Live Feed

Today, February 9, 2026

15:30

Solana (SOL) could fall below $50 after forming a bearish head and shoulders pattern, according to an analysis from Cointelegraph citing multiple experts. The report noted that SOL has already dropped more than 72% from its peak in January of last year. This decline confirmed a downward break from the classic bearish pattern, signaling a potential drop below the $50 mark. The analysis further explained that the SOL/USD monthly chart has been forming this pattern over the past two years and could potentially fall as low as $30 without a clear support level.

14:40

BTC has risen by 1.73% in the past five minutes on the Binance USDT market. Currently, BTC is trading at $69,727.99.

14:31

The three major U.S. stock indices opened lower today.

- S&P 500: -0.24%

- Nasdaq: -0.34%

- Dow Jones: -0.14%

14:07

Bithumb announced at 2:05 p.m. UTC on Feb. 9 that it has temporarily suspended deposits and withdrawals for Vana (VANA), citing a mainnet network issue.

13:44

Bitmine (BMNR) purchased an additional 40,613 ETH, worth $83.45 million, last week, according to OnchainLenz. The company now holds 4,325,738 ETH, valued at $9.19 billion and representing 3.58% of the total supply. Of this total, 2,897,459 ETH ($6.2 billion) is currently staked.

13:37

Upbit has announced the temporary suspension of deposits and withdrawals for Vana (VANA) due to a node synchronization issue.

13:04

Watcher.Guru reported via X that MicroStrategy (MSTR) purchased an additional 1,142 BTC for $90 million last week at an average price of $78,815. The company now holds a total of 714,644 BTC, valued at $54.35 billion, with an average purchase price of $76,056.

