Live Feed

Today, January 12, 2026

22:09

Global credit rating agency Fitch Ratings has warned that securities backed by Bitcoin carry a level of risk comparable to speculative-grade investments, Cointelegraph reported. Fitch identified Bitcoin's inherent price volatility and counterparty risk—the possibility that a party in a financial transaction could default on its contractual obligations—as the main risk factors. The agency noted that a sudden drop in volatility could breach the collateral maintenance ratio, which is the value of Bitcoin collateral relative to the issued debt. This could cause the collateral's value to plummet and lead to investor losses. Fitch added that the bankruptcies of crypto lenders such as BlockFi and Celsius demonstrate how collateral-based models can quickly collapse during periods of market stress.

21:54

U.S. President Donald Trump has implemented an executive order imposing a 25% tariff on countries that trade with Iran, Walter Bloomberg reported.

21:54

According to CoinNess market monitoring, BTC has fallen below $91,000. BTC is trading at $90,971.4 on the Binance USDT market.

21:42

U.S. Senators Ron Wyden and Cynthia Lummis have introduced a standalone bipartisan bill, the Blockchain Regulatory Certainty Act (BRCA), according to reporter Eleanor Terrett. The bill's provisions were previously introduced in the House by the Republican Majority Leader and included in the Crypto-Asset National Security Enhancement and Enforcement (CLARITY) Act. The legislation aims to protect the rights of developers to write code and of individuals to self-custody their digital assets. The BRCA is currently being discussed for inclusion in the Senate's negotiations on a market structure bill, but its incorporation into the final version is uncertain.

21:31

The three major U.S. stock indices finished in positive territory. The S&P 500 rose 0.16%, the Nasdaq Composite gained 0.26%, and the Dow Jones Industrial Average was up 0.17%.

20:55

U.S. Senator Elizabeth Warren, a noted crypto critic, has argued that an executive order from the Trump administration could put investors at risk by allowing pension and retirement funds to hold cryptocurrency, according to CNBC. Warren has sent an official letter to SEC Commissioner Paul Atkins requesting more detailed information on the matter.

19:56

New York City Mayor Eric Adams publicly supported the NYC Token at a press conference in Times Square, according to Decrypt. Adams described the token as a commemorative asset and stated that proceeds will be used to combat antisemitism and anti-American sentiment, as well as to fund blockchain education. He explained that a significant portion of the funds raised will be allocated to non-profit organizations, historically Black colleges and universities (HBCUs), and scholarships for underprivileged groups. The NYC Token has not yet been officially launched, and Adams said he is not currently receiving any compensation for his involvement with the project.

19:08

The U.S. Commodity Futures Trading Commission (CFTC) has launched an Innovation Advisory Committee composed primarily of figures from the cryptocurrency industry, according to CoinDesk. CFTC Commissioner Mike Selig, who is reorganizing the innovation-focused advisory body, named several crypto company CEOs as its first members, including Tyler Winklevoss of Gemini, as well as leaders from Kraken, Crypto.com, Bitnomial, and Bullish. The committee also includes representatives from prediction market platforms like Polymarket and Kalshi, and traditional financial institutions such as Nasdaq, CME, ICE, and Cboe. Selig stated that the goal is to create fit-for-purpose market structure regulations that reflect technologies like AI and blockchain.

19:02

U.S. Treasury Secretary Scott Bessent has warned President Donald Trump that an investigation into Federal Reserve Chair Jerome Powell could negatively affect financial markets, according to Axios. Bessent noted that such a probe could heighten market uncertainty and undermine confidence.

18:30

President Donald Trump has warned that the U.S. could be forced to refund hundreds of billions of dollars if the Supreme Court rules his administration's tariff policies are illegal. He stated that such an outcome would create immense chaos and be practically unaffordable for the country. CoinNess previously reported that the U.S. Supreme Court is expected to issue a ruling on the matter on Jan. 14.

