Live Feed

Today, December 30, 2025

16:46

Nasdaq-listed global healthcare company Prenetics has announced it will discontinue its Bitcoin purchasing program. According to Crypto Briefing, the company is halting the program to focus on its consumer health brand, IM8. Prenetics plans to hold its existing 510 BTC, valued at $45 million, and does not intend to sell its current holdings. The company had been consistently buying Bitcoin since announcing in June that it would strengthen its BTC treasury strategy.

16:40

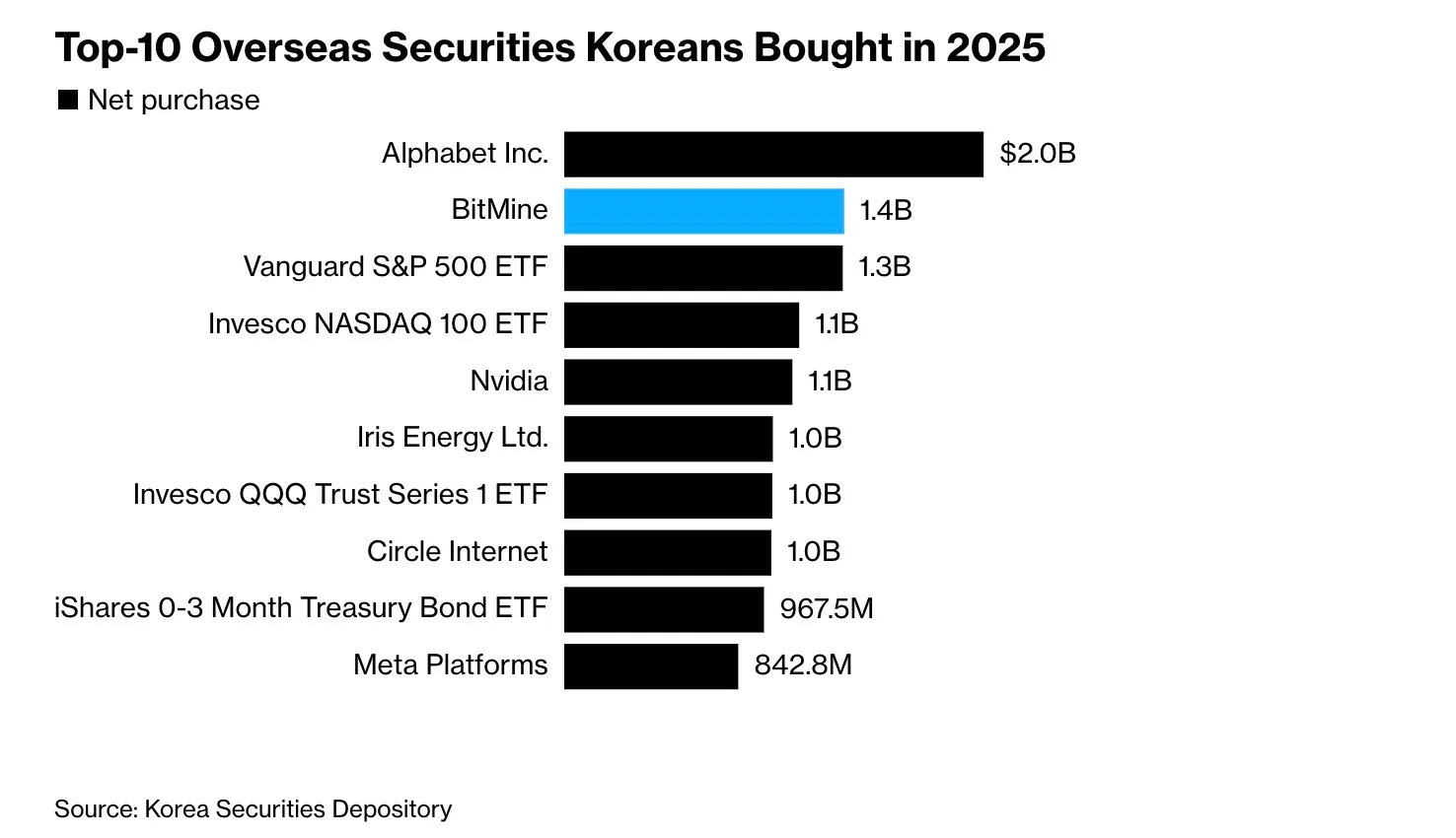

Bitmine (BMNR), which is strategically accumulating ETH, has become the second most popular overseas stock among South Korean investors this year, Bloomberg reported. According to the report, South Korean investors have net-purchased approximately $1.4 billion worth of the company's stock this year. They have also increased their investment exposure through a 2x leveraged ETF launched by T-Rex.

