Live Feed

Today, March 5, 2026

01:19

CoinDesk Senior Analyst James Van Straten said on X that Bitcoin appears to have formed a bottom around the $60,000 level, with funding rates remaining negative and showing signs of a potential short squeeze. He explained that the Implied Volatility (IV) index suggests Bitcoin has already begun its bottoming process. Van Straten noted that while past market lows were often accompanied by sharp increases in IV, volatility is now declining over time despite various geopolitical events. He added that if IV continues to fall regardless of price, it would signal that demand is increasing without panic.

00:57

American Bitcoin (ABTC), a mining firm backed by President Donald Trump's sons Donald Trump Jr. and Eric Trump, has increased its holdings to over 6,500 BTC. Eric Trump announced that the company purchased more than 500 BTC in the last 21 days. He added that ABTC now ranks as the 17th largest Bitcoin holder among publicly traded companies worldwide.

00:41

Danal, the operator of Paycoin (PCI), announced today that it will partner with Binance Pay and Circle to launch an integrated payment and settlement service for foreign visitors in South Korea this April. According to The Asia Business Daily, the service will allow Binance users visiting the country to make payments with their existing assets without a separate currency exchange process. USDC will be used as the settlement currency.

00:38

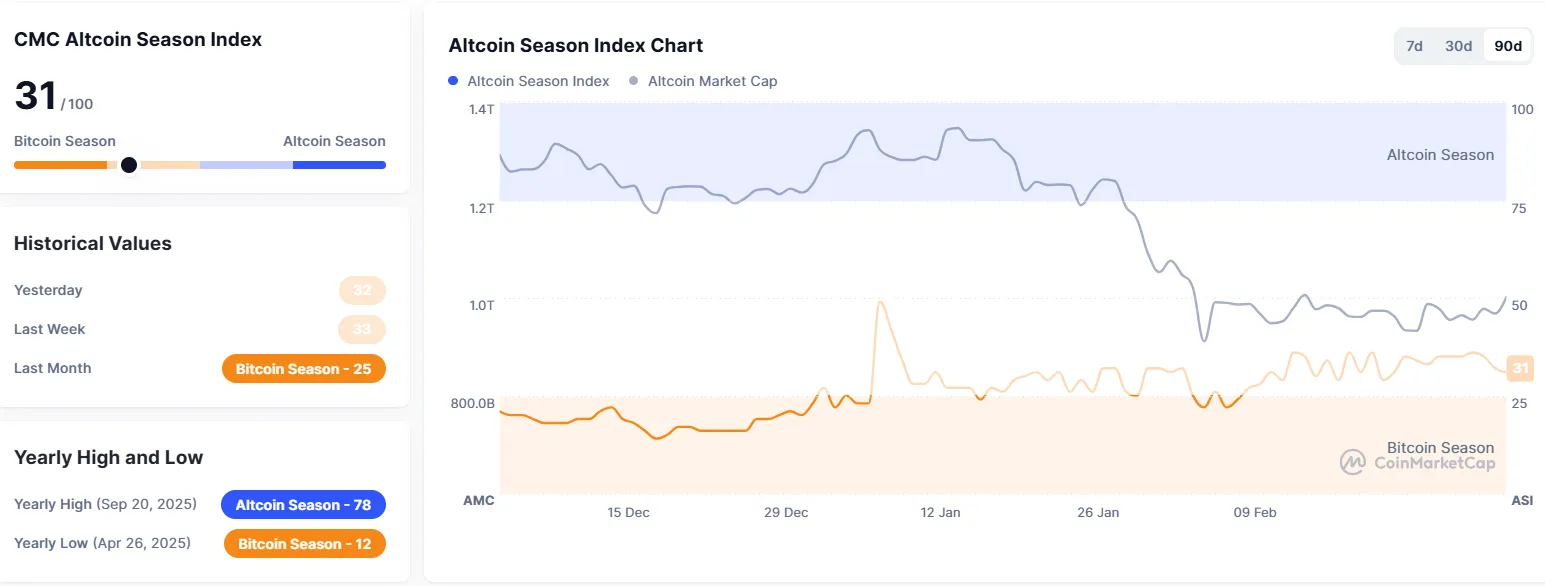

The Altcoin Season Index from cryptocurrency data aggregator CoinMarketCap has fallen to 31, a decrease of five points from the previous day. The index is calculated by comparing the price performance of the top 100 cryptocurrencies by market capitalization (excluding stablecoins and wrapped coins) against Bitcoin. An "altcoin season" is declared when 75% of the top 100 coins outperform Bitcoin over the preceding 90 days. Otherwise, it is considered a "Bitcoin season." A reading closer to 100 suggests an altcoin season is underway.

00:35

Hana Card is launching a full-scale domestic payment marketing initiative in collaboration with Circle and Crypto.com (CRO), News1 reported. The move is part of a broader strategy by parent company Hana Financial Group to establish a KRW-pegged stablecoin partnership and take a leading role in the cryptocurrency ecosystem. Hana Card previously signed a memorandum of understanding (MOU) with Circle last December.

00:14

Liquidity in South Korea may be shifting from the stock market to the cryptocurrency market, crypto analyst Bull Theory argued on X. The analyst noted that while the KOSPI index rose 80% in four months, Bitcoin fell 52% over the same period. This rally in Korean stocks eventually became overheated, with a surge in leverage and ETF trading volume. However, Bull Theory explained that the trend is now reversing, with foreign investors exiting the Korean stock market at a record-breaking pace. Foreigners sold $13.7 billion worth of Korean stocks in February, and the KOSPI has fallen about 20% over the last five days. In contrast, BTC has risen 11% since the KOSPI began its decline, suggesting that liquidity is flowing back into the crypto market.

