Web3 chatting app Beoble acquires $2 million in pre-seed funding round

Web3 social messaging app Beoble announced on Wednesday that it has secured a total of $2 million in pre-seed funding, gaining recognition for its innovative communication service technology and potential for future growth.

Empowering individuals in the Web3 era

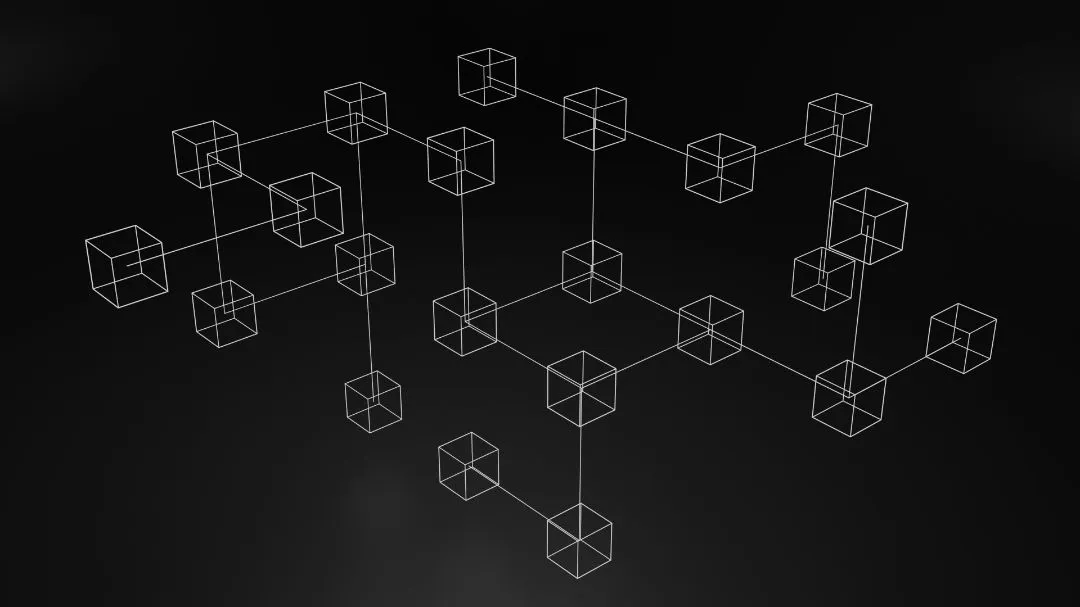

Targeted at the Hong Kong and Singaporean markets, Beoble is a Web3-based social messenger platform that employs a decentralized encryption network called the Communication Delivery Graph, which allows users to engage in end-to-end encrypted chatting between their digital wallets. It also offers a communication toolkit for integrating decentralized applications (dApps). The service emphasizes giving ownership to individuals rather than corporations, distributing “cat points” to users based on their participation and contribution to the ecosystem, which are then used to determine their eligibility for rewards like token airdrops. It currently supports all EVM-compatible blockchains like Ethereum and Polygon and plans to include others like Solana, Aptos and Sui.

“Beoble’s new solution for facilitating communication among Web3 wallets will address the vulnerabilities in control and security that are characteristic of existing Web2 messaging platforms, making it a leader in the Web3 messaging market,” said Beoble CEO Cho Sung-min.

Attracting industry giants

In this pre-seed round, major investors include firms focusing on crypto and blockchain projects such as Digital Currency Group (DCG), HashKey Capital and GBV Capital. Notably, Samsung Electronics’ venture capital arm, Samsung Next, also participated as an investor.

Furthermore, Beoble has received acclaim from experts for providing a direct communication channel among Web3 wallet owners and allowing them to conduct non-fungible token (NFT) and peer-to-peer (P2P) transactions. The company was also selected for the Web3 incubation program conducted by internet juggernaut Kakao’s public open-source blockchain, Klaytn, in April of last year.

Beoble is currently accepting pre-registration applications for beta testing until Nov. 30 and will launch the beta version on Dec. 2.