Live Feed

Today, March 2, 2026

14:39

U.S. President Donald Trump is scheduled to address the nation on Iran from the White House at 4:00 p.m. UTC today, ABC reported.

14:33

The three major U.S. stock indices opened lower today.

- S&P 500: -1.07%

- Nasdaq: -1.5%

- Dow Jones: -1.15%

14:26

Crypto transaction volume moving out of Iran's largest exchange, Nobitex, surged by 700% within minutes following the U.S. and Israeli airstrike on Tehran, CoinDesk reported. According to blockchain analytics firm Elliptic, the funds were primarily transferred to overseas exchanges. Elliptic suggested this could indicate capital flight from Iran, bypassing sanctions on the traditional banking system.

14:00

Blockchain prediction market platform Opinion (OPN) has launched a website for users to check and claim their Season 1 airdrop allocations. Following the news, OPN experienced a sharp surge on Binance's pre-market for perpetuals, at one point rising over 30% to surpass $0.57 amid a spike in trading volume. OPN is a major prediction market project within the BSC ecosystem. The project recently kicked off its Season 2, which includes a "Double Dip" event featuring a 50% fee discount for two weeks.

13:57

The U.S. Embassy in Lebanon has urged its citizens to leave the country immediately. The embassy cited a deteriorating local security situation and urged citizens to depart as soon as possible via commercial flights.

13:53

JPMorgan has assessed the escalating geopolitical tensions involving Iran not as a signal to exit the stock market, but as an opportunity to buy on price dips. According to analyst Mislav Matejka, now is the time to leverage short-term weakness to increase positions. He predicted that the current conflict is likely to be temporary and that the surge in oil prices will also ease over time. JPMorgan anticipates that fundamentals will remain robust and inflation will stay within a manageable range. The bank also analyzed that the repricing in the technology and AI sectors has largely been completed, which could limit further downward pressure. JPMorgan maintained its overweight recommendation for international stocks, emerging markets, and eurozone equities.

13:49

Bitmine purchased an additional 50,928 ETH, worth $98.6 million, last week, Lookonchain reported on X. The firm now holds 4,473,587 ETH, valued at approximately $8.66 billion.

13:46

Walter Bloomberg reported via X that the Israeli military has begun striking Hezbollah targets throughout Lebanon.

13:44

Turkey's ruling Justice and Development Party (AK Party) has submitted an economic bill to parliament that would formalize a cryptocurrency tax framework, CoinDesk reported. The bill proposes a 10% quarterly withholding tax on profits generated on crypto platforms regulated under the country's Capital Markets Law. This rate would apply to both individuals and corporations, regardless of residency status. The president would have the authority to adjust the tax rate anywhere from 0% to 20%, depending on factors such as token type, holding period, and issuer. Additionally, service providers that broker crypto transactions would be subject to a 0.03% transaction tax based on the transaction amount or market value. Investors trading on unlicensed platforms would be required to declare their annual profits separately. If the bill passes, it will take effect two months after its promulgation.

13:19

U.S. Secretary of Defense Pete Hegseth stated that while the United States did not start the current war, it will be the one to end it. He said the operation's objective is to destroy Iran's nuclear weapons capability, emphasizing that Iran will never be allowed to possess them. Hegseth added that the operation is not an "endless war" and is different from the conflicts in Iraq or Afghanistan.

13:13

ProCap Financial (BRR) has purchased an additional 450 Bitcoin (BTC), expanding its total holdings to 5,457 BTC, according to CoinDesk. The purchase makes ProCap the 19th-largest corporate holder of BTC among publicly traded companies and has also lowered its average acquisition cost. Chairman and CEO Anthony Pompliano stated that the company is executing a dual strategy of purchasing more Bitcoin to lower its average cost and buying back its own shares, which it considers undervalued by the market. He added that both measures contribute to enhancing shareholder value.

13:07

MicroStrategy (MSTR) announced it has purchased an additional 3,015 BTC for $204.1 million at an average price of approximately $67,700. The company now holds a total of 720,737 BTC, valued at $54.77 billion, with an average purchase price of $75,985 per BTC.

12:49

Crypto hacking losses totaled $26.5 million in February, The Block reported, citing data from blockchain security firm PeckShield. The figure represents a 98.2% decrease from the $1.5 billion lost in February 2025 and a 69% drop from January's $86 million.

A total of 15 exploits occurred during the month, with the top five incidents accounting for 98% of the total damages. The largest single incident was a $10 million oracle manipulation attack on YieldBlox, a Stellar-based lending protocol. Other major cases included exploits of the IoTeX ioTube bridge ($8.8 million), CrossCurve ($3 million), FOOMCASH ($2.3 million), and Moonwell ($1.8 million).

