Live Feed

Today, March 5, 2026

04:50

BitMEX co-founder Arthur Hayes warned on X that Bitcoin's current rebound could be a temporary phase. "BTC is not yet showing a different movement from the stock prices of U.S. Software-as-a-Service (SaaS) companies," he added. "It's a situation where we can't be complacent yet." Hayes previously analyzed in a blog post earlier this year that BTC was being affected by its price correlation with SaaS companies, which had fallen significantly compared to the Nasdaq average.

04:49

Injective (INJ) has announced on its official X account that a new mainnet is scheduled to launch.

04:16

U.S. spot Ethereum ETFs recorded a total net inflow of $169.09 million on March 4, according to Trader T. This marks a return to net inflows just one day after the funds experienced net outflows.

- BlackRock ETHA: +$39.01 million

- Fidelity FETH: +$30.29 million

- Bitwise ETHW: +$8.85 million

- VanEck ETHV: +$9.52 million

- Grayscale ETHE: +$21.91 million

- Grayscale Mini ETH: +$59.51 million

04:12

U.S. spot Bitcoin ETFs saw net inflows of $461.45 million on March 4, marking the third consecutive day of net inflows, according to data compiled by Trader T.

The breakdown is as follows:

- BlackRock's IBIT: +$306.25 million

- Fidelity's FBTC: +$48.01 million

- Bitwise's BITB: +$7.98 million

- Ark Invest's ARKB: +$14.63 million

- Invesco's BTCO: +$9.1 million

- Franklin's EZBC: +$8.5 million

- VanEck's HODL: +$5.2 million

- WisdomTree's BTCW: +$7.77 million

- Grayscale's GBTC: +$21.66 million

- Grayscale's Mini BTC: +$32.35 million

04:03

OKX announced it will list the ROBO/USDT spot trading pair at 10:00 a.m. UTC today.

03:50

Europol, the European Union's law enforcement agency, has shut down the core infrastructure of Tycoon 2FA, one of the world's largest scam platforms, in collaboration with companies including Coinbase and Microsoft, Cointelegraph reported. Microsoft blocked 330 domains linked to Tycoon 2FA, while Coinbase provided assistance by tracking blockchain transactions to help identify the platform's administrators and buyers.

03:36

Ethereum's goal is to prevent the centralization of power for the day when artificial intelligence (AI) functions as the internet's primary interface, CoinDesk reported. In an interview at NEARCON 2026, Davide Crapis, AI lead at the Ethereum Foundation, warned that if AI is used in all fields without incorporating elements like self-sovereignty, censorship resistance, and privacy, no one will ultimately be able to enjoy such rights. He added that the foundation's strategy is twofold: providing the infrastructure for autonomous AI agents to prove their identity and process payments, and designing technical standards to help users maintain control over their data and identity.

03:02

Bybit has announced that it will list OPN for spot trading at 1:00 p.m. UTC on March 5.

02:55

The following shows estimated liquidation volumes and position ratios for major crypto perpetual futures over the past 24 hours:

- BTC: $315.33 million liquidated (87.26% shorts)

- ETH: $156.47 million liquidated (83.76% shorts)

- SOL: $25.64 million liquidated (81.15% shorts)

02:53

Despite aggressive short-selling in the cryptocurrency market, key indicators are signaling a healthy rally, cryptocurrency analyst Sykodelic said on X. He noted that Open Interest (OI) and leverage ratios are currently rising in tandem with the price. In particular, spot trading volume is growing alongside the price increase, underpinning the buying pressure. Conversely, funding rates are strongly negative, suggesting that a majority of traders are betting on short positions. The Coinbase Premium, which indicates U.S.-based buying pressure, is also in positive territory. Sykodelic interpreted this as a market with solid spot buying, while leveraged positions are concentrated on the short side. He predicted that if spot buying continues to push prices higher, a short squeeze could occur.

02:38

A private policy meeting between South Korea's Financial Services Commission (FSC) and the ruling Democratic Party, scheduled for March 5, has been postponed, NewDaily reported. The delay is attributed to rising tensions in the Middle East, which have increased volatility in the stock and foreign exchange markets, prompting financial authorities to prioritize stabilization efforts. The meeting was set to discuss the enactment of a 'Digital Asset Basic Act,' a second-phase virtual asset bill that includes provisions such as limiting major shareholder stakes in crypto exchanges. A new date for the policy discussion has not yet been confirmed.

