Live Feed

Today, December 26, 2025

02:14

According to CoinNess market monitoring, BTC has risen above $88,000. BTC is trading at $88,092.68 on the Binance USDT market.

01:39

An address associated with Winslow Strong, a board member of the Qualia Research Institute, withdrew 307 CBBTC ($27.03 million) and 1,900 ETH ($5.6 million) from the Aave lending protocol and deposited the assets into Coinbase eight hours ago, Lookonchain reported.

00:53

Strategy (MSTR) CEO Phong Le said he is not concerned with Bitcoin's short-term price movements, arguing that investors should judge an asset by its long-term value. Speaking on the Coin Stories podcast, Le described BTC as an asset with unpredictable price action that requires a systematic and mathematical approach, according to Cointelegraph. He also emphasized that the U.S. government is more favorable toward BTC than ever before and that traditional financial institutions are competitively entering the market.

00:47

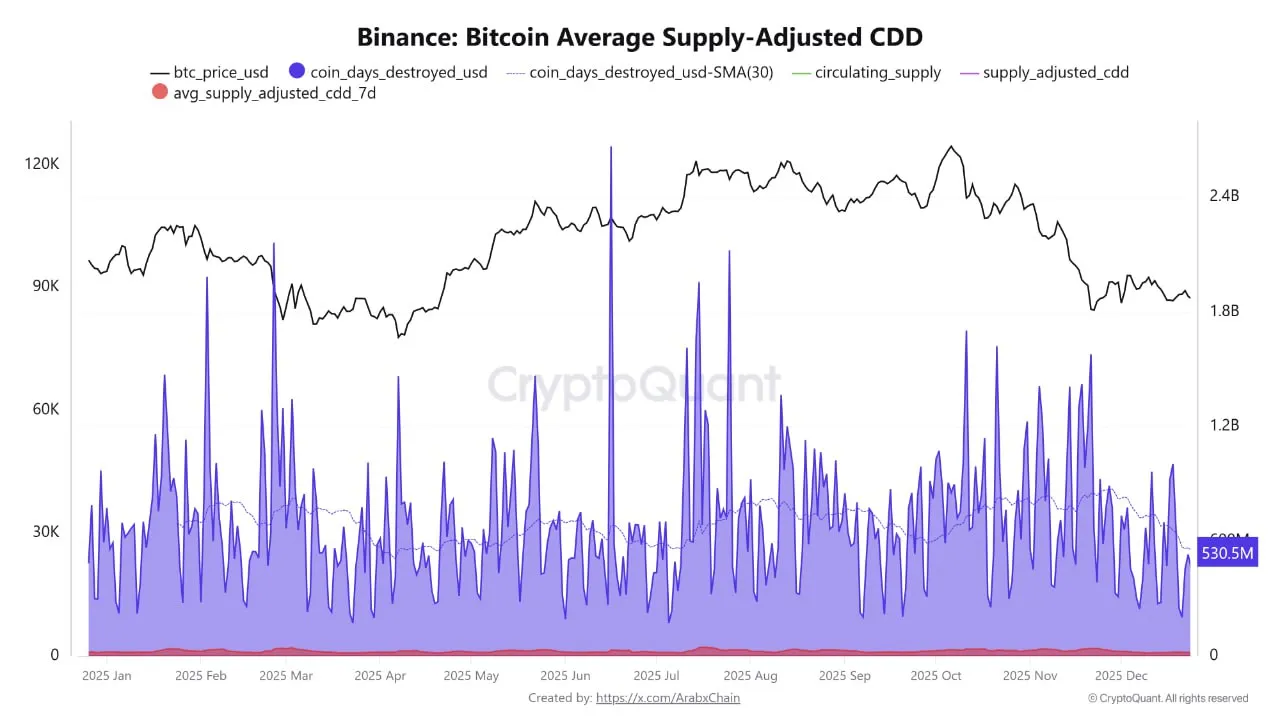

The current correction in Bitcoin appears to be temporary, according to crypto analyst Arab Chain in a contribution to CryptoQuant. The analyst noted that the Coin Days Destroyed (CDD) metric is at a moderate level compared to figures seen at past market tops, suggesting there is no aggressive selling from long-held coins. Similarly, the Supply-Adjusted CDD is stable and far from the sharp levels observed at bull market peaks. This indicates the recent BTC decline was not caused by a large-scale sell-off from long-term investors. Instead, the analyst explained that the correction is more likely a temporary adjustment due to slowing momentum or weakening liquidity.

