Live Feed

Today, January 19, 2026

23:04

The recent correction in Bitcoin has reaffirmed the overall bearish trend in the cryptocurrency market, according to Matt Howells-Barby, a vice president at Kraken. He noted that since a sharp decline on Oct. 10 of last year, the market has consistently shown significant asymmetric downside risk, reacting sensitively to negative news while showing limited gains on positive developments. Howells-Barby explained that while BTC was recently positioned at a key support level with potential for further upside, its upward momentum was quickly broken by emerging geopolitical issues. However, he observed that the correction was limited to about 3.5%, suggesting some traders are maintaining their positions in anticipation that President Trump might ease tariff threats, similar to last year's tensions with China. He concluded that market volatility could increase with any statements suggesting either an escalation or de-escalation of the tariff conflict between the U.S. and the EU.

22:31

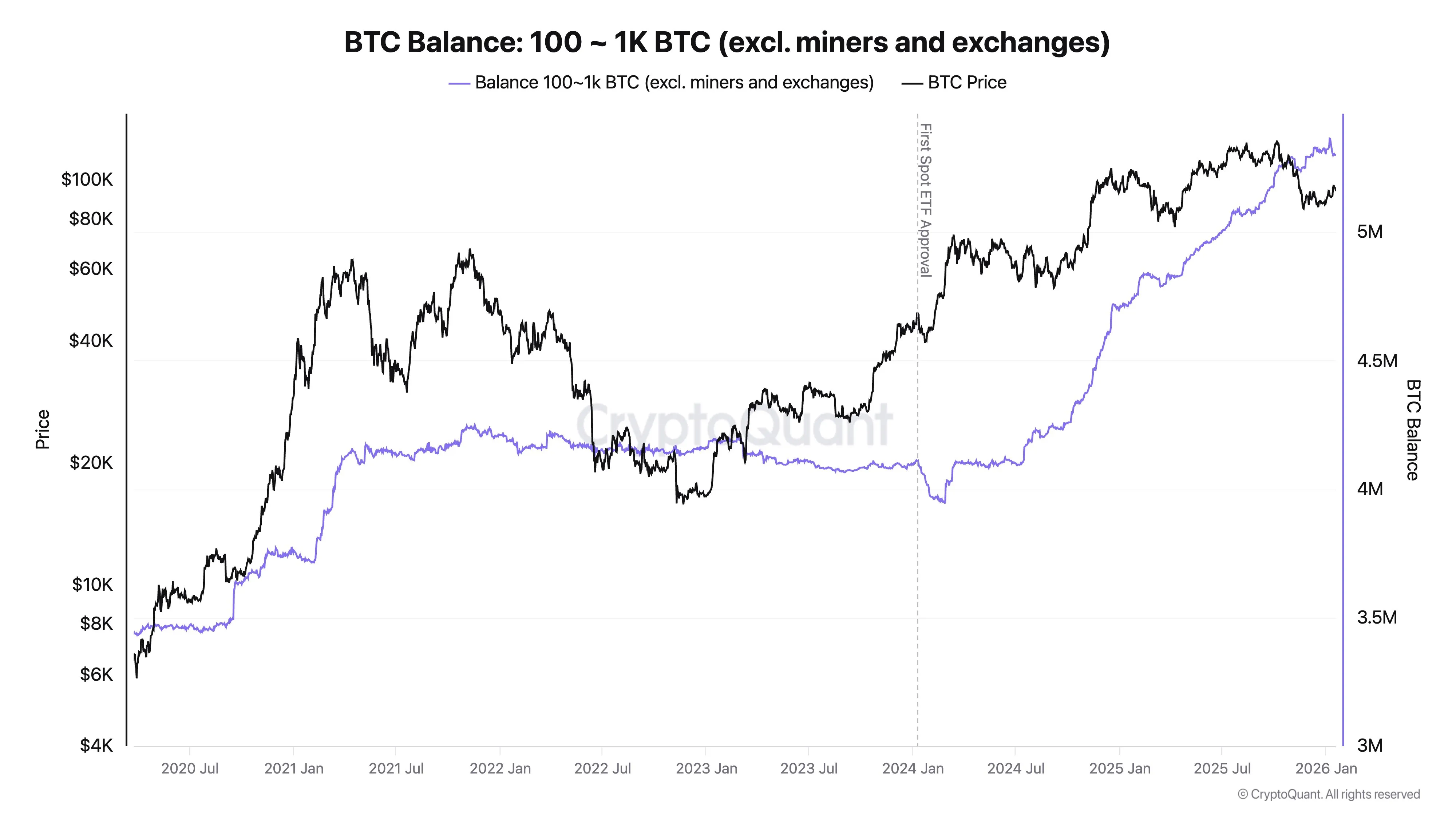

Institutional demand for Bitcoin (BTC) remains strong, according to CryptoQuant CEO Ju Ki-young. In a post on X, Ju stated that institutional addresses have recorded a net inflow of approximately 577,000 BTC, valued at around $53 billion, over the past year. He added that this net inflow trend is ongoing. Ju explained that this metric is derived by tracking U.S. custody wallets, which typically hold between 100 and 1,000 BTC. These wallets serve as a proxy for institutional demand once addresses belonging to exchanges and miners are excluded. He also noted that holdings from spot Bitcoin ETFs are included in this calculation.

21:37

A new market structure that deviates from the traditional halving cycle, institutional fund flows, and the macroeconomic environment are the three main variables that will influence Bitcoin's price movements this year, Coindesk reported, citing research from NYDIG and Wintermute. The analysis suggests the conventional four-year crypto cycle centered on the halving may now be over, with cryptocurrencies beginning a transition into a more stable asset class as institutional products like ETFs reshape the market. Consequently, key catalysts for Bitcoin's price this year could include the actions of institutional investors within this new structure, evolving geopolitical and macroeconomic risks, and whether retail investors shift capital from stock markets to crypto.

20:53

