

09:16

An anonymous whale address beginning with 0x46DB0 has withdrawn 2,000 ETH, valued at $6.65 million, from the OKX exchange, according to on-chain analyst ai_9684xtpa. Since Dec. 5 of last year, the address has withdrawn a total of 53,451.6 ETH ($177 million) from exchanges. The whale's average entry price is $3,125.13, resulting in an estimated unrealized profit of $11.06 million.

09:05

Ripple has secured preliminary approval for an Electronic Money Institution (EMI) license from financial authorities in Luxembourg, The Block reported. The move will allow Ripple to operate stablecoin payment services for institutional clients within the European Union.

09:05

Binance Wallet has announced support for perpetual futures trading through the decentralized perpetual futures exchange (PerpDEX) ASTER. This integration allows users to trade perpetual futures for both cryptocurrencies and U.S. stocks without needing to deposit assets directly onto the Binance exchange.

09:01

The South Korean crypto exchange Coinone announced that it will delist Heroes of Mavia (MAVIA) at 6:00 a.m. UTC on Feb. 13.

08:56

Global payments giant Visa is integrating BVNK's stablecoin payment infrastructure into its Visa Direct service, CoinDesk reported. The move allows select businesses to pre-fund payments with stablecoins and send them directly to individuals' digital wallets. Visa Direct is used for business-to-person payments, including salary disbursements and overseas remittances. Through the partnership, BVNK plans to establish new payment standards for stablecoins.

08:38

Solana-based crypto exchange Backpack has launched a private beta of its Unified Prediction Portfolio, a service that integrates spot, futures, and prediction markets, The Block reported. According to CEO Armani Ferrante, the feature allows users to flexibly allocate funds from a single account, enabling them to bet on prediction markets while simultaneously hedging positions with perpetual futures or holding spot assets.

08:31

Losses from cryptocurrency scams exceeded an estimated $17 billion (25 trillion won) last year, according to blockchain data analytics firm Chainalysis. The firm also reported that impersonation scams surged approximately 1,400% year-over-year, while the average loss per incident increased by 253% over the same period.

08:15

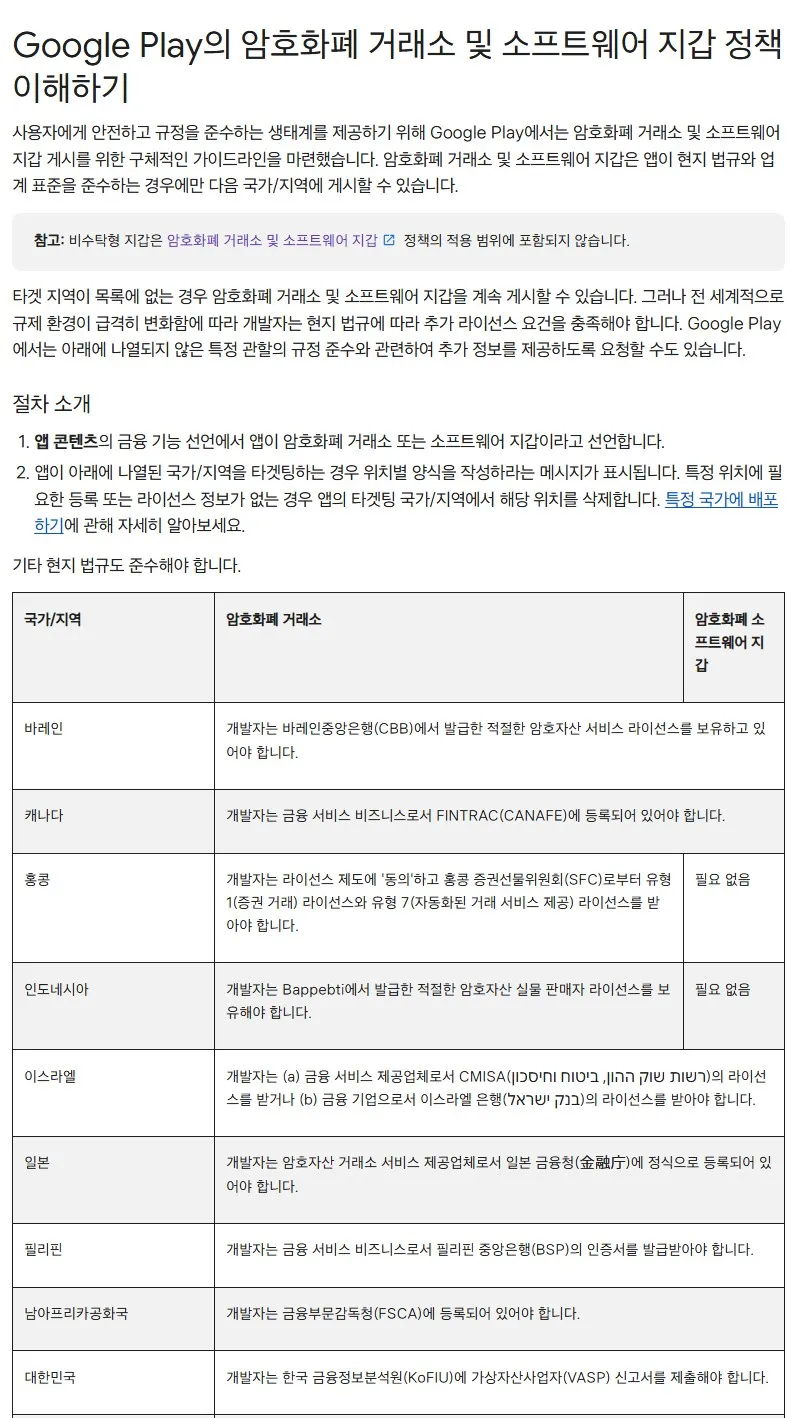

The Google Play Store has notified developers that starting Jan. 28, cryptocurrency exchange and software wallet applications must be registered as Virtual Asset Service Providers (VASPs) with South Korea's Financial Intelligence Unit (FIU). This move could lead to download and update restrictions for overseas exchange apps that have not registered with the FIU.