00:35

A security vulnerability in version 2.68 of the Trust Wallet (TWT) self-custody crypto wallet's browser extension has resulted in total losses of $6 million to date, according to blockchain expert ZachXBT. Trust Wallet stated that mobile users and users of other extension versions were not affected by the incident. The company added that its team is actively working to resolve the issue and will share further updates as they become available.

00:31

CoinMarketCap's Altcoin Season Index has fallen one point from yesterday to 16. The index measures whether market conditions favor altcoins or Bitcoin by comparing the price performance of the top 100 cryptocurrencies by market capitalization, excluding stablecoins and wrapped coins, against that of Bitcoin. An altcoin season is declared when 75% of these top 100 coins outperform Bitcoin over a 90-day period. A score closer to 100 indicates an altcoin season, while a lower score suggests a Bitcoin season.

00:18

Korea Investment & Securities has signed a Memorandum of Understanding (MOU) with crypto exchange Bithumb to provide asset management services, Pinpoint News reported. Under the agreement, the two companies will collaborate on various fronts to offer customized asset management solutions for their clients.

00:06

A record $23.347 billion in Bitcoin options are set to expire at 8:00 a.m. UTC on Dec. 26, according to data from the crypto options exchange Deribit. This amount surpasses the previous high of $14.3 billion recorded on Dec. 27 of last year. The current put/call ratio stands at 0.35, with a max pain price of $95,000. Concurrently, $3.7 billion worth of Ethereum options will also expire, with a put/call ratio of 0.44 and a max pain price of $3,000.

00:01

The Crypto Fear & Greed Index, compiled by data provider Alternative, has fallen three points from yesterday to 20, continuing its phase of extreme fear. The index measures market sentiment on a scale where 0 indicates extreme fear and 100 represents extreme optimism. It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

Yesterday, December 25, 2025

23:45

According to CoinNess market monitoring, BTC has fallen below $87,000. BTC is trading at $86,960.68 on the Binance USDT market.

20:21

A governance proposal for Uniswap (UNI), dubbed UNIFICation, has passed, founder Hayden Adams announced. The proposal, which received 125.34 million votes in favor and 742 against, includes provisions to burn 100 million UNI. It also activates a fee on/off mechanism on the Ethereum mainnet, with the UNI collected from these fees also set to be burned.

16:48

In its 2026 crypto outlook report, The Block assessed that while the crypto industry achieved long-awaited progress in institutional adoption and regulatory clarity in 2025, prices largely failed to rebound and overall market sentiment remained lukewarm. Below is a CoinNess summary of the key market takeaways for 2025:

- Total crypto market cap reached a record high of $4.3 trillion, but price gains were concentrated in only a handful of tokens

- Layer 1 blockchains began to diverge in roles: Solana, BNB, and Hyperliquid gained attention as centers for speculative asset trading, while Ethereum strengthened its position as a data availability (DA) hub under its rollup-centric roadmap

- Newly launched Layer 1 networks pursued differentiated strategies, leading to increased ecosystem specialization

- Coinbase’s Layer 2 network, Base, emerged as a new market leader

- Platforms targeting institutions and consumers directly launched their own Layer 2 infrastructure

- Large-scale institutional adoption of real-world asset (RWA) tokenization accelerated

- On-chain trading volumes were driven by derivatives and prediction markets, including perpetual decentralized exchanges (perp DEXs)

- Digital Asset Trust (DAT) investment firms emerged into the spotlight

- The spot crypto ETF market expanded to include assets such as Solana and Ripple

- The U.S. shifted toward a more clearly defined, rules-based regulatory framework

16:09

A Bitcoin OG, identified by the address 1011short, has increased a long position in SOL by 207,351 tokens, Lookonchain reported. The address also holds a 5x long position of 203,341 ETH, a 5x long position of 1,000 BTC, and a 10x long position of 508,929 SOL, with current unrealized losses totaling $43 million.