12:32

Crypto analyst Javon Marks has projected that the XRP/BTC pair could surge by as much as 600%, The Crypto Basic reported. According to his chart analysis, XRP has broken above a multi-year downtrend line and is now in a retest phase, suggesting a potential for an upward reversal. The XRP/BTC pair is currently at approximately 0.00002040, down about 33% from its high in July 2025. However, Marks analyzed that a strong rally could unfold if the breakout from the long-term downtrend line holds. His target is 0.0001579 BTC, representing a potential upside of about 600%. This calculation implies that if Bitcoin's price remains stable at the $66,000 level, XRP could rise to over $10.

12:27

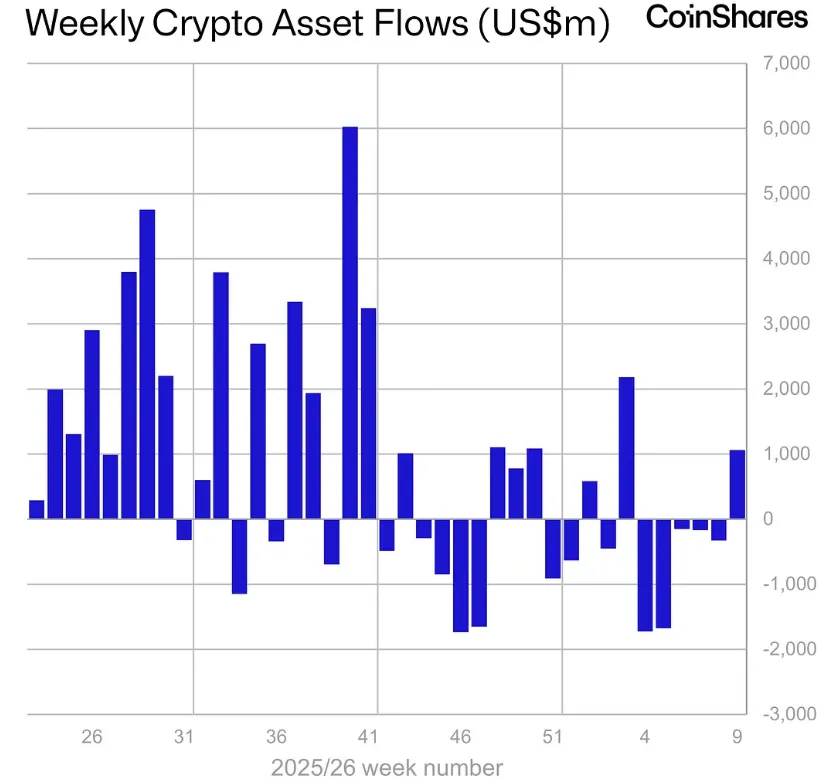

Digital asset investment products saw total net inflows of $1.061 billion last week, according to the latest weekly report from CoinShares. The shift marks an end to a five-week streak of net outflows. The United States led the inflows with $957.2 million, while Sweden, Italy, and France collectively saw net outflows of $4.6 million. By asset, Bitcoin investment products attracted $881.5 million, and Ethereum products saw inflows of $116.9 million.

12:18

QCP Capital has analyzed that global liquidity cycles, rather than geopolitical variables, are the primary drivers of Bitcoin's medium-term trend, The Block reported. The firm noted that despite recent tensions in the Middle East, BTC price action has remained relatively stable. While Bitcoin briefly fell to the low $60,000s last weekend following the outbreak of conflict with Iran, it recovered to the $66,000 range after approximately $300 million in long positions were liquidated. QCP Capital assessed that this deleveraging was relatively limited compared to more chaotic liquidation phases in the past.

11:44

Bitcoin (BTC) is trading around $66,500 on the third day of the conflict in Iran, rebounding more than 5% from a weekend low of $63,000, CoinDesk reported. While the weekend's airstrikes triggered the liquidation of around $300 million in long positions, analysis suggests the scale of forced liquidations was limited. Meanwhile, international oil prices surged to a multi-month high of $82 per barrel, and other safe-haven assets like gold and silver also climbed. In contrast, S&P 500 and Nasdaq 100 futures have fallen by more than 1%.

11:07

Arthur Hayes has argued that a prolonged military intervention in Iran by the U.S. and Israel would likely compel the Fed to ease its monetary policy, potentially serving as a strong bullish catalyst for Bitcoin (BTC), DL News reported. He stated that U.S. military involvement in the Middle East has historically led to fiscal expansion and an increased money supply. Citing the rate cuts that followed the Gulf War and the Sept. 11 attacks, Hayes stressed that the solution to war has historically been cheaper and more abundant money. He added that the right time to buy BTC is when the Fed either cuts interest rates or expands liquidity. Currently, BTC is trading at around $66,000, a level approximately 50% below its high from October of last year.

