Live Feed

Today, January 27, 2026

12:31

Liquidity in the altcoin market has severely deteriorated, according to an analysis by AmberCN. The firm noted that 1INCH, considered a major altcoin with a market capitalization of approximately $180 million, plunged 7% following a single sell order of less than $2 million. The token's decline has since widened to 13%. AmberCN also highlighted that the 24-hour trading volume for the 1INCH/USDT trading pair on Binance is only $1.5 million. Of this total, $1.16 million is attributed to arbitrage bots, placing the actual liquidity at around $340,000.

12:27

A bill that would exempt cryptocurrencies from property taxes in Arizona has passed a state Senate committee, according to Decrypt. On Jan. 26, the Arizona Senate Finance Committee approved both Senate Bill 1044, which excludes assets like Bitcoin from property tax, and Senate Concurrent Resolution 1003, a measure to amend the state constitution accordingly. The legislation will now advance to the Senate Rules Committee for further review before a full floor vote. Final approval is contingent on a voter referendum scheduled for this November.

12:20

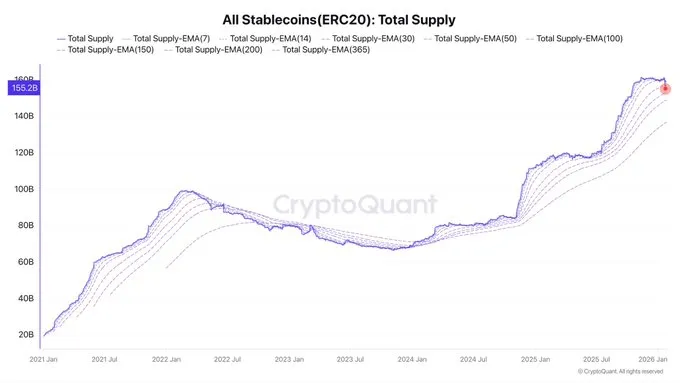

Stablecoins could become a substantial threat to bank deposits, according to an analysis by global investment bank Standard Chartered (SC). Cointelegraph reports that Geoff Kendrick, SC's head of digital assets research, noted that if the U.S. CLARITY Act on crypto market structure is passed, U.S. bank deposits could decrease by an amount equal to roughly one-third of the market capitalization of dollar-pegged stablecoins. He pointed out that regional banks would be the most significantly affected. Kendrick explained that the effect of funds flowing back into the system as deposits would be limited, as Tether and Circle hold only 0.02% and 14.5% of their reserves in bank deposits, respectively. He added that if the stablecoin market cap expands to $2 trillion by 2028, up to $500 billion in deposits could exit banks in developed nations.

11:49

American Bitcoin (ABTC), a Bitcoin mining company founded by Eric Trump, the second son of U.S. President Donald Trump, has purchased an additional 416 BTC, Solid Intel reported. The company now holds 5,843 BTC.

11:46

Holding a cryptocurrency solely in anticipation of a price increase should not be enough to subject it to securities laws, a U.S. lawyer has argued in a submission to the U.S. Securities and Exchange Commission's (SEC) crypto task force. According to Cointelegraph, Teresa Goody Guillen, a lawyer specializing in crypto regulation, stated in a public letter on the SEC's website that holding a token with the simple expectation of a price rise constitutes a passive economic interest. She argued that this act alone is insufficient to meet the criteria for applying securities law and that cryptocurrencies should be evaluated more flexibly, taking a variety of factors into account. Guillen added that, as Ripple has pointed out, applying securities regulation based only on the expectation of profit confuses speculation with investor rights. Ripple previously told the SEC on Jan. 9 that considering crypto holdings as subject to securities law based on price appreciation hopes alone would be an act of regulatory overreach.