12:59

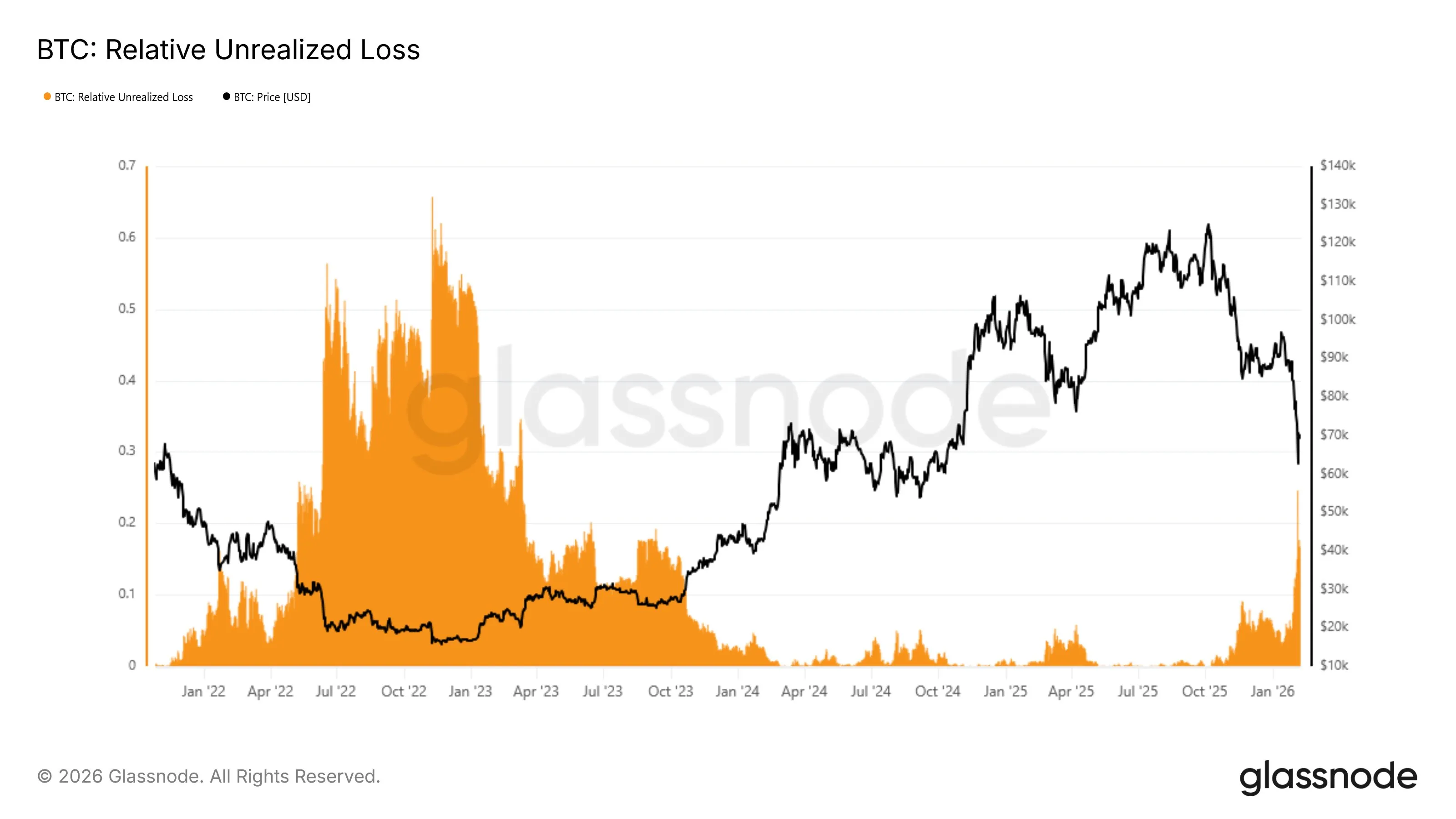

If BTC trades at the $70,000 level, the market's unrealized losses would amount to approximately 16% of its total market capitalization, according to on-chain analytics firm Glassnode. The firm added that the current market environment shows a pattern similar to that of early May 2022.

12:53

Hong Kong-based blockchain and trading technology solutions provider MATH has announced its decision to allocate 20% of its annual net profit to purchasing Bitcoin. On Feb. 9, the company completed its first purchase of approximately $1 million in BTC at an average price of $54,000. The acquisition was made through MATH's proprietary financial product, the Accumulator, a derivative contract for making regular purchases at a price lower than the market rate over a set period. MATH stated that Bitcoin is the foundation of the entire blockchain industry and accumulating it at current price levels will enhance shareholder value in the long term.