18:19

The cryptocurrency market has entered a second phase of institutional adoption, undergoing a structural pivot from being retail-investor-focused to being led by institutional capital, according to an analysis by Binance Research. The report highlights Morgan Stanley's S-1 filings for Bitcoin and Solana ETFs, following the approval of U.S. spot Bitcoin ETFs in 2024, as a prime example of this new phase. This development signifies a shift for Wall Street, moving from simply distributing digital asset products to actively planning and launching them. The analysis suggests that rival financial firms like Goldman Sachs and JPMorgan could follow suit. Additionally, the report projects that easing concerns about digital asset trading firms being excluded from MSCI indexes, coupled with demand for portfolio diversification, could create a favorable environment for digital assets in 2026.

18:04

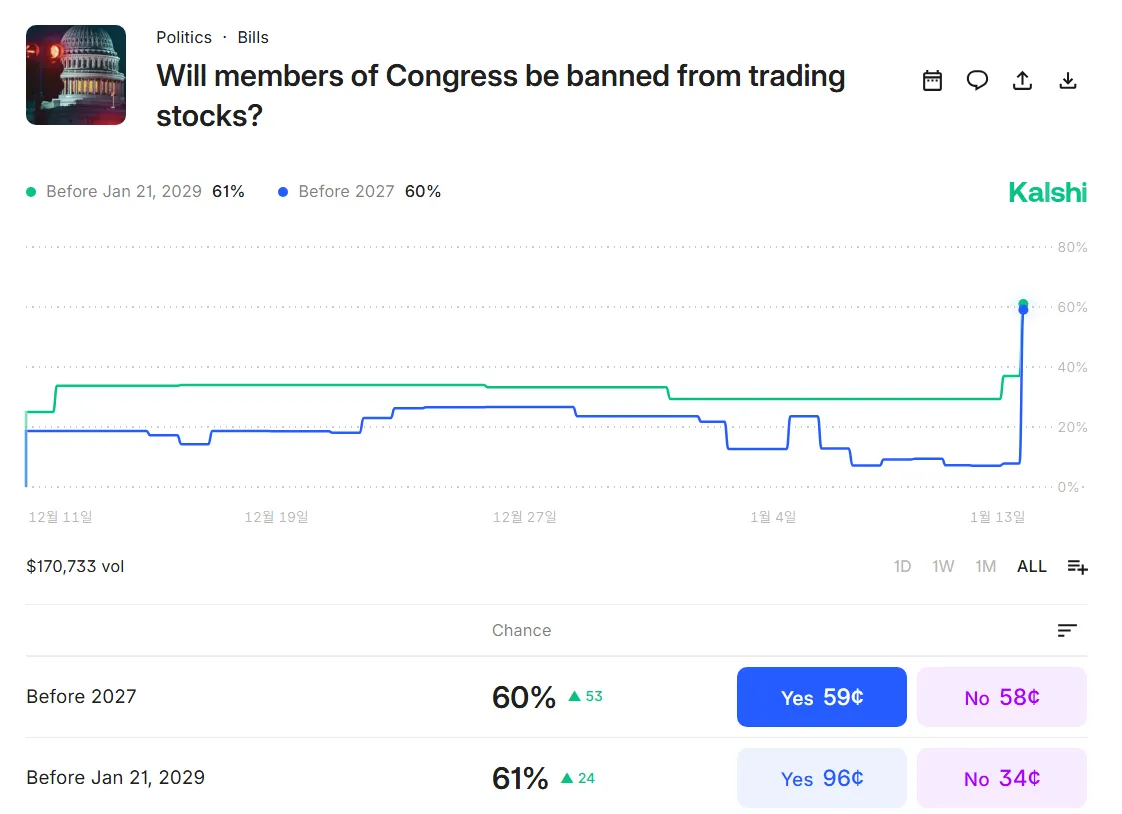

Data from U.S. prediction market platform Kalshi indicates a 60% probability that a bill banning stock trading by members of the U.S. Congress will pass this year.

