Live Feed

Today, January 15, 2026

01:02

The South Korean crypto exchange Upbit announced that it is temporarily suspending deposits and withdrawals for Worldcoin (WLD) to conduct wallet system maintenance.

00:51

The Bank of Korea has frozen its benchmark interest rate at 2.50% for the fifth consecutive time. The decision follows previous rate holds in July, August, October, and November of last year.

00:45

An Ondo Finance (ONDO) multisig address deposited 25 million ONDO, worth approximately $10.2 million, to five exchanges including Coinbase, OKX, Bybit, Gate, and KuCoin about six hours ago, EmberCN reported. Such transfers to exchanges are often seen as a precursor to selling.

00:39

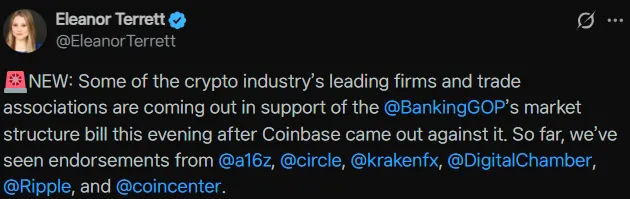

While Coinbase has withdrawn its support for the U.S. crypto market structure bill, known as the Clarity Act, several other companies have affirmed their backing, according to a report from Eleanor Terrett, host of Crypto in America. Supporters of the legislation include a16z, Circle, Kraken, the Chamber of Digital Commerce, Ripple, and Coin Center.

Coinbase previously pulled its support over several concerns, including what it described as a de facto ban on tokenized stocks, the potential to block DeFi while allowing unlimited access to financial data, a weakening of the Commodity Futures Trading Commission's (CFTC) authority relative to the SEC, and the possible prohibition of stablecoin reward features. The exchange's opposition had raised the possibility that a Senate markup session on the bill, scheduled for Jan. 15, could be canceled.

00:31

CoinMarketCap's Altcoin Season Index now stands at 29, a one-point decrease from yesterday. The index gauges market sentiment by comparing the performance of the top 100 cryptocurrencies, excluding stablecoins and wrapped coins, against Bitcoin over the past 90 days. An "altcoin season" is indicated when 75% of these top coins outperform Bitcoin over that period, with a score closer to 100 signaling stronger altcoin momentum. A lower score suggests a "Bitcoin season."

00:06

The shared sequencer solution Espresso can resolve the system gap between global financial and consumer applications and the blockchain, according to a new report from South Korean blockchain consulting firm ARK Point. In the report, titled "Espresso: Building a Global Baselayer for the Rollup Economy," the firm argues that while rollups have successfully scaled transaction execution, they have also created a fragmented ecosystem of chains. Relying on the Ethereum Layer 1 as the underlying infrastructure to connect these chains is insufficient for the real-time services required by modern applications, as finality on Ethereum still takes 12 to 15 minutes.

Espresso aims to solve this infrastructure gap by providing a high-performance, decentralized consensus and finality layer—a "baselayer"—specifically designed to unify the rollup ecosystem. The project offers transaction finality in two seconds and has a roadmap for achieving sub-one-second finality. The report notes that major industry players, including Celo (CELO), Arbitrum (ARB) developer Offchain Labs, and Polygon (POL), are moving beyond testing and are now integrating Espresso as core infrastructure.

00:01

The Crypto Fear & Greed Index has risen 13 points from the previous day to 61, shifting into the 'Greed' territory amid improving investor sentiment, according to data from Alternative. This marks the first time the index has surpassed 60 to enter the 'Greed' phase since Oct. 10 of last year, which coincided with a record-breaking forced liquidation event.

The index measures market sentiment on a scale where 0 indicates 'Extreme Fear' and 100 represents 'Extreme Greed.' It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market dominance (10%), and Google search volume (10%).

Yesterday, January 14, 2026

23:53

An address presumed to belong to Bitmine (BMNR) has staked an additional 154,304 ETH, worth $519.76 million, over the past four hours, Onchain Lens reported. The address is now staking a total of 1,685,088 ETH, valued at $5.65 billion.

23:42

The Algorand (ALGO) Foundation is moving its headquarters from Singapore to the United States and launching a new board of directors, DL News reported. CEO Staci Warden said the foundation is focusing on areas where blockchain can have a tangible impact, including immediate global payments, accessibility to financial products, and economic resilience. She added that by realigning its U.S. presence, the foundation aims to help the United States secure a leadership role in next-generation financial infrastructure.

23:35

Research and brokerage firm TD Cowen has lowered its price target for Strategy to $440 from a previous $500, The Block reported. The downgrade is attributed to the dilution of stock value from the continued issuance of common and preferred shares, along with weakened Bitcoin profitability.

22:21

A Senate markup for a cryptocurrency market structure bill, known as the Clarity Act, scheduled for Jan. 16, may be canceled after Coinbase withdrew its support for the legislation. Eleanor Terrett, host of "Crypto in America," reported the development, citing an anonymous source. Writing on X, Terrett said she has been unable to confirm if the matter is proceeding within the Senate Banking Committee and has requested comment from the office of Chairman Tim Scott. However, she noted that industry sources confirmed Coinbase had asked the Senate to postpone the markup and subsequently officially withdrew its support for the bill.

