Live Feed

Today, March 6, 2026

03:43

U.S. spot Ethereum ETFs recorded $22.72 million in net inflows on March 5, marking the second consecutive day of positive flows, according to Trader T.

The breakdown is as follows:

- BlackRock (ETHA): +$28.89 million

- Grayscale Mini ETH: +$7.13 million

- Invesco (QETH): +$2.71 million

- Grayscale (ETHE): -$3.41 million

- Bitwise (ETHW): -$3.58 million

- VanEck (ETHV): -$3.81 million

- 21Shares (TETH): -$5.21 million

03:39

U.S. spot Bitcoin ETFs recorded a total net outflow of approximately $240 million on March 5, marking the first net outflow in four trading days, according to data compiled by Trader T.

- BlackRock IBIT -$101 million

- Fidelity FBTC -$48.03 million

- Bitwise BITB -$46.38 million

- Ark Invest ARKB -$22.67 million

03:36

The Central Bank of Russia (CBR) has proposed a plan to grant cryptocurrency licenses to banks, Cryptopolitan reported. CBR Governor Elvira Nabiullina said the proposed legislation would allow existing financial institutions, such as banks and brokerage firms, to obtain crypto trading licenses through a simple notification process and offer brokerage services based on their existing licenses. To mitigate volatility risk, however, the proposal would limit a bank's crypto exposure to 1% of its own capital. The deadline for the bill's adoption is July 1.

03:18

Cryptocurrency exchange OKX is launching a social network called Orbit within its trading app, CoinDesk reported. The feature will allow users to upload market commentary, broadcast live discussions, and create trading groups. According to the announcement, users can also enhance their credibility by displaying performance metrics such as portfolio returns, profit and loss, and win rates. OKX previously secured an investment from ICE, the parent company of the New York Stock Exchange (NYSE).

03:11

Major Bitcoin mining companies are abandoning their strategy of holding BTC and are instead cashing out to reduce risk, Cointelegraph reported. Miners have sold a total of 15,000 BTC since October of last year.

Cango sold 4,451 BTC in February, representing 60% of its holdings, while Bitdeer sold its entire BTC position during the same period. Riot Platforms also sold off portions of its holdings on several occasions last December, and Core Scientific has announced plans to sell 2,500 BTC within the first quarter of this year. Additionally, MARA Holdings, the largest publicly traded mining company, recently mentioned the possibility of selling its BTC holdings.

This trend marks a stark contrast to previous cycles, where miners typically accumulated their mined BTC in treasury in anticipation of further price increases. The report added that miners are taking measures to reduce financial risk amid increasing margin pressure after the market environment deteriorated sharply following large-scale forced liquidations last October.

03:01

South Korean crypto exchanges Bithumb and Coinone have announced the addition of SOLV to their respective delisting watchlists. According to Bithumb, the designation follows the confirmation of a security incident, such as a hack, affecting the asset's wallet or distributed ledger. The exchange noted that the cause of the incident has not been identified or resolved.

02:52

The following shows estimated liquidation volumes and position ratios for major crypto perpetual futures over the past 24 hours:

- BTC: $99.11 million liquidated (69.28% longs)

- ETH: $58.92 million liquidated (59.52% longs)

- SOL: $12.34 million liquidated (69.09% longs)

02:38

Justin Sun, founder of Tron (TRX), stated that he still holds all the LIT he previously purchased and remains optimistic about Litentry's long-term prospects. He added that he is currently rebalancing his wallet and plans to re-deposit the tokens into the Litentry Liquidity Pool (LLP) soon. Earlier this year, Sun purchased 13.25 million LIT for $33 million. In a recent AMA, Litentry founder Vladimir Novakovski referred to Sun as a "HODLer."

01:33

Three teenagers have been arrested in South Korea on charges of special robbery after allegedly luring a victim with a fake over-the-counter (OTC) crypto deal, assaulting them, and stealing over 30 million won (around $22,500) in cash, MBN News reported. The Gyeonggi Goyang Police are investigating the three suspects. The incident took place on March 2 in Goyang City. The group is believed to have planned the crime in advance and contacted the victim through Telegram.

01:18

An address suspected to belong to ParaFi Capital appears to be swapping its AAVE holdings for SKY, EmberCN reported. Three days ago, the address deposited 42,500 AAVE, worth $5.26 million, into Coinbase Prime. Four hours ago, it withdrew 70 million SKY, valued at $5.38 million, from the same platform.

