Live Feed

Today, January 24, 2026

15:03

Our real-time cryptocurrency news service operates 24 hours a day, starting from 10:00 p.m. UTC on Sundays and concluding at 3:00 p.m. UTC on Saturdays. During the scheduled break from Saturday 3:00 p.m. UTC to Sunday 10:00 p.m. UTC, we will only issue updates in the event of major breaking news.

14:37

Coinbase has announced that it will conduct scheduled server maintenance for three hours, starting at 3:00 p.m. UTC on Jan. 24.

14:31

Multi-chain aggregator trading platform Ave.ai announced that its joint New Year Trading Competition with BNB Chain has entered its final competitive phase, with about two days remaining. The event, which concludes on Jan. 26, features a total prize pool of 100,000 USDT. Currently, the first-place participant's cumulative trading volume has surpassed 765,000 USDT, with the ultimate winner set to receive 10,000 USDT.

Ave.ai explained that the campaign was designed to boost on-chain trading activity among BNB Chain users. Participants are automatically entered by logging into Ave.ai and executing trades on the BNB Chain, with all on-chain volume being tallied. The rewards are structured as a three-tiered system: a participation reward sharing a 20,000 USDT pool for achieving 200 USDT in volume, a tiered airdrop distributing a 15,000 USDT pool to those who reach specific volume thresholds, and a leaderboard competition where the top 200 traders compete for a 65,000 USDT pool.

The platform added that it expects competition for the top rankings to intensify as the event's deadline approaches. Ave.ai also noted that users can access on-chain data analysis and the latest strategies by joining its official alpha investment research community.

13:24

Nifty Gateway, the NFT platform owned by Gemini, has announced it will officially shut down its services on Feb. 23. The platform is now available for withdrawals only.

12:28

A potential ban on interest payments for stablecoins under the proposed U.S. Crypto-Asset Market Structure (CLARITY) Act could risk driving capital out of regulated markets, according to Colin Butler, head of markets at Mega Matrix. He warned that funds might flow into opaque offshore financial markets.

Andrei Grachev, a founding partner at Falcon Finance, echoed this concern, suggesting that capital could shift to synthetic dollar products. He cited Ethena's USDe as a prime example, noting that such products exist in a regulatory gray area because they do not fall under the definition of payment stablecoins in the proposed legislation. Grachev argued that a ban on stablecoin interest could ultimately undermine U.S. competitiveness.

12:24

Enterprise blockchain firm R3 will provide yields to institutional investors on the Solana network, CoinDesk reported. The initiative will target high-yield institutional assets such as private credit and trade finance. R3 co-founder Todd McDonald said he believes Solana is the most suitable network for an on-chain future, citing its architecture, throughput, and transaction-focused design.

10:43

Whale Alert reported that 770,000,000 USDT has been transferred from HTX to Aave. The transaction is valued at about $769 million.

08:05

A whale address that purchased 6,411 ETH last year at an average price of $3,873 deposited 1,999 ETH ($5.92 million) to an exchange early today, according to on-chain analyst ai_9684xtpa. A sale at current prices would result in an estimated loss of approximately $1.815 million. The address currently holds 3,803 ETH.

07:25

The following are the long/short position ratios for BTC perpetual futures over the last 24 hours on the top three global crypto futures exchanges by open interest:

Overall: 49.74% long / 50.26% short

1. Binance: 50.07% long / 49.93% short

2. Bybit: 50.14% long / 49.86% short

3. OKX: 50.36% long / 49.64% short

07:03

Amid market uncertainty following recent remarks by President Trump, investment in crypto startups has continued, Decrypt reported, citing data from DeFiLlama. In the third week of January alone, 14 crypto startups raised a total of $362 million, bringing the cumulative funding for the year to over $1 billion. However, this year's fundraising volume is down more than 50% from the same period last year, indicating a slowdown in investment enthusiasm compared to the previous bull market.

The largest investment in January went to cryptocurrency custody firm BitGo, which raised $213 million through an IPO. The tokenization sector also saw significant investment, with Superstate raising $83 million in a Series B round led by Bain Capital Crypto and others. Superstate issues blockchain-based investment products, including a tokenized fund based on U.S. Treasury bonds.

