Live Feed

Yesterday, January 17, 2026

15:01

Our real-time cryptocurrency news service provides continuous coverage from 10:00 p.m. UTC on Sunday through 3:00 p.m. UTC on Saturday. During the period from 3:00 p.m. UTC on Saturday to 10:00 p.m. UTC on Sunday, we will provide updates only in the event of major breaking news.

15:00

Pro-XRP Australian lawyer Bill Morgan stated that the Ripple lawsuit is unlikely to be reopened, despite suggestions to the contrary from some Democratic lawmakers. According to U.Today, Morgan explained that U.S. law upholds the principle of res judicata, which prevents the same parties from re-litigating a case that has already received a final judgment. His comments address criticism from some Democratic members of the Republican-led House of Representatives, who have questioned the U.S. Securities and Exchange Commission (SEC) for dropping cases against Ripple, Kraken, Binance, Coinbase, and eight other crypto firms. The lawmakers allege the cases were dropped in exchange for large political donations. However, Morgan asserted that it is impossible to reopen a case that has already been closed, noting that the legal dispute between Ripple and the SEC concluded last year with a victory for Ripple.

13:50

Crypto ETF issuer Defiance has announced it will delist its ETHI exchange-traded fund (ETF), which combines leverage with an options-based strategy for ETH-linked returns. The fund is being delisted approximately four months after its launch on Sept. 19 of last year.

12:41

Bitcoin could reclaim the $100,000 level and potentially rise to $107,000, driven by three key factors, according to a Cointelegraph analysis. The outlet noted that BTC has completed a technical breakout, surpassing the $95,000 upper boundary of an ascending triangle pattern and now holding it as support, with a golden cross of the 20-day and 50-day moving averages also imminent. Secondly, selling pressure from long-term holders is easing, as outflows from investors holding BTC for over five years have dropped to less than half of their cycle peak. Finally, the analysis suggests that an environment of expanding global liquidity and the end of the Federal Reserve's quantitative tightening could lead Bitcoin to outperform gold.

