Live Feed

Today, January 22, 2026

03:01

Binance has announced that it will delist 20 spot trading pairs at 3:00 a.m. UTC on Jan. 23. The affected pairs are AI/BTC, ALLO/BNB, APE/BTC, AUCTION/BTC, BOME/FDUSD, DYDX/FDUSD, ENA/BNB, FIL/ETH, ID/BTC, KITE/BNB, LDO/BTC, LRC/ETH, NMR/BTC, PENGU/FDUSD, PNUT/BTC, PYR/BTC, STRK/FDUSD, XVG/ETH, YFI/BTC, and ZIL/ETH.

02:40

Solana (SOL) co-founder Anatoly Yakovenko has outlined three principles he believes can help early-stage crypto projects attract capital. In a post on X, Yakovenko stated that projects should ensure staking is available for long-term holders, unlock more than 20% of the token supply on launch day, and fully vest investor allocations after one year. He added that beyond these points, success depends on achieving product-market fit (PMF).

02:11

South Korean blockchain investment firm Hashed has launched Maroo, a new blockchain designed for a Korean won-backed stablecoin, The Block reported. The platform is engineered to combine the openness and scalability of a public chain with the regulatory compliance and privacy features required by traditional financial institutions. While its initial focus is the Korean won, Hashed plans to expand Maroo to support other fiat currencies in line with local regulations. A key feature of the network is that transaction fees are paid directly with the KRW stablecoin, allowing users to interact with the chain without needing to hold a separate native cryptocurrency. Hashed has also established a subsidiary, Hashed Open Finance, to advance projects in stablecoins, real-world asset (RWA) tokenization, and security token offerings (STOs) within the South Korean financial market.

00:59

The U.S. Senate Agriculture Committee has released a revised draft of its crypto market structure legislation, the CLARITY Act, according to Eleanor Terrett, host of Crypto in America. While specific details of the draft have not yet been made public, Committee Chairman John Boozman said it was unfortunate that an agreement with the Democratic Party could not be reached. He added that he looks forward to a scheduled hearing on the bill at 8:00 p.m. UTC on Jan. 27.

00:50

U.S. asset manager Strive is pursuing an additional $150 million fundraising round, The Block reported. The proceeds are intended for purchasing Bitcoin, repaying convertible notes issued by its subsidiary Semler Scientific, and settling debt borrowed from Coinbase Credit. This move follows the company's previous effort last December to issue $500 million in Series A perpetual preferred stock.

00:38

Vietnam has started accepting license applications for a pilot program for cryptocurrency exchanges, The Block reported. To qualify, applicants must have a minimum of $400 million in equity capital and meet strict requirements regarding ownership structure, personnel, and infrastructure. Applications are limited to companies based in Vietnam, with foreign ownership capped at 49%.

00:38

Lookonchain reported, citing Arkham (ARKM) data, that Bitmine (BMNR) appears to have withdrawn 34,954 ETH, valued at $105.5 million, from Kraken and BitGo over the past two hours. The on-chain data firm noted that Bitmine currently holds approximately 4.2 million ETH.

