Live Feed

Today, February 13, 2026

00:01

The Crypto Fear & Greed Index, compiled by data provider Alternative, rose four points from yesterday to 9. The market sentiment remains in the "Extreme Fear" phase. The index measures sentiment on a scale from 0, indicating extreme fear, to 100, representing extreme optimism. It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

Yesterday, February 12, 2026

23:59

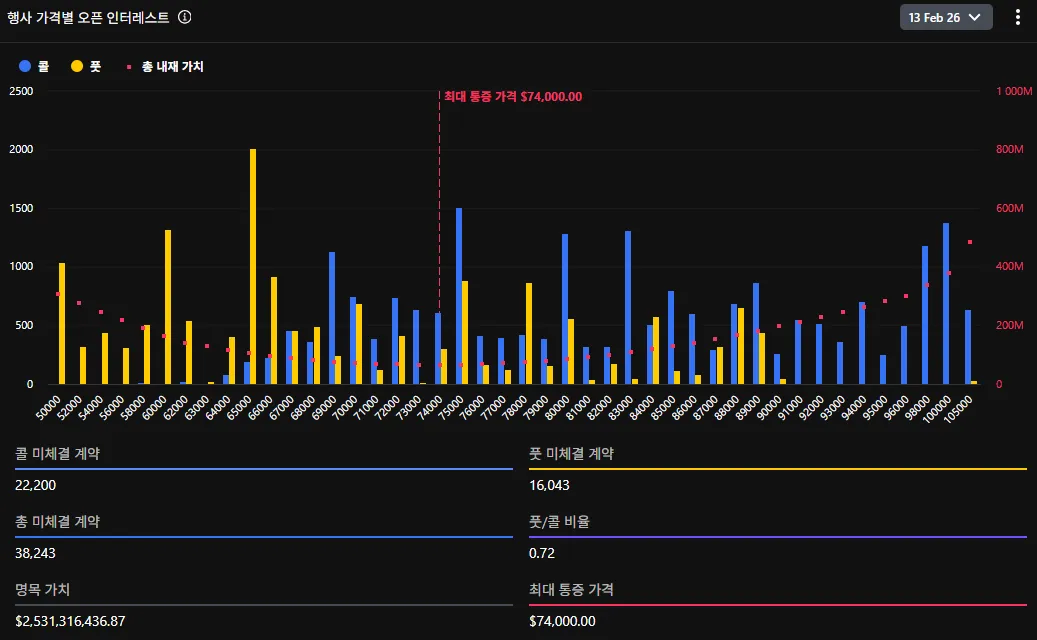

According to crypto options exchange Deribit, Bitcoin options worth $2.5 billion are set to expire at 8:00 a.m. UTC today, Feb. 13. The put/call ratio is 0.72, and the max pain price—the level at which the most option holders would see their contracts expire worthless—is $74,000. At the same time, Ethereum options valued at $420 million will also expire, with a put/call ratio of 0.85 and a max pain price of $2,100.

23:48

South Korean crypto exchange Bithumb has announced the temporary suspension of deposits and withdrawals for Rei (REI), citing issues on the Rei Network.

23:36

The U.S. Department of Justice (DOJ) has indicted a man on charges of wire fraud and money laundering in connection with a cryptocurrency investment scheme, The Block reported. The man allegedly posed as a professional cryptocurrency investor to solicit funds, ultimately gambling away $1 million of the investors' money.

22:39

The U.S. Commodity Futures Trading Commission (CFTC) has appointed a number of crypto industry leaders to its Innovation Advisory Committee (IAC), CoinDesk reported. New members include Coinbase CEO Brian Armstrong, Ripple CEO Brad Garlinghouse, Robinhood CEO Vlad Tenev, Solana founder Anatoly Yakovenko, Uniswap founder Hayden Adams, and Chainlink founder Sergey Nazarov. They join existing members such as Gemini founder Tyler Winklevoss, Kraken CEO Arjun Sethi, and Polymarket CEO Shayne Coplan. The IAC is an expanded and reorganized version of the CEO Innovation Committee, which was established last December.