11:32

Bitwise Chief Investment Officer (CIO) Matt Hougan has identified the surging price of gold and regulatory uncertainty in the U.S. as key factors driving the cryptocurrency market. He noted that about half of the value of gold, which has served as a form of currency for over two millennia, has been generated in the last 20 months, reflecting accumulated excess liquidity, debt, and currency devaluation. Hougan also pointed to a proposed crypto market structure bill, which he referred to as the Clarity Act, as a significant variable. He stated that while prediction markets gave the bill an 80% chance of passing earlier this month, that probability has dropped significantly after Coinbase criticized the current draft as ineffective. Hougan projected that if the bill ultimately fails, the crypto market could face a three-year period where it must directly prove its value. During this time, real-world use cases like stablecoins and tokenized stocks would be the main catalysts for changing the regulatory environment. However, he warned that if the bill fails and the adoption of these use cases also stalls, policy changes could pose a major threat to the crypto market.

11:09

Major European online investment platform Trading212 offered cryptocurrency exchange-traded notes (ETNs) to retail investors without a license from the UK's Financial Conduct Authority (FCA), Cointelegraph reported. The products, which are bond-like investments tracking the price of assets like Bitcoin, were permitted for sale to retail investors by the FCA starting last October, provided firms obtained regulatory approval. Trading212 reportedly failed to secure this approval before offering the ETNs and has since begun the authorization process following the regulator's intervention.

10:34

Japan's Financial Services Agency (FSA) has initiated a public consultation to define the scope of bonds permissible as reserves for stablecoins, The Block reported. Under Japanese regulations, stablecoin issuers are required to manage a portion of their reserve assets in the form of designated trust beneficiary rights. This consultation aims to specify which types of bonds these trust funds can be invested in. The FSA announced that it plans to accept comments until Feb. 27.

10:16

A technical indicator is signaling a potential mid-to-long-term bullish reversal for Bitcoin, Cointelegraph reported. The outlet cited crypto analyst Coinvo Trading, who observed that the Stochastic RSI for both U.S. and Chinese 10-year Treasury yields has formed a bullish cross in conjunction with Bitcoin's weekly chart. The analyst added that this pattern has appeared just before the last four major bull runs. However, Cointelegraph noted that the market remains in a defensive phase, as on-chain data still points to weakness and spot Bitcoin ETFs have recorded net weekly outflows.

10:09

The number of active accounts on the Tron (TRX) network has surpassed 4.59 million, an increase of 36% over the past month, Lookonchain reported.

09:23

Global crypto research firm Four Pillars has published a report arguing that EigenCloud presents a viable alternative for verifying off-chain computations. The report notes that most current services lack a method to objectively verify events, such as decisions made by artificial intelligence or code executed by service providers, creating a critical vulnerability for applications that require high levels of privacy and trust.

EigenCloud is designed to address this by combining cryptographic verification with collateral-based restaking within a hardware-based Trusted Execution Environment (TEE). This allows for general-purpose computations to be performed off-chain while ensuring their results can be verified, overcoming the limitations of existing systems that struggle with complex calculations due to software, hardware, and consensus constraints.

The report highlights that EigenCloud prioritizes developer accessibility by supporting familiar Web2 environments like Docker containers, GPU computation, and external API calls. This enables traditional software developers without smart contract expertise to leverage blockchain-based verification. Four Pillars concludes that verifiability is a necessity, not an option, and points to EigenCloud's growing use cases in infrastructure for AI agents, prediction markets, cross-chain security, and institutional finance.

09:03

South Korean crypto exchange Bithumb has announced that it will temporarily suspend deposits and withdrawals for Neo (NEO) and Gas (GAS) starting at 9:00 a.m. UTC on Feb. 3. The suspension is to support an upcoming upgrade to the Neo mainnet.

08:02

South Korean crypto exchange Coinone announced that it will list SENT for trading against the Korean won at 3:00 a.m. UTC on Jan. 28.

08:01

South Korean crypto exchange Bithumb has announced that it will temporarily suspend deposits and withdrawals for dYdX (DYDX) starting at 8:00 a.m. UTC on Jan. 30 to support a network upgrade.

