Live Feed

Yesterday, March 7, 2026

19:54

According to CoinNess market monitoring, BTC has fallen below $67,000. BTC is trading at $66,993.31 on the Binance USDT market.

15:00

We provide real-time cryptocurrency updates around the clock from 10:00 p.m. UTC on Sunday through 3:00 p.m. UTC on Saturday. Outside these hours, coverage is limited to critical market-moving developments.

14:46

An on-chain indicator suggests a potential resumption of Bitcoin's rally, according to crypto analyst CW8900. In a post on X, the analyst noted that a golden cross recently formed on the "BTC Inter-exchange Flow Pulse" indicator, which tracks the flow of BTC between spot and derivatives exchanges. This signal has historically served as a precursor to strong upward rallies.

However, the analyst pointed out that the rise is not immediate. After the 2019 bear market ended, a major rally began about 30 days after the golden cross formed, and in 2023, the lag was approximately 40 days. CW8900 projected that while volatility similar to recent trends could continue for about another month, the trend has already reversed, and an explosive rise is not far off.

14:01

Binance has released its 40th Proof of Reserves report, based on a snapshot taken on March 1. User Bitcoin holdings totaled approximately 631,000 BTC, down 8,004 BTC (1.25%) from the previous report on Feb. 1. Ethereum holdings decreased by 307,203 ETH (7.35%) to approximately 3.87 million ETH. Meanwhile, USDT holdings fell by about 360 million USDT (0.98%) to a total of roughly 36.4 billion USDT.

13:04

Bybit has released its 29th Proof of Reserves report, with a snapshot date of Feb. 26. The report shows user BTC holdings at approximately 59,000 BTC, a decrease of 2.41% compared to the previous report on Jan. 27. User ETH holdings increased by 11.4% to around 520,000 ETH, an addition of 53,607 ETH. Total USDT holdings stood at about 6.12 billion USDT, down 1.71%.

12:56

Monthly stablecoin trading volume reached an all-time high of $1.8 trillion in February. Circle's USDC notably accounted for 70% of this total, or $1.2 trillion, significantly surpassing Tether (USDT), the largest stablecoin by market capitalization. Experts view the surge in supply of the regulation-compliant USDC, along with increased fund inflows to exchanges, as a strong signal of market recovery.

11:20

U.S. President Donald Trump claimed on his social media platform, Truth Social, that Iran has apologized to its Middle Eastern neighbors and promised to cease further attacks. He stated that due to sustained attacks from the U.S. and Israel, Iran has been defeated and will be unable to regain its influence for decades to come.

11:09

DeFi lending protocol Spark appears to have recently initiated a buyback of its SPK token, according to a report from EmberCN. The on-chain analysis firm noted that an address believed to belong to Spark transferred 570,000 USDS to a new multi-signature address two days ago. This address then used CoW Swap's TWAP feature to purchase small amounts of SPK in multiple transactions. To date, the address has bought back 1.84 million SPK, valued at $36,000.

08:48

South Korean financial authorities are likely to exclude stablecoins from the list of permissible assets for corporate investment under new guidelines being prepared, The Herald Business reported. The policy aims to prevent reckless investment in the early stages of the market by excluding dollar-pegged stablecoins such as USDT and USDC. However, the report notes that even with this exclusion from the corporate guidelines, it will still be possible to buy and sell stablecoins using personal wallets or overseas exchanges, including Coinbase's over-the-counter (OTC) platform.

07:34

The U.S. Army has abruptly canceled a large-scale training exercise for its elite 82nd Airborne Division headquarters unit, fueling speculation about a potential deployment for a ground war against Iran, the Washington Post (WP) reported. While no official deployment orders have been issued, analysts suggest an immediate mobilization is possible given the division's historical roles. The U.S. Department of Defense has declined to comment on the specifics of the rumored deployment. U.S. President Donald Trump was previously reported to have shown deep interest in committing American ground troops in Iran.

07:31

Iranian President Masoud Pezeshkian stated in a national address that Iran can never unconditionally surrender and urged the people to unite in the country's defense, according to Chinese state media CCTV. He also conveyed an apology to neighboring countries, adding that Iran's interim leadership committee had decided on March 6 to halt missile launches unless a neighboring country attacks first. The statement follows previous remarks by U.S. President Donald Trump, who said that unconditional surrender was the only option for negotiations with Iran.

06:23

BTC perp long/short ratios on top exchanges by open interest

The following are the 24-hour long/short ratios for BTC perpetual futures on the world’s three largest crypto futures exchanges by open interest:

Overall: 48.84% long, 51.16% short

- Binance: 48.12% long, 51.88% short

- Gate: 48.27% long, 51.73% short

- Bybit: 49.14% long, 50.86% short

06:21

Whale Alert reported that 390,000,000 USDT has been transferred from HTX to Aave. The transaction is valued at about $390 million.