Meanwhile, the KOSPI, which closed at 5059.45 yesterday after a 12.06% drop, is currently trading at 5633.10, a rebound of about 10.59%. Trading curbs on buy orders have been activated for both the KOSPI and KOSDAQ markets.

00:11

The Korea Exchange has activated buy-side sidecars for the KOSPI and KOSDAQ.

00:01

The Crypto Fear & Greed Index, compiled by data provider Alternative, rose 12 points from the previous day to 22. The index has remained in the 'Extreme Fear' stage since shifting from 'Fear' on Jan. 30. The metric gauges market sentiment on a scale from 0 (extreme fear) to 100 (extreme greed). It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

Yesterday, March 4, 2026

23:22

Eric Trump, son of U.S. President Donald Trump, has sharply criticized major banks over their stance on stablecoin yields. In a post on X, he argued that large institutions like JPMorgan, Bank of America, and Wells Fargo are lobbying to prevent Americans from earning higher returns on their deposits. Trump claimed these banks profit from the spread between the interest they receive from the Federal Reserve and the lower rates paid to depositors. He also stated they are attempting to limit cryptocurrency platforms from offering yields or rewards of 4% to 5% or more, describing the practice as "anti-American" behavior that disregards consumers and individual investors.

22:58

U.S. regulators are accelerating efforts to refine their oversight of cryptocurrencies and prediction markets. According to Bloomberg, the U.S. Securities and Exchange Commission (SEC) has submitted commission-level guidance to the White House on how to apply federal securities laws to certain crypto assets. The guidance is reported to potentially include a token classification system aimed at clarifying regulatory jurisdiction. The U.S. Commodity Futures Trading Commission (CFTC) has also reportedly submitted regulatory measures for prediction markets for White House review.

22:25

A16z Crypto is planning to raise a $2 billion fifth fund, Bloomberg reported.

22:09

Coinbase has announced the listing of Opinion (OPN). Trading is scheduled to begin on March 5, provided liquidity conditions are met.

22:04

U.S. President Donald Trump said the United States must secure a dominant position in the cryptocurrency sector, according to Watcher.Guru.

21:59

Crypto asset manager Bitwise has donated $233,000 to support Bitcoin open-source developers, Decrypt reported. The funds, sourced from the profits of the firm's spot Bitcoin ETF (BITB), were distributed to three organizations: Brink, OpenSats, and the Human Rights Foundation's (HRF) Bitcoin Development Fund.

