Live Feed

Today, December 18, 2025

13:14

North Korean hackers have stolen $2.02 billion in cryptocurrency this year, an all-time high, Decrypt reported, citing a Chainalysis report. According to the report, the amount represents a 51% increase from the previous year. North Korean attacks accounted for 59% of the $3.4 billion stolen from crypto hacks worldwide this year. The report explained that while the frequency of attacks has decreased, North Korean hackers are evolving to maximize the damage from a single incident, utilizing methods such as using AI to gain fraudulent employment and planting malicious code in open-source software.

13:13

Fuse Energy, a Solana-based Decentralized Physical Infrastructure Network (DePIN) project, has raised $70 million in a Series B funding round led by Lowercarbon Capital and Balderton Capital, according to a report from SolanaFloor via X. The funding round values the company at $5 billion. Fuse Energy is known as a decentralized energy grid project.

13:11

U.S. fintech platform SoFi (SOFI) has launched SoFiUSD, the first stablecoin to be issued by a U.S. national bank and backed by Federal Reserve cash, CoinDesk reported. The new stablecoin is designed to improve payment efficiency for businesses and financial institutions, offering 24-hour real-time settlement through public blockchains. The company plans to expand stablecoin use cases in mainstream financial markets by providing infrastructure for members of its SoFi Bank.

12:59

Kevin Hassett, Director of the White House National Economic Council (NEC) and a leading contender to be the next Federal Reserve Chair, has stated that an interest rate cut is appropriate at the current time, according to multiple media reports. He noted that U.S. interest rates are somewhat out of step with those in other parts of the world and that many, including U.S. President Donald Trump, are in favor of a rate cut. Hassett emphasized that solid economic data, such as the steady increase in private sector employment, provides sufficient room to support further rate reductions.

12:48

Binance co-founder Changpeng Zhao said he has recently discussed crypto industry regulations, innovation, and adoption strategies with approximately 10 governments, both publicly and privately. He made the comments during an Ask Me Anything (AMA) session on the official BNB Chain X account.

12:34

Tokenized stock platform xStocks has announced support for The Open Network (TON) wallets, enabling the trading of tokenized U.S. stocks within the Telegram messaging app. Users can now trade major U.S. stocks like Apple, Tesla, and Microsoft in real-time through wallets such as Ton Wallet, Tonkeeper, and MyTonWallet, without requiring a separate brokerage account. The platform's xStocks are on-chain tokens backed by actual shares of U.S. publicly traded companies, with all transactions recorded on the TON blockchain.

12:34

An anonymous address that purchased 103 trillion SHIB, or 17.4% of the total supply, in 2020 has deposited 464.3 billion SHIB ($3.48 million) to OKX in the last hour, according to AmberCN. The address, which begins with fd6fa872, originally paid 37.8 ETH ($137,000) for its holdings. It now holds 96.22 trillion SHIB, valued at $718 million, which accounts for 16.3% of the supply.

12:09

Global asset manager Franklin Templeton predicts that institutional investors will significantly increase their allocation to cryptocurrencies starting next year. In an interview with DL News, Robert Crossley, head of Global Industry Advisory Services at Franklin Templeton, said the crypto market is no longer the exclusive domain of a specific group. He noted that traditional institutions focused on portfolio diversification and long-term strategies are now considering entering the space, which is narrowing the gap between established and younger investors. Crossley highlighted that 126 crypto ETFs are currently pending approval, viewing their potential launch as a useful way to improve market accessibility. He added that future market interest will likely expand to asset tokenization and on-chain fund management.

12:09

Stablecoin issuer United Stables has announced the launch of U, a new stablecoin built on the BNB Chain. The project aims to address liquidity fragmentation by integrating and supporting existing stablecoins rather than competing with them, using assets like USDT, USDC, and USD1 as collateral. United Stables also plans to introduce future features, including gas-free transfers and AI-powered autonomous payments. Binance Wallet has added support for U.

12:00

The majority of projects supported by Kaito's Kickstarter program have experienced a significant drop in their fully diluted valuation (FDV) following their token generation events (TGE), Wu Blockchain reported, citing data from CoinGecko. For instance, Web3 AI gaming company PlayAI (PLAI), which had a pre-TGE valuation of $50 million, now has an FDV of approximately $2.1 million. Similarly, Hana Network (HANA) has seen its valuation fall from around $40 million to its current $10.5 million. The report noted that other projects from the program are also trading at FDVs considerably lower than their pre-TGE levels.

11:12

Binance Alpha has announced the addition of TTD. The platform, an on-chain trading service within the Binance Wallet, focuses on listing early-stage coins.