12:32

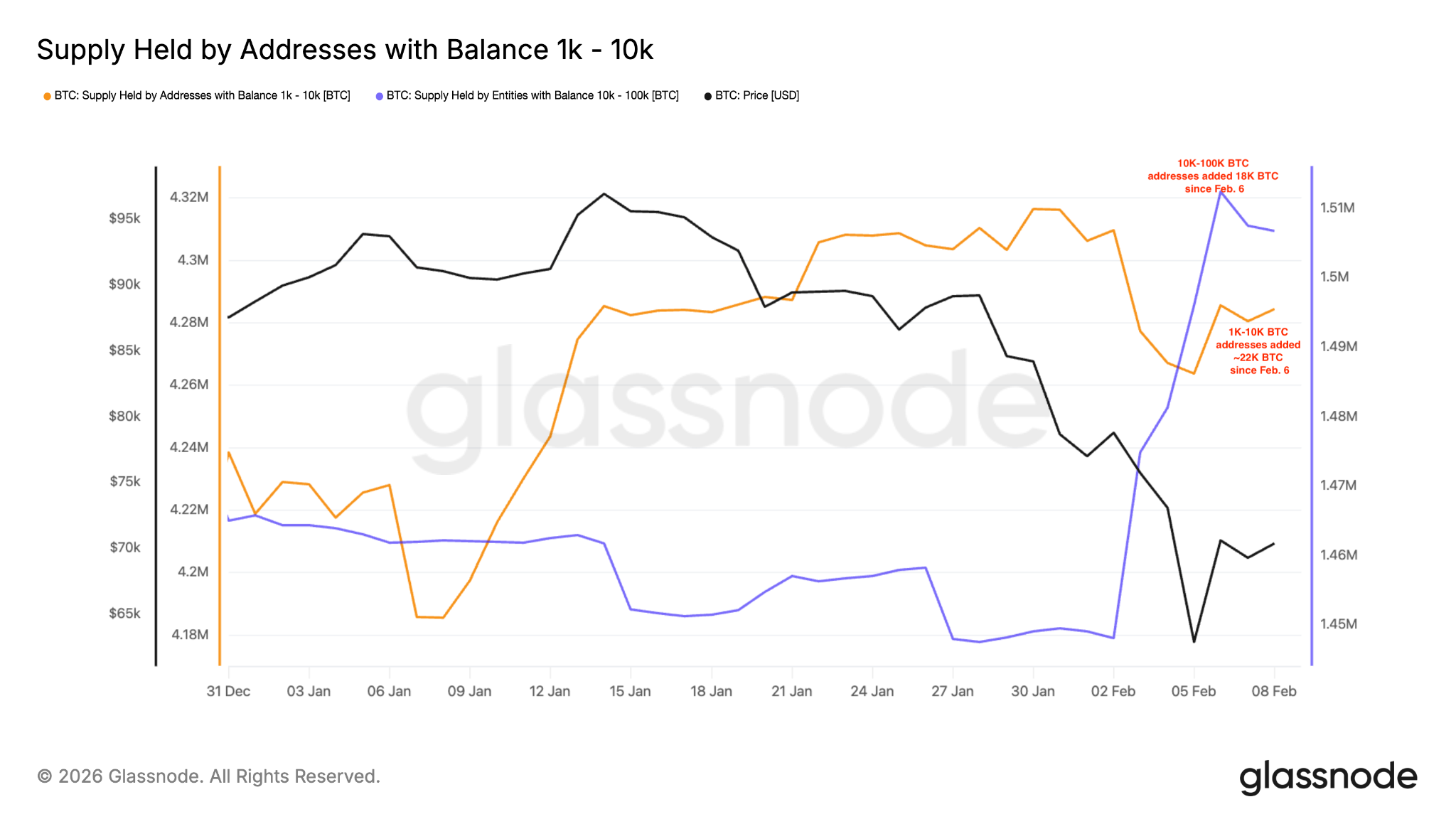

Whale addresses holding more than 1,000 BTC accumulated approximately 40,000 BTC during the recent market downturn, Cointelegraph reported, citing data from Glassnode. The accumulation was split between two cohorts: addresses holding 1,000 to 10,000 BTC added around 22,000 BTC, while those with 10,000 to 100,000 BTC purchased about 18,000 BTC. Following the whale buying activity, BTC rebounded nearly 20% from a low of $60,000 to reach $72,000. Adding to the recovery momentum, the Binance Secure Asset Fund for Users (SAFU) purchased an additional 4,225 BTC, worth approximately $300 million. The SAFU address now holds a total of 10,455 BTC.

12:29

Cango (CANG), a Bitcoin mining company listed on the New York Stock Exchange (NYSE), announced it sold 4,451 BTC last weekend, generating proceeds of $305 million. The entire amount was used to repay a portion of its BTC-collateralized loans. Cango stated that the sale will help it actively pursue a transition into AI computing infrastructure.