21:41

Cryptocurrency firm Zerohash has applied to the U.S. Office of the Comptroller of the Currency (OCC) for a national trust bank charter, Bloomberg reported. According to the filing, the company is seeking to establish Zerohash National Trust Bank (ZNTB). ZNTB plans to offer a range of digital asset financial services, including custody for digital assets and fiat currency, staking and validator services, trade execution, and stablecoin management.

21:35

Although Bitcoin is continuing its rally and has reached a four-week high, market confidence in the upward trend remains weak, Cointelegraph reports. The analysis notes that on-chain and derivatives data indicate approximately 43% of BTC holders are still in a loss position. Consequently, investors are favoring defensive put options over bullish call options, with puts trading at about a 10% premium to calls in the BTC options market. The report identifies around $76,000 as a key psychological resistance level, as this is the average purchase price for major companies like Strategy. If the price surpasses this point, it could trigger additional selling pressure.

21:10

Scotiabank, one of Canada's top five banks, has partnered with digital asset manager 3iQ to launch a multi-cryptocurrency ETF, Cointelegraph reported. The Dynamic Active Multi-Crypto ETF (DXMC) is listed on Cboe Canada and offers diversified exposure to assets including BTC, ETH, SOL, and XRP. Its management fee is set at 0.25% until March 1, 2027.

21:03

The three major U.S. stock indices closed higher today.

- S&P 500: +0.78%

- Nasdaq: +1.29%

- Dow Jones: +0.49%

21:02

The U.S. Federal Reserve has released its Beige Book, a report on economic conditions in its 12 districts. The following is a summary of the findings:

- Seven of the 12 districts reported slight to modest growth in economic activity, a decrease from the nine districts that did so in the January survey.

- Some districts showed weakness due to economic uncertainty, increased price sensitivity, and reduced spending by low-income households.

- Employment remained stable overall. Some businesses have adopted artificial intelligence (AI) and automation technologies to improve efficiency.

- Regarding inflation, businesses generally expected the pace of price increases to slow somewhat in the short term.

21:00

According to CoinNess market monitoring, BTC has fallen below $73,000. BTC is trading at $72,986.69 on the Binance USDT market.

20:51

With Bitcoin surpassing $73,000, the market downturn may be coming to an end, according to Owen Lau, an analyst at New York brokerage Clear Street. Speaking to CoinDesk, Lau cited several positive developments. He noted that U.S. President Donald Trump's recent call to pass the CLARITY Act has increased its chances of becoming law before the end of summer. On the infrastructure front, Lau pointed to Kraken's approval for a Fed Master Account, which grants access to core payment systems, as a sign of progress. Institutional participation is also expanding, he added, highlighting Morgan Stanley's selection of BNY Mellon and Coinbase Custody Trust Company as custodians for its upcoming Morgan Stanley Bitcoin Trust. Lau described this as a move that reinforces Coinbase's role within the institutional crypto ecosystem. He also suggested that heightened geopolitical tensions in the Middle East are showcasing the utility of blockchain networks as an alternative payment solution amid financial market disruption. These combined developments, Lau explained, foreshadow a larger shift across the industry.

20:08

President Donald Trump held a private meeting with Coinbase CEO Brian Armstrong just hours before issuing a statement urging the passage of the crypto market structure bill (CLARITY Act), Politico reported. The details of the meeting were not disclosed.

19:42

Digital asset trading firm Crossover Markets has raised $31 million in a Series B funding round, Cointelegraph reported. The round was led by Tradeweb, with participation from DRW Venture Capital, Ripple, Virtu Financial, Wintermute Ventures, Illuminate Financial, and XTX Markets. The company was valued at $200 million. The funds will be used to expand CROSSx, Crossover's crypto electronic communication network for institutional trading.

