Live Feed

Today, December 27, 2025

00:43

Two addresses linked to Pantera Capital have deposited 5,264 ETH, worth $15.39 million, to Coinbase Prime, Onchainlens reported.

00:36

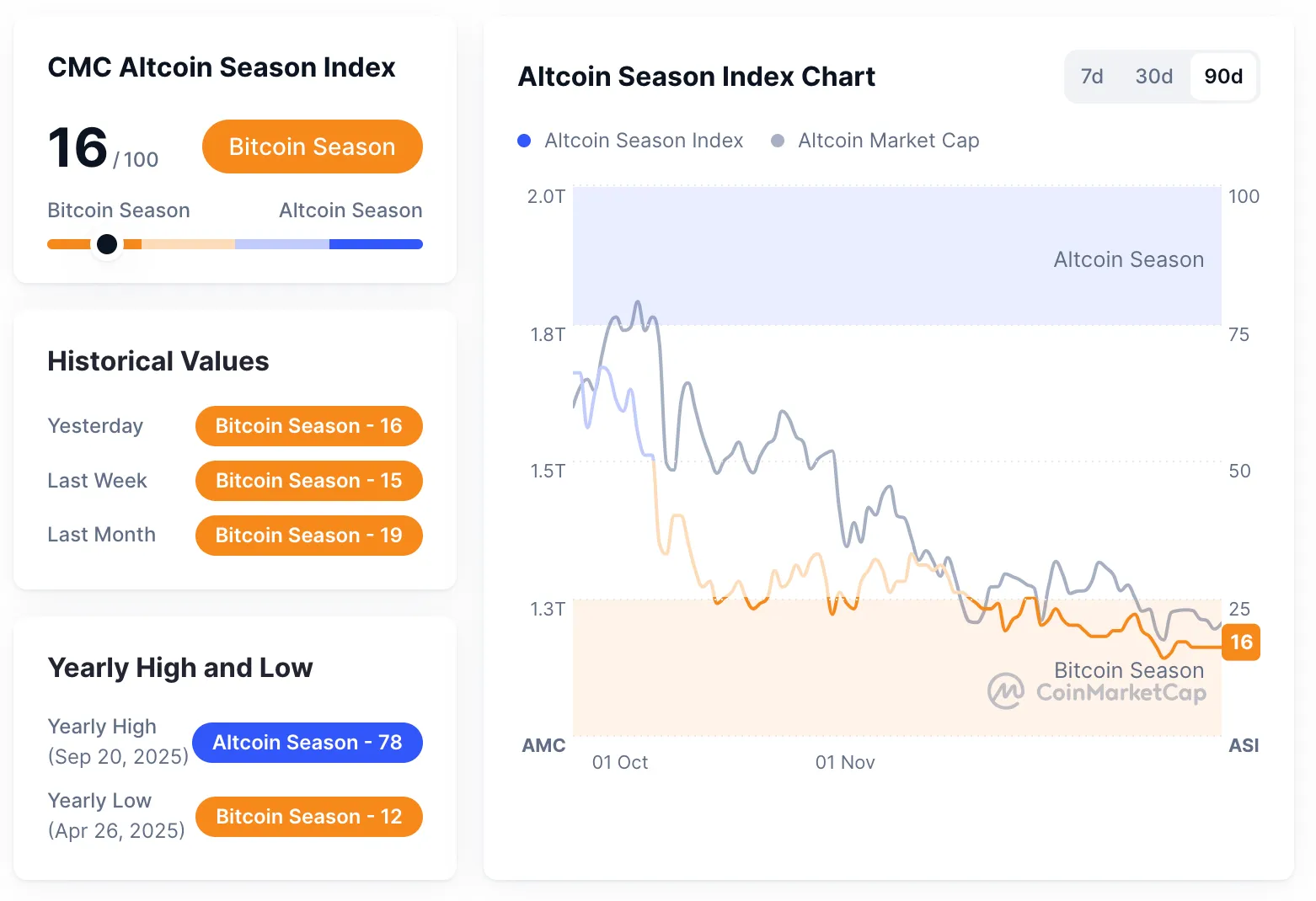

CoinMarketCap's Altcoin Season Index remains at 16, unchanged from the previous day. The index is calculated by comparing the price performance of the top 100 coins by market capitalization, excluding stablecoins and wrapped tokens, against Bitcoin over the last 90 days. An "altcoin season" is declared if 75% of these top coins outperform Bitcoin during that period, with a score closer to 100 indicating stronger altcoin performance.