00:31

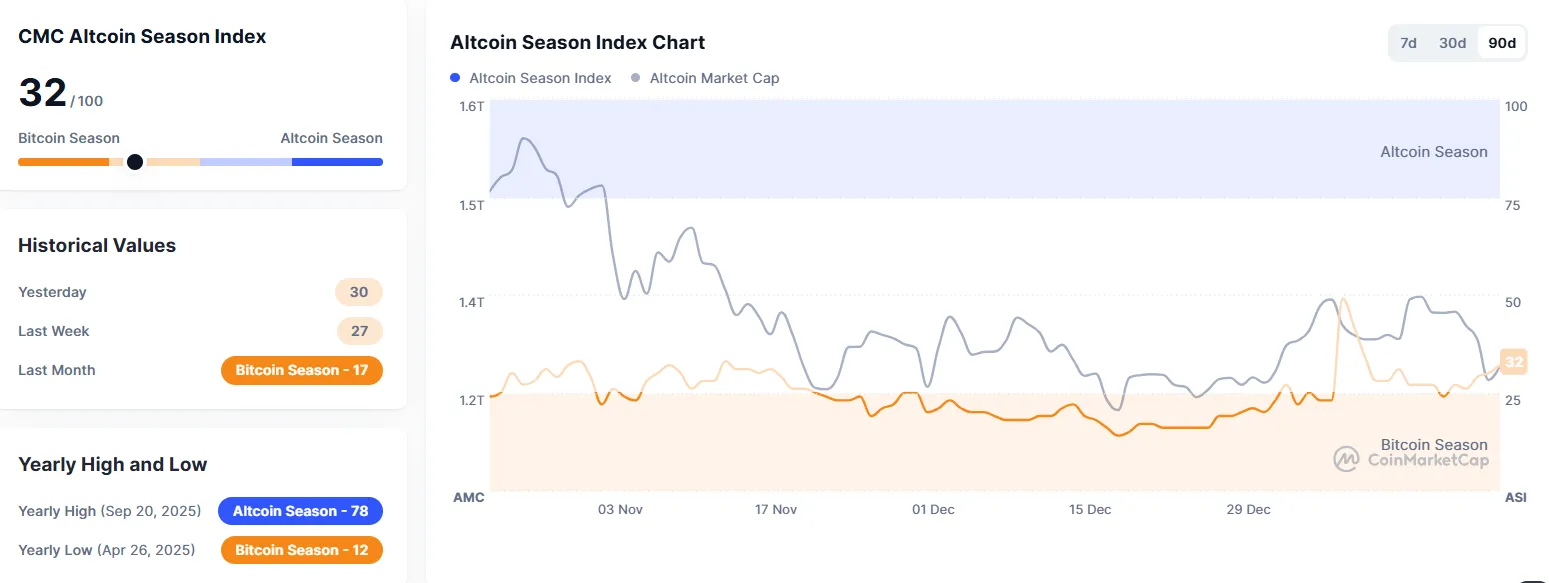

CoinMarketCap's Altcoin Season Index has climbed four points from yesterday to 32. The index measures whether it is an altcoin season or a Bitcoin season by comparing the price performance of the top 100 cryptocurrencies, excluding stablecoins and wrapped coins, against Bitcoin. An altcoin season is declared when 75% of these top coins have outperformed Bitcoin over the past 90 days. A score closer to 100 indicates a stronger altcoin season.

00:11

An anonymous whale has accumulated an additional 20,000 ETH since Jan. 8, bringing the total holdings of an address starting with 0xfb7 to 60,098 ETH ($179.22 million), according to Onchain Lens. The investor recently purchased 10,000 ETH ($28.9 million) through crypto market maker Wintermute and deposited 58.13 million USDC into FalconX for further acquisitions.

00:07

South Korea's benchmark KOSPI index surpassed the 5,000 mark for the first time in its history during early trading. The index is currently trading at 5,012.20, up 2.08% from the previous session.

00:01

The Crypto Fear & Greed Index, compiled by data provider Alternative, has fallen four points to 20, continuing the market's state of extreme fear. The index measures market sentiment on a scale where 0 indicates extreme fear and 100 represents extreme optimism. The score is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market capitalization dominance (10%), and Google search volume (10%).

Yesterday, January 21, 2026

23:55

A U.S. Senate Banking Committee markup of its crypto market structure bill (CLARITY Act) will likely be postponed again until late February or March, Bloomberg reported. Citing an anonymous source, the report attributed the delay to the committee shifting its priorities to housing policy at the request of the Trump administration ahead of the November midterm elections. The committee had previously postponed the markup on Jan. 15.

23:42

Coinbase CEO Brian Armstrong and Bank of France Governor François Villeroy de Galhau expressed conflicting views on whether stablecoins should pay interest during a panel discussion at the World Economic Forum in Davos, Coindesk reported. Armstrong argued that users have a right to earn a return on their money and that allowing stablecoin interest is necessary for national competitiveness. He noted that China has already permitted interest payments on its central bank digital currency (CBDC), the digital yuan, and stressed that a U.S. ban on such payments would only allow competitors to thrive. In contrast, Villeroy de Galhau contended that private tokens paying interest would pose a risk to the traditional banking system. He stated that he does not believe the digital euro should pay interest, adding that the primary public objective must be to preserve financial stability. The two also disagreed on Bitcoin. Armstrong described the cryptocurrency as more independent than central banks because it lacks an issuer and cannot be controlled by any single entity. Villeroy de Galhau countered that unregulated stablecoins and private currencies could become a political threat, potentially leading to a loss of national monetary sovereignty.