22:26

The U.S. Federal Reserve has proposed classifying cryptocurrencies as an independent asset class within the market for uncleared derivatives, which are trades conducted without a central clearinghouse like an exchange, Cointelegraph reported. In a working paper, the Fed stated that cryptocurrencies are significantly more volatile than traditional asset classes and do not align with the risk categories of the current asset classification model (SIMM). The central bank also suggested that traders should be required to post higher margin deposits to prevent liquidations. The paper further recommended applying separate risk weights for volatile cryptocurrencies like BTC and ETH versus pegged assets such as stablecoins. The Fed noted that creating a benchmark index composed of a 50/50 mix of volatile cryptocurrencies and stablecoins could lead to more accurate calculations of market volatility and appropriate risk weights for crypto assets.

22:09

Nasdaq-listed sports betting company DraftKings has announced plans for a major expansion of its prediction market platform, DraftKings Predictions, this year. According to The Block, DraftKings CEO Jason Robins said the company sees a huge opportunity in the platform and plans to invest capital to acquire millions of customers.

22:02

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

22:02

Decibel, an Aptos-based on-chain trading engine, is launching its protocol-native stablecoin, USDCBL, Cointelegraph reported. The stablecoin will be used as collateral for on-chain perpetual futures. Its reserves will consist of cash and short-term U.S. Treasury bonds, with any revenue generated from these assets going to the protocol. Meanwhile, Decibel plans to launch its mainnet this month.

21:53

The possibility of a BTC rebound driven by a short squeeze is growing as bearish bets become overheated, Cointelegraph reported. The average funding rate for BTC has entered strongly negative territory for the first time since March 2023 and November 2022. Cryptocurrency analyst Leo Ruga noted that this indicates overheated bearish sentiment, a phenomenon often seen during a market bottoming phase. Another analyst, Pelin Ay, suggested that if a sharp price drop accompanies the negative funding rate and the $58,000 level holds as support, it could set the stage for a short squeeze. However, the outlet added that such a move would require liquidity support, noting that the market capitalization of USDT recently decreased by $2.87 billion.

21:27

Coinbase announced in its earnings report that total revenue for the fourth quarter of last year was $1.78 billion, a 20% decrease year-over-year. This figure fell short of the market expectation of $1.83 billion. The company also posted a net loss of $670 million, swinging to a loss. Meanwhile, Coinbase purchased $39 million worth of BTC during the same period.

21:03

Payments firm Fiserv, a Fortune 500 company, is launching a real-time cash payment system called INDX for cryptocurrency companies, Cointelegraph reported. The system will allow businesses to instantly settle U.S. dollar payments through a single custodial account. INDX will operate 24/7 and offer insurance coverage of up to $25 million through the U.S. Federal Deposit Insurance Corporation (FDIC).

21:01

The three major U.S. stock indices closed lower today.

- S&P 500: -1.57%

- Nasdaq: -2.03%

- Dow Jones: -1.34%

20:49

Cryptocurrency-focused Super PAC Fairshake plans to spend $1.5 million to unseat U.S. Congressman Al Green in his primary race, CoinDesk reported. Green is a prominent opponent of cryptocurrency who received an "F" grade, signifying strong opposition, from the advocacy group Stand With Crypto. His opponent, Christian Menefee, received an "A" grade from the same organization.

20:36

U.S. SEC Chairman Paul Atkins told the Senate Banking Committee that prediction markets are a significant issue on which regulators are focused. According to The Block, Atkins stated that both he and CFTC Chairman Michael Selig are concentrating on the matter. He added that while prediction markets are an area where jurisdiction can overlap, they fall mostly under the purview of the CFTC. Atkins also noted that the subtle distinctions between prediction markets and commodities often depend on the terminology used. He also mentioned that the SEC and CFTC meet once a week.

