Live Feed

Today, January 22, 2026

07:55

The following are the long/short position ratios for BTC perpetual futures over the last 24 hours on the world's top three cryptocurrency futures exchanges by open interest:

Overall: 49.61% long / 50.39% short

1. Binance: 48.72% long / 51.28% short

2. Bybit: 48.83% long / 51.17% short

3. OKX: 49.45% long / 50.55% short

06:58

South Korean crypto exchange Upbit announced it has updated the circulating supply schedule for Axelar (AXL) at the request of the project's team. The revision increases the planned first-quarter circulating supply by 17,122,766 AXL, raising the total from 1,100,610,413 to 1,117,733,179. Following the update, the circulating supply for the second quarter is scheduled to be 1,169,427,498 AXL.

06:51

South Korean crypto exchange Upbit has announced that it will temporarily suspend deposits and withdrawals for NEO and GAS starting at 3:00 a.m. UTC on Feb. 2. The suspension is due to an upcoming hard fork on the NEO N3 network.

06:49

Binance has announced the listing of the ELSA/USDT perpetual futures contract at 7:25 a.m. UTC today. The contract will support up to 20x leverage.

06:34

Ark Invest CEO Cathie Wood stated that Bitcoin is nearing the end of its current downturn. In an interview with CNBC, she explained that the correction in this cycle is likely to be much shallower than in the past. Wood noted that because the last bull run was very gradual by Bitcoin's standards, the current correction is also relatively limited. She suggested that while BTC could retest the $80,000 to $90,000 range, this level is likely to act as support. Wood characterized the current market trend as part of the asset's maturation process rather than a structural bear market, adding that an upward trend will resume once the correction concludes.

06:23

Thailand's Securities and Exchange Commission (SEC) is preparing new regulations to support cryptocurrency ETFs, futures trading, and tokenized investment products, Cointelegraph reported. The Thai SEC plans to release guidelines for establishing crypto ETFs by early this year. The commission also intends to allow crypto futures trading on the Thailand Futures Exchange (TFEX), introduce a market-making system, and formally recognize cryptocurrencies as an official asset class under the country's Derivatives Act.

06:15

Whale Alert reported that 600,000,000 USDT has been transferred from Binance to an unknown wallet. The transaction is valued at about $600 million.

06:03

Ethereum founder Vitalik Buterin has proposed integrating Distributed Validator Technology (DVT) into the network's staking mechanism. In a post on the Ethereum technology forum ethresear.ch, Buterin explained that introducing native DVT would allow ETH holders to stake without being entirely dependent on a single node. He noted that under the current system, an Ethereum validator can only operate one node and faces penalties if that node experiences downtime. By leveraging DVT, a single validator could distribute its key across multiple nodes, thereby reducing the risk of such penalties.

06:02

Binance has announced it will temporarily suspend deposits and withdrawals on the BNB Smart Chain (BEP20) for wallet maintenance, starting at 6:55 a.m. UTC on Jan. 23.

05:40

The tokenization of real-world assets (RWA) has emerged as one of the most prominent topics in the cryptocurrency sector at the 2026 World Economic Forum (WEF) annual meeting in Davos, Switzerland, BeInCrypto reported. The RWA tokenization market recently surpassed $21 billion in value. Discussions on the subject included major industry figures like Coinbase CEO Brian Armstrong and Ripple CEO Brad Garlinghouse, as well as officials from the European Central Bank. Experts predict that with the regulatory clarity established last year, the market could grow to as large as $16 trillion by 2030.

05:31

The South Korean crypto exchange Upbit announced it will list Hey Elsa (ELSA) at 7:30 a.m. UTC on Jan. 22, opening trading pairs against the South Korean won, BTC, and USDT.

05:26

Binance has announced it will list spot trading for SENT at 12:00 p.m. UTC on Jan. 22. The token will be listed with a Seed Tag, which is applied to projects that may exhibit higher volatility and risk compared to other listed tokens.

05:26

The New York Stock Exchange's (NYSE) plan to build a blockchain for real-world asset (RWA) tokenization has been criticized as being superficial and lacking substance. According to Cointelegraph, Omid Malekan, a professor at Columbia Business School, pointed out that the NYSE's announcement failed to specify which blockchain would be used or whether the tokens would be permissioned. He also noted the absence of crucial information such as tokenomics and fee structures. Malekan argued that the NYSE's model is based on a highly centralized structure and that even the most sophisticated technology cannot alter this framework unless the exchange is willing to forgo its numerous existing partnerships and relationships.

05:19

South Korean crypto exchange Upbit has announced that it will temporarily suspend deposits and withdrawals for Tezos (XTZ) starting at 9:00 a.m. UTC on Jan. 23. The exchange cited a network upgrade as the reason for the suspension.