06:14

The Ethereum Foundation has designated security against quantum computing threats as a core strategic priority and has officially launched a dedicated Post-Quantum team, Coindesk reported. In the short term, the foundation aims to enhance user wallet security by holding bi-weekly developer sessions. These sessions will focus on strengthening user security through discussions on in-protocol cryptographic tools, account abstraction paths, and signature aggregation structures. The foundation is also expanding its research support, allocating $1 million to the Poseidon Prize for strengthening the Poseidon hash function and another $1 million to the Proximity Prize for research into quantum-resistant technology.

06:04

U.S. spot Ethereum ETFs recorded a net outflow of $41.7 million on Jan. 23, marking the fourth consecutive day of withdrawals, according to data from Farside Investors. The figures show that BlackRock's ETHA had an outflow of $44.5 million, while Grayscale's ETHE saw an outflow of $10.8 million. Grayscale's Mini ETH fund partially offset the trend with a net inflow of $9.2 million.

05:58

U.S. spot Bitcoin ETFs recorded a total net outflow of $103.5 million on Jan. 23, marking the fifth consecutive day of outflows, according to data from Farside Investors. The outflows were led by BlackRock's IBIT, which saw a withdrawal of $101.6 million, while Fidelity's FBTC experienced an outflow of $1.9 million.

05:52

Whale Alert reported that 300,000,000 USDC has been transferred from an unknown wallet to Binance. The transaction is valued at about $300 million.

