CoinNess soars to 2nd among news apps in Korea amid bitcoin ETF frenzy

CoinNess, the leading crypto media platform in South Korea, announced today that it has become the country’s largest online community platform for cryptocurrency enthusiasts.

100,000 daily active users

The virtual asset media outlet revealed that during the second week of January, the average daily active user (DAU) count neared 100,000.

The platform also experienced a milestone, with the average concurrent user count surpassing 15,000 for the first time, edging out Coinpan, Korea's preeminent cryptocurrency community website.

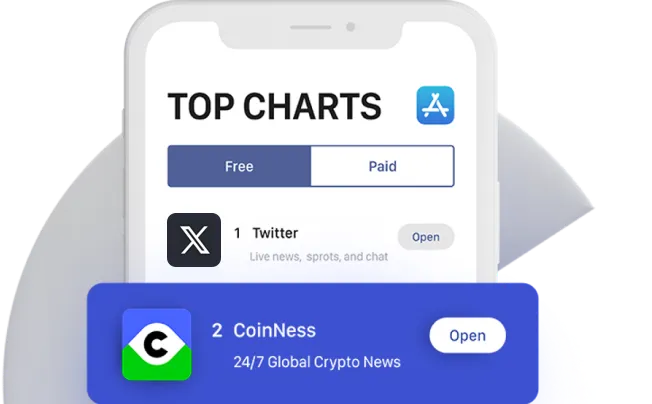

High ranking in app markets

Additionally, CoinNess achieved the second position in the Top Charts for free iPhone apps in the news category on the Apple App Store in Korea. The top spot is held by the social media platform X, previously known as Twitter. On the Android Play Store, the CoinNess app ranked 82nd in the finance category and is the fourth most popular among crypto-related apps, trailing behind Bithumb, Upbit and Bitget.

The significant increase in CoinNess’ user base can be attributed to the recent surge in interest in spot bitcoin exchange-traded funds (ETFs). More and more Korean investors have turned to CoinNess, finding it crucial to stay informed about the U.S. Securities and Exchange Commission’s (SEC) approval of spot bitcoin ETFs and to begin participating in the cryptocurrency market.

Korean crypto market’s prominence

The prominence of the Korean market in the world of cryptocurrency is highlighted by the Korean won's leading role in the fiat currency trading of bitcoin. According to a Bloomberg report, in November, the Korean won made up 42.8% of all fiat currencies used in bitcoin transactions, surpassing the U.S. dollar.

Regarding this development, Kim Jung-ho, CEO of CoinNess, said, “Korean investors generally commit substantially more funds to cryptocurrency investments than the average seen globally. They are keenly attuned to international news and market trends, demonstrating a propensity for analyzing the market from diverse viewpoints.”

Established in 2018, CoinNess is a news platform specializing in live updates on virtual asset investment. The media expanded to include an online community in 2021, creating a more holistic experience for its users. In Korea, CoinNess prides itself on having the largest active user base in the cryptocurrency media and community sector.

Furthermore, CoinNess stands out as the only business-to-business (B2B) provider of live cryptocurrency news in Korea. It delivers real-time crypto updates to prominent platforms, including Coinone and Gopax, which are among the nation's five largest fiat-to-crypto exchanges.

English service in Q1

Moving forward, CoinNess is gearing up to launch a new service in the first quarter, offering live, around-the-clock updates on cryptocurrency markets in English to a global audience. As a key partner with Ness LAB, the blockchain research firm responsible for the NESS token, CoinNess seeks to enhance Ness LAB’s efforts to cultivate an information economy within the cryptocurrency sector.