20:27

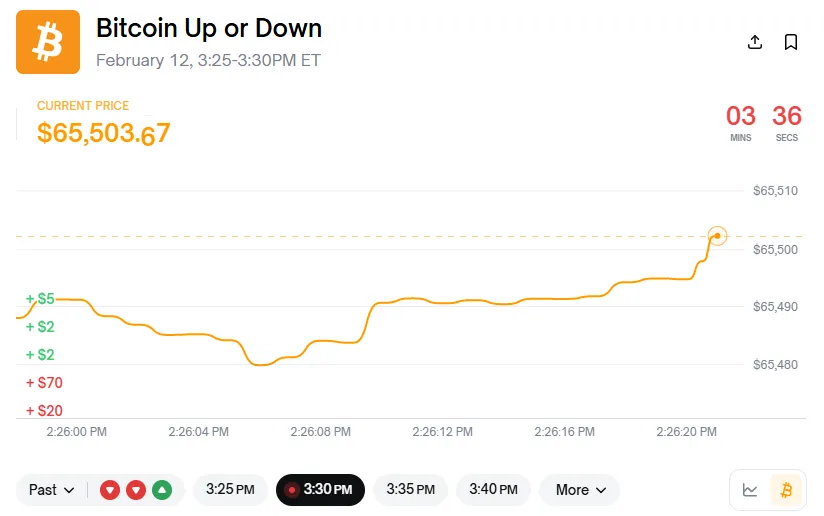

The decentralized prediction market Polymarket has launched a Bitcoin price prediction market that is generated in five-minute intervals, according to the Watcher.Guru X account.

20:14

Bitcoin could face a prolonged sideways trend similar to 2022 if it fails to overcome key resistance, according to an analysis by Glassnode. The on-chain analytics firm noted that Bitcoin is currently trading in a range between its True Market Mean of $79,200 and its Realized Price near $55,000. This pattern, Glassnode stated, is highly reminiscent of the first half of 2022, when Bitcoin was trapped in a similar range before entering a long-term bear market and bottoming out near $15,000 in November. To escape this sideways movement, the firm explained that Bitcoin must break through the $72,000 resistance level.

19:52

Aave Labs has announced a governance proposal titled "Aave Will Win" that would direct 100% of its product revenue to the Aave DAO. According to CoinDesk, if the proposal passes, V4 will serve as the foundation for Aave's future development, formally establishing a structure where all revenue from products developed by Aave Labs is allocated to the DAO rather than the company itself. According to CoinMarketCap, AAVE is currently trading at $110.87, up 2.81%.

19:25

Companies with digital asset treasuries (DATs) purchased a total of 43,230 BTC, worth approximately $3.5 billion, in January, with Strategy accounting for 93% of the total, Decrypt reported. During the period, Strategy acquired 40,150 BTC, while all other corporate buyers collectively purchased 3,080 BTC.

18:45

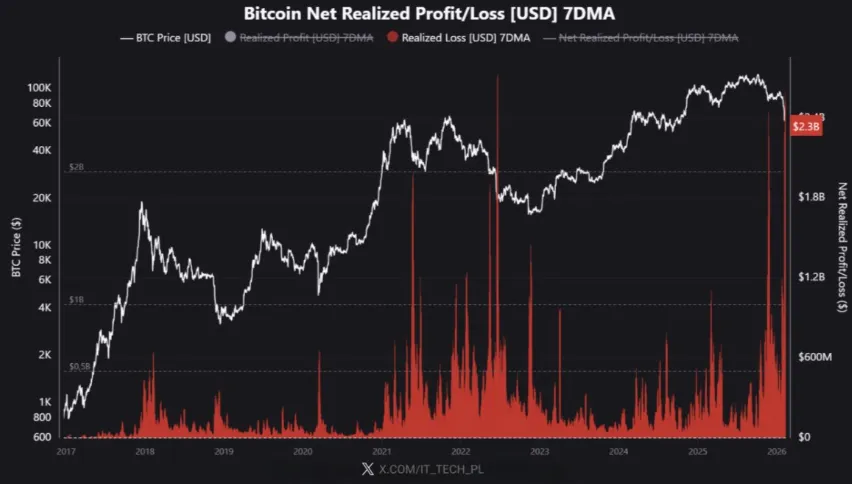

On-chain data platform CryptoQuant analyzed on its official X account that the recent Bitcoin decline will be recorded as one of the largest crashes in the cryptocurrency's history, comparable to the 2021 crash. The firm emphasized that the event ranks between the third and fifth largest of all time based on the scale of losses, adding that crashes of this magnitude are rare in Bitcoin's history.

