Live Feed

Today, January 2, 2026

06:00

The following are the long/short position ratios for BTC perpetual futures on the world's top three cryptocurrency futures exchanges by open interest over the last 24 hours:

Overall: 49.29% long, 50.71% short

1. Binance: 49.3% long, 50.7% short

2. OKX: 49.64% long, 50.36% short

3. Bybit: 51.02% long, 48.98% short

04:58

The value of tokenized real-world assets (RWAs) on the Solana blockchain has increased by 10% over the past month to $873.3 million, Cointelegraph reported, citing data from RWA.xyz. In a related analysis, asset manager Bitwise suggested that Solana could be a major beneficiary if the U.S. passes its proposed crypto market structure bill, the CLARITY Act, this year. Bitwise believes the legislation would spur rapid growth in the RWA tokenization sector.

04:40

South Korean crypto exchange Upbit announced it will temporarily suspend deposits and withdrawals for digital assets on the Arbitrum One network, starting at 3:00 p.m. UTC on Jan. 8. The affected cryptocurrencies are ANIME, ARB, MLK, BOUNTY, and LZM.

03:40

According to CoinNess market monitoring, BTC has risen above $89,000. BTC is trading at $89,008.28 on the Binance USDT market.

03:14

Bitcoin has not yet reached its market bottom, according to an analysis by Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence. In a post on X, McGlone noted that BTC is currently trading at about a 13% discount to its 50-week moving average. He added that historically, market bottoms have typically formed when the price reached a discount of around 55% to that average, suggesting the potential for further declines.

03:00

The following shows estimated liquidation volumes and position ratios for major crypto perpetual futures over the past 24 hours:

- BTC: $18.99 million liquidated (84.56% shorts)

- ETH: $10.55 million liquidated (66.7% shorts)

- RIVER: $9.27 million liquidated (77.43% shorts)

02:47

BioPassport (BIOT) has shared its key roadmap for 2026 via an official Medium post. The plan includes a service overhaul and rebranding in the first quarter, followed by the launch of a wellness tracker beta service and the introduction of an AI coaching system in the second quarter. In the third quarter, the project will focus on ecosystem expansion and preparations to build a proprietary mainnet. The year will conclude with the implementation of global service support in the fourth quarter.

02:38

XRP was the most traded cryptocurrency on the South Korean exchange Upbit in 2025, according to user data released by its operator, Dunamu. Other highly traded assets included BTC, ETH, USDT, and DOGE. The report showed that Upbit's cumulative user base reached 13.26 million, with 1.1 million new users joining in 2025. The user base was composed of 65.4% men and 34.6% women. By age, investors in their 30s were the largest group at 28.7%, followed by those in their 40s (24.1%) and 20s (23.2%). The analysis also found that the most active trading hour was 12:00 a.m. UTC.

01:52

The South Korean cryptocurrency exchange Coinone has announced it will support the rebranding of APENFT (NFT) to AINFT. The project's logo will also be updated, while its ticker will remain NFT.

01:02

AEON, a payment and settlement layer for the AI economy, has announced a strategic partnership with X Layer, OKX's proprietary Ethereum Layer 2 network. The collaboration will integrate AEON's QR code-based Scan-to-Pay crypto payment feature into X Layer, enabling payments across Southeast Asia, Africa, and Latin America. As part of the partnership, AEON's Web3 mobile payment solution will also be incorporated into OKX Pay, the native wallet within the OKX mobile app, allowing users to access the Scan-to-Pay function directly.

00:47

Turkmenistan has legalized cryptocurrency mining and trading, Cointelegraph reported. Under the new regulations, both domestic and foreign nationals who complete a registration process will be permitted to mine cryptocurrencies, and the operation of mining pools will also be allowed. Additionally, cryptocurrency exchanges headquartered in Turkmenistan will be required to obtain a license. However, the country has not yet recognized cryptocurrency as legal tender, currency, or a security.