12:22

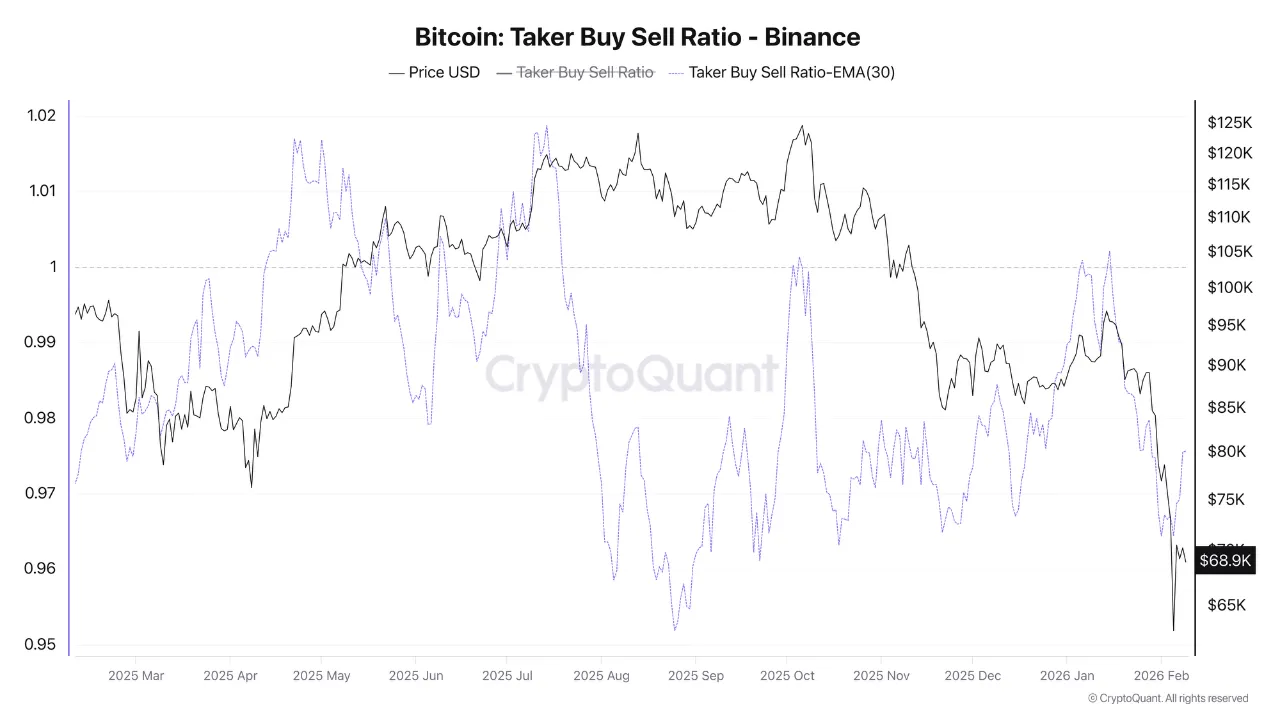

Bitcoin is facing strong selling pressure from the derivatives market ahead of the U.S. Consumer Price Index (CPI) announcement, crypto analyst Darkfost wrote in a CryptoQuant contribution.

According to the analyst, the monthly average market order buy volume in the futures market has turned negative again. After a brief period from last November to this January when buyers had the upper hand, sellers now hold a distinct advantage. On Binance, the market buy-to-sell ratio has fallen from 1 to 0.97.

Darkfost noted that this trend is accelerating and would require significantly stronger spot demand to reverse. Given current spot trading volumes and spot ETF inflows, the market appears to be driven primarily by futures trading. The recent rebound seems unstable ahead of key U.S. macroeconomic data releases, including the January non-farm payrolls and unemployment rate on Feb. 11 and the CPI on Feb. 13, he concluded.

11:44

Asset manager Bitwise has listed five crypto exchange-traded products (ETPs), including for BTC and ETH, on the Borsa Italiana, the Italian stock exchange, according to European financial news outlet RankiaPro. This marks Bitwise's first direct listing in the Italian market. All the listed ETPs are physically backed.

11:21

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

11:08

Bernstein has analyzed the recent Bitcoin downturn, describing it as one of the most unfounded in history and reaffirming its year-end price target of $150,000. According to the firm, the current weakness in BTC is a temporary crisis of confidence rather than a structural issue. Unlike past bear markets, Bernstein noted, there are no systemic flaws such as major corporate bankruptcies or the collapse of hidden leverage. The firm also pointed to a crypto-friendly U.S. administration and the introduction of spot crypto ETFs by large asset managers. Bernstein views BTC as a programmable, blockchain-based asset that will become the optimal financial infrastructure for an AI agent environment. Regarding recent concerns, the firm stated that the threat from quantum technology is a common challenge for all global digital systems. It also highlighted that mining companies are diversifying into AI data centers and that corporations holding crypto are structured to withstand long-term declines, making the possibility of forced liquidations very low. These factors support its decision to maintain the $150,000 price target set at the beginning of the year, Bernstein concluded.

10:31

Chinese-language cryptocurrency platform Xinbi has processed approximately $17.9 billion in on-chain transactions despite Telegram sanctions and a U.S. crackdown, Cointelegraph reported, citing a report from blockchain analytics firm TRM Labs. According to the report, Xinbi immediately shifted its operations to other messaging platforms after its Telegram channels were blocked in 2025, sustaining its ecosystem by launching its own crypto wallet, "XinbiPay." This activity suggests the platform functions as a primary conduit for laundering proceeds from cybercrime and phishing scams, the report explained. Since 2025, Xinbi has been suspected of links to a Telegram-based black market involved in money laundering, the trade of personal information, and the sale of illegal tools.

10:30

According to CoinNess market monitoring, BTC has fallen below $69,000. BTC is trading at $68,986.35 on the Binance USDT market.