00:53

A wallet associated with the Pump.fun (PUMP) team has deposited 1.757 billion PUMP, worth approximately $3.54 million, to the exchange Bitget, Onchain Lens reported. The wallet currently holds 12.3 billion PUMP, valued at $24.77 million. Deposits to exchanges are often interpreted as a precursor to selling.

00:44

Bitcoin payments app Strike announced it has obtained a BitLicense and a Money Transmitter License from the New York State Department of Financial Services (NYDFS). The BitLicense is considered one of the strictest regulatory licenses in the U.S. With this approval, Strike can now offer Bitcoin-related products and services to individuals and businesses throughout New York State. The company previously launched a credit service in the U.S. that allows users to borrow cash against their Bitcoin holdings.

00:38

The Consumer Dispute Mediation Commission of South Korea's Consumer Agency has initiated a collective dispute mediation process concerning payments for an API integration event held by the crypto exchange Bithumb, Yonhap News reported. The commission will post a public notice about the mediation until March 23 while it begins to draft a settlement proposal.

The dispute stems from a promotion Bithumb ran last November for first-time API traders, which offered a full rebate on trading fees and a support payment of 100,000 won (around $75). After the event began, the exchange added a clause excluding one-time trades made solely to receive the benefits and subsequently refused to make the payment to some users.

00:33

An Ethereum whale address that had been dormant for 10 years has transferred 100.27 ETH, worth $212,000, to a new address, according to Onchain Lens. The whale originally acquired 401.1 ETH for $125 during the Ethereum ICO, representing an estimated return of 6,687 times the initial investment.

00:32

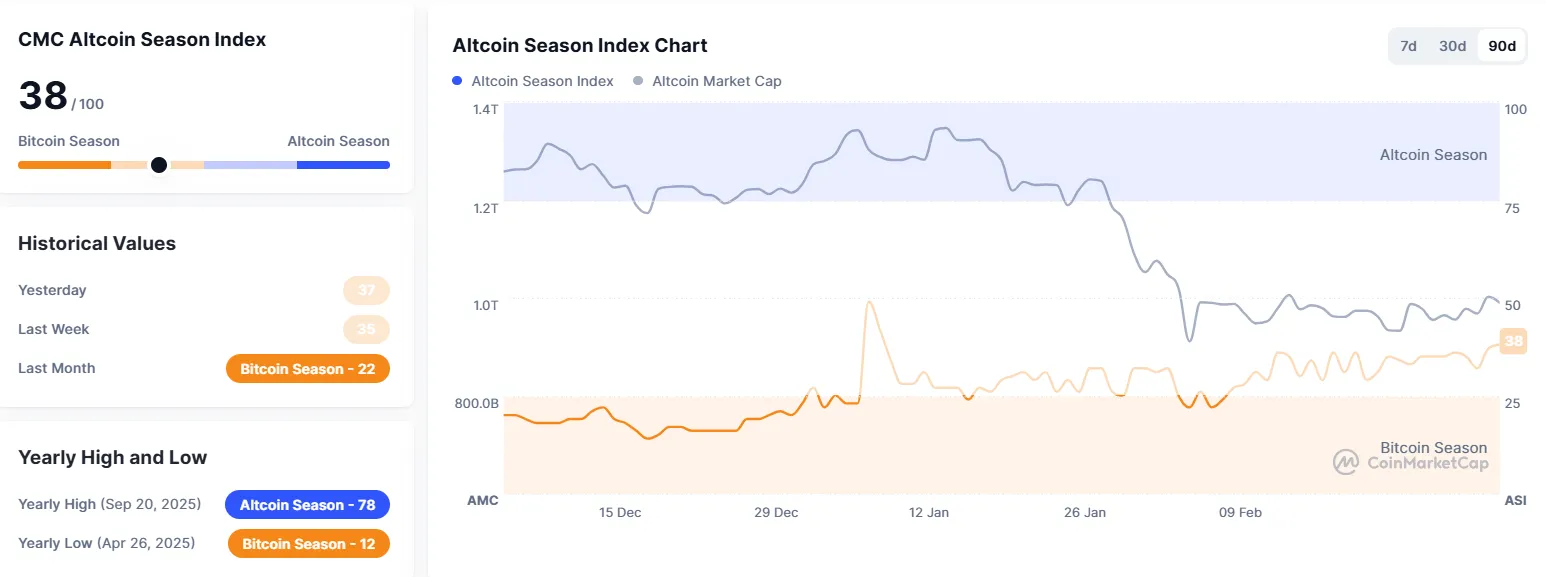

CoinMarketCap's Altcoin Season Index has risen seven points from yesterday to 38. The index compares the price performance of the top 100 coins by market capitalization—excluding stablecoins and wrapped coins—against Bitcoin. A period is considered an altcoin season if 75% of these coins outperform Bitcoin over the past 90 days; otherwise, it is deemed a Bitcoin season. A score closer to 100 indicates a stronger trend toward an altcoin season.