06:20

Although XRP has recorded five consecutive monthly declines for the first time in nine years, its downward momentum appears to be exhausted, according to an analysis by crypto analyst TraderJB. The Crypto Basic reported that the analyst noted a long lower wick has formed on the three-day chart. He explained that while XRP is down 52% from its high, it has retested all support zones formed since November 2024 on the three-day chart, even reaching the $1.25 level seen during the record liquidation event last October. TraderJB suggested this retesting of lower levels is a process of confirming support, which could signal a potential for a future trend reversal. For the uptrend to continue, he said XRP must reclaim the $1.61 resistance level and then surpass its July high of $3.6. However, the analyst warned that if the $1.2 support level is breached, the bullish trend would be completely invalidated.

06:03

Spot gold in Dubai is being sold at a discount of $30 per ounce due to logistics paralysis stemming from the conflict in the Middle East, Chinese financial news agency Cailian Press reported. The outlet added that rising local costs for transportation, insurance, and storage are fueling concerns over physical supply shortages in major importing nations. Dubai is a global hub for gold refining and trade, but deliveries are currently delayed amid ongoing U.S. and Israeli military strikes against Iran. While the spot price of gold is trading above $5,000 per ounce, its rally has stalled this week due to a strong U.S. dollar and other geopolitical factors.

05:50

Bitcoin has entered a bear market according to the four-year cycle theory and could see its price fall an additional 30% this year, according to crypto hedge fund ZX Squared Capital.

CK Zheng, the fund's founder, explained that he expects a further price correction for BTC this year due to factors including the situation in Iran. He noted this follows a typical pattern where the asset peaked last October, 18 months after the April 2024 halving, and has since been declining. Zheng added that the cycle is being reinforced by retail investors who repeatedly buy on positive news and sell in fear. He argued that BTC is still viewed as a speculative asset rather than a safe haven like gold, and institutional adoption has been slow. The decline could accelerate, he warned, if companies holding BTC begin selling to cover debt obligations.

05:32

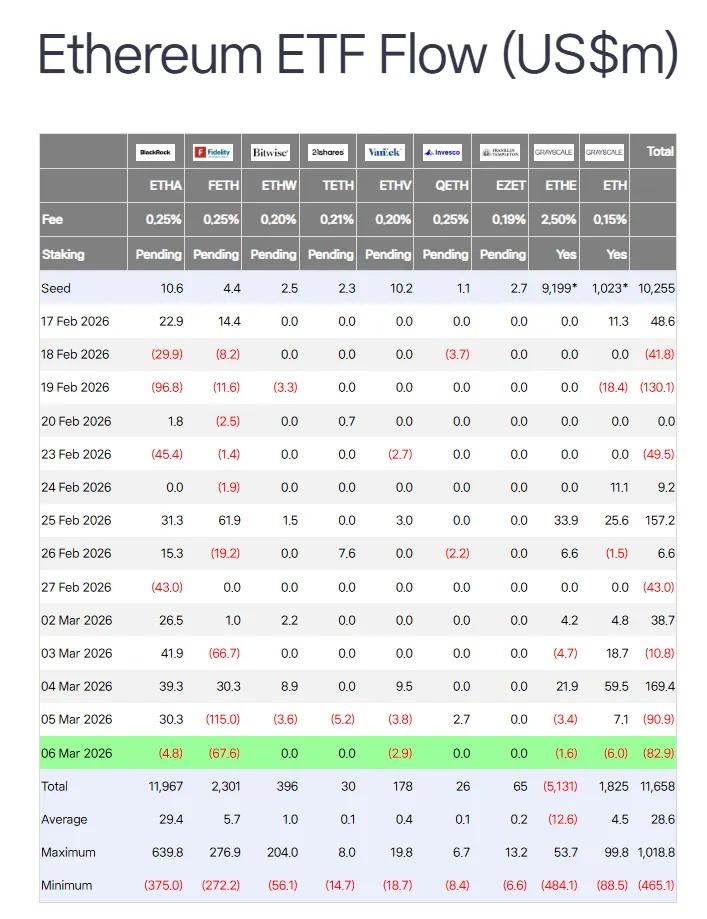

U.S. spot Ethereum ETFs recorded a total net outflow of $82.9 million on March 6, marking the second consecutive day of outflows, according to data compiled by Farside Investors. No individual ETF reported a net inflow for the day.