07:29

Bank of Korea Governor Rhee Chang-yong stated that stablecoins remain highly controversial, speaking at the Asian Financial Forum (AFF) in Hong Kong, according to local media outlet rthk. He warned that if a won-pegged stablecoin were to be launched, it could be combined with U.S. dollar stablecoins to circumvent capital outflow regulations. Rhee explained that dollar-pegged stablecoins are used across various regions and have lower transaction costs than using the U.S. dollar directly. He added that if exchange rate volatility fuels market speculation, funds could flow into U.S. stablecoins, potentially leading to large-scale capital movements. Rhee also emphasized that regulation is becoming more difficult as a growing number of non-bank institutions are issuing stablecoins.

06:50

Bybit has announced that it will list the USAT/USDT spot trading pair at 2:00 p.m. UTC today.

06:25

Prediction market platform Kalshi has opened a new office in Washington, D.C., to enhance its lobbying efforts with the U.S. government, according to The Block. The company has also hired John Bivona, who served as a White House liaison for the Department of Homeland Security during the Biden administration, to lead its government affairs.

06:04

OKX announced that it will list the SENT/USDT spot trading pair at 12:00 p.m. UTC today.

06:02

A wallet containing 320.88 BTC, worth approximately 41.1 billion won ($29.8 million) and presumed lost by South Korea's Gwangju District Prosecutors' Office, has been located, Digital Asset reported. According to data from Hansung University's Blockchain Research Institute submitted to the office of Democratic Party lawmaker Min Byeong-deok, the BTC was transferred to an unidentified wallet address between 6:00 a.m. and 7:00 a.m. UTC on Aug. 21, 2025. As of Jan. 27, 2026, the funds remain in that wallet with no subsequent transfers.

05:59

The following are the 24-hour long/short position ratios for BTC perpetual futures on the world's top three crypto futures exchanges by open interest:

Overall: Long 49.65%, Short 50.35%

1. Binance: Long 50.04%, Short 49.96%

2. OKX: Long 51.8%, Short 48.2%

3. Bybit: Long 49.43%, Short 50.57%

05:58

Decentralized prediction market Polymarket has launched new markets linked to Volmex's 30-day implied volatility indexes for BTC and ETH, CoinDesk reported. The new offerings allow users to predict how high price volatility will be in 2026. The markets will pay out if the respective index reaches or exceeds a predetermined level by Dec. 31, 2026.

05:54

The Australian Securities and Investments Commission (ASIC) has identified regulatory gaps related to cryptocurrency firms as a key risk for the year, Decrypt reported. The agency stated that companies involved in crypto, payments, and artificial intelligence (AI) that operate in regulatory gray areas are exposing consumers to unlicensed advice and deceptive practices.

04:45

The market capitalization of Ethereum-based stablecoins has fallen by $7 billion over the past week, raising concerns about shrinking market liquidity, CryptoPotato reported, citing crypto analyst Darkfost. The analyst explained that a decline in stablecoin market cap is a potential bearish signal, noting that a similar pattern emerged during Bitcoin's prolonged downturn in 2021. The report adds that exchange data supports the liquidity concerns, with approximately $6 billion in assets withdrawn from Binance last week. Market pressure is expected to intensify as BTC trades below $88,000, compounded by macroeconomic headwinds such as the Federal Reserve's liquidity reduction.

04:32

Binance has announced it will delist several cross and isolated margin trading pairs at 6:00 a.m. UTC on Jan. 30. The affected cross margin pairs include KSM/BTC, SNX/BTC, ICX/BTC, DYDX/BTC, HIVE/BTC, 1INCH/BTC, MANA/BTC, and LRC/BTC. The isolated margin pairs to be delisted are KSM/BTC, SNX/BTC, ICX/BTC, SYS/BTC, DYDX/BTC, HIVE/BTC, AR/BTC, 1INCH/BTC, MANA/BTC, and LRC/BTC.

