Live Feed

Today, January 26, 2026

10:21

Cointelegraph has highlighted four key points to watch for Bitcoin in the coming week:

- A breakdown below previous lows following last weekend's decline.

- The U.S. Federal Open Market Committee (FOMC) press conference on Jan. 29.

- Concerns of a potential inverse correlation with cryptocurrencies as gold and silver rally to new highs.

- A drop in the percentage of BTC holders in profit to 62%.

10:17

Japanese listed company Metaplanet, which has been accumulating Bitcoin, announced that while its 2025 revenue and operating profit exceeded expectations, it anticipates a significant impairment loss on its BTC holdings, Cointelegraph reported. An impairment loss is recognized when the market value of an asset falls below its carrying value on a company's books.

Metaplanet provisionally reported approximately $58 million in revenue and $40 million in operating profit for the year. However, the company stated that a valuation loss of $700 million on its BTC holdings is expected to result in a comprehensive net loss of $491 million.

10:07

Japan's SBI Holdings has filed an application with the country's Financial Services Agency (FSA) for a cryptocurrency exchange-traded fund (ETF) that would track the prices of BTC and XRP, CoinDesk reported via its official X account. If approved, the product would be the first ETF in the Japanese market to combine more than one cryptocurrency.

09:41

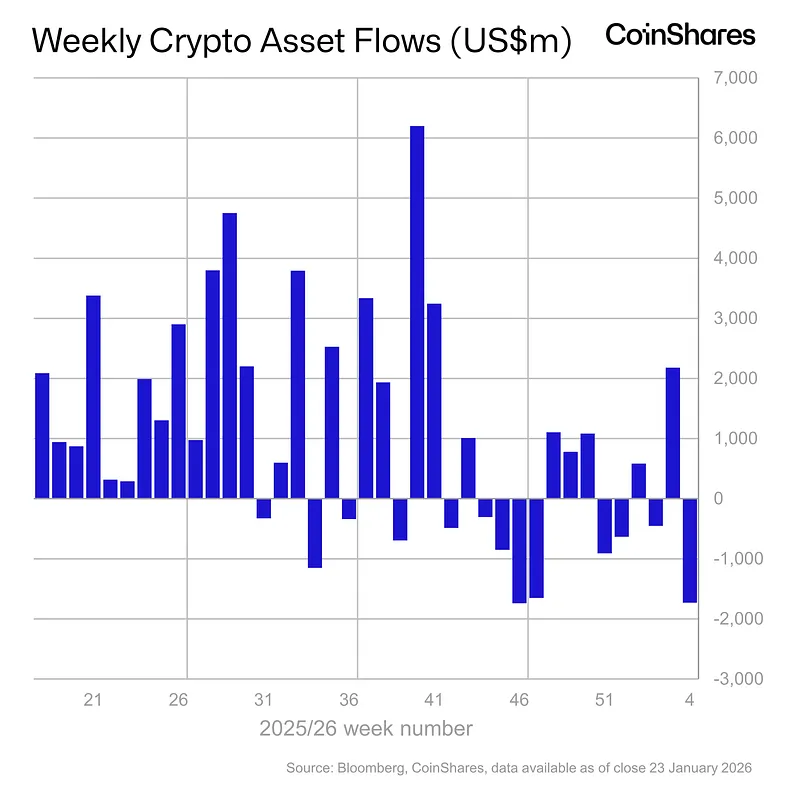

Digital asset investment products saw a total of $1.73 billion in net outflows last week, the largest amount since mid-November 2025, according to a weekly fund flow report from CoinShares. By country, the U.S. experienced approximately $1.8 billion in net outflows, while Switzerland, Germany, and Canada recorded net inflows of $32.5 million, $19.1 million, and $33.5 million, respectively. Bitcoin investment products accounted for $1.09 billion of the outflows, and Ethereum products saw $630 million withdrawn.

09:36

Sola (SXP) has announced via its official blog that it is halting all future protocol development and updates, citing various operational constraints. The project explained that while several teams considered an acquisition following the resignation of its former CEO, the deals were ultimately unsuccessful due to issues uncovered during due diligence. A key problem identified was a lack of control over financial funds managed by Binance. The existing development team will now disband to pursue individual activities, while the former CEO plans to launch a separate, independent project to provide a new direction for current SXP holders.