16:30

Whale Alert reported that 3,858 BTC has been transferred from Coinbase Institutional to an unknown wallet. The transaction is valued at about $344 million.

16:24

XRP reserves on exchanges have fallen to their lowest level in eight years, fueling expectations of a price increase from a potential supply shock, Cointelegraph reported. According to data from Glassnode, the balance of XRP on exchanges dropped sharply from 3.76 billion on Oct. 8 to 1.6 billion by the end of December, the lowest amount since 2018. Cointelegraph's analysis suggests this indicates a weakening willingness to sell among holders and that large-scale accumulation is underway. The report added that with a key support level around $1.78, the combination of potential ETF inflows and shrinking liquidity could position XRP for a structural bull market in 2026.

15:56

The OECD's Crypto-Asset Reporting Framework (CARF) will officially launch as scheduled on Jan. 1, 2026, Cointelegraph reported. Under the framework, 48 countries, including the UK and the European Union, will mandate that crypto exchanges and platforms collect and report user data such as tax residency, account balances, and transaction histories. This information will be shared among nations through an international tax information exchange system to enhance transparency in global cryptocurrency taxation.

15:38

Ki Young Ju, CEO of CryptoQuant, said in a post on X that while whales are currently accumulating BTC in the spot market, the futures market has become an arena for speculative activity by retail investors. He suggested that this combination of whale accumulation and retail speculation could lead to a price rally once over-leveraged positions are liquidated.

15:31

Nasdaq-listed SharpLink Gaming, a strategic investor in ETH, currently holds 863,020 ETH, representing approximately 0.7% of the token's circulating supply, according to Solid Intel.

14:57

According to CoinNess market monitoring, BTC has risen above $89,000. BTC is trading at $89,004.82 on the Binance USDT market.

14:32

The three major U.S. stock indices opened lower, with the S&P 500 down 0.05%, the Nasdaq Composite down 0.04%, and the Dow Jones Industrial Average down 0.06%.

14:25

Whale Alert reported that 1,000 million USDT has been minted at the Tether Treasury.

14:23

Grayscale announced on X that it has filed a Form S-1 with the U.S. Securities and Exchange Commission (SEC) to convert its Bittensor (TAO) Trust into a spot exchange-traded fund (ETF).

14:13

An analysis suggests that the Bitcoin treasury strategy of Strategy, the largest single corporate holder of BTC, will face a significant test next year. According to Cointelegraph, experts have pointed out that while Strategy can leverage its BTC net asset value (NAV) premium to issue stock and expand leverage in a bull market, the model's sustainability could weaken sharply in sideways or bear markets. The media outlet explained that Strategy is no longer considered a traditional operating company but has transformed into a leveraged Bitcoin investment vehicle. While this structure can generate substantial returns in a bull market, it is also susceptible to sharp downturns depending on market conditions. Investors are advised to closely monitor the company's BTC holdings, average purchase price, leverage ratio, preferred stock and bond issuances, and overall cryptocurrency market performance.

14:05

Whale Alert reported that 1,300,000,000 USDT has been transferred from Aave to HTX. The transaction is valued at about $1,299 million.

13:57

While the issue of quantum computing is gaining attention in the cryptocurrency market, digital asset manager Grayscale has assessed that it is unlikely to have a tangible impact on asset prices by 2026, according to CoinDesk. In a recent report, Grayscale noted that quantum computers could theoretically break current cryptographic standards and derive private keys from public keys, thereby threatening blockchain security. However, the firm stated that it would take considerable time for this theory to become a practical reality. Grayscale concluded that in the long term, most blockchains, including Bitcoin, will need to transition to quantum-resistant cryptography. While a blockchain's ability to counter quantum threats may become a valuation metric in the future, the report suggests the short-term impact on market value will be insignificant.

13:43

Overtake (TAKE) announced on its official X account that a recent sharp price drop was not the result of a security breach or hacking. The statement follows a 10-minute period in which the token plunged approximately 70%, as previously reported by CoinNess. The project's team said it believes the crash is linked to a large-scale liquidation in the derivatives market and is closely monitoring the situation. It also confirmed that all wallets managed by the foundation and team remain secure.

13:39

Chinese investors have poured $188 million into companies related to the digital yuan following an announcement by the People's Bank of China (PBOC) that it will allow interest payments on central bank digital currency (CBDC) wallets, DL News reported. Approximately 30% of the investment was directed to Lakala, a provider of hardware wallets and merchant payment infrastructure. The PBOC previously announced new guidelines, effective Jan. 1, to strengthen the digital yuan's infrastructure and governance by including it in deposit reserves and classifying wallets based on liquidity.