10:29

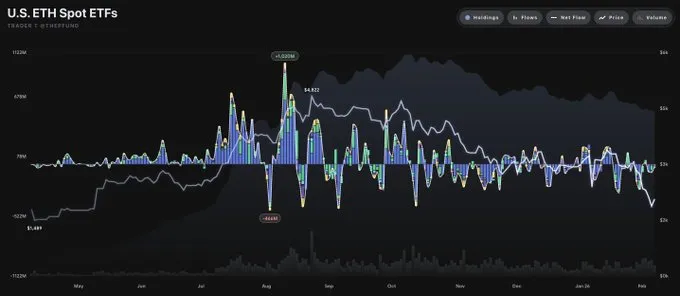

On Feb. 6, U.S. spot Ethereum (ETH) ETFs experienced a total net outflow of $16.77 million, according to data compiled by TraderT. This marks the third consecutive day of net outflows.

Individual fund flows were as follows:

- BlackRock's ETHA: -$45.46 million

- Fidelity's FETH: +$4.63 million

- Bitwise's ETHW: +$11.8 million

- Invesco's QETH: +$2.45 million

- VanEck's ETHV: +$3.01 million

- Grayscale's Mini ETH Trust: +$6.8 million

10:28

South Korean crypto exchange Upbit announced that it will temporarily suspend deposits and withdrawals for Pocket Network (POKT) starting at 9:00 a.m. UTC on Feb. 10 due to a network upgrade.

10:28

U.S. spot Bitcoin ETFs saw a net inflow of $369.8 million on Feb. 6, according to data compiled by TraderT. This marks a return to net inflows after three consecutive days of outflows. No ETFs recorded net outflows on the day.

- BlackRock's IBIT: +$230.27 million

- Fidelity's FBTC: +$24.54 million

- Bitwise's BITB: +$28.7 million

- Ark Invest's ARKB: +$43.25 million

- Invesco's BTCO: +$6.97 million

- VanEck's HODL: +$15.94 million

- Grayscale's Mini BTC: +$20.13 million

10:23

The recent sharp decline in Bitcoin's price from $77,000 to $60,000 was largely driven by the hedging activities of options market makers (MMs), according to an analysis by 10x Research. Markus Thielen, CEO of 10x Research, told CoinDesk that MMs in the options market were found to be in a large short gamma position during the price drop. He explained that MMs, who provide market liquidity by taking the opposite side of investor trades, manage risk in a short gamma position by buying when prices rise and selling when they fall. This activity created additional selling pressure as Bitcoin's price declined. Thielen noted that approximately $1.5 billion in short gamma positions had accumulated as the price fell from $75,000 to $60,000, amplifying the selling pressure during the downturn. The price was only able to rebound after this sell-off was absorbed. He concluded that the growth of the BTC options market has increased the volatility of the spot price due to these hedging activities.

10:07

The Open Network (TON) Foundation has launched TON Pay, a software development kit (SDK) designed to facilitate everyday cryptocurrency payments, Cointelegraph reported. The system aims to transform Telegram into an e-commerce and financial hub, with plans to introduce features for subscription payments and gas-free transactions.

10:04

South Korea's National Assembly's Political Affairs Committee will hold a plenary meeting at 1:00 a.m. UTC on Feb. 11 to address the recent incident involving erroneous Bitcoin payments at Bithumb, Digital Asset exclusively reported. It is unusual for the committee to convene a plenary session for a cryptocurrency-related issue. Following the incident, both the ruling Democratic Party and the opposition People Power Party have criticized the exchange, calling the matter serious.

10:01

Bithumb announced that it will temporarily suspend deposits and withdrawals for Pocket Network (POKT) at 10:00 a.m. UTC on Feb. 10 due to a network upgrade.

09:39

South Korea's Financial Supervisory Service (FSS) Governor Lee Chan-jin has stated that the Bitcoin mistakenly distributed by Bithumb must be returned, KBS reported. Lee explained that since Bithumb had clearly announced it would award 2,000 won per person for its "random box" event, the mistaken payments are a clear case of unjust enrichment. He asserted that the obligation to return the assets is indisputable and that the original assets—the Bitcoin itself—must be returned in principle. Lee described the situation for investors who sold the erroneously deposited coins as "catastrophic." However, he added that investors who had confirmed with Bithumb that the deposit was legitimate before acting may not be required to return the original assets.