- BlackRock's ETHA: -$4.8 million

- Fidelity's FETH: -$67.6 million

- 21Shares' TETH: -$5.21 million

- VanEck's ETHV: -$2.9 million

- Grayscale's ETHE: -$1.6 million

- Grayscale's Mini ETH: -$6 million

05:29

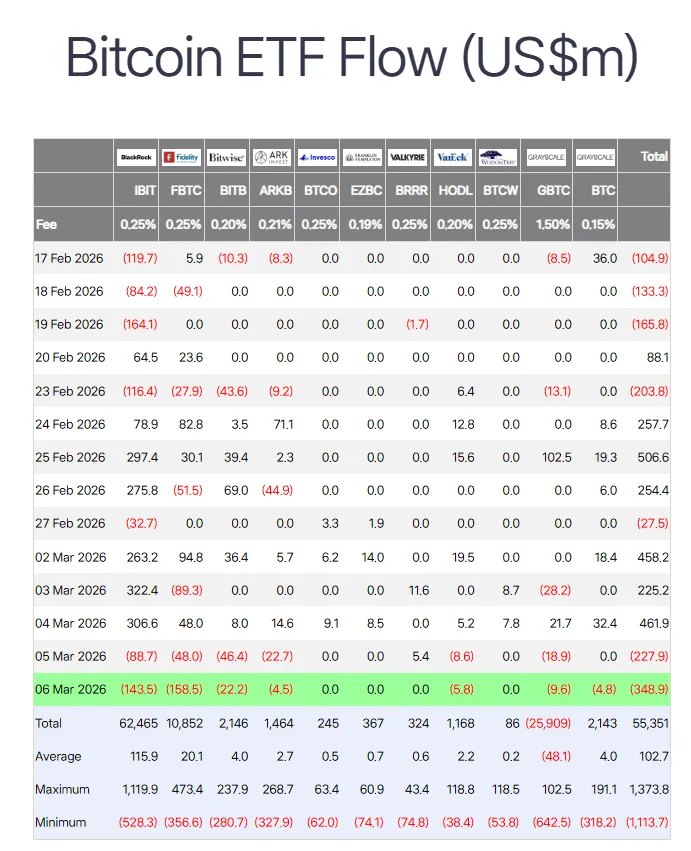

U.S. spot Bitcoin ETFs saw approximately $348.9 million in net outflows on March 6, according to data compiled by Farside Investors. This marks the second consecutive day of net outflows, with no single ETF recording a net inflow.

- BlackRock's IBIT: -$143.5 million

- Fidelity's FBTC: -$158.5 million

- Bitwise's BITB: -$22.2 million

- Ark Invest's ARKB: -$4.5 million

- VanEck's HODL: -$5.8 million

- Grayscale's GBTC: -$9.6 million

- Grayscale's Mini BTC: -$4.8 million

05:02

Bybit has announced that its co-CEO, Helen Liu, will resign effective April 30 to pursue a new venture. Liu joined Bybit in 2020, serving as vice president of human resources and marketing and later as chief operating officer (COO) before being appointed co-CEO last year. The company said it does not plan to name a successor and will continue to expand its global business under the existing leadership structure.

04:58

The following shows estimated liquidation volumes and position ratios for major crypto perpetual futures over the past 24 hours:

- BTC: $132.79 million liquidated (83.66% longs)

- ETH: $63.73 million liquidated (85.74% longs)

- SOL: $13.32 million liquidated (88.67% longs)

02:06

A U.S. court in New York has dismissed a civil lawsuit against Binance and its founder, Changpeng Zhao, that accused them of aiding terrorism, Reuters reported on March 6. The suit was filed by 535 victims and family members from 64 terrorist attacks around the world. The plaintiffs had argued that Binance and Zhao facilitated cryptocurrency transactions for terrorist organizations, thereby making it easier for them to carry out attacks.

The court ruled that the plaintiffs failed to plausibly demonstrate that Binance and Zhao were directly involved in the attacks or intended to support them. It also noted that the claim that the defendants took any action to help or ensure the success of the attacks was unsubstantiated.

In response, Zhao stated that no centralized exchange has any motive to be associated with terrorists and would not actively trade with them. He added that as a resident of Dubai, he has personally witnessed missile interceptions.

01:57

Akash Network (AKT) announced via its official X account that an on-chain vote will begin today, March 7, on a proposal to introduce a Burn-Mint Equilibrium (BME) model centered on token burning. If the proposal passes, a network upgrade to implement the model is scheduled for 2:00 p.m. UTC on March 23. According to Akash, the BME model is designed to restore the direct utility of the AKT token and link its value to network usage. If approved, all AKT used for deployments on the network will be burned.

01:01

An anonymous Ethereum whale has staked 8,208 ETH, worth approximately $16.85 million, on the staking platform Kiln. According to Onchain Lens, the whale address '0xcced2d' executed the transaction about five hours ago through an intermediary address, '0x4024C', after a year of inactivity. The whale has accumulated $16.09 million in ETH over the past four years and currently holds an unrealized profit of around $768,000.

00:24

Michael Saylor, co-founder of MicroStrategy, predicted that Bitcoin will replace the existing financial system based on a Darwinian theory of survival of the fittest. In a recent interview, he described Bitcoin as the standard-bearer for the digital financial revolution. Saylor argued that money will eventually move at the speed of light. He contrasted Bitcoin, which circulates globally 24/7 with low value-transfer costs, with traditional financial markets that are constrained by trading hours, holidays, and regulatory barriers. Saylor added his belief that digital capital, capable of moving at the speed of light with minimal expense, will ultimately prevail, replacing the slower and more cumbersome legacy financial system.

00:14

Prediction market platforms Kalshi and Polymarket are in discussions to raise capital at valuations of approximately $20 billion each, the Wall Street Journal reported. Citing people familiar with the matter, the WSJ noted that both companies have held talks with potential investors regarding funding rounds at the $20 billion valuation mark. Kalshi was last valued at $11 billion during a funding round in December, while Polymarket secured a $9 billion valuation in October. If these new rounds are successful, the valuations for both firms would nearly double.