00:19

The Korea Exchange has activated the KOSDAQ buy-side sidecar for the second consecutive day.

00:14

BlackRock withdrew 4,172 BTC, worth $296.17 million, from Coinbase over the past eight hours, according to Onchain Lens. Withdrawals from exchanges are generally interpreted as a move to hold the assets.

00:10

The Bank of Canada has completed Project Samara, a pilot project for tokenizing government bonds, The Block reported. As part of the initiative, Export Development Canada (EDC) issued the country's first tokenized bond, which was settled using wholesale central bank deposits. The central bank also tested the feasibility of issuing a single three-month bond worth 100 million Canadian dollars to a select group of investors. It collaborated with financial institutions including TD Bank and the Royal Bank of Canada (RBC) for the test. The Samara platform, built on Hyperledger Fabric, managed the entire lifecycle of the bond, including issuance, bidding, interest payments, redemption, and trading.

00:01

The "Fear & Greed Index" from crypto data provider Alternative has fallen four points from the previous day to 18, indicating a state of "extreme fear." The index, which shifted from "fear" to "extreme fear" on Jan. 30, has remained in the latter stage since. The metric gauges market sentiment on a scale from 0 (extreme fear) to 100 (extreme optimism). It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

Yesterday, March 5, 2026

23:59

According to data from crypto options exchange Deribit, Bitcoin options with a notional value of $2.2 billion are set to expire at 8:00 a.m. UTC today, March 6. The put/call ratio for this batch is 1.70, with a max pain price of $69,000.

Additionally, Ethereum options worth $397 million will expire at the same time. These options have a put/call ratio of 0.89 and a max pain price of $1,950.

23:25

Plume (PLUME), a blockchain focused on regulatory-compliant real-world assets (RWA), announced through its official channels on March 5 that its native RWA revenue-sharing protocol, Nest, has expanded to the Solana (SOL) network.

In partnership with Solana ecosystem stablebank Perena, Nest has launched an RWA vault on the network to distribute profits to users from RWA-based lending and credit markets. Nest explained that the goal is to bring tokenized institutional funds to Solana.

The expansion utilized the cross-chain interoperability protocol LayerZero (ZRO). Plume and Nest stated they plan to support the expansion of tokenized RWAs across on-chain environments, ensuring they are not confined to a single ecosystem.

22:39

JPMorgan has concluded that the U.S. Federal Reserve's rate-cutting cycle is already over, Maeil Business Newspaper reported. According to a report from the Bank of Korea's New York office, JPMorgan recently revised its forecast for the number of Fed rate cuts this year from one to zero. The bank stated that the rate cuts appear to have concluded last December and that inflation is expected to remain above the target level for the time being.

22:19

U.S. regulators have clarified that tokenized securities must be subject to the same capital requirements as their traditional counterparts, CoinDesk reported. In a document sent to banks, the U.S. Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) stated that a change in the technology used for a security does not alter its regulatory treatment. The agencies argued that just as the legal rights of a security owner are protected regardless of how the asset is traded, the underlying capital requirements must also be applied consistently. They added that while tokenized assets can be used as financial collateral, they will be subject to the same haircut levels as traditional securities. The regulators also noted that these capital rules will apply regardless of whether a permissioned blockchain is used.

22:03

Coinbase announced it has postponed the listing of LMTS to March 6. Trading is scheduled to begin after 5:00 p.m. UTC, provided liquidity conditions are met.

22:00

The Solana spot ETF is showing impressive performance despite a drop in the price of SOL, according to Bloomberg analyst Eric Balchunas. He noted that the ETF has attracted a total of $1.5 billion in inflows with almost no outflows, and half of this capital comes from institutional investors. Balchunas also highlighted that when adjusted for market capitalization relative to Bitcoin, the current pace of inflows is twice as fast as that of the Bitcoin ETFs at their launch. He described this as a very impressive achievement, considering that the price of Solana has fallen by 57% since the ETF's debut.