03:57

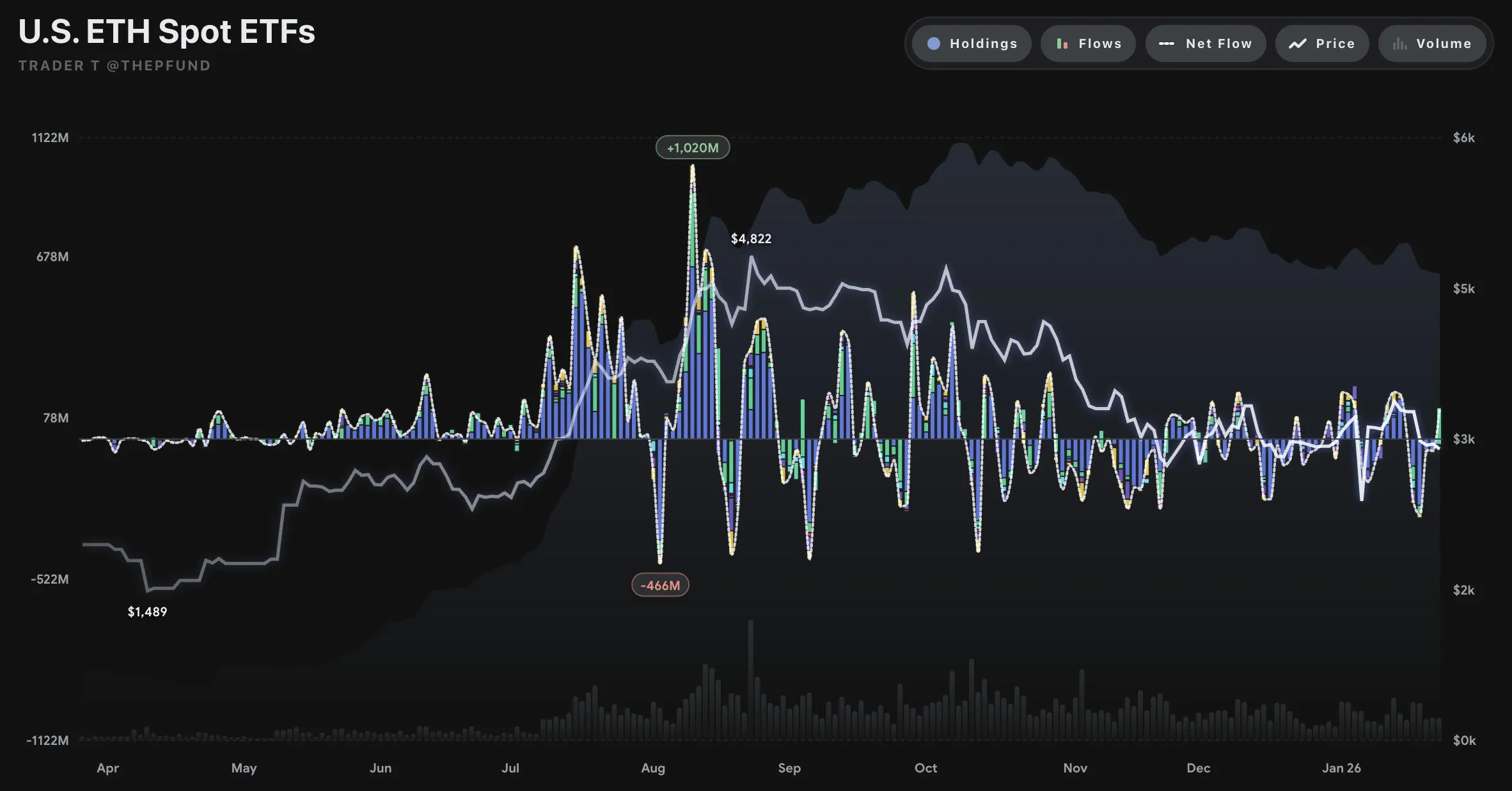

U.S. spot Ethereum ETFs recorded $110 million in net inflows on Jan. 26, marking a return to positive flows after a four-day streak of outflows, according to data from Trader T. The reversal was primarily driven by Fidelity's FETH, which attracted $137 million. This offset the $20.16 million in outflows from BlackRock's ETHA.