13:37

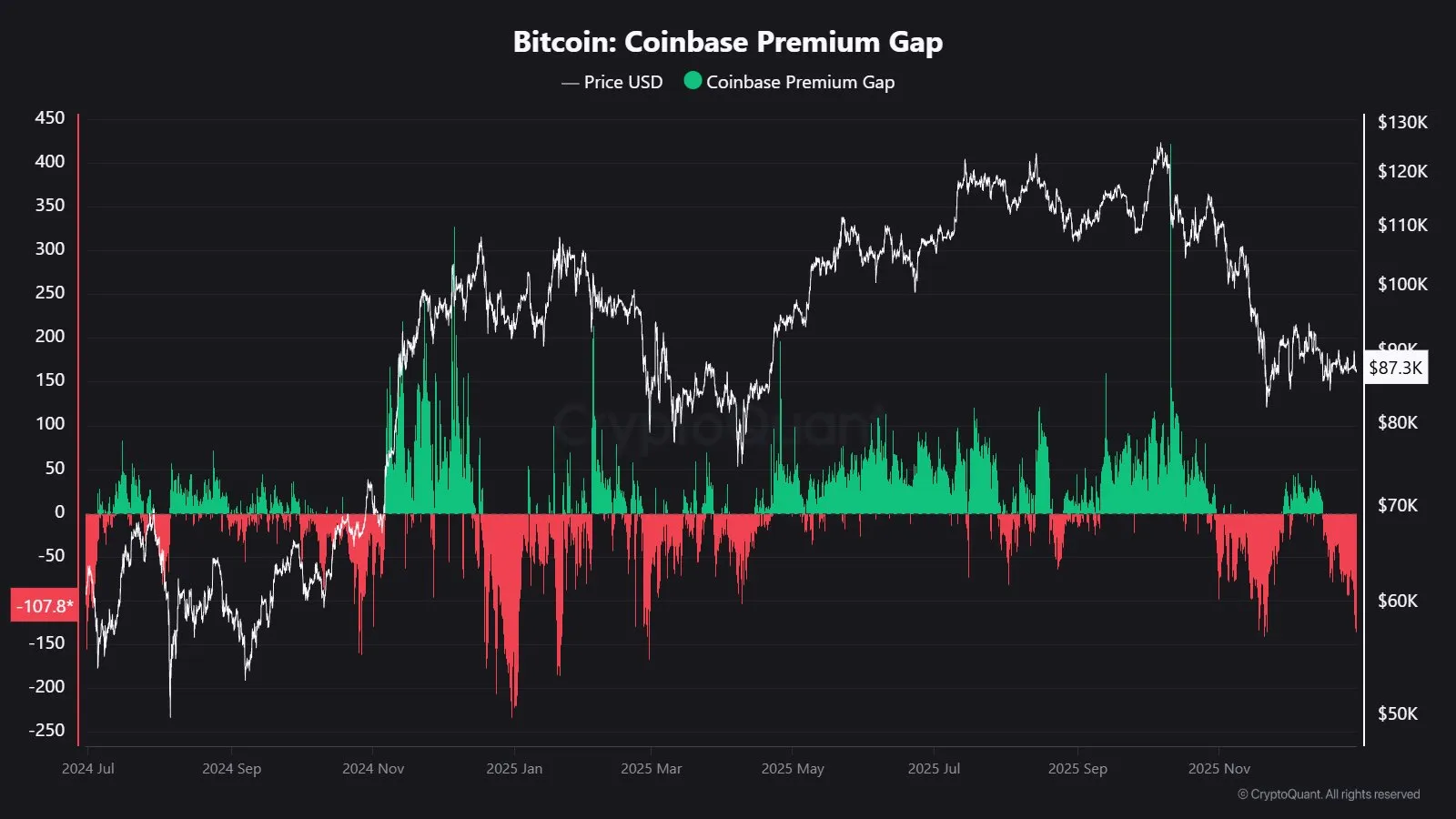

The Coinbase Premium has dropped to a level seen only about five times a year, according to CryptoQuant contributor and analyst martuun. The Coinbase Premium is an indicator that shows the difference between the Bitcoin price on Coinbase and its price on other global exchanges. The analyst noted that the premium is currently at -$122, adding that such an extreme discount has only been observed on about five occasions this year.

13:24

Industry experts forecast that stablecoins will become a core component of global financial infrastructure by 2026, serving as the underlying "plumbing" for both decentralized and traditional finance, Cointelegraph reports.