15:30

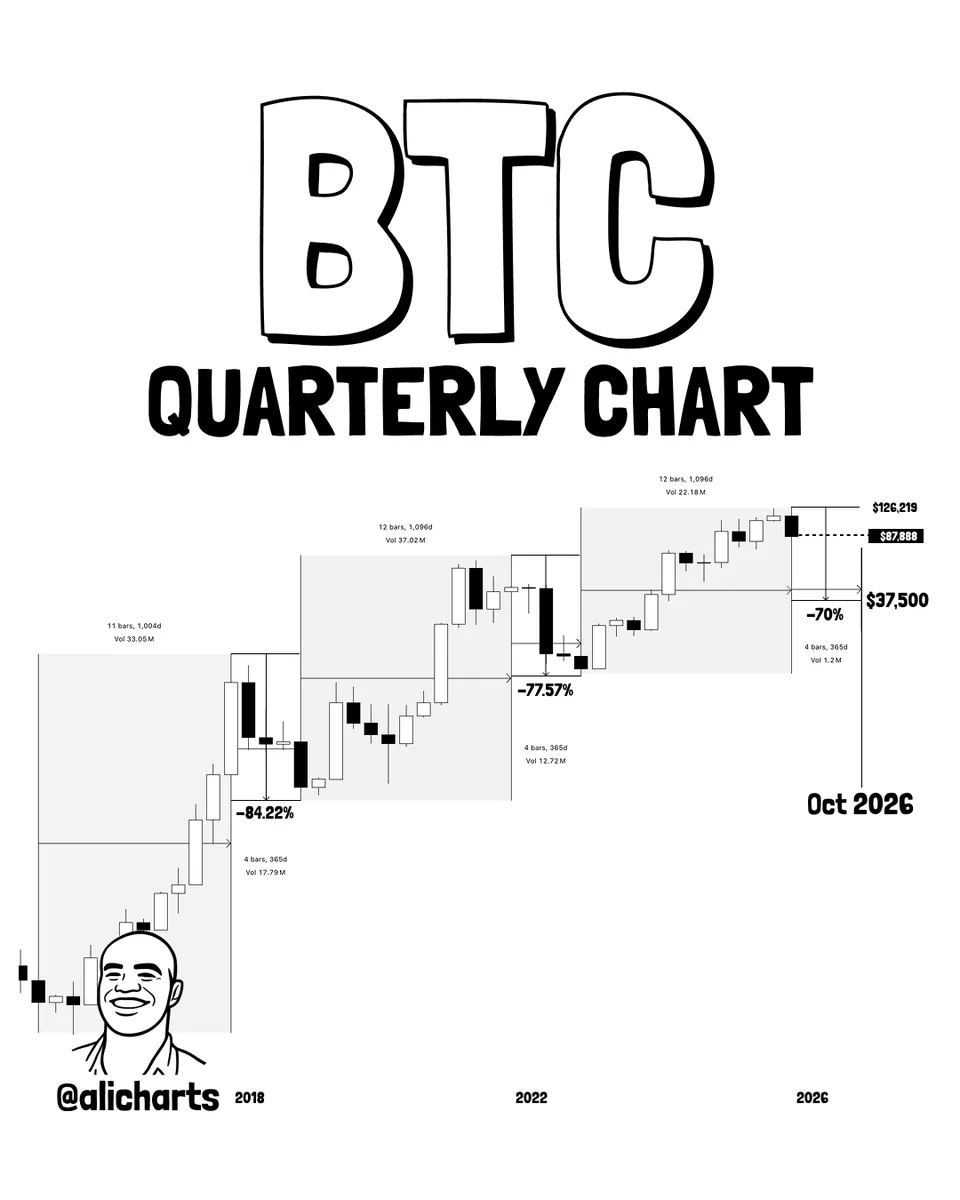

On-chain analyst Ali Martinez noted on X that historically, it has taken Bitcoin approximately 1,064 days to move from a market bottom to a peak. He added that the subsequent move from a market peak to a new bottom has typically taken around 364 days.

13:23

World Liberty Financial (WLFI), a firm associated with the Trump family, announced on X that its stablecoin, USD1, has surpassed a market capitalization of $3 billion. The company described the achievement as a significant milestone for its team and community, adding that its goal is to build the financial network of the future and that this is just the beginning. According to CoinMarketCap, USD1's current market capitalization stands at $3.07 billion.

12:53

Jim Cramer, the host of CNBC's Mad Money, has predicted a bear market for Bitcoin, according to a post on X by CryptoQuant CEO Ki Young Ju. Ju noted that Cramer is widely mocked in the stock and crypto communities as a contrarian indicator whose market forecasts often turn out to be incorrect.