11:35

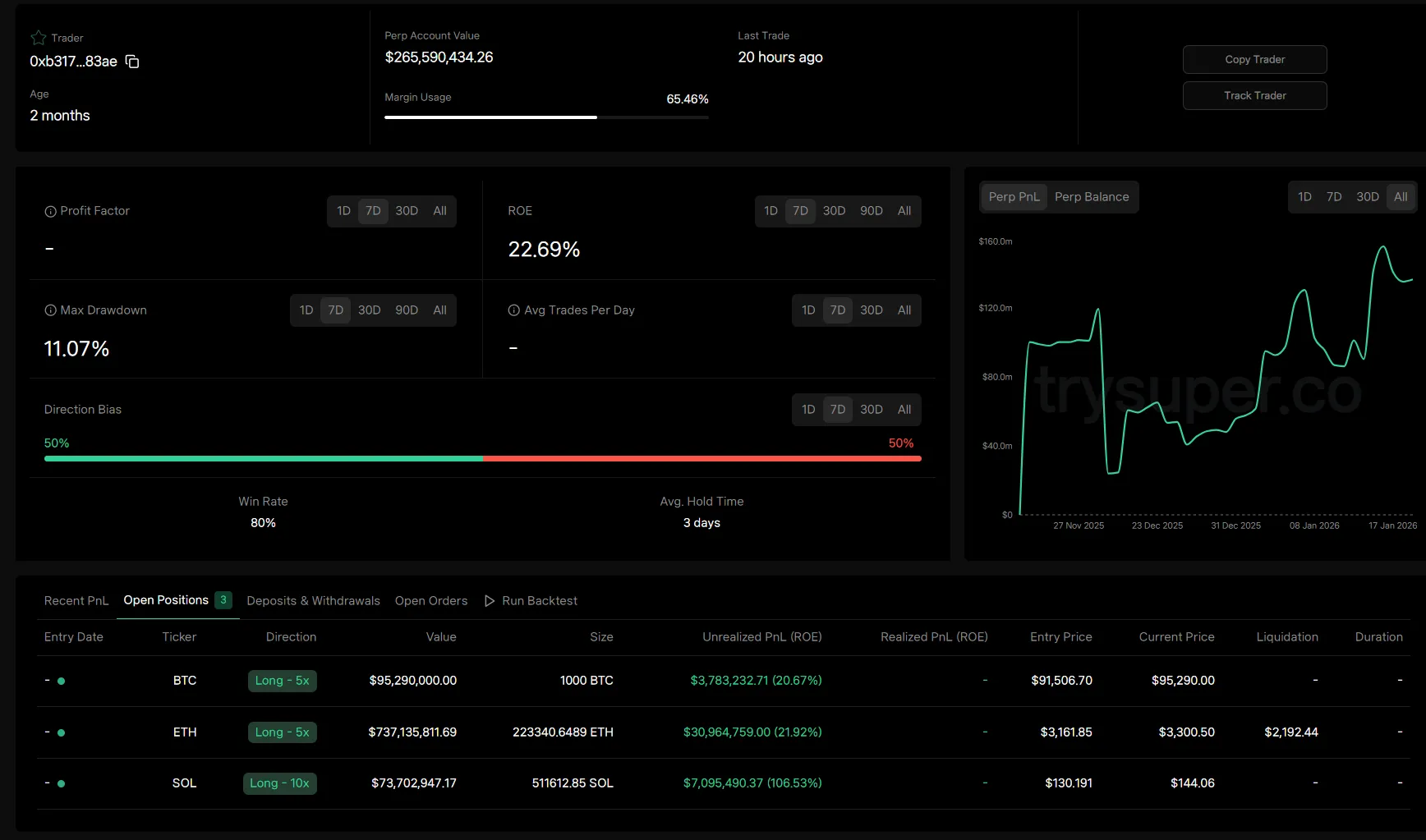

A Hyperliquid whale address, starting with 0xb317, previously suspected of insider trading ahead of the largest-ever forced liquidation event last October, is currently holding approximately $40 million in unrealized profits from long positions in BTC, ETH, and SOL.

The address's positions include a 5x leveraged long of 1,000 BTC (up $3.78 million), a 5x leveraged long of 223,340 ETH (up $30.96 million), and a 10x leveraged long in SOL (up $7.09 million). The average entry prices were $91,506 for BTC, $3,161 for ETH, and $130 for SOL.

Some members of the crypto community speculate that the address belongs to Garrett Jin, the former CEO of the now-defunct exchange BitForex.

