Live Feed

Today, December 17, 2025

07:32

Binance has announced that it will delist eight spot trading pairs at 3:00 a.m. UTC on Dec. 19. The affected pairs are AI/FDUSD, BICO/BTC, DOLO/BNB, MITO/BNB, MITO/FDUSD, MOVE/BTC, NEWT/BNB, and OM/BTC.

07:30

IoTeX (IOTX) has released a white paper for its token that complies with the European Union's Markets in Crypto-Assets (MiCA) regulation. The document provides a foundation for EU-based exchanges, custody providers, and partners to support IOTX within the MiCA regulatory framework. Under MiCA, utility tokens can be distributed without separate approval or authorization, but issuers are required to publish a white paper that meets the regulation's disclosure standards.

07:05

Whale Alert reported that 3,000 BTC has been transferred from an unknown wallet to Binance. The transaction is valued at about $260 million.

07:01

Binance Alpha has announced the addition of ZKP. The platform is an on-chain trading venue within Binance Wallet that focuses on listing early-stage coins.

07:00

Solana co-founder Anatoly Yakovenko has shared his vision for SKR, the upcoming token for Solana Mobile. He explained that while the technology stack is still far from complete, its eventual implementation will grant SKR token holders control over the phone, user experience, and revenue generation structure. Yakovenko added that the combination of the Solana Mobile stack and a Trusted Execution Environment (TEE) will be designed to automatically distribute profits to SKR holders.

06:49

The Japanese government is considering delaying the introduction of a separate tax on cryptocurrency gains until 2028, Reuters reported. While there was initial discussion of a 2027 implementation if an amendment to the Financial Instruments and Exchange Act passed the Diet next year, the current consensus favors reforming the system after observing market conditions. The government has stated that a delay is necessary as investor protection measures are still considered inadequate. Currently, profits from crypto trading in Japan are classified as miscellaneous income and are taxed at a rate of up to 55% when combined with other earnings. Investors and the industry have been advocating for a separate tax rate of 20%, consistent with the tax on stock market gains.

06:21

The dYdX Foundation is considering a proposal to distribute $100,000 in DYDX tokens to the 100 traders who incurred the largest liquidation losses during the first two weeks of December. The foundation announced on X that the initiative is part of a broader, community-approved $1 million pilot program designed to compensate for such losses.

06:06

The government of Bhutan plans to invest 10,000 BTC in the development of its 'Mindfulness City' in Gelephu, Cointelegraph reported. The city aims to attract various industries, including finance, tourism, and healthcare, and will offer regulatory flexibility for cryptocurrency and fintech companies.

06:04

Anthony Pompliano, founder of crypto investment firm Pomp Investments, has stated that it would be extremely difficult for any other publicly traded company to match Strategy's Bitcoin holdings. Speaking on the 'Pomp Podcast,' he noted that Strategy currently holds 670,000 BTC, equivalent to about 3.2% of the total supply, Cointelegraph reports. Pompliano argued that while catching up is theoretically possible, it is practically unfeasible. He explained that Michael Saylor began purchasing BTC for the company in 2020 with an initial $500 million investment when prices were between $9,000 and $10,000. To replicate that position today would require tens or even hundreds of billions of dollars in capital.

06:02

Grayscale has projected the following key investment trends for the cryptocurrency market next year:

1. Increased risk of U.S. dollar debasement.

2. Expanded adoption of digital assets driven by greater regulatory clarity.

3. Accelerated proliferation of stablecoins following the passage of the GENIUS Act.

4. Asset tokenization reaching an inflection point.

5. Growing demand for privacy solutions as blockchain technology becomes more mainstream.

6. The rise of blockchain as an alternative to centralized artificial intelligence.

7. Accelerated growth in decentralized finance (DeFi), led by the lending sector.

8. Increased demand for next-generation infrastructure to support the broader commercialization of blockchain.

9. A greater focus on sustainable revenue models.

10. The establishment of staking as a fundamental investment strategy.

05:56

The following are the BTC perpetual futures long/short position ratios over the last 24 hours on the top three cryptocurrency futures exchanges by open interest:

Aggregate: Long 49.11%, Short 50.89%

1. Binance: Long 48.9%, Short 51.1%

2. Bybit: Long 49.32%, Short 50.68%

3. OKX: Long 50%, Short 50%

05:54

Binance has revealed a new three-stage process for listing projects on its platform. The system evaluates projects based on performance and potential, moving them through Binance Alpha, Binance Futures, and finally, Binance Spot.