The amount of ETH staked on the Ethereum network has reached an all-time high, with approximately 30% of the total supply staked as of Jan. 18, Solid Intel reported. According to CoinMarketCap, ETH is currently trading at $3,214.79, down 3.83%.

19:36

The Injective (INJ) community has approved a governance proposal to reduce the INJ token supply and transition to a deflationary model, CryptoBriefing reported. The proposal passed with 99.9% of the vote. This allows Injective to implement an on-chain update to its token inflation parameters. The main goal is to permanently limit new INJ issuance while strengthening the burn mechanism to decrease the circulating supply. Injective has reportedly burned approximately 6.85 million INJ since its mainnet launch.

19:29

According to an analysis by crypto media outlet Cointelegraph, Bitcoin's short-term price drop of approximately 3.7% on the morning of Jan. 19 led to the liquidation of $233 million in long positions. This event has eased overheated leverage risk in the market without breaking the overall market structure. While investor sentiment has cooled rapidly, on-chain and derivatives data suggest the move is more of a structural adjustment than a bearish reversal. The analysis notes that an influx of buying pressure from investors looking to buy the dip will be crucial to halting the decline.

From a technical perspective, Cointelegraph pointed out that Bitcoin continues to make higher lows and higher highs on its daily chart. The $92,000 to $93,000 range aligns with a significant demand zone of concentrated buy orders and is also a test of the monthly volume-weighted average price support. Therefore, this price action is likely part of a process to establish a higher low before an attempt to reclaim the $100,000 level. Notably, approximately $250 million in net long positions were executed around the $92,000 mark on Jan. 19, which suggests that demand for dip-buying is outpacing panic selling.

19:11

The non-fungible token (NFT) market is not dead, according to Yat Siu, co-founder of Animoca Brands. In an interview with CoinDesk, Siu stated that while the market has entered a downturn, it is still being driven by a number of wealthy collectors. He compared this dynamic to heirs of prominent families collecting Picasso's works, who feel a sense of camaraderie with other collectors, effectively forming a club. Siu described NFTs as a digital version of this, representing a community. He also added that although the value of his personal NFT portfolio has declined by about 80%, he is unconcerned as he did not buy them with the intent to resell, viewing them instead as assets with long-term investment value.