11:26

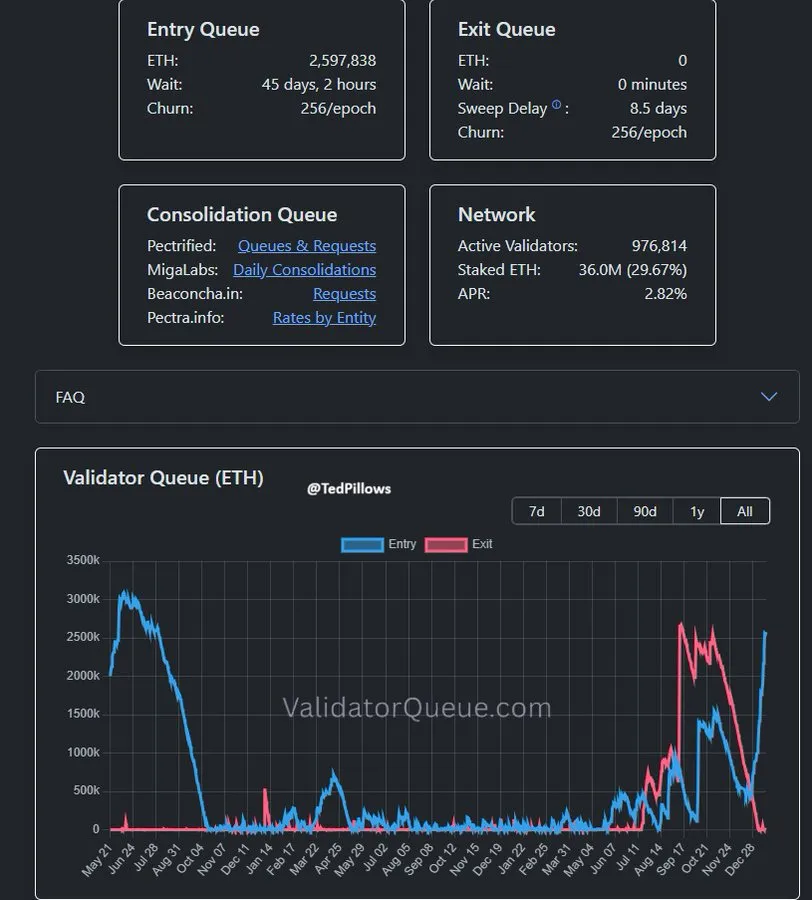

The Ethereum staking queue currently holds approximately 2,597,838 ETH, a figure that marks a two-and-a-half-year high, crypto influencer Ted Pillows reported, citing data from validatorqueue. This surpasses the previous record of 1.759 million ETH set on Jan. 10. While the current wait time to become a new Ethereum validator is approximately 45 days and two hours, the unstaking queue is empty.

08:51

A wallet presumed to belong to the Solayer team deposited 18.32 million LAYER, worth $3 million, to Binance 26 minutes ago, Onchainlens reported. The address still holds 16.56 million LAYER, valued at $2.7 million.

07:59

Binance has announced the delisting of four perpetual futures contracts: BID/USDT, DMC/USDT, ZRC/USDT, and TANSSI/USDT. The contracts will be removed at 9:00 a.m. UTC on Jan. 21.

07:15

Coinbase has announced the addition of SKR and FIGHT to its listing roadmap.

06:52

Elon Musk briefly supported a plan for OpenAI to raise funds through an initial coin offering (ICO) before leaving the company, CoinDesk reported. Documents detailing early discussions between Musk and OpenAI's founders show that in January 2018, Musk agreed to a proposal for OpenAI to raise $10 billion via an ICO but later withdrew his support. He subsequently resigned from the OpenAI board to focus on artificial intelligence work at Tesla. The media outlet noted that ICOs were a popular fundraising method for startups in 2017 and 2018, driven by regulatory uncertainty and high investor demand. The boom subsided as authorities tightened regulations and the market cooled.

06:03

Over the past 24 hours, the BTC perpetual futures long/short ratios on the top three cryptocurrency futures exchanges by open interest show a slight dominance of short positions. The aggregate ratio across all exchanges is 49.13% long to 50.87% short. By exchange, the ratios are: Binance (47.63% long, 52.37% short), OKX (47.88% long, 52.12% short), and Bybit (47.58% long, 52.42% short).

06:00

The following are liquidation volumes and ratios for cryptocurrency perpetual futures over the past 24 hours. BTC saw $41.59 million in liquidations, with long positions accounting for 89.52%. ETH followed with $18.95 million in liquidations, of which 73.11% were long positions. Meanwhile, RIVER recorded $9.15 million in liquidations, with short positions making up 56.91%.

05:57

A group that defrauded investors out of 19 billion won (around $13.8 million) with the promise of profits from AI-powered cryptocurrency trading has been sentenced to prison in an appeals court, Yonhap News reported. The perpetrators were accused of deceiving investors by claiming an AI-equipped computer could generate returns by exploiting price differences between global cryptocurrency exchanges.

05:45

An address presumed to belong to Bitmain purchased an additional 20,000 ETH, worth $65.4 million, from Kraken nine hours ago, Lookonchain reported.

05:37

U.S. fast-food chain Steak 'n Shake has purchased an additional $10 million worth of BTC. The move follows a previous announcement that the company would accept BTC for payments and hold all cryptocurrency received from customers as a strategic reserve.

05:19

U.S. spot Ethereum ETFs recorded a net inflow of $4.7 million on Jan. 16, marking the fifth consecutive day of inflows, according to data from Farside Investors. By fund, BlackRock's ETHA saw an inflow of $14.9 million, while Grayscale's ETHE experienced an outflow of $10.2 million.

05:16

U.S. Bitcoin spot ETFs recorded a total net outflow of $394.7 million on Jan. 16, ending a four-day streak of net inflows, according to data from Farside Investors.

Flows for the day were as follows:

- BlackRock (IBIT): +$15.1 million

- Fidelity (FBTC): -$205.2 million

- Bitwise (BITB): -$90.4 million

- Ark Invest (ARKB): -$69.4 million

- Grayscale (GBTC): -$44.8 million

05:09

The White House is considering withdrawing its support for the CLARITY Act, a crypto market structure bill, if Coinbase fails to return to negotiations with an acceptable agreement on stablecoin yields for the banking sector. Eleanor Terrett, host of Crypto in America, reported the development, citing sources. According to the report, the White House stated that Coinbase's withdrawal of support came without prior notice and characterized the move as a betrayal of both the administration and the crypto industry.