02:23

Officials from Queenbee Coin, accused of stealing Bitcoin seized by the Seoul Gangnam Police Station, held an internal meeting on the day of the theft in May 2022 to discuss the possibility of retrieving the cryptocurrency, JoongAng Ilbo reported exclusively. Police have reportedly confirmed that the arrests were made based on multiple witness statements and circumstantial evidence indicating that Queenbee Company employees met to plan the transfer of the coins on the day of the theft. The suspects are accused of using a previously known mnemonic code to steal around 22 BTC, currently valued at approximately 2 billion won ($1.5 million), which had been voluntarily submitted to and seized by the police.

01:59

An address associated with the crypto influencer Sillytuna, who has 25,000 followers on X, has lost $24 million worth of aEthUSDC in an address poisoning attack, blockchain security firm PeckShield reported. The attacker currently holds approximately $20 million in DAI across two wallets. PeckShield noted that the attacker has begun bridging small amounts of the stolen funds to the Arbitrum network but has not yet transferred them to a mixing protocol. Address poisoning is a scam in which attackers create a vanity wallet address that matches the first and last few characters of a user's address, tricking the victim into sending funds to the fraudulent address.

01:19

CoinDesk Senior Analyst James Van Straten said on X that Bitcoin appears to have formed a bottom around the $60,000 level, with funding rates remaining negative and showing signs of a potential short squeeze. He explained that the Implied Volatility (IV) index suggests Bitcoin has already begun its bottoming process. Van Straten noted that while past market lows were often accompanied by sharp increases in IV, volatility is now declining over time despite various geopolitical events. He added that if IV continues to fall regardless of price, it would signal that demand is increasing without panic.

00:57

American Bitcoin (ABTC), a mining firm backed by President Donald Trump's sons Donald Trump Jr. and Eric Trump, has increased its holdings to over 6,500 BTC. Eric Trump announced that the company purchased more than 500 BTC in the last 21 days. He added that ABTC now ranks as the 17th largest Bitcoin holder among publicly traded companies worldwide.

00:41

Danal, the operator of Paycoin (PCI), announced today that it will partner with Binance Pay and Circle to launch an integrated payment and settlement service for foreign visitors in South Korea this April. According to The Asia Business Daily, the service will allow Binance users visiting the country to make payments with their existing assets without a separate currency exchange process. USDC will be used as the settlement currency.