17:34

Cryptocurrency trading and custody platform Bakkt Holdings has acquired stablecoin payments company Distributed Technologies Research (DTR), CryptoBriefing reported. The acquisition will be conducted as an all-stock transaction.

17:30

AlphaTON, a Nasdaq-listed firm with a digital asset treasury (DAT) of TON tokens, has signed a $46 million computing infrastructure agreement with Cocoon, a TON-based AI computing network, The Block reported. Under the deal, AlphaTON will supply Cocoon with 576 of Nvidia's B300 chips.

16:39

An address presumed to belong to World Liberty Financial (WLFI), a DeFi protocol led by the Trump family, sent 500 million WLFI ($83.12 million) to an address associated with crypto market maker Jump Trading, Onchain Lens reported.

16:28

According to CoinNess market monitoring, BTC has risen above $92,000. BTC is trading at $92,000 on the Binance USDT market.

16:13

U.S. investment bank Benchmark has identified this week as a crucial watershed moment for the cryptocurrency sector, Coindesk reported. Benchmark noted that the U.S. Senate is preparing to vote on the crypto market structure bill, known as the CLARITY Act. The bank believes this legislation could be the starting point for fundamentally resolving the long-standing regulatory vacuum in the industry. Furthermore, Benchmark explained that the bill is particularly important because it could mitigate the risk of regulatory reversal, such as a future administration changing the current government's stance on crypto.

16:05

Whale Alert reported that 3,744 BTC has been transferred from Coinbase Institutional to an unknown new wallet. The transaction is valued at about $343 million.

15:36

Nasdaq-listed Sharps Technology, a strategic investor in SOL, is partnering with Coinbase to participate in validator operations, The Block reported. The company plans to delegate a portion of its 2 million SOL holdings to a validator run by Coinbase.

15:19

The Bitcoin Core development team has appointed a new code maintainer for the first time since May 2023, crypto media outlet Protos reported. The new developer is known only by the pseudonym TheCharlatan, with no other information disclosed. Maintainers have the authority to decide which code proposed by developers is implemented into the Bitcoin system. The team is now composed of six members.

14:05

WorldLibertyFinancial (WLFI), a DeFi protocol led by the Trump family, has launched a lending market called World Liberty Markets, The Block reported. The new market is based on the margin trading protocol Dolomite. Users can borrow assets including ETH, USDC, USDT, and tokenized Bitcoin using USD1 as collateral.

13:56

The Bank of Italy has warned that market risks from Ethereum could spill over into infrastructure and financial stability risks in an extreme scenario where the asset's price collapses to zero, Cointelegraph reported. In a research paper, the central bank noted that because validators are compensated in ETH, a sharp price decline could cause some to exit the network. This, in turn, could lead to weakened security, delays in block production, and impaired payment and settlement functions. The report also cautioned that since Ethereum is used as a settlement infrastructure for stablecoins and tokenized assets, any shock could spread to the real-world financial system.

13:44

Standard Chartered (SC) has predicted that this will be the year of Ethereum (ETH), The Block reported. The bank stated that it expects ETH to post significant gains against BTC, citing Ethereum's dominant position in stablecoins, real-world asset (RWA) tokenization, and DeFi, as well as its notable growth in network throughput. SC's price target for ETH this year is $7,500, with a positive long-term outlook of $30,000 by 2029 and $40,000 by 2030.

13:38

According to Onchainlens, Bitmain (BMNR) purchased an additional 24,266 ETH ($75.37 million) last week. The company's total holdings now stand at 4,167,768 ETH, valued at $12.9 billion.

13:25

President Donald Trump is set to interview BlackRock Chief Investment Officer (CIO) Rick Rieder this week as a candidate for the next Chair of the Federal Reserve, Walter Bloomberg reported. Trump is expected to announce his final selection later this month.