SAND Token to be Listed on Japanese Crypto Exchange bitFlyer

Japanese crypto exchange bitFlyer has recently announced its plans to list The Sandbox (SAND) on its trading platform, making it the 22nd crypto asset to be available on bitFlyer. Specific details are yet to be announced. This move reflects bitFlyer’s commitment to expanding its offering and providing customers with more investment options and opportunities in the realm of Web3.

Global presence

Founded in 2014 with a mission to simplify the world through blockchain technology, bitFlyer has taken its crypto asset trading business to the global stage. Its expansion includes sister companies bitFlyer USA and bitFlyer Europe, which have allowed the exchange to extend its reach beyond Japan.

Blockchain-powered metaverse

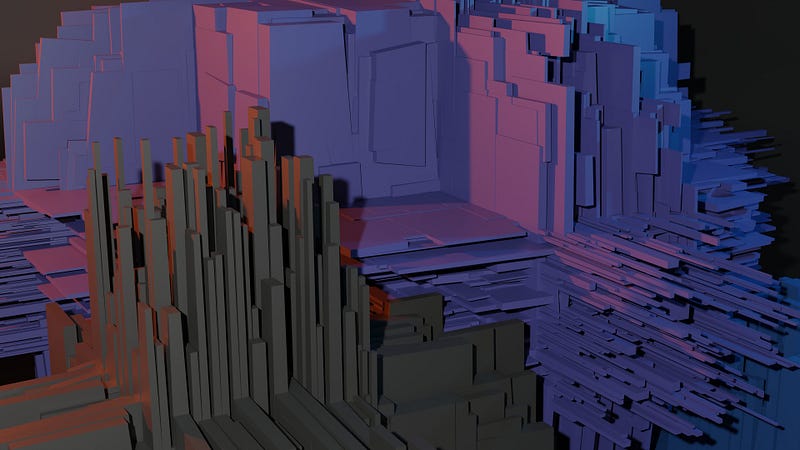

The Sandbox is a metaverse platform that harnesses the power of blockchain technology, empowering users to create and possess digital content using the platform’s tools. Moreover, The Sandbox features virtual land called LAND, which is regularly utilized by companies for hosting events and various other activities. At the heart of this ecosystem lies the SAND token, which enables users to trade user-generated content, participate in governance by voting, and engage in staking.

Attention in East Asia

Notably, The Sandbox has been generating significant attention in East Asia. Last month, the metaverse platform initiated an event titled “Hallyu Rising,” collaborating with renowned Korean brand partners, including automaker Renault Korea. As part of this event, Renault Korea launched the Renault Korea Hub within The Sandbox’s environment. This hub gives car enthusiasts a unique chance to design their own vehicles and enjoy exclusive experiences. The event also included a land sale, offering users the chance to acquire LAND adjacent to the Korean brands, thereby encouraging more active user engagement.