22:10

JPMorgan anticipates that capital flowing into the cryptocurrency market will increase this year, led by institutional investors, The Block reported. In a recent report, the investment bank noted that a record $130 billion entered the crypto market last year, an increase of over 30% from the prior year. The bank projects that upcoming regulations—such as the Clarity Act, which would establish a U.S. crypto market structure—will encourage institutions to adopt cryptocurrencies more actively. This is expected to drive more venture capital investment, mergers and acquisitions, and initial public offerings across various sectors, including stablecoin issuers, payment firms, exchanges, wallet services, and blockchain infrastructure. JPMorgan also suggested that this year's inflows are more likely to be driven by institutional investors, in contrast to last year's trend, which was led by companies holding digital assets.

21:36

The Sui (SUI) network has been restored and is now operating normally, the project announced via X. The announcement follows a notice from five hours prior that the mainnet was experiencing network latency and that a solution was being actively pursued. Sui advised users who continue to face issues to refresh their app or browser.

21:17

Coinbase CEO Brian Armstrong has announced his official opposition to a draft cryptocurrency regulation bill from the U.S. Senate Banking Committee. In a post on X, Armstrong stated that after reviewing the draft for the past two days, he cannot support it because it could lead to more negative outcomes than the current system. He identified several core problems with the proposal, including a de facto ban on tokenized securities, the blocking of DeFi, the weakening of the Commodity Futures Trading Commission's (CFTC) authority relative to the SEC, and a potential ban on stablecoin reward features. While acknowledging the Senate's bipartisan efforts, Armstrong concluded that the current draft is a significant step backward and that it would be better for the bill not to pass at all.

20:59

Blockchain-based lending platform Figure Technology Solutions has launched OPEN, a network that supports the on-chain trading of public stocks, Wu Blockchain reported. The network is built on the Provenance blockchain, developed by Figure, and is designed to enable the issuance and trading of tokenized stocks backed by real-world shares. This allows companies to issue digital securities on-chain based on physical stocks, which investors can then trade directly on the blockchain network.

20:01

Asset manager Bitwise has listed seven new exchange-traded products (ETPs) based on Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) on Nasdaq Stockholm in Sweden, Cointelegraph reported. The listing allows Swedish investors to access spot and staking-linked cryptocurrency products denominated in the local currency, the Swedish krona (SEK). The newly listed products include a spot Bitcoin ETP, a spot Ethereum ETP, staking-based ETPs for ETH and SOL, a hybrid ETP combining Bitcoin and gold, and an ETP that tracks the MSCI Digital Asset Select 20 index of the top 20 cryptocurrencies by market capitalization.

19:20

Of the approximately 20.2 million cryptocurrencies that entered the market between mid-2021 and the end of 2025, 53.2% are no longer trading, Coindesk reported, citing data from CoinGecko. The number of failed tokens surged in 2025, with 11.6 million projects delisted that year alone, a sharp increase from 1.3 million in 2024 and 2,584 in 2021.

A significant portion of these failures occurred in the fourth quarter of 2025, when 7.7 million tokens disappeared from the market in just three months, representing 35% of all failed projects since 2021. This period followed a "liquidation cascade" event on Oct. 10, 2025, which saw the simultaneous liquidation of $19 billion in leveraged positions. The report noted that this highlights the market's vulnerability to short-term speculation and the double-edged nature of its low barrier to entry, which allows for a large influx of projects lacking robust technology.

18:40

Tokenization brokerage infrastructure firm Alpaca has raised $150 million in a Series D funding round, valuing the company at $1.15 billion, The Block reported. The round was led by Drive Capital with participation from Citadel Securities, Opera Tech Ventures, DRW, Bank Muscat, and Kraken. The specific use of the funds was not disclosed.

17:48

Neel Kashkari, president of the Minneapolis Federal Reserve and a prominent crypto skeptic within the U.S. central bank, has stated that cryptocurrency is fundamentally useless to consumers.

17:46

Senate Banking Committee Chairman Tim Scott stated in an interview with CoinDesk that it would be inappropriate to insert an ethics provision targeting President Donald Trump's cryptocurrency business into a pending crypto bill. Scott argued that such an ethics debate is outside the jurisdiction of the Banking Committee and should be handled as a separate matter by the Senate Ethics Committee. He added that while discussions are possible, adding the provision to the bill as is would be more difficult than expected. The U.S. Senate Banking Committee is scheduled to vote on the Digital Asset Market Clarity Act this Thursday.

17:32

The U.S. Securities and Exchange Commission (SEC) has concluded its investigation into the Zcash Foundation, which began in 2023, according to media reports. The agency notified the foundation that it will not recommend any enforcement action in connection with the matter.

17:27

The FTX estate has announced it will conduct its next round of creditor repayments on March 31. The distribution will be made to creditors registered as of Feb. 14. Concurrently, the estate has submitted a revised proposal to the bankruptcy court to reduce its reserve for disputed claims. If the court approves the proposal, the total amount available for repayment is expected to increase.

17:08

Nasdaq-listed Figure Technology Solutions has launched the On-Chain Public Equity Network (OPEN), a blockchain-based platform that enables the issuance and lending of real-world stocks without intermediaries. Unlike existing tokenized stocks, which are often synthetic assets that track actual shares, OPEN directly issues stocks with real ownership on its proprietary blockchain. This allows investors to lend or collateralize their shares directly on-chain, bypassing complex intermediaries like brokerage firms and custodians.

17:03

Cryptocurrency custody firm BitGo has attracted more funds than expected for its initial public offering (IPO), according to media reports. The company had previously announced its plan to raise $201 million through the offering.

16:39

Global crypto derivatives exchange Deribit announced it will support USDC-based options trading for Avalanche (AVAX) and Tron (TRX), in addition to its existing perpetual futures for the assets.