11:00

U.S. stock futures are trading lower in the pre-market on March 2, according to CoinDesk. Futures for the S&P 500, Nasdaq 100, and Dow Jones are all showing weakness, while recently surging oil and gold prices have retreated from their highs. The outlet reported that commodity prices, which had jumped amid geopolitical tensions, are now undergoing a correction as traders take profits. Despite this, stock futures remain under pressure as investors maintain a wait-and-see approach.

10:33

Cointelegraph has outlined five key points to watch in the Bitcoin market this week.

- BTC avoids panic selling amid Iran conflict, defends mid-$60,000s.

- A bearish target of $45,000 for BTC has re-emerged.

- Analysis spreads that the Iran situation is not a 'World War III' scenario, with a low probability of all-out war.

- Oil price volatility and U.S. inflation are highlighted as variables creating headwinds for risk assets.

- BTC ETF flows show signs of reversal, with recent signals indicating a shift to net inflows.

10:09

Concerns are mounting over macroeconomic pressure on Bitcoin (BTC) as rising tensions in the Strait of Hormuz could lead to oil price instability over the next four weeks, BeInCrypto reported. Market observers believe a surge in oil prices could fuel inflation expectations, potentially delaying the Federal Reserve's interest rate cuts and weighing on risk assets. This could create a chain reaction: rising oil prices lead to renewed inflationary pressure, which dampens rate cut expectations, pushes up government bond yields, and ultimately reduces market liquidity. In such a scenario, Bitcoin's volatility could increase due to its nature as a high-beta liquidity asset. Analysts also note that given Bitcoin's recent high correlation with risk assets, a sharp rise in bond yields could accelerate the liquidation of leveraged positions.

09:53

The Hong Kong Monetary Authority (HKMA) has signed a Memorandum of Understanding (MoU) with Shanghai authorities to build a blockchain-based platform connecting cross-border cargo data with trade finance, CoinDesk reported. The collaboration, part of the HKMA's 'Project Ensemble' framework, will explore linking electronic bills of lading (e-B/L) and trade data, and integrating with Hong Kong's Commercial Data Interchange (CDI) and the CargoX system. Authorities aim to reduce paper-based procedures and improve efficiency in the cargo trade finance market, estimated to be worth $1.5 trillion annually.

09:46

An analysis from CryptoQuant contributor Moreno suggests that short-term Bitcoin holders are not panic selling, despite escalating geopolitical risks related to Iran. Moreno pointed out that event-sensitive short-term holders have shown little reaction to the recent tensions. While BTC saw a decline in mid-February, temporarily testing the $63,000-$64,000 range, there have been no clear signs of sharp stop-loss liquidations or fear-driven selling. According to Moreno, this behavior contrasts with previous risk scenarios where short-term holders typically reacted with immediate sell-offs. He suggested that the delayed response may be due to market fatigue rather than an absence of panic. However, Moreno cautioned that this is not an all-clear signal and that a sharp directional shift could occur if new risk factors emerge.

09:37

A consortium of 12 major European banks, including ING, UniCredit, and BBVA, is preparing to launch a euro-pegged stablecoin in the second half of 2026, CoinDesk reported, citing Spanish media outlet Cinco Días. The consortium, known as Qivalis, is reportedly in discussions with cryptocurrency exchanges and liquidity providers regarding the listing and distribution of the new asset. Qivalis is continuing talks with both European and global exchanges, and participating banks will also be able to distribute the stablecoin through their own channels. The stablecoin is designed to be 100% backed by reserves, with at least 40% held in bank deposits and the remainder in short-term eurozone government bonds. It will also support 24-hour redemptions. The initiative aims to provide a European alternative to dollar-based stablecoins that complies with the EU's Markets in Crypto-Assets (MiCA) regulation.

09:12

Aave Labs' "Aave Will Win" governance proposal has passed its initial Temp Check snapshot vote with 52.58% in favor and 42% against.

The proposal introduces a structure to direct 100% of the revenue from products developed by Aave Labs to the DAO treasury. It also includes a provision for up to $42.5 million in stablecoins and 75,000 AAVE tokens to support the development team.

Following the vote, the proposal will advance to the ARFC (Request for Final Comments) stage for further discussion and potential amendments before a final on-chain vote (AIP).

According to CoinMarketCap, AAVE is currently trading at $114.36, down 0.63%.