00:38

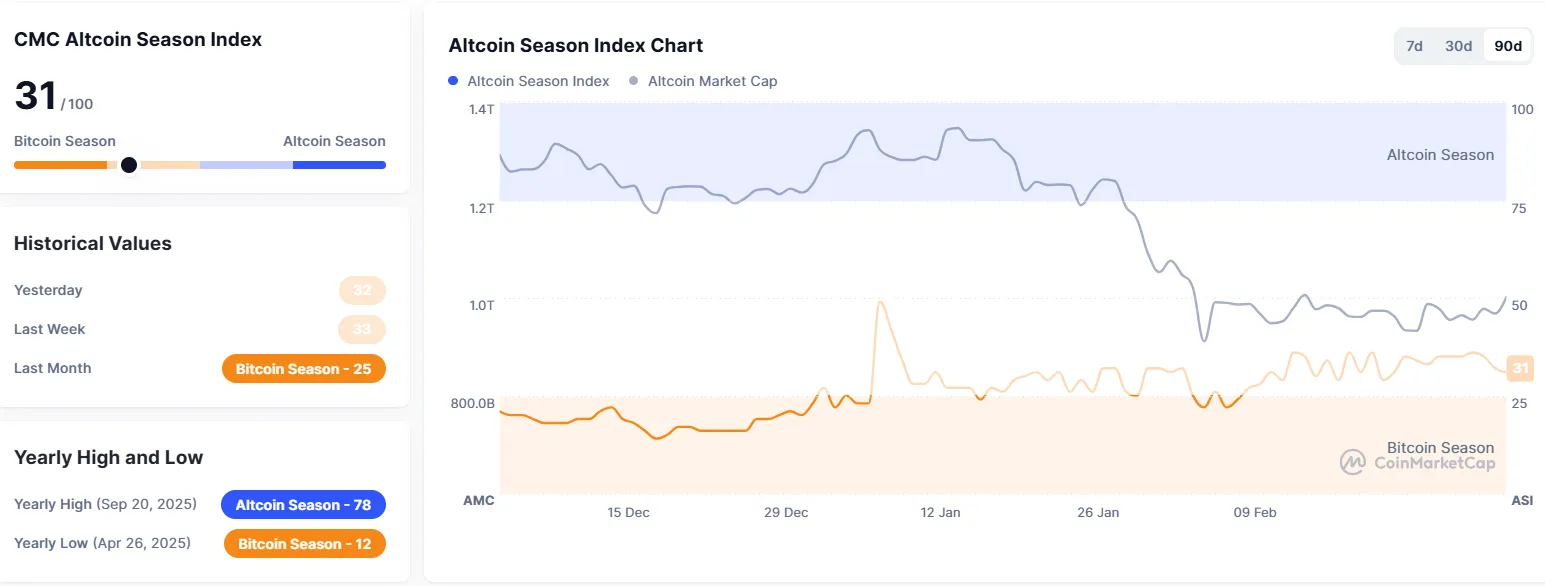

The Altcoin Season Index from cryptocurrency data aggregator CoinMarketCap has fallen to 31, a decrease of five points from the previous day. The index is calculated by comparing the price performance of the top 100 cryptocurrencies by market capitalization (excluding stablecoins and wrapped coins) against Bitcoin. An "altcoin season" is declared when 75% of the top 100 coins outperform Bitcoin over the preceding 90 days. Otherwise, it is considered a "Bitcoin season." A reading closer to 100 suggests an altcoin season is underway.

00:35

Hana Card is launching a full-scale domestic payment marketing initiative in collaboration with Circle and Crypto.com (CRO), News1 reported. The move is part of a broader strategy by parent company Hana Financial Group to establish a KRW-pegged stablecoin partnership and take a leading role in the cryptocurrency ecosystem. Hana Card previously signed a memorandum of understanding (MOU) with Circle last December.

00:14

Liquidity in South Korea may be shifting from the stock market to the cryptocurrency market, crypto analyst Bull Theory argued on X. The analyst noted that while the KOSPI index rose 80% in four months, Bitcoin fell 52% over the same period. This rally in Korean stocks eventually became overheated, with a surge in leverage and ETF trading volume. However, Bull Theory explained that the trend is now reversing, with foreign investors exiting the Korean stock market at a record-breaking pace. Foreigners sold $13.7 billion worth of Korean stocks in February, and the KOSPI has fallen about 20% over the last five days. In contrast, BTC has risen 11% since the KOSPI began its decline, suggesting that liquidity is flowing back into the crypto market.

Meanwhile, the KOSPI, which closed at 5059.45 yesterday after a 12.06% drop, is currently trading at 5633.10, a rebound of about 10.59%. Trading curbs on buy orders have been activated for both the KOSPI and KOSDAQ markets.

00:11

The Korea Exchange has activated buy-side sidecars for the KOSPI and KOSDAQ.

00:01

The Crypto Fear & Greed Index, compiled by data provider Alternative, rose 12 points from the previous day to 22. The index has remained in the 'Extreme Fear' stage since shifting from 'Fear' on Jan. 30. The metric gauges market sentiment on a scale from 0 (extreme fear) to 100 (extreme greed). It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

Yesterday, March 4, 2026

23:22

Eric Trump, son of U.S. President Donald Trump, has sharply criticized major banks over their stance on stablecoin yields. In a post on X, he argued that large institutions like JPMorgan, Bank of America, and Wells Fargo are lobbying to prevent Americans from earning higher returns on their deposits. Trump claimed these banks profit from the spread between the interest they receive from the Federal Reserve and the lower rates paid to depositors. He also stated they are attempting to limit cryptocurrency platforms from offering yields or rewards of 4% to 5% or more, describing the practice as "anti-American" behavior that disregards consumers and individual investors.

22:58

U.S. regulators are accelerating efforts to refine their oversight of cryptocurrencies and prediction markets. According to Bloomberg, the U.S. Securities and Exchange Commission (SEC) has submitted commission-level guidance to the White House on how to apply federal securities laws to certain crypto assets. The guidance is reported to potentially include a token classification system aimed at clarifying regulatory jurisdiction. The U.S. Commodity Futures Trading Commission (CFTC) has also reportedly submitted regulatory measures for prediction markets for White House review.

22:25

A16z Crypto is planning to raise a $2 billion fifth fund, Bloomberg reported.

22:09

Coinbase has announced the listing of Opinion (OPN). Trading is scheduled to begin on March 5, provided liquidity conditions are met.