00:31

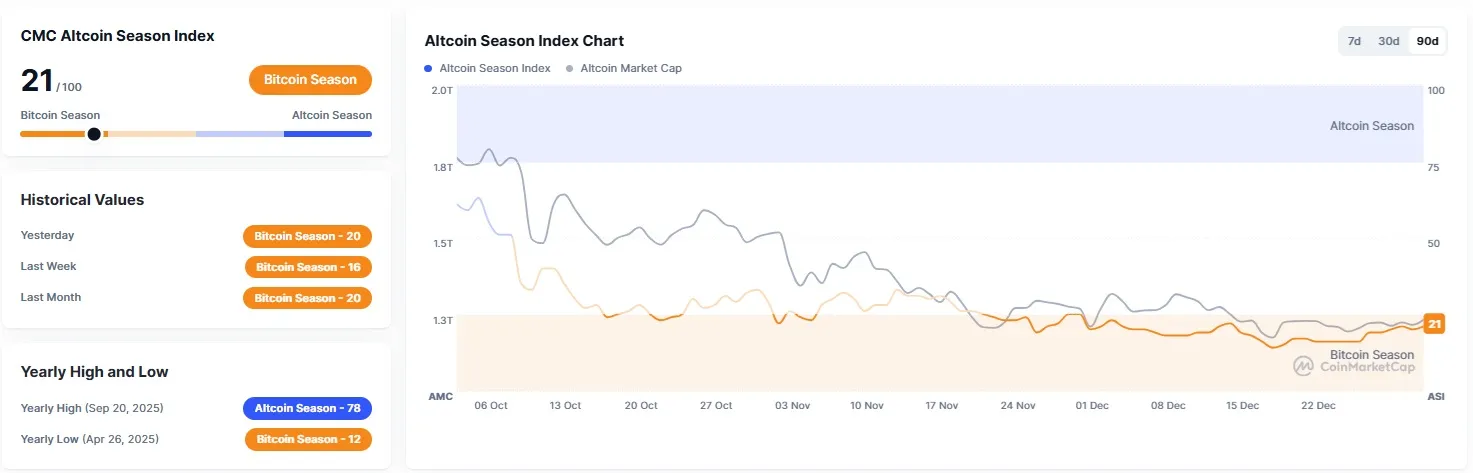

CoinMarketCap's Altcoin Season Index is currently at 21. The index compares the price performance of the top 100 cryptocurrencies, excluding stablecoins and wrapped tokens, against Bitcoin over the last 90 days. An "altcoin season" is indicated when 75% of these top 100 coins outperform Bitcoin over the 90-day period. Conversely, a "Bitcoin season" is declared when Bitcoin outperforms the majority of top altcoins. A score closer to 100 signifies a stronger altcoin season.