09:16

Ripple and its executives have sold more than 58.5 billion XRP, worth approximately $109 billion, since 2012, according to a report by CryptoBasic. The publication noted that at XRP's launch in 2012, 100 billion tokens were allocated to the company and its leadership to support ecosystem development. Current combined holdings for Ripple and its executives are estimated at around 41.485 billion XRP. Ripple has previously stated that it is reducing its holdings through sales to alleviate concerns about centralization. Over the same period, the price of XRP has risen by about 31,000%.

09:11

For the cryptocurrency market to enter a genuine bull run, the majority of junk coins must be purged, according to Benjamin Cowen, founder of Into The Cryptoverse. In comments reported by YouToday, Cowen argued that thousands of existing cryptocurrencies rely solely on speculative momentum with no real demand or utility, a structural weakness that is inevitably exposed in an environment of shrinking liquidity. He described the failure of unsound projects during a bear market as an essential process for normalizing capital allocation. Cowen also cautioned against the optimism of some influencers predicting an altcoin season, calling such views dangerous without fundamental improvements to market structure. He emphasized that capital can only concentrate on high-quality assets once worthless ones are removed, a process he believes will ultimately revitalize the industry.

09:01

South Korea's Digital Asset eXchange Alliance (DAXA) announced that its member exchanges have placed Oasys (OAS) under an investment warning.

08:48

Samsung, Shinhan Financial Group, and Hana Financial Group are partnering to establish a framework for issuing, distributing, and using a won-backed stablecoin, Maeil Business Newspaper reported. According to sources in the financial and business sectors, Shinhan Financial Executive Director Jin Ok-dong and Hana Financial Chairman Ham Young-joo recently agreed with Samsung to launch the initiative and have begun preparations. The financial groups reportedly determined that Samsung's participation is essential, viewing its technological expertise and strong overseas business foundation as key to making a won-backed stablecoin competitive against its dollar-pegged counterparts.

08:24

Bybit has announced that it will delist the SERAPH/USDT, XO/USDT, PSTAKE/USDT, and MASA/USDT spot trading pairs at 8:00 a.m. UTC on Feb. 3.

07:48

DEX aggregator Matcha Meta has suffered a $16.8 million exploit during its integration with SwapNet, The Block reported. The attacker reportedly swapped approximately $10.5 million in USDC for 3,655 ETH on the Base chain before bridging the funds to Ethereum. The exploit is believed to have targeted a vulnerability in a SwapNet smart contract, allowing the hacker to steal pre-approved funds.

07:33

Binance has announced the delisting of 21 spot trading pairs, effective Jan. 27 at 8:00 a.m. UTC. The affected pairs are BTC/UAH, COMP/BTC, DASH/ETH, ETC/ETH, IO/BTC, LINEA/BNB, MINA/BTC, MMT/BNB, MOVE/BNB, OG/BTC, OGN/BTC, PLUME/BNB, PNUT/FDUSD, RUNE/ETH, SEI/FDUSD, SHIB/DOGE, STX/FDUSD, TIA/FDUSD, TON/BTC, VET/ETH, and YB/BNB.

07:21

AMO Block, the developer of the vehicle data trading platform cryptocurrency AMO Coin (AMO), has unveiled its roadmap for 2026. Key initiatives include the development of Drive-to-Earn (D2E) 2.0 based on Tesla vehicle data, the launch of an AMO Live Data Center, the release of a Full Self-Driving (FSD) mining mode, and exploring potential API integration with automakers such as Hyundai and Kia.

07:14

South Korea’s National Tax Service (NTS) announced on Jan. 26 that it will establish a dedicated unit to combat tax evasion involving virtual assets. According to News1, the plan was unveiled at the Government Complex Sejong as part of the agency’s 2026 National Tax Administration Operation Plan. The new unit will oversee all efforts related to virtual asset tax evasion, including building systems to track and analyze transaction data.

07:10

Binance has announced the listing of six new spot trading pairs: BNB/U, ETH/U, KGST/U, SOL/U, TRX/USD1, and USD1/U. Trading for these pairs is set to begin at 8:30 a.m. UTC on Jan. 27.