11:09

Samson Mow, CEO of the Bitcoin technology company Jan3, announced on X that he plans to liquidate his assets related to Bitmain (BMNR) and Ethereum (ETH) to go all-in on BTC. Mow had previously stated in October that South Korean retail investors were driving the rally in ETH, predicting that it would not end well.

10:51

Travel Retail Norway (TRN), an operator of duty-free shops at Norwegian airports, has introduced Bitcoin payment options, according to local media outlet Kommunikasjon. This marks the first time a global airport duty-free retailer has adopted BTC as a payment method.

10:35

Taiwan's Ministry of Justice currently holds 210.45 BTC in seized assets, Bitcoin Magazine reported.

10:32

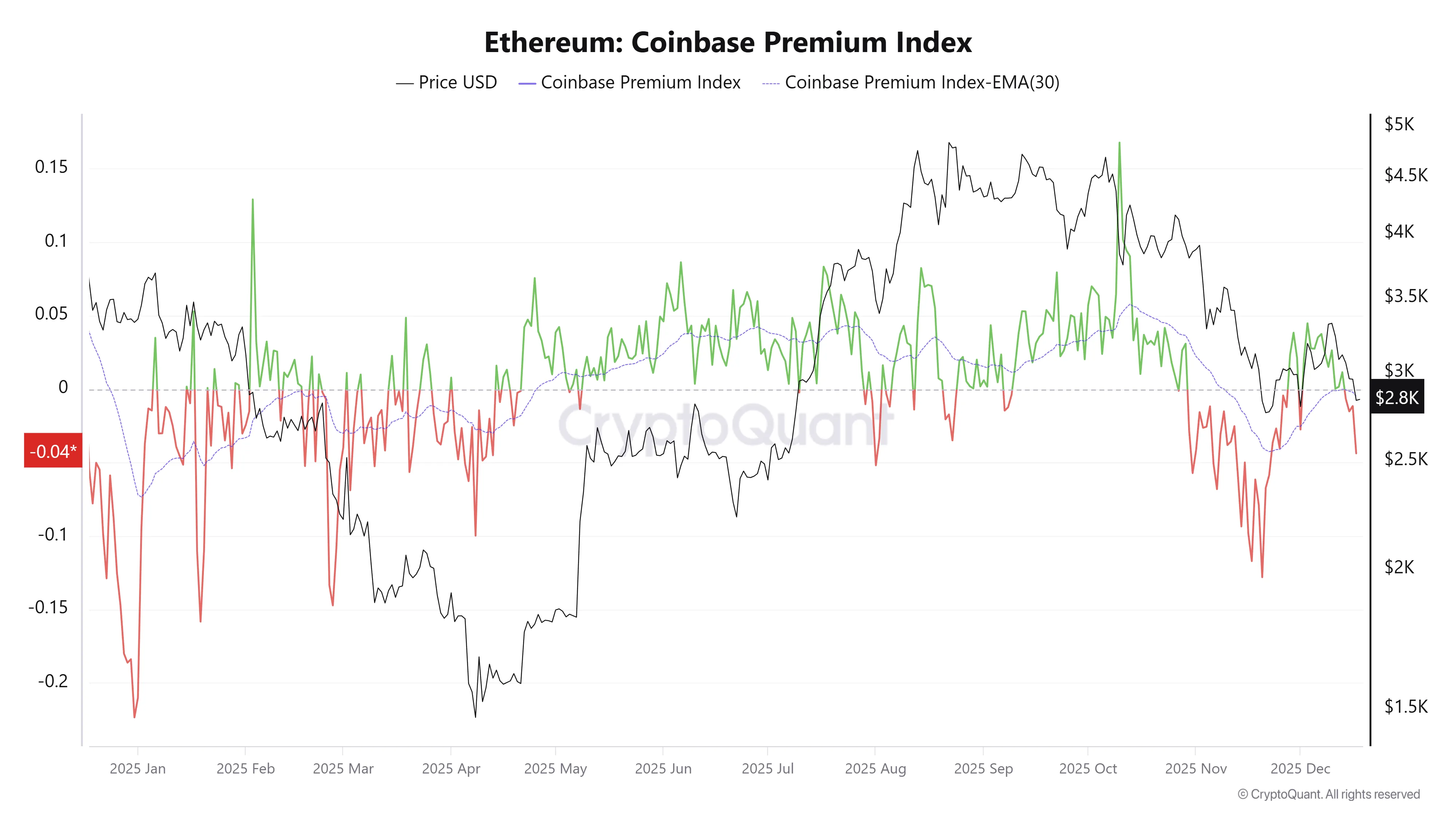

Ethereum (ETH) is experiencing continued bearish pressure as its Coinbase premium remains negative and network activity shrinks, BeInCrypto reported. The unrealized profit rate for whale addresses holding between 1,000 and over 100,000 ETH has steadily declined for the past four months, now approaching zero and raising the risk of further sell-offs. The report notes that the Coinbase premium turned negative in the third week of December, while the number of active Ethereum addresses this month has hit its lowest level of the year. This creates a risk that if these large investors sell to recover capital, it could trigger a market-wide panic sell. Despite these indicators, some institutions like Bitwise remain optimistic, forecasting that ETH will reach a new all-time high, driven by regulatory improvements and accelerating institutional adoption.

10:01

South Korean crypto exchange Coinone announced that it will list Agent Lisa (LISA). Trading against the South Korean won (KRW) will begin at 2:00 a.m. UTC on Dec. 19.

09:30

Strategy (MSTR) has purchased a total of 223,798 BTC, valued at $1.945 billion, so far this year, according to BitcoinTreasuries. The company's last announced purchase was for 10,645 BTC on Dec. 15. Strategy now holds a total of 671,268 BTC at an average purchase price of $74,972.