00:15

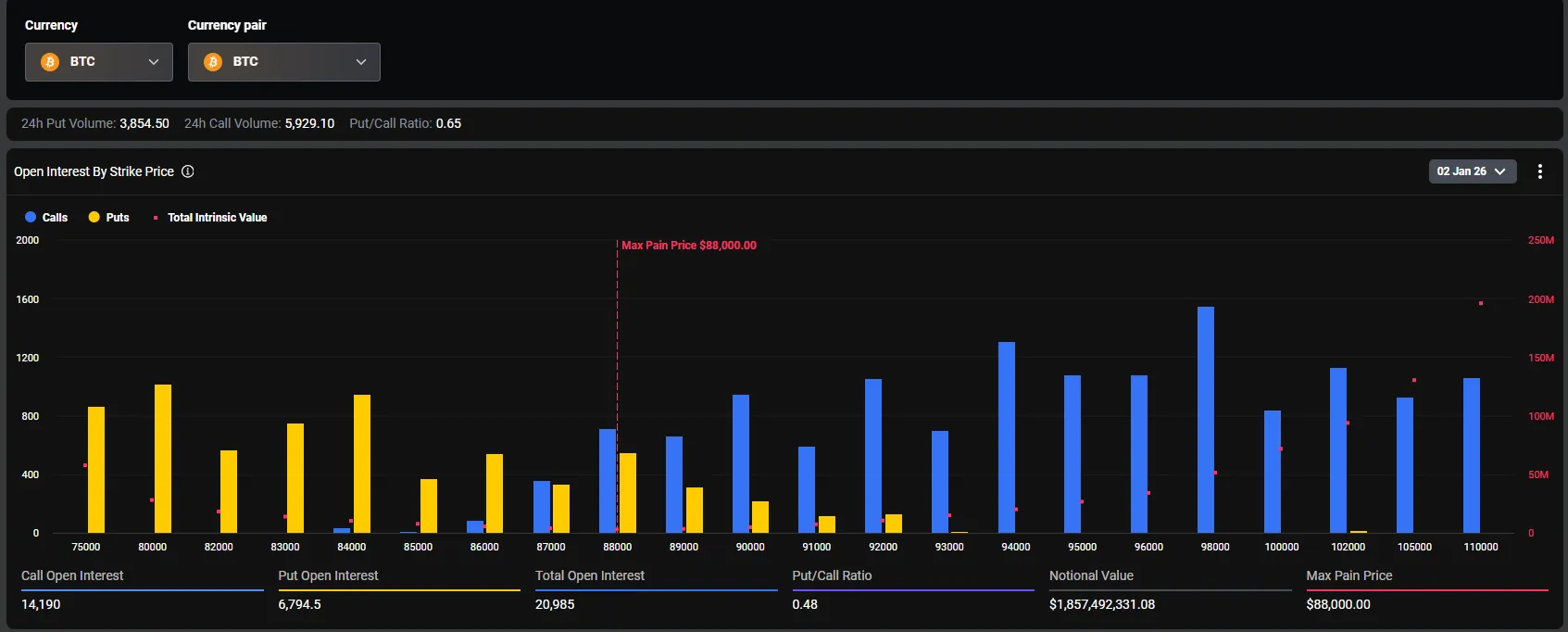

Bitcoin options with a notional value of $1.85 billion are set to expire at 8:00 a.m. UTC on Jan. 2, according to data from crypto options exchange Deribit. The contracts have a put/call ratio of 0.48 and a max pain price of $88,000, the point at which the largest number of options would expire worthless. Additionally, Ethereum options worth $390 million will expire at the same time. These options have a put/call ratio of 0.62 and a max pain price of $2,950.

00:03

The Crypto Fear & Greed Index from data provider Alternative stands at 28, an increase of eight points from yesterday. This shift moves market sentiment from extreme fear to fear. The index measures market sentiment on a scale from 0 (extreme fear) to 100 (extreme optimism). It is calculated based on factors including volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

Yesterday, January 1, 2026

23:58

Iran has begun accepting cryptocurrency for sales of advanced military hardware, including drones, missiles, and warships, in a move to bypass Western financial sanctions, the Financial Times (FT) reported. According to the report, the Defense Export Center (Mindex), an export agency under Iran's Ministry of Defense, announced its readiness to negotiate military contracts allowing for various payment methods, including digital currencies, barter, and the Iranian rial. The FT noted that this is one of the first public instances of a state declaring its willingness to accept cryptocurrency as payment for strategic military equipment exports.

22:27

a16z Crypto has presented its outlook for the digital asset sector, predicting that this year will mark a significant turning point for blockchain applications. The firm highlighted that stablecoins are set to become a core element of global finance, anticipating major shifts in payments, privacy, and blockchain use cases.

21:45

The Flow (FLOW) Foundation is moving forward with a two-stage recovery plan following a hack that resulted in a $3.9 million loss, Cointelegraph reported. The foundation has reportedly abandoned its initial plan for a network rollback due to community opposition and will instead burn the tokens that were created without authorization. Currently, the Flow network has normalized its non-EVM chain, Cadence, and plans to restore its EVM chain within a few days. The report added that the hacker is believed to have stolen 150 million FLOW, approximately 10% of the total supply, and deposited the funds on an exchange suspected to be Binance. The assets were then swapped for BTC and withdrawn. This could potentially lead to scrutiny of the exchange's anti-money laundering and know-your-customer compliance procedures.

21:08

The U.S. Federal Reserve is likely to hold interest rates steady in January as it considers preemptive measures to prevent a liquidity drain, CoinDesk reported. According to the minutes from the December Federal Open Market Committee (FOMC) meeting, the Fed is weighing the purchase of short-term Treasury bills and an expansion of its repo facility. The minutes noted that current liquidity pressures are building faster than during the 2017-2019 quantitative tightening period, prompting the Fed to consider buying $220 billion in short-term Treasurys. The market is now focused on the first FOMC meeting of the year on Jan. 27-28, with the CME FedWatch Tool indicating an 85.1% probability of a rate hold. The prevailing analysis suggests the Fed will prioritize liquidity management over rate cuts.