The year 2026 is expected to be pivotal for regulated, dollar-backed stablecoins, with greater regulatory clarity driving mainstream adoption across banking, fintech, and corporate and retail payment networks. Use cases are projected to expand into B2B settlements, treasury operations, and payroll. In emerging markets across Africa, Asia, and Latin America, stablecoins are also anticipated to see rapid adoption for daily payments, remittances, and wealth preservation.

However, challenges remain. Divergent national regulatory frameworks could increase systemic risk, market polarization, and liquidity fragmentation. Tokenized deposits are also expected to emerge as a key competitor, potentially replacing stablecoins in areas requiring high regulatory stability as banks innovate with permissioned ledgers.

Experts also foresee a shift toward on-chain finance, with institutional investors expected to deploy an estimated $230 billion in currently idle, non-yield-bearing stablecoins into DeFi-based solutions.

13:00

Bitcoin's drop of over 2.6% on Dec. 29, which occurred shortly after it reclaimed the $90,000 level, is being analyzed as a classic bear trap. According to Cointelegraph, crypto investor James Bull, who has around 173,000 followers on X, suggested that the price action could be a "Christmas bear trap." He predicted a significant rebound in January 2026, similar to patterns observed over the past four years.

Bull explained that last year, Bitcoin fell 8.5% between Dec. 26 and Dec. 31, 2024, only to rally 12.5% between Jan. 1 and Jan. 6, 2025. Another analyst, known as 'Bitcoin Therapist,' added that if the two-year halving cycle pattern is broken, Bitcoin could reach a new all-time high in the first quarter of 2026, which would complete what the analyst called the largest bear trap in history.

Meanwhile, Cointelegraph noted that based on the daily chart, BTC is forming a symmetrical triangle pattern. If the price closes a daily candle above the pattern's upper trendline and continues to rise, the next target could be the $107,400 level.

12:50

Cypherpunk Technologies, a digital asset financial firm backed by the Winklevoss brothers, has purchased an additional 56,418 ZEC, valued at $29 million, according to Wu Blockchain. This latest acquisition brings the company's total holdings to 290,062 ZEC, which accounts for 1.76% of the token's circulating supply. Cypherpunk CEO Will McEvoy said the company aims to expand its ZEC holdings to 5% of the total circulating supply.

12:38

Global cryptocurrency exchange Binance has suspended card-based withdrawals for users in Ukraine starting this week, according to local media reports. The suspension affects withdrawals via cards such as Visa and Mastercard for Ukrainian users who accessed the exchange through the fiat payment service Bifinity. Binance clarified that the change in payment methods applies only to Ukrainian users who utilized the Bifinity service.

12:33

According to CoinNess market monitoring, Overtake (TAKE) plummeted more than 70% in approximately 10 minutes. The sharp decline began around 12:20 p.m. UTC on Dec. 30, with the price falling from about $0.32 to a low of $0.11116. The token is currently trading at $0.12298, down 70.47%, according to Binance Alpha.

12:27

The number of smart contracts deployed on Ethereum reached an all-time high of 8.7 million in the fourth quarter of this year, crypto analyst Joseph Young stated on X. He noted that this follows several consecutive quarters of growth and likely reflects genuine ecosystem expansion rather than inflated metrics. Young attributed the growth to the expansion of Layer 2 networks, increased issuance of Real-World Asset (RWA) tokens, broader stablecoin adoption, and advancements in wallet and intent infrastructure.

12:27

XRP's short-term trajectory depends on its ability to defend the $1.85 support level, according to an analysis by Watcher.Guru. The outlet noted that with 1 billion XRP scheduled to be unlocked from escrow in January, the release could create short-term downward pressure, as the asset is barely holding above this key support.

For a bullish scenario to remain viable, XRP must maintain the $1.85 level, see trading volume recover around the $2.00 mark, and break through the downtrend resistance at $2.08. Meeting these conditions could invalidate the current bearish structure. Conversely, if XRP breaks below $1.85 before January, the next support level is likely to be $1.77, and strong selling pressure could push the price down to $1.60. The analysis concluded that the escrow unlock could amplify a negative cycle by creating both technical and psychological burdens.

12:18

The optimistic year-end Bitcoin price predictions from so-called industry experts for 2025 were almost all incorrect, CoinDesk reported. The media outlet noted that forecasts from traditional finance analysts and executives at firms like Fidelity, BlackRock, and JPMorgan, as well as from prominent Bitcoin bulls, were wide of the mark. Analyses from research institutions such as VanEck and Fundstrat also proved inaccurate. While a few experts lowered their price targets during the year, very few predicted a price below $100,000. CoinDesk concluded that 2025 served as a reminder of an old market truth: Bitcoin defies all predictions and breaks technical charts. It emphasized that while making predictions in the crypto industry is easy, being correct is rare.