09:15

A prominent Bitcoin early adopter, identified by the address "1011short," has expanded a long position on ETH, according to data from Lookonchain. The investor recently purchased an additional 12,406 ETH, bringing the total 5x leveraged position to 203,341 ETH, valued at approximately $577 million. The position has an average entry price of $3,147.39 and a liquidation price of $2,132.82. It is currently carrying an unrealized loss of $1.39 million.

09:14

South Korean cryptocurrency exchange Upbit announced that it will temporarily suspend deposits and withdrawals for Initia (INIT) starting at 9:00 a.m. UTC on Dec. 22.

09:13

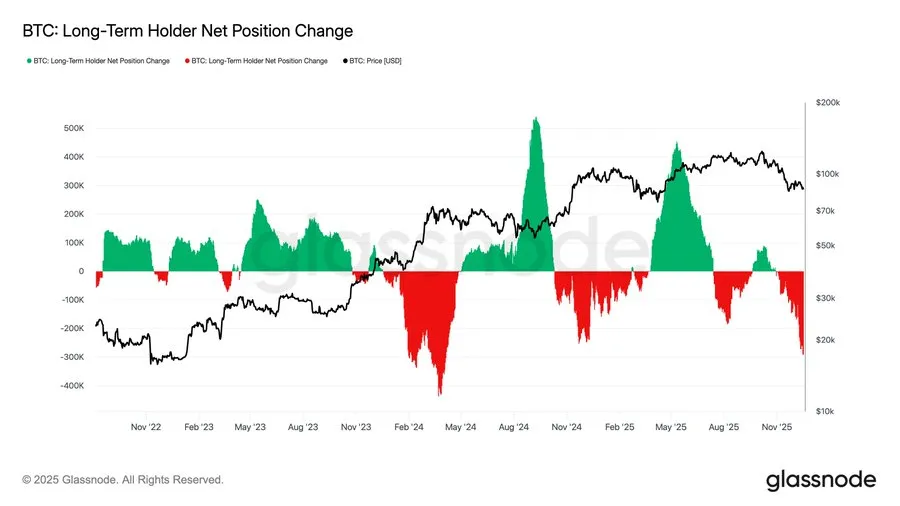

Bitcoin long-term holders (LTH) are not only continuing to sell but are also increasing their sales volume amid persistent market pressure, Glassnode analyst Chris Beamish reported on X.

09:07

Three addresses believed to belong to the Sign (SIGN) team deposited $9.3 million worth of SIGN to Binance about 30 minutes ago, Onchain School reported via X. Deposits to exchanges are typically interpreted as a precursor to selling. According to CoinMarketCap, SIGN is trading at $0.03202, an increase of 8.18%.

08:32

Bybit has announced that it will soon list VOOI for spot trading. A specific listing schedule has not yet been disclosed.

08:26

According to CoinNess market monitoring, BTC has risen above $87,000. BTC is trading at $87,000 on the Binance USDT market.

08:26

Uniswap founder Hayden Adams announced via X that the "UNIFICation" governance proposal has been put to a final vote. The proposal includes burning 100 million UNI and activating a fee on/off mechanism on the Ethereum mainnet, with the UNI collected from these fees also slated for burning. The voting period runs from 1:30 a.m. UTC on Dec. 20 until Dec. 25.

08:07

Binance Alpha has announced the addition of RTX. The platform is an on-chain trading service within the Binance Wallet that focuses on listing early-stage coins.