18:39

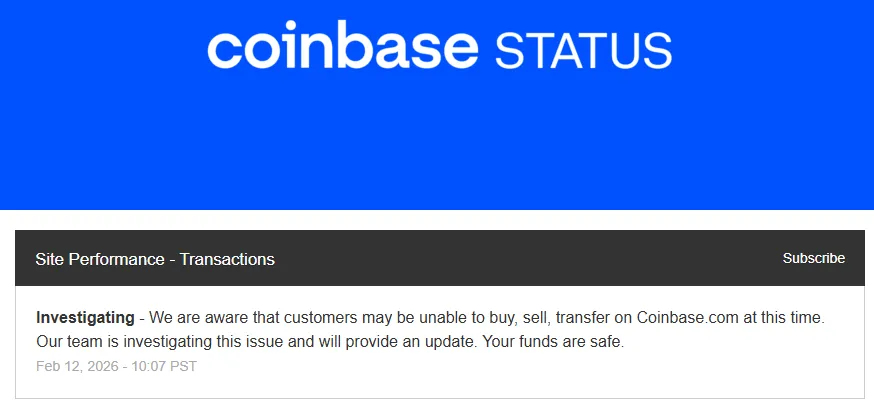

Coinbase has announced through its official channels that it is experiencing errors with buy, sell, and transfer functions on its website, Coinbase.com. The company is investigating the issue and has assured users that their assets are safe.

18:31

Ark Invest CEO Cathie Wood has stated that Bitcoin could serve as a hedge amid the deflationary disruption caused by artificial intelligence (AI) and other technological innovations, CoinDesk reported. Speaking at Bitcoin Investor Week in New York, Wood argued that the traditional financial system is unprepared for the productivity shock from AI, robotics, and other exponential technologies. She explained that this shock will lead to a sharp drop in prices, upend existing business models, and create deflationary chaos. Wood noted that the current economic system, which is accustomed to 2-3% inflation, will struggle to adapt to this new environment. She emphasized that Bitcoin is a hedge against both inflation and deflation, as it is free from the vulnerabilities of traditional finance. Wood highlighted Bitcoin's decentralized structure and fixed supply as key strategic advantages.

18:10

Timur Aitov, chairman of Russia's Financial Market Security Committee, said in an interview that the country plans to use the digital ruble for trade with its BRICS partners, DL News reported. He noted that BRICS nations require a central bank digital currency (CBDC) for trade, which is why Russia's central bank is targeting a Sept. 1 launch for digital ruble payments. Aitov acknowledged that domestic demand for a CBDC is not very high, agreeing with the assessment that individuals, businesses, and particularly banks do not need it. He described the digital ruble as being, in many ways, an international project.

17:40

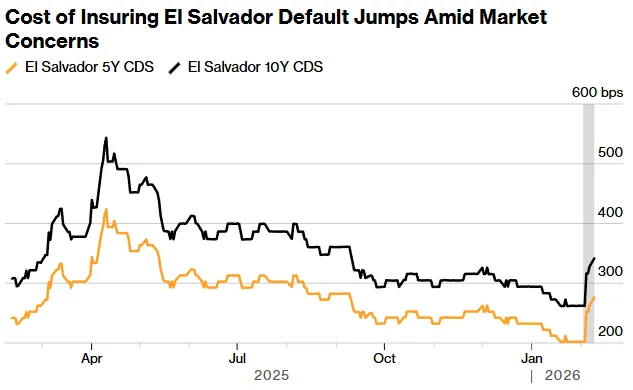

The value of El Salvador's Bitcoin holdings has fallen by approximately $300 million amid the cryptocurrency's price decline, Walter Bloomberg reported. The situation highlights the risks associated with President Nayib Bukele's crypto investment strategy and is creating anxiety in the country's bond market, the report added. Despite these losses, El Salvador continues to buy Bitcoin, a move that is complicating negotiations for a $1.4 billion loan from the International Monetary Fund (IMF). Analysts have warned that the country's persistent crypto purchases, coupled with delays in pension reform, could jeopardize the IMF's support.

17:16

More than 20,000 AI agents have been deployed on blockchains including Ethereum, BNB Chain, and Base within two weeks of the launch of the new Ethereum standard, ERC-8004, Wu Blockchain reported. The standard is designed to allow autonomous AI agents to identify each other, transact, and build reputations on-chain without intermediaries.