The initial stage, Binance Alpha, serves to pre-disclose promising projects to the community. Projects that meet certain criteria can then be listed on the perpetual futures market. Those that satisfy all final requirements are listed on the Binance spot market, allowing them to secure full liquidity.

Binance explained that the phased structure is intended to systematically guide quality projects to market while increasing user trust in the listing process. The exchange added that advancement through the stages is based on a comprehensive evaluation that includes project fundamentals, user engagement, and regulatory compliance.

05:41

05:33

The capacity of the Bitcoin Lightning Network has reached 5,606 BTC, its highest level since March 2023, Cointelegraph reported, citing data from LN analytics platform Amboss. The outlet noted that the network's capacity had been on a downward trend for the past year before beginning to increase in November. This growth is attributed to rising adoption by major cryptocurrency exchanges and functional improvements to the network.

05:01

An address presumed to belong to Matrixport deposited 1,000 BTC, worth $86.9 million, to Binance approximately 12 minutes ago, according to Onchain-lense.

05:01

Two former senior executives at Theta Labs, the developer of Theta Network (THETA), have filed a whistleblower lawsuit against CEO Mitch Liu, Decrypt reported. The suit alleges that Liu inflated the price of THETA through insider trading and false partnerships, including exaggerating a service contract with Google Cloud. The plaintiffs also claim Liu retaliated against employees who raised concerns. Liu has not issued a public statement regarding the lawsuit.

04:50

U.S. President Donald Trump plans to interview Federal Reserve Governor Christopher Waller as part of the selection process for the next Fed Chair, the Wall Street Journal (WSJ) reported. Waller, who is known for his favorable stance on cryptocurrency and DeFi, is on a shortlist for the position. Other candidates include former Fed Governor Kevin Warsh, White House economic advisor Kevin Hassett, Fed Vice Chair for Supervision Michelle Bowman, and BlackRock executive Rick Rieder.

04:47

A bipartisan group of U.S. senators has introduced legislation to establish a task force aimed at combating cryptocurrency fraud and scams, Cointelegraph reports. The proposed bill, named the SAFE Act, was co-sponsored by Senators Elissa Slotkin (D) and Jerry Moran (R). The legislation would create a joint effort between the U.S. Department of the Treasury, the Financial Crimes Enforcement Network (FinCEN), other regulatory agencies, and private companies to track and disrupt illicit networks in real time.

04:21

According to CoinNess market monitoring, BTC has fallen below $87,000. BTC is trading at $86,991.83 on the Binance USDT market.