23:25

South Korean crypto exchange Bithumb has launched an information security advisory committee composed of external experts, Yonhap News reported. The committee will be co-chaired by Bithumb CEO Lee Jae-won and Korea University Professor Kim Seung-joo.

22:51

Category Labs, the developer of the EVM-compatible project Monad, announced that it may purchase up to $30 million worth of MON tokens from the open market during the first half of this year. The company clarified that this is not a firm commitment, explaining that it may start or stop the purchases depending on market conditions.

22:34

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

22:33

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

22:16

Ark Invest, led by Cathie Wood, estimates that the market for tokenized real-world assets (RWA) could reach $11 trillion by 2030, The Block reported. The current market size is estimated to be between $19 billion and $22 billion. In a report, Ark Invest stated that the mass adoption of tokenized assets is likely to occur after regulatory clarity is established and institutional-grade infrastructure is developed. Meanwhile, the firm also projected that Bitcoin's market capitalization could reach $16 trillion during the same period.

21:47

Native American tribes in Connecticut have filed a court brief supporting a state crackdown on the prediction market platform Kalshi, arguing it is siphoning off revenue from tribal casinos, Decrypt reported. The tribes assert that Kalshi is violating the Indian Gaming Regulatory Act by offering prediction and sports-related contracts without their consent. Previously, Connecticut had ordered Robinhood and Crypto.com to halt what it deemed unlicensed online gambling. While Kalshi has sued regulators over the measures, calling them unfair, the tribal groups countered that prediction markets are eroding casino revenue on their lands. The prediction market industry has recently seen rapid growth, with weekly trading volume reaching $6 billion. Kalshi is valued at $11 billion.

21:42

U.S. ETF manager F/m Investments has requested approval from the U.S. Securities and Exchange Commission (SEC) to tokenize shares of its U.S. Treasury 3-Month Bill ETF (TBIL), The Block reported. The proposal involves recording ownership on a permissioned blockchain ledger, which would allow for the transfer and settlement of shares to be processed on-chain.

The company stated this is the first formal request for SEC relief regarding the tokenization of a registered investment company's ETF shares. F/m assured that the tokenized shares would maintain the same CUSIP, rights, fees, voting power, and economic conditions as their traditional counterparts, operating within the framework of the Investment Company Act of 1940. The firm also highlighted that the structure would ensure board oversight, daily transparency, and third-party custody and auditing.

21:26

The three major U.S. stock indices finished in positive territory. The S&P 500 rose by 1.16%, the Nasdaq Composite was up 1.18%, and the Dow Jones Industrial Average gained 1.21%.

20:52

Discussions among NATO allies are intensifying over an Arctic security framework, an idea mentioned by President Donald Trump, a spokesperson for the alliance said, according to Walter Bloomberg. The spokesperson explained that the talks will focus on ensuring Arctic security through a collective effort, with a key role for the seven NATO allies in the Arctic region. The spokesperson also emphasized that NATO aims to cooperate with Denmark, Greenland, and the U.S. to prevent Russia and China from establishing an economic or military foothold in Greenland.

20:29

President Donald Trump has identified Alan Greenspan, who led the Federal Reserve in the 1990s, as his model for a central bank chair. Trump praised the monetary policy of the Greenspan era, stating that he desires a Fed leadership that is both growth-friendly and flexible. The remarks are being interpreted as renewed pressure on the Fed to cut interest rates and shift its policy stance.

20:25

Denmark’s foreign minister has described President Donald Trump's statement that he has no intention of using military force as a positive signal. However, the minister pointed out that Trump still holds political ambitions that are unacceptable to Denmark. He clarified that while the possibility of dialogue remains open, there can be no compromise on matters related to sovereignty.

20:21

U.S. President Donald Trump has stated that Russian President Vladimir Putin agreed to participate in a Peace Board, Walter Bloomberg reported. Trump added that Putin consented to the formation of the peace council, noting that this could advance discussions toward resolving conflicts.