04:56

A group has been sentenced to prison for laundering approximately 23 billion won (about $17 million) in proceeds for a Chinese online fraud organization, Yonhap News reported. The individuals were convicted of receiving funds from the criminal enterprise, using the money to purchase cryptocurrency on exchanges, and then transferring the assets back to the organization.

04:52

The following shows estimated liquidation volumes and position ratios for major crypto perpetual futures over the past 24 hours:

- ETH: $238 million liquidated (50.28% shorts)

- BTC: $217 million liquidated (55.38% shorts)

- HYPE: $16.6 million liquidated (54.33% longs)

04:48

The Layer 1 protocol Saga (SAGA) was exploited for $7 million on its SagaEVM chain, The Block reported. The project has temporarily suspended network operations to investigate the damage and complete recovery efforts.

04:39

Bitwise Chief Investment Officer (CIO) Matt Hougan has suggested that the cryptocurrency market likely hit its bottom in the fourth quarter of 2023. According to Cointelegraph, Hougan noted in a report that the period saw several optimistic trends, including record-high Ethereum and Layer 2 transactions, revenue growth for crypto companies, an all-time high in stablecoin market capitalization, and expanding DeFi adoption.

He argued that the current market situation is similar to the first quarter of 2023. At that time, following the collapse of FTX, market data was mixed, but the price of BTC surged over the subsequent two years. Hougan identified several potential catalysts that could drive the market this year, including progress on the U.S. crypto market structure bill (CLARITY Act), the announcement of a new Federal Reserve Chair, and a stablecoin supercycle.

04:19

LG CNS and the Bank of Korea have demonstrated an automated payment system for digital currencies powered by agentic AI, Yonhap News reported. The company tested a payment infrastructure on a digital currency platform that uses deposit tokens, in which an AI agent autonomously handled product searches, purchase decisions, and payments. The demonstration is part of the Bank of Korea's Project Hangang, which has been ongoing since last year.

04:10

Cryptocurrency custody firm BitGo has set its initial public offering (IPO) price at $18 per share, giving the company a fully diluted valuation of $2 billion, CoinDesk reported. The company is scheduled to begin trading on the New York Stock Exchange (NYSE) on Jan. 21 under the ticker BTGO.

04:09

03:32

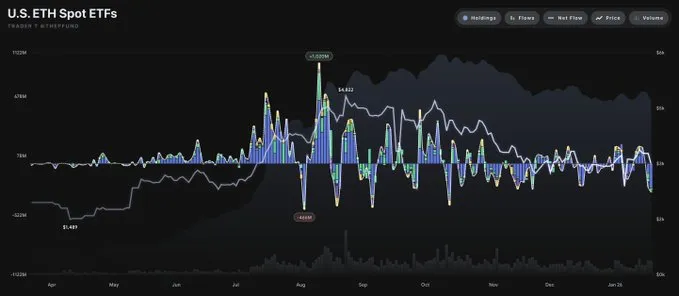

U.S. spot Ethereum ETFs experienced total net outflows of $238.55 million (416.5 billion won) on Jan. 21, marking the second consecutive day of net outflows, according to TraderT. BlackRock's ETHA led the outflows with $283.46 million, followed by Fidelity's FETH with $30.89 million, Grayscale's ETHE with $11.38 million, and VanEck's ETHV with $4.42 million. Grayscale's Mini ETH was the only fund to see inflows, attracting $10.01 million.

03:29

U.S. Bitcoin spot ETFs experienced a net outflow of $707.3 million on Jan. 21, marking the largest single-day withdrawal in two months and the third consecutive day of outflows, according to data compiled by TraderT. The outflows were primarily driven by BlackRock's IBIT (-$355.23 million) and Fidelity's FBTC (-$287.67 million). Other funds also saw outflows, including Ark Invest's ARKB (-$29.83 million), Bitwise's BITB (-$25.87 million), Grayscale's GBTC (-$11.25 million), and Valkyrie's BRRR (-$3.80 million). VanEck's HODL was the only fund to record a net inflow, adding $6.35 million.

03:19

South Korean crypto exchange Bithumb announced it will add a KRW trading pair for Seeker (SKR) at 8:00 a.m. UTC on Jan. 22.

03:01

Binance has announced that it will delist 20 spot trading pairs at 3:00 a.m. UTC on Jan. 23. The affected pairs are AI/BTC, ALLO/BNB, APE/BTC, AUCTION/BTC, BOME/FDUSD, DYDX/FDUSD, ENA/BNB, FIL/ETH, ID/BTC, KITE/BNB, LDO/BTC, LRC/ETH, NMR/BTC, PENGU/FDUSD, PNUT/BTC, PYR/BTC, STRK/FDUSD, XVG/ETH, YFI/BTC, and ZIL/ETH.