04:19

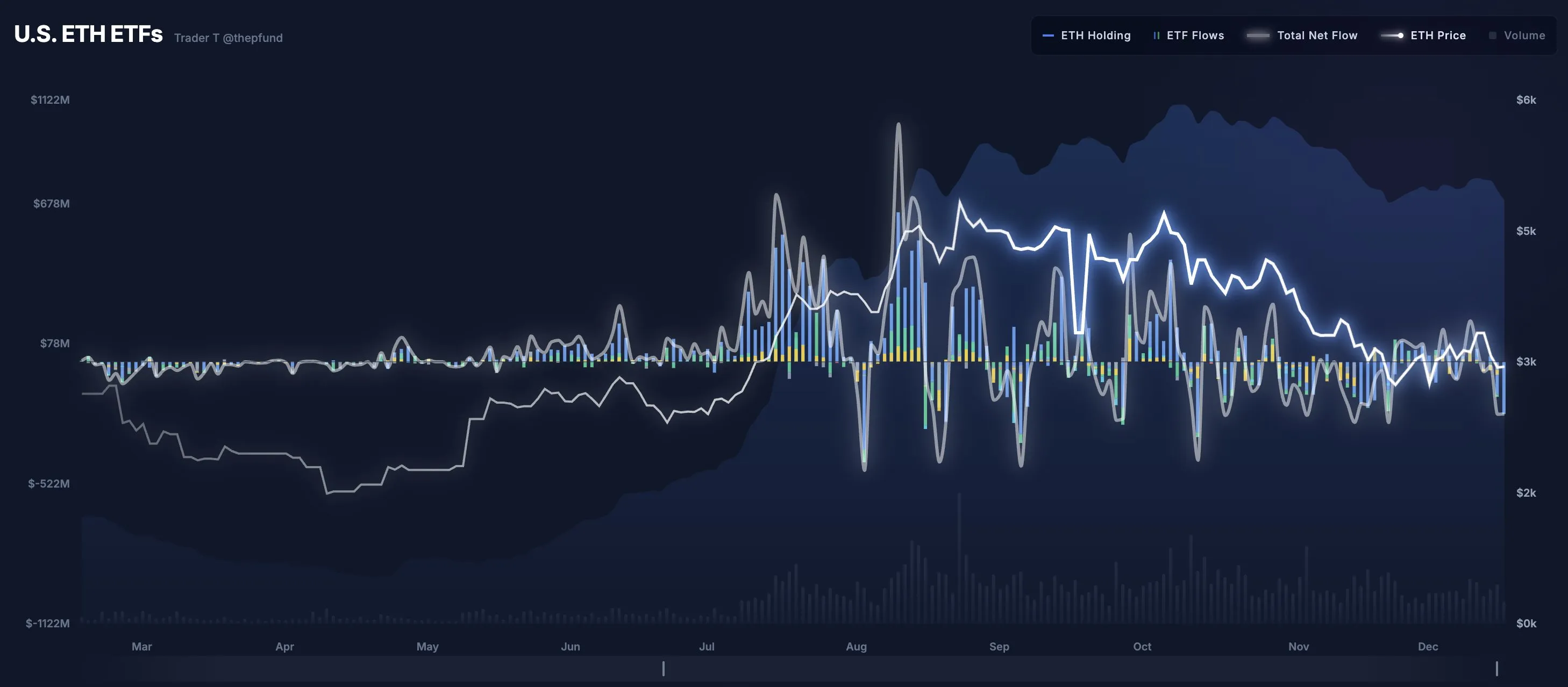

U.S. spot Ethereum ETFs experienced a total net outflow of $223.66 million on Dec. 16, marking the fourth consecutive day of withdrawals, according to data compiled by TraderT. BlackRock's ETHA led the outflows, with $220.72 million exiting the fund, while Fidelity's FETH saw a net outflow of $2.94 million. The remaining ETFs recorded no net inflows or outflows for the day.

04:19

U.S. Bitcoin spot ETFs recorded a total net outflow of $277.37 million (410.7 billion won) on Dec. 16, marking the second consecutive trading day of withdrawals, according to data compiled by TraderT. The outflows were led by BlackRock's IBIT, which saw $210 million exit the fund, and Bitwise's BITB, which had a net outflow of $50.93 million. Meanwhile, Fidelity's FBTC bucked the trend, attracting a net inflow of $26.72 million.

03:40

Animoca Brands Japan, a subsidiary of NFT and blockchain game developer Animoca Brands, has signed a Memorandum of Understanding (MOU) with Bitcoin staking protocol developer Babylon Labs to foster a strategic partnership in the Japanese market. The two companies will explore ways to support self-custody Bitcoin finance (BTCFi) for Japanese corporations by utilizing Babylon Labs' trustless Bitcoin vault technology.

03:25

The Hyperliquid Foundation has introduced a governance proposal to permanently burn all HYPE tokens held in its Assistance Fund (AF) and has opened the matter to a validator vote. Validators must declare their stance on the governance forum by 4:00 a.m. UTC on Dec. 21. The final outcome will be determined by the weight of user staking aligned with each validator's position. The fund currently holds 37.114 million HYPE, valued at $1.02 billion and representing 13.7% of the token's total supply.

03:05

Binance has announced it will temporarily suspend deposits and withdrawals for Terra Classic (LUNC) at 2:10 p.m. UTC on Dec. 18 to support an upcoming network upgrade.

03:02

Forced liquidations in the cryptocurrency perpetual futures market over the past 24 hours included $105 million in ETH, with long positions accounting for 69.92% of the total. BTC saw $61.81 million in liquidations, where short positions comprised 66.74%. PIPPIN also experienced $10.90 million in liquidations, with shorts making up 54.55% of that figure.