Coinbase previously rescinded its support for the bill, citing several issues. The company raised concerns over what it described as a de facto ban on tokenized stocks, provisions that could block DeFi and permit unlimited access to financial information, a weakening of the Commodity Futures Trading Commission's (CFTC) authority in favor of the SEC, and the potential for the legislation to block stablecoin reward functions.

02:42

Cryptocurrency bank Anchorage Digital is considering a new funding round of between $200 million and $400 million ahead of a potential initial public offering (IPO), Cointelegraph reported. The company is said to be in discussions to raise capital with the goal of going public as early as 2026.

Anchorage Digital, which specializes in custody, trading, and staking services for institutional clients, is also focusing on expanding its stablecoin business following the passage of recent U.S. stablecoin legislation. The company stated that it plans to double the size of its stablecoin team this year.

02:35

Goldman Sachs CEO David Solomon has stated that the U.S. crypto market structure bill, known as the CLARITY Act, still has a long way to go before making progress, Cointelegraph reported. Speaking during the company's fourth-quarter 2025 earnings call, Solomon noted that Goldman Sachs is watching the legislation very carefully due to its potential impact on tokenization and stablecoins. He added that recent developments suggest it will take considerable time for the bill to advance. A planned markup of the bill in the Senate Banking Committee was previously postponed after Coinbase withdrew its support for the current draft.

02:02

Pressure from President Donald Trump to lower interest rates could undermine the Federal Reserve's political independence, potentially leading to a weaker U.S. dollar and benefiting Bitcoin, according to a DL News report. André Dragosch, head of research for Europe at Bitwise, described this possibility as the "Erdoğanization of the Fed," drawing a parallel with the Turkish government's interference in its central bank. In Turkey, the collapse of central bank independence triggered a sharp currency devaluation and high inflation, which in turn led to a surge in demand for Bitcoin. Dragosch noted that a weakening of Fed independence structurally implies higher inflation and a weaker dollar, which he views as a positive for Bitcoin. The analysis suggests that if the Fed chair is replaced or succumbs to political pressure, BTC could emerge as a prominent alternative asset.