18:58

The government of Bermuda is partnering with Coinbase and Circle to build a complete on-chain economy, a Coinbase representative told The Block at the World Economic Forum in Davos. The initiative aims to establish a digital asset infrastructure across government agencies, businesses, and consumers, transitioning the national economy to a system based on blockchain payments and financial tools. As part of the collaboration, Coinbase, the largest U.S. crypto exchange, and Circle, the issuer of the USDC stablecoin, will provide digital asset infrastructure and corporate tools to the government, local banks, insurers, small businesses, and consumers. The companies will also support nationwide digital finance education and technology onboarding.

18:51

On-chain analytics firm Glassnode has analyzed that while Bitcoin's upward momentum has weakened, the current price action is more indicative of a range-bound consolidation than a major trend reversal. The firm noted that Bitcoin fell from a recent high of $98,000 to the low $90,000s this week.

In its weekly market report, Glassnode explained that selling pressure in the spot market is gradually easing as trading volume slightly recovers, but demand remains uneven due to relatively low buying pressure. The derivatives market shows mixed signals, with a slight increase in futures open interest alongside a drop in funding rates. However, U.S. spot ETFs have seen a return to net inflows, and on-chain activity is stable. Overall, Glassnode suggests that while Bitcoin continues to move sideways, the market structure is gradually improving.

18:43

London-based neobank Revolut has obtained a banking license in Peru, enabling it to operate as a fully regulated bank in the country, Bloomberg reported. The move is set to spearhead the company's broader expansion across Latin America. This development comes as Revolut continues to expand its cryptocurrency and stablecoin services, having launched a feature in October of the previous year that allows users to exchange USDT and USDC with the U.S. dollar.

18:15

Kamino (KMNO), a Solana-based automated liquidity management protocol, announced via its official X account that it now supports the dollar-pegged stablecoin USD1. This allows users to deposit USD1 and use it as collateral for loans on the Solana network. USD1 is issued by World Liberty Financial (WLFI), a DeFi protocol led by the Trump family.

18:09

Finnish President Alexander Stubb stated that the European Union has several tools at its disposal to compel the United States to withdraw its tariff threats, Walter Bloomberg reported. He added that he does not believe the U.S. will use military means to take control of Greenland. The comments follow threats from U.S. President Donald Trump to impose 'Greenland tariffs' on eight European nations, without ruling out the possibility of military force. Meanwhile, some analysts have suggested that Bitcoin's short-term weakness on Monday morning could be linked to the escalating conflict between the U.S. and the EU over the territory.

17:46

CryptoQuant CEO Ju Ki-young stated that the New York Stock Exchange's (NYSE) tokenized settlement system will eventually expand to public blockchains. His comments follow reports that the NYSE plans to launch a 24/7 trading service for U.S. stocks via an on-chain tokenized exchange. Ju noted that while the NYSE's system will initially operate on a permissioned blockchain, he believes public chains will play a significant role over time. He drew a parallel with Bitcoin, which first gained indirect market exposure through trusts and corporate holdings like those of Strategy before spot ETFs were approved as regulations matured. Ju concluded that as rules for tokenization are established, compatibility with public chains must also be developed.

17:28

U.S. real estate investment firm Cardone Capital has purchased an additional $10 million worth of BTC, CryptoBriefing reported.

17:08

President Trump has stated that he will not rule out the possibility of using military force in Greenland, according to Solid Intel.

16:23

Coinbase has launched a custom stablecoin service that enables businesses to issue their own digital dollars collateralized on a 1:1 basis, Solid Intel reported. This allows companies to become direct issuers and operate digital dollars optimized for their own business ecosystems, rather than relying on third-party stablecoins.

16:21

A whale appears to be in the process of selling 13,000 ETH, worth approximately $41.75 million, according to Lookonchain. The on-chain analytics firm reported that a wallet linked to Galaxy Digital's over-the-counter (OTC) desk initiated the transfer. Of the total amount, 6,500 ETH has since been deposited to the exchanges Binance, Bybit, and OKX.

16:19

Ember Protocol and Bluefin, both part of the Sui ecosystem, have launched a new type of vault that utilizes Polymarket data, according to Sui. The new product connects prediction market data with automated investment strategies.

15:21

Cardano founder Charles Hoskinson has criticized Ripple CEO Brad Garlinghouse for supporting the crypto market structure bill (CLARITY), Cryptobasic reported. Hoskinson warned that accepting the legislation, which includes provisions for DeFi regulation and a ban on interest payments for stablecoins, would amount to handing power back to hostile regulators.