07:05

South Korea has begun building infrastructure to support the exchange of won-pegged stablecoins linked to local government currencies, the Seoul Economic Daily reported. Bdan Jumeoni (meaning “silk pouch” in Korean) is a project launched under a tripartite memorandum of understanding signed in May 2025 by Hashed, Naver Financial, and the Busan Digital Asset Exchange, and has recently introduced its official application. The app is currently in a pre-launch phase, displaying only its core planned features. One key function will allow users to exchange foreign currencies for Dongbaekjeon—Busan’s municipal currency—which is issued as a stablecoin backed by the Korean won.

07:01

South Korean crypto exchange Upbit announced it has updated the circulating supply plan for Zilliqa (ZIL) at the request of the project's team. A CoinNess analysis shows the change affects the first-quarter supply, which increased by 443,195,861 ZIL from 19,905,499,223 to 20,348,695,084. Additionally, the circulating supply for the second quarter is now listed as 20,458,855,084 ZIL.

06:49

Spot gold has surpassed $5,100 per ounce, setting another new all-time high.

06:45

According to CoinNess market monitoring, BTC has risen above $88,000. BTC is trading at $88,006.51 on the Binance USDT market.

06:13

A South Korean court has dismissed a damages lawsuit filed by an Upbit user against the exchange's operator, Dunamu, over losses incurred during a system failure amid the country's martial law declaration on Dec. 3, 2024, Digital Asset reported. On Jan. 15, the Daejeon District Court rejected the plaintiff's claim for approximately 130 million won (about $93,000) in damages and compensation. The court ruled that the martial law declaration and the resulting surge in order volume were unforeseeable and found no evidence that Dunamu had breached its management duties.

05:59

The following are the long/short position ratios for BTC perpetual futures over the last 24 hours on the world's top three crypto futures exchanges by open interest:

Overall: 47.95% long, 52.05% short

1. Binance: 47.2% long, 52.8% short

2. Bybit: 47.85% long, 52.15% short

3. OKX: 46.83% long, 53.17% short

05:48

The UK's Financial Conduct Authority (FCA) has launched the final consultation phase for its proposed cryptocurrency regulations, Cointelegraph reported. According to the report, the FCA is seeking additional market feedback on 10 key regulatory proposals in what is effectively the last public consultation before the rules are finalized. The proposals cover business conduct standards, restrictions on purchasing crypto on credit, regulatory reporting requirements, and custody rules for client assets. The deadline for submissions is March 12.

04:50

Approximately 70% of institutional investors believe Bitcoin is undervalued, Cointelegraph reported, citing Coinbase's first-quarter cryptocurrency report. A survey conducted from early December to early January polled 75 institutional and 73 retail investors. The results showed that 71% of institutional investors and 60% of retail investors consider Bitcoin to be undervalued. Additionally, 80% of the institutional respondents indicated they would either maintain their holdings or purchase more if the crypto market were to fall by another 10%. Regarding the current market cycle, 54% of all respondents identified it as an accumulation phase or a bear market. The report also suggested that if the Federal Reserve cuts its benchmark interest rate twice this year, the resulting monetary easing could create a favorable environment for risk assets.

04:33

The growing possibility of a U.S. federal government shutdown is causing a downturn in Bitcoin and other risk assets, according to an analysis by The Block. Rick Maeda of Presto Research explained that the recent BTC decline stems from macroeconomic factors like U.S. political uncertainty rather than crypto-specific issues. He noted that the U.S. Congress is currently facing a budget deadlock and political conflict, increasing the chances of a shutdown. Meanwhile, Vincent Liu, chief investment officer at Kronos Research, stated that the market is pricing in this political risk, with the probability of a shutdown rising to 75% on Polymarket. According to CoinMarketCap, BTC is trading at $87,781, down 1.25% from the previous day.

04:04

A large-scale altcoin bull market similar to those seen in previous cycles is unlikely to occur in 2026, BeInCrypto reported, citing an analysis of CryptoRank data. The report highlights several structural headwinds, including capital dilution from a rapid increase in the number of new tokens and persistent selling pressure from projects with low circulating supplies and high fully diluted valuations (FDV). Furthermore, the analysis suggests that speculative capital is being diverted to alternative investments like memecoins and perpetual futures, while institutional funds continue to concentrate in major assets such as ETH, SOL, and XRP. This has entrenched a market structure that makes it difficult for capital to flow into small and mid-cap altcoins.