According to Google's notice, apps must comply with local laws and industry standards to be published in a given country. If an app lacks the necessary registration or license for a specific location, it will be removed from that country's targeting. The policy explicitly exempts non-custodial wallets. It remains unclear whether proof of VASP application submission is sufficient or if full FIU approval is required.

While the five major South Korean exchanges supporting won deposits—Upbit, Bithumb, Coinone, Korbit, and Gopax—already hold VASP licenses, prominent overseas platforms such as Binance, OKX, Bybit, Bitget, KuCoin, Gate.io, BingX, and MEXC do not possess the required license to operate in the country.

08:12

Major Spanish financial firm Bankinter has acquired an undisclosed minority stake in cryptocurrency exchange Bit2Me, CoinDesk reported. Bankinter also participated in a funding round for Bit2Me last August that included Tether.

08:02

South Korean crypto exchanges Bithumb, Upbit, and Coinone have announced an extension of the investment warning designation for Flow (FLOW). The exchanges stated that the decision was made by member companies of the Digital Asset Exchange Alliance (DAXA). According to the announcement, the exchanges are reviewing a clarification received from the project team regarding the facts and follow-up measures related to the warning. The designation is being extended to allow for a more thorough review.

07:49

An address presumed to belong to crypto market maker DWF Labs has withdrawn 6.93 million FXS, valued at $5.41 million, from Binance, according to Onchainlens. Withdrawals from exchanges are typically interpreted as a move to hold an asset.

07:25

Ethereum (ETH) founder Vitalik Buterin stated on X that the initial vision for Web3 is entering a stage of technological maturity. He explained that Ethereum has significantly improved its scalability and reduced costs through its transition to Proof-of-Stake (PoS), the development of Zero-Knowledge Ethereum Virtual Machines (ZK-EVMs), and Layer 2 scaling technologies. Buterin added that core web service functions, such as messaging and file management, have now reached a level where they can be implemented in a decentralized way. He cited examples like Waku, a decentralized messaging technology for the Ethereum ecosystem; the InterPlanetary File System (IPFS); and the decentralized document collaboration service Fileverse as proof that the viability of using decentralized tools independent of centralized services is increasing.

06:57

South Korean crypto exchanges Upbit and Bithumb announced they will list USDE on their BTC, USDT, and KRW trading pairs today at 9:00 a.m. UTC.

06:54

Pakistan has decided to integrate the USD1 stablecoin into its national digital payment system in collaboration with WorldLibertyFinancial (WLFI), a DeFi project led by the Trump family, Reuters reported. The move will allow USD1 to be used for cross-border payments alongside Pakistan's own central bank digital currency (CBDC).

06:30

The following are the 24-hour long/short ratios for BTC perpetual futures on the top three global crypto futures exchanges by open interest:

Overall: 50.48% long, 49.52% short

1. Binance: 51.61% long, 48.39% short

2. OKX: 51.34% long, 48.66% short

3. Bybit: 51.11% long, 48.89% short

06:26

Justin Slaughter, VP of Regulatory Affairs at crypto investment firm Paradigm, predicted on X that even if the U.S. crypto market structure bill (CLARITY Act) is passed, its actual implementation could take several years. He noted that the bill would require the creation of at least 45 new rules and that the details would be highly complex to coordinate, especially considering the involvement of the Commodity Futures Trading Commission (CFTC). Slaughter emphasized that even if the bill passes in the near future, it would likely be implemented under the next administration. Citing historical precedent for major legislation, he stated that implementation has previously taken a minimum of three years and as long as eight.

06:22

An anonymous whale has withdrawn 12,000 ETH, valued at $39.98 million, from Binance, according to Onchain Lens. The whale's current holdings now stand at 80,980 ETH. Withdrawals from exchanges are typically interpreted as a sign of accumulation.

06:19

According to CoinMarketCap, Monero (XMR) has surpassed Bitcoin Cash (BCH) to become the 11th-largest cryptocurrency, with its market capitalization exceeding $12.9 billion. XMR is currently trading at $706.63, up 10.55%.

06:17

South Korean law firm Bae, Kim & Lee LLC has outlined key legal issues regarding the issuance of stablecoins that require examination under current regulations, ahead of the country's second phase of digital asset legislation. The firm raised several critical questions, including the current legal status of stablecoins like USDT and USDC on domestic exchanges, the likelihood of their classification as securities, and whether issuers could be considered Virtual Asset Service Providers (VASPs). Further points of examination include the legality of issuing a won-backed stablecoin for payments, the use of corporate accounts to buy stablecoins for settlements, and the criteria exchanges use for listing them. The firm also questioned the legality of purchasing stablecoins with credit cards, the compliance of DeFi services offering interest on stablecoin deposits, and the potential regulatory framework for stablecoins in the upcoming legislation.

05:42

MEVerse announced it will conduct maintenance to address a mainnet network error. The process is expected to take approximately five hours.

05:41

An anonymous whale, identified as 255 $BTC Sold, has closed long positions on HYPE, SOL, BTC, ETH, and XRP for a profit of $14.49 million, according to Onchain Lens. The trader subsequently opened $35 million in short positions on BTC, ETH, and SOL using 20x leverage.