11:43

Coinglass has released its 2025 annual report on the crypto derivatives market, with key findings summarized by on-chain analyst EmberCN. The report highlights that 2025 was the year of DATs, as these companies increased their BTC holdings from 600,000 at the start of the year to 1.05 million by November, accounting for about 5% of the total Bitcoin supply. Total trading volume in the crypto derivatives market reached approximately $85.7 trillion for the year, with a daily average of $264.5 billion. The total notional value of liquidated long and short positions amounted to $150 billion, with daily liquidations averaging between $400 million and $500 million, primarily concentrated in October and November. Among centralized exchanges, Binance, OKX, Bitget, Bybit, and Gate were ranked as the top five platforms. The report also noted significant growth in crypto prediction markets, which are expected to exceed $52 billion in cumulative trading volume, and a sharp rise in market interest for on-chain U.S. stock tokens within the RWA sector. Furthermore, decentralized derivatives are projected to move beyond the proof-of-concept phase to actively compete for market share.

10:24

Phong Le, CEO of Strategy (MSTR), has expressed optimism for Bitcoin's prospects in 2026, despite its recent drop below $87,000, according to The Daily Hodl. The downturn in BTC's price led to an 8.5% fall in Strategy's stock. However, Le emphasized that Bitcoin is a unique asset, describing it as a generational technological invention that combines innovations in macroeconomics and capital markets.

He acknowledged that Bitcoin could exhibit short-term volatility similar to other risk assets. Still, Le said he anticipates a more accommodative stance from the Fed, a risk-on environment during the midterm election season, and wider adoption by banks and state governments.

10:18

The NFT market has fallen to its lowest level of 2025 after failing to secure a year-end rally, Cointelegraph reported, citing data from CoinGecko. The total market capitalization for NFTs in December stood at $2.5 billion, a 72% decrease from the January peak of $9.2 billion. For the first three weeks of December, weekly NFT sales consistently remained below $70 million. According to CryptoSlam, the number of unique buyers fell from the 180,000s to the 130,000s, while the number of sellers dropped below 100,000. This downturn has impacted major collections, with the floor prices for CryptoPunks and the Bored Ape Yacht Club (BAYC) falling by 12% to 28% over the past 30 days.

10:10

An analysis by DeFi analytics platform Sentora, formerly IntoTheBlock, shows that eight of the top 10 companies by digital asset treasury size are based in the United States. The U.S.-based firm Strategy leads the list, holding 671,268 BTC. It is followed by MARA Holdings with 53,250 BTC and Twenty-One Capital (XXI) with 43,514 BTC.

09:59

LD Capital founder Jack Yi is currently facing an unrealized loss of $143 million on his holdings of 645,000 ETH, according to on-chain analyst Ai 姨. In a post on X, the analyst explained that Yi's average purchase price is $3,150. Ai 姨 anticipates that once a planned $1 billion fund investment is completed, the average purchase price for the ETH holdings will stabilize at around $3,050.

08:50

A newly created address withdrew 50,000 ZEC, worth approximately $22.17 million, from Binance earlier today, according to a report from Onchain Lens. Meanwhile, ZEC is trading at $446.56, up 9.93%, data from CoinMarketCap shows.

07:32

Bybit has announced that it remains over-collateralized, with reserve ratios for 40 cryptocurrencies ranging from 100% to 160% as of Dec. 17. According to an update on its official website, key reserve ratios include 105% for BTC, 101% for ETH, 101% for XRP, 103% for SOL, 102% for USDT, and 112% for USDC.

06:47

South Korean crypto exchange Upbit has announced it will temporarily suspend digital asset and Korean won (KRW) deposits and withdrawals for a regular audit of its assets and deposits. The suspension for digital assets will run from 11:00 a.m. UTC on Dec. 31 to 11:00 p.m. UTC the same day. KRW transactions will be restricted from 5:00 p.m. to 11:00 p.m. UTC on Dec. 31.

06:23

Russia's two leading stock exchanges, the Moscow Exchange (MOEX) and the Saint Petersburg Exchange (SPB), have completed preparations to launch cryptocurrency trading, according to a report from Wu Blockchain. The exchanges stated they are ready to begin offering crypto trading as soon as a legal framework is established.

Under the proposed regulations, both retail and institutional investors would be able to participate. Retail investors would be permitted to trade up to 300,000 rubles (approximately $4,000) annually. Institutional investors are expected to face no specific trading limits, with the exception of privacy coins. This development follows an earlier Bloomberg report that the Russian government was advancing legislation to allow cryptocurrency investments for the general public.