19:37

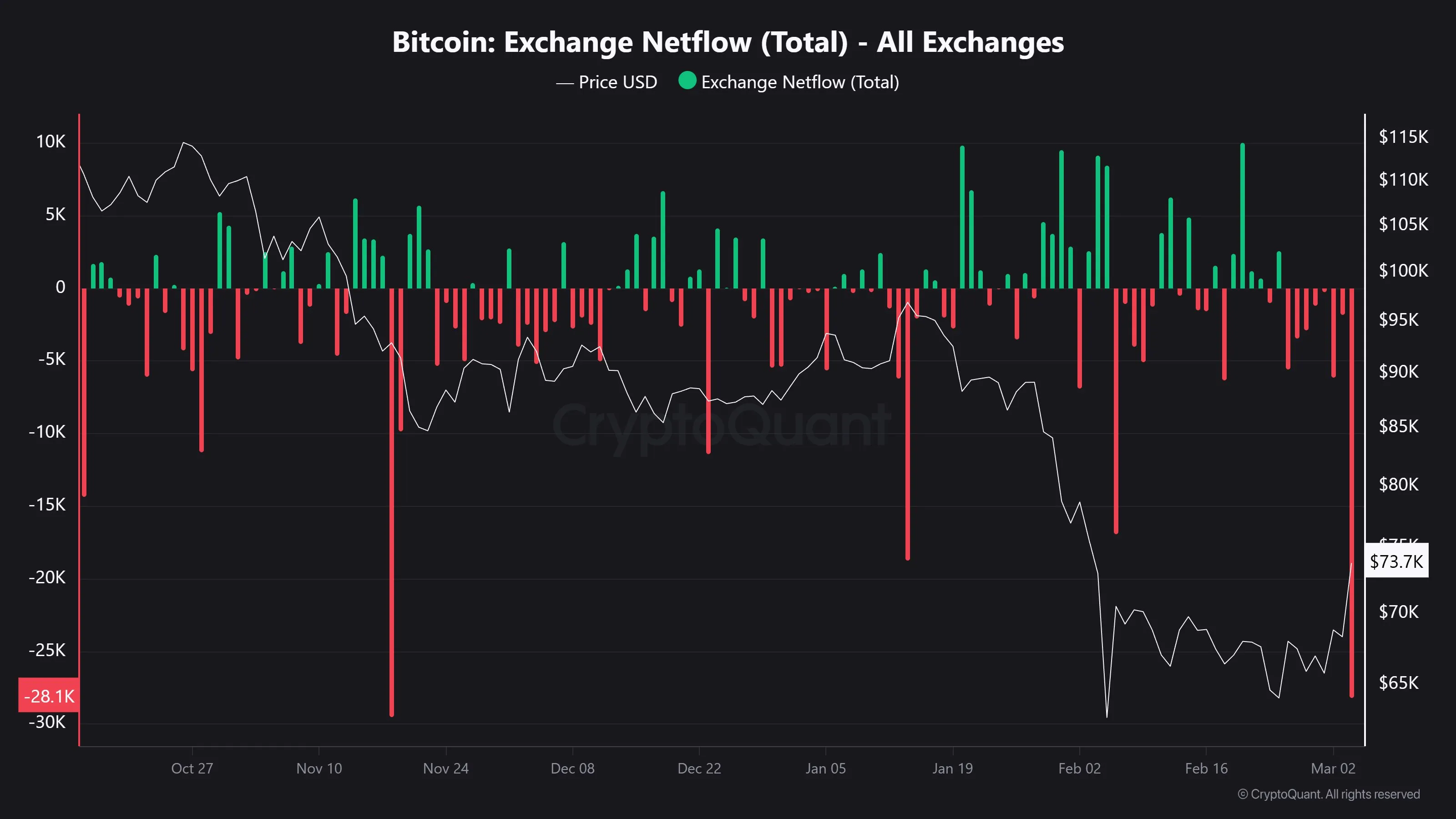

A net outflow of 28,195 BTC from centralized exchanges (CEX) occurred on March 4, Unfolded reported, citing data from CryptoQuant. This represents the largest single-day net outflow since November 2025.

19:20

According to CoinNess market monitoring, BTC has risen above $74,000. BTC is trading at $74,013.67 on the Binance USDT market.