00:29

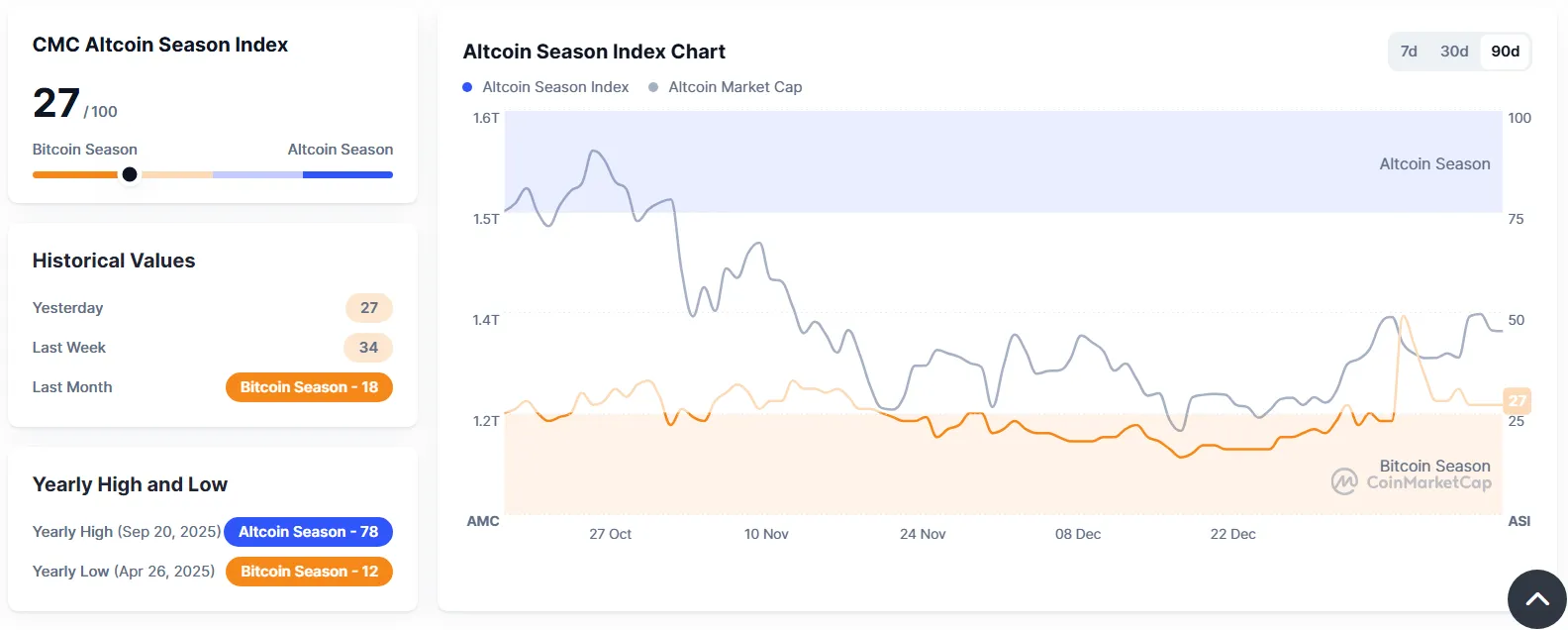

CoinMarketCap's Altcoin Season Index has risen one point from the previous day to 27. The index measures whether 75% of the top 100 cryptocurrencies by market capitalization, excluding stablecoins and wrapped tokens, have outperformed Bitcoin over the last 90 days. A score closer to 100 indicates an altcoin season, while the opposite suggests a Bitcoin season.

00:08

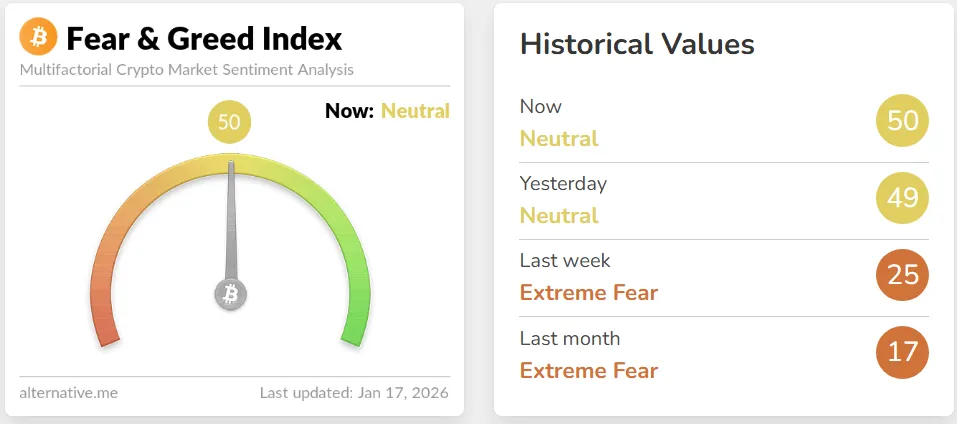

The Crypto Fear & Greed Index, compiled by data provider Alternative, rose one point from the previous day to 50, maintaining its Neutral status. The index measures market sentiment on a scale where 0 indicates extreme fear and 100 represents extreme optimism. It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

00:05

U.S. mortgage lender Newrez will now recognize holdings of cryptocurrencies like Bitcoin and Ethereum as eligible assets when underwriting home loans, according to Cointelegraph. The policy applies to Bitcoin, Ethereum, spot crypto ETFs, and U.S. dollar-pegged stablecoins. This allows loan applicants to use their crypto holdings for asset verification and income estimation without having to sell them. The assets must be held at a regulated U.S. exchange or financial institution, and their volatility will be adjusted for during the evaluation process. However, all loan repayments and associated fees must still be paid in U.S. dollars. Newrez stated that the initiative aims to expand homeownership among younger generations, noting that approximately 45% of Gen Z and Millennial investors own cryptocurrency.