20:08

Bitcoin's upward momentum could be constrained by activity in the options market, according to an analysis by Cointelegraph. The report notes that as yields on cash-and-carry strategies—which involve buying spot assets while shorting futures—have fallen below 5% annually, investors are increasingly turning to covered calls. This strategy, which involves holding spot BTC while selling call options to generate income, can offer annual returns between 12% and 18% but may suppress the asset's price ceiling.

Evidence of this trend can be seen in Bitcoin's implied volatility (IV) for contracts throughout 2025, which has decreased from 70% to around 45%. Cointelegraph suggests this decline indicates that consistent selling of call options by institutional players has reduced overall market volatility. However, the analysis also points out that there is significant buying demand for call options to counter the selling pressure, and demand for put options to hedge against downside risk remains robust. This dynamic is ultimately viewed as a sign of a maturing market as institutional capital enters to profit from volatility.

19:47

Ethereum (ETH) founder Vitalik Buterin said on X that the dApp ecosystem must be developed to counter failures in centralized infrastructure, such as the recent Cloudflare outage. The incident in November paralyzed approximately 20% of websites globally. Buterin argued that to prevent such events, dApps that are not subject to external pressures must become foundational infrastructure for society. He noted that the crypto industry's ideal of decentralization is being eroded for the sake of convenience and urged the sector to regain its technical independence. Buterin also suggested that the introduction of related futures products could be discussed for the ETH network to enhance the predictability of gas fees.

18:17

The 10 largest cryptocurrency hacks of 2025 resulted in approximately $2.2 billion in losses, according to a report by crypto media outlet The Block. The incidents are summarized below.

1. Bybit, Feb. 21, $1.4 billion: Private key theft and phishing, attributed to the Lazarus Group.

2. Cetus, May 22, $223 million: Liquidity drain exploiting fake tokens and a logic error.

3. Balancer (BAL), Nov. 3, $128 million: Exploitation of a calculation bug in a stablecoin pool.

4. Bitget, April 20, $100 million: Flaw in a market-making bot's logic and price manipulation.

5. Phemex, Jan. 23, $85 million: Hot wallet private key leak.

6. Nobitex, June 18, $80 million: Hot wallet hack and internal data breach.

7. Infini, Feb. 24, $49.5 million: Misuse of smart contract admin privileges.

8. BtcTurk, Aug. 14, $48 million: Hot wallet private key leak.

9. CoinDCX, July 19, $44.2 million: Server intrusion.

10. GMX, July 9, $42 million: Exploitation of a vulnerability in a liquidity provider pool's smart contract.

17:19

Whale Alert reported that 500 million XRP has been locked in escrow at Ripple.

16:17

While altcoin exchange-traded funds (ETFs) are launching rapidly in the United States, they are unlikely to achieve the same level of growth as their Bitcoin counterparts, according to a recent analysis. The Block reported that Ben Slavin, Global Head of ETFs at BNY Mellon, acknowledged accelerating launches and confirmed investor demand for altcoin ETFs. However, Slavin stated it would be difficult for these funds to hold a significant portion of their underlying assets' circulating supply, unlike Bitcoin ETFs, which hold around 7%. He predicted that because altcoin ETFs are sensitive to market trends, short-term demand will fluctuate with price, but long-term investor interest will continue to grow.

Separately, Ripple Labs President Monica Long explained that although more than 40 crypto ETFs have launched this year, their share of the U.S. ETF market remains minimal. She suggested that wider adoption of crypto ETFs could accelerate market participation from corporations and institutions. Long added that large corporations are showing increased interest in financial strategies that use digital assets and in investments in tokenized assets.

16:01

Charles Schwab CEO Rick Wurster stated in a Schwab Network interview that the macroeconomic environment will become more favorable for Bitcoin, despite the recent market downturn. He cited factors such as quantitative easing, the U.S. Federal Reserve's bond-buying program, and weak demand for U.S. Treasurys as key drivers.

13:42

Losses from 26 major cryptocurrency hacking incidents in December totaled approximately $76 million, according to blockchain security firm PeckShield. The figure represents a decrease of over 60% from the $194.27 million lost in November.