14:10

Paradex, a decentralized exchange based on Starknet, plans to roll back its blockchain after a database migration error caused the price of Bitcoin to temporarily drop to $0, The Block reported. The glitch, which saw BTC prices plummet before surging, has already resulted in the liquidation of thousands of positions on the platform.

14:05

Venezuelans are converting their national currency, the bolivar, into the stablecoin USDT following U.S. military intervention in the country, CNBC reported. Demand for USDT surged after a U.S. airstrike earlier this month, pushing its price to around $1.40 in some peer-to-peer markets. Li Haonan, co-founder and CEO of Codex, explained that the price of USDT in Venezuela rose by approximately 40% in a single day. He stated this was not due to speculative trading by retail investors but rather residents seeking a safe haven during an emergency.

13:24

The New York Stock Exchange (NYSE) plans to launch a service that will allow for 24/7 trading of U.S. stocks via an on-chain tokenization exchange, Watcher.Guru reported.

13:20

In its latest Bitfinex Alpha weekly report, cryptocurrency exchange Bitfinex noted that Bitcoin broke through the $94,000-$95,000 resistance level last week, climbing to a two-month high of $97,850. The exchange added that this rally triggered the largest short squeeze in 100 days, leading to a decrease in open interest as leveraged positions were cleared and resulting in a somewhat improved market structure.

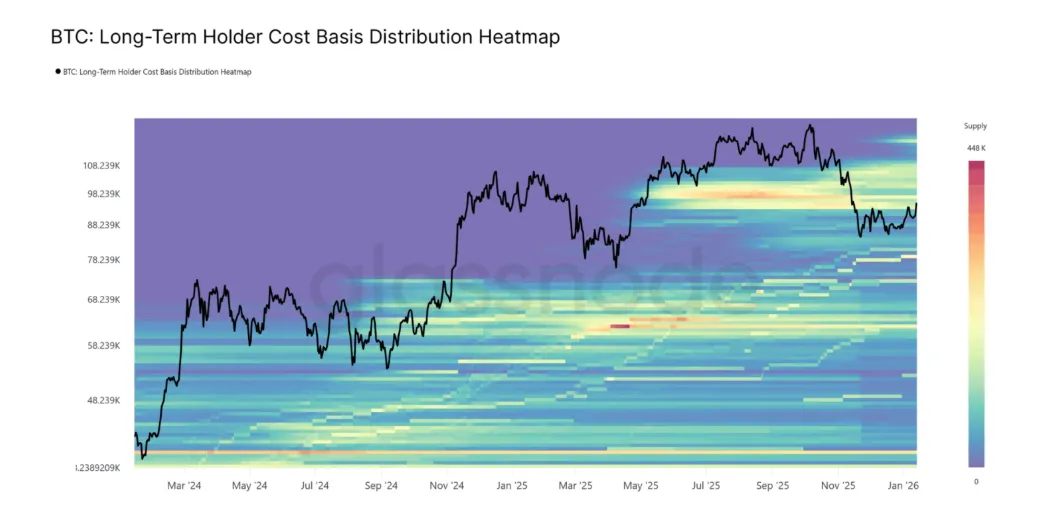

However, Bitfinex pointed out that the $93,000-$110,000 range is an area of concentrated selling from long-term holders (LTHs) and has historically limited upward price movements. While LTHs currently remain net sellers, the report identified a positive signal in the slowing pace of their sell-offs, with weekly selling volume based on realized profits declining to around 12,800 BTC. Bitfinex concluded that if this trend continues, BTC could break through this key resistance zone and resume its rally toward a new all-time high.

13:13

USDT issuer Tether has announced a partnership with Laotian cryptocurrency exchange Bitqik. Through the collaboration, Tether will provide local online content and share real-world cryptocurrency use cases in major cities to enhance financial literacy on Bitcoin and stablecoins.

12:36

Crypto derivatives exchange Paradex has experienced a service outage, causing most of its systems to stop functioning, Cointelegraph reported. The disruption has affected key services, including the user interface, cloud infrastructure, and blockchain systems. All open orders will be forcibly canceled. Paradex stated that it is currently analyzing the cause of the outage and is in the process of restoring its systems.