January 16, 2026

23:31

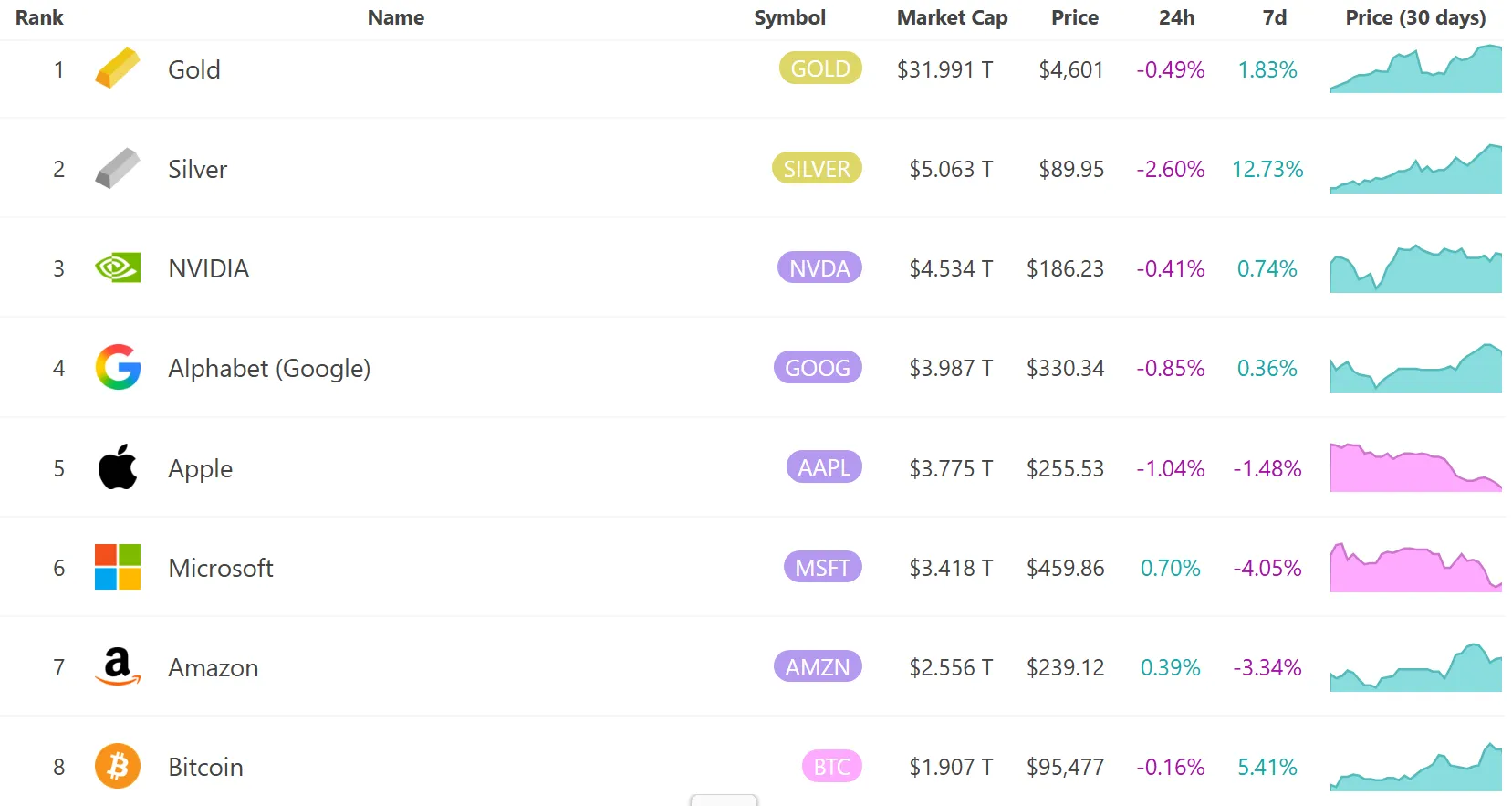

According to CryptoBriefing, silver has posted the strongest performance over the past 12 months compared to stocks, cryptocurrencies, and gold, with its market capitalization increasing by more than $3.9 trillion amid a price surge. Silver's market cap has now surpassed $5 trillion, making it the second-largest global asset after gold, which has a market cap of approximately $32 trillion. The price of silver soared to an all-time high of around $93 before correcting to the $89 range. Over the same period, gold gained about 70%, while the S&P 500 rose 17%, the Nasdaq climbed 21%, and Bitcoin fell 4%.