05:31

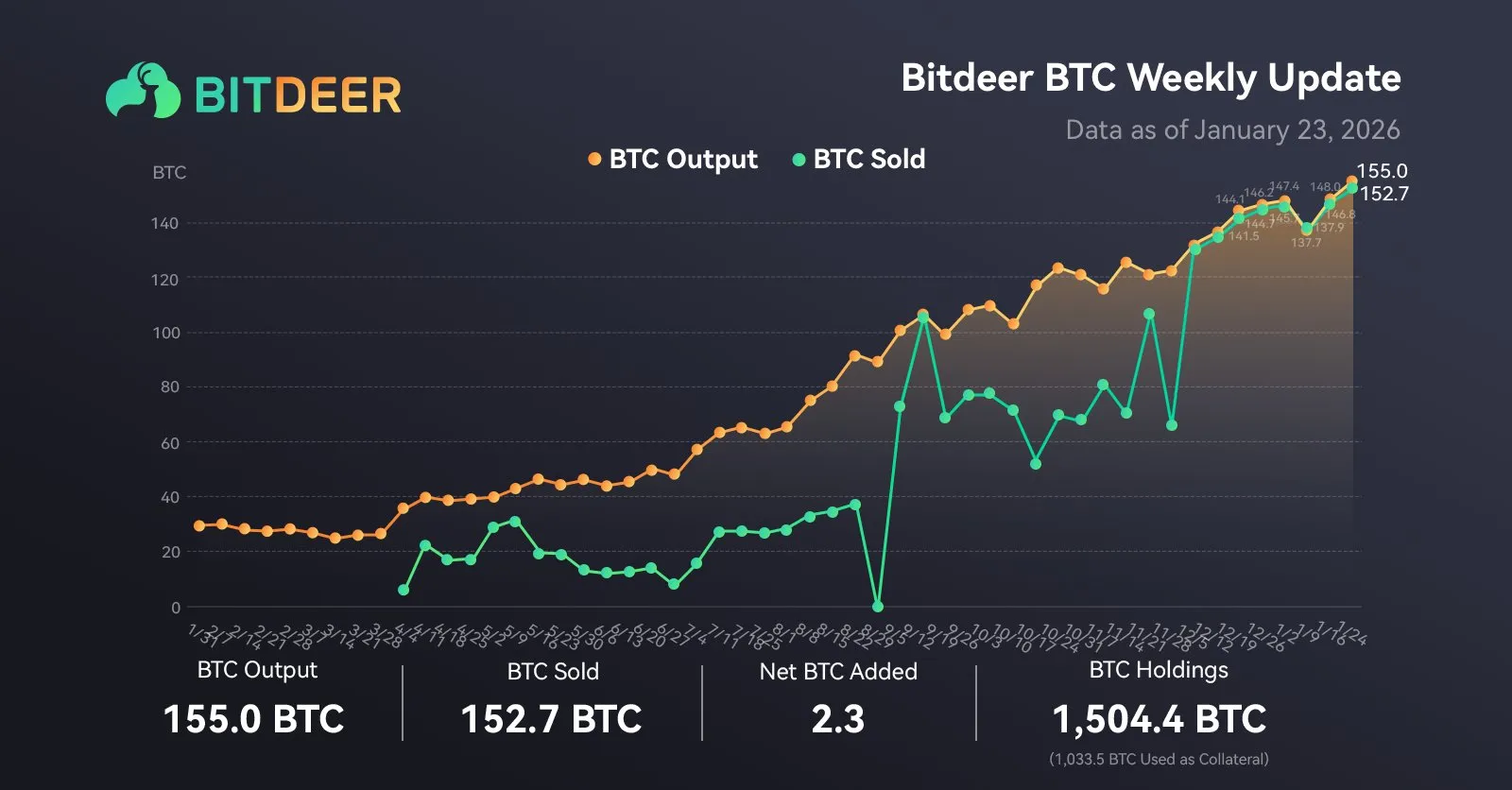

Bitcoin cloud mining firm Bitdeer announced on its official X account that it mined 155 BTC this week. During the same period, the company sold 152.7 BTC, leaving it with net holdings of 1,504.4 BTC as of Jan. 23.

05:09

SpaceCoin (SPACE), a decentralized satellite-based internet project, has announced the airdrop distribution plan for its native token, according to Wu Blockchain. For the Season one airdrop, 25% of the allocation will be unlocked immediately at the Token Generation Event (TGE), with the remainder distributed in monthly installments over the following three months. Season two is set to begin one month after the TGE, featuring a monthly unlock of 33.3% for three consecutive months. SpaceCoin also revealed a limited-time staking program offering a 10% annual percentage rate (APR). This follows a previous token swap partnership between SpaceCoin and World Liberty Financial (WLFI).

04:59

Over the past 24 hours, the cryptocurrency perpetual futures market saw significant liquidations, with short positions bearing the brunt of the losses. Bitcoin (BTC) led with $110 million in liquidations, of which 78.92% were shorts. Ethereum (ETH) followed with $92.47 million in liquidations, with shorts accounting for 64.85%. Solana (SOL) also experienced notable liquidations, totaling $13.59 million, where 57.63% were short positions.

00:23

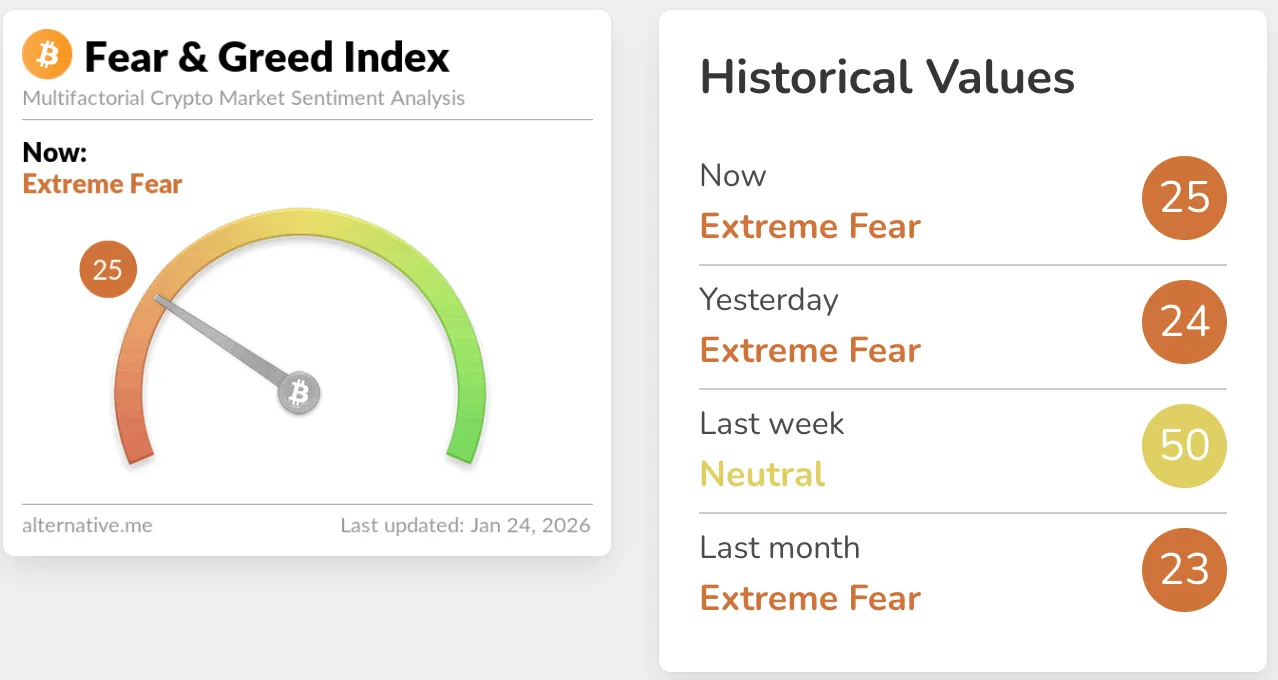

The Crypto Fear & Greed Index from data provider Alternative rose one point from the previous day to 25, keeping market sentiment in the Extreme Fear category. The index measures sentiment on a scale where 0 indicates extreme fear and 100 represents extreme optimism. It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

00:05

Democrats in the U.S. Senate have proposed an amendment to the upcoming Crypto-Asset Market Structure Act (CLARITY) that would address potential conflicts of interest for President Donald Trump, The Block reported. Ahead of discussions in the Senate Agriculture Committee, the proposed provision seeks to prohibit the president, vice president, and members of Congress from conducting financial transactions using digital assets. The move follows a previous Bloomberg report estimating that President Trump has earned around $1.4 billion from crypto-related businesses, including the stablecoin project World Liberty Financial.

Yesterday, January 23, 2026

23:43

The U.S. Securities and Exchange Commission (SEC) has announced it will drop its civil lawsuit against Gemini after reaching a settlement. The agency had previously sued both Gemini and Genesis, accusing them of selling unregistered securities through the Gemini Earn crypto lending program.

23:39

The U.S. Office of the Comptroller of the Currency (OCC) has rejected a call from Senator Elizabeth Warren to launch a special investigation into the bank chartering process for World Liberty Financial (WLFI), CoinDesk reported. Warren, a prominent critic of cryptocurrency, had previously urged the agency to halt the process until President Trump divests his stake in the company. The OCC stated that it will decide on the charter application based on its standard procedures.

23:27

Coinbase announced that it has added Doodles (DOOD) and Moonbirds (BIRB) to its listing roadmap.

23:26

Vera Songwe, an economist and former UN Under-Secretary-General, stated that stablecoins have become more important than aid in Africa, Cointelegraph reported. Speaking at the Davos Forum in Switzerland, she explained that stablecoins are establishing themselves as a cheaper and faster means of remittance across the continent. Songwe noted that previously, sending $100 within Africa incurred a fee of six dollars and was often slow. In contrast, she said, stablecoins have reduced fees and significantly shortened settlement times.

23:20

Billionaire entrepreneur and venture capitalist Kevin O'Leary believes energy is currently a more valuable asset than Bitcoin, Coindesk reported. He stated that the immense energy required for Bitcoin mining and artificial intelligence, along with the infrastructure that supports it, are the best assets to own. O'Leary also highlighted Coinbase and Robinhood as noteworthy stocks for investing in crypto infrastructure. He described Robinhood as the best bridge for managing stocks and crypto on a single platform and projected that Coinbase could attract a large number of corporate clients once regulatory issues are resolved.

23:06

Strategy (MSTR) founder Michael Saylor announced on X that the company will host its Bitcoin for Corporations 2026 conference in Las Vegas on Feb. 24-25.