00:03

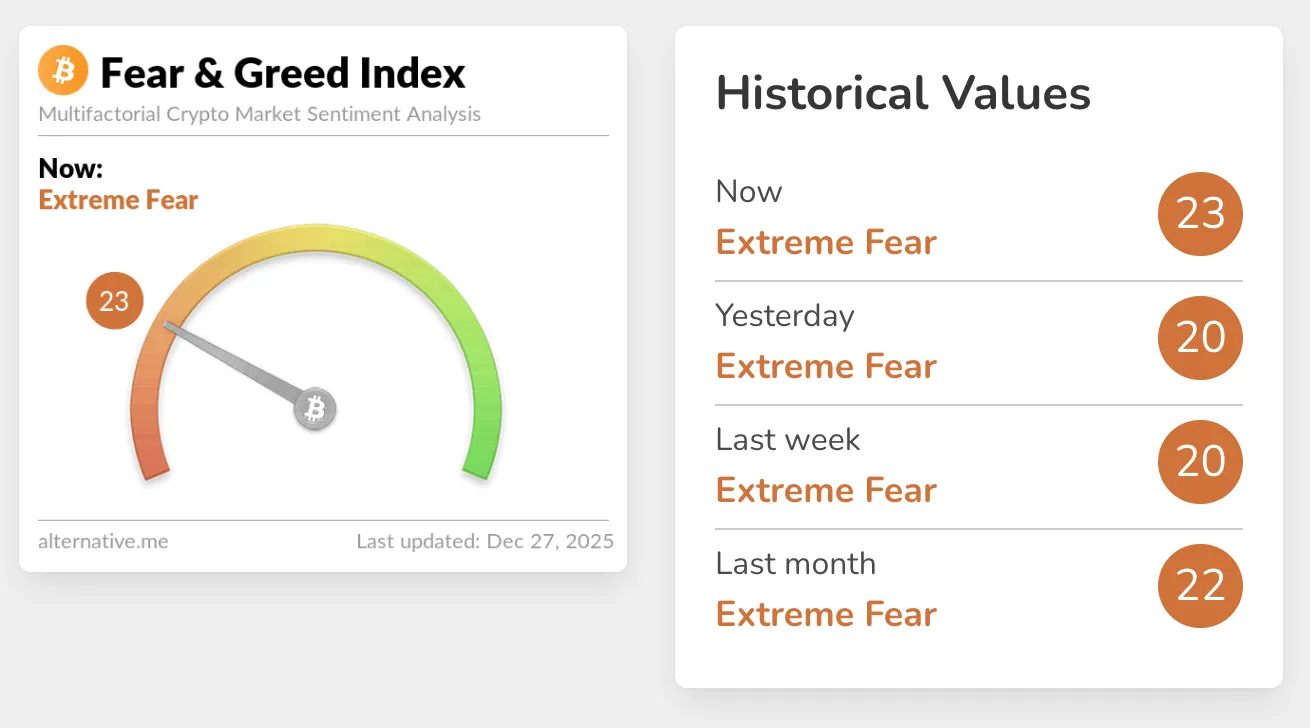

The Crypto Fear & Greed Index rose three points from the previous day to 23, though it remains in the Extreme Fear category, according to data from Alternative. The index measures market sentiment on a scale from 0, indicating extreme fear, to 100, representing extreme greed. It is calculated based on factors including volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

00:02

Bitmain has staked 74,880 ETH, worth $210 million, after several months of accumulation, Onchainlens reported. Meanwhile, Shapelink unstaked 35,627 ETH, valued at $100 million.

Yesterday, December 26, 2025

23:17

Chinese mining rig manufacturer Bitmain is offering significant discounts on its flagship products as the Bitcoin mining industry grapples with declining profitability, Cointelegraph reported. The discounts apply to most of the company's products, including its S19 and S21 series. Additionally, Bitmain has shifted some products from fixed pricing to an auction-based sales model, a move rarely seen during previous industry booms. The report notes that the current hash rate price has fallen below the minimum profit margin for mining operators.

23:10

Stani Kulechov, founder of the crypto lending protocol Aave, has clarified that his recent purchase of $15 million worth of AAVE was not intended to expand his governance influence. He explained that while the purchase is factual, he did not use the tokens in governance voting. The clarification follows a controversy that arose after a proposal for the Aave DAO to absorb Aave Labs, the protocol's developer, was rejected. Kulechov's large token acquisition at the time had sparked concerns about his potential to unduly influence the protocol.

23:05

A Coinbase employee has been arrested in India on suspicion of involvement in a hacking incident at the U.S. cryptocurrency exchange, Bloomberg reported. The individual is accused of providing hackers with system access in exchange for cash.

20:36

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

18:48

The cryptocurrency ETF market is poised for substantial growth in 2026, with one analyst forecasting inflows of up to $40 billion, Cointelegraph reported. Bloomberg ETF analyst Eric Balchunas stated that he expects approximately $15 billion in new funds to enter the market, a figure that could rise to $40 billion if investment conditions are favorable. Balchunas suggested that investor interest in crypto ETFs will likely be renewed as the Federal Reserve is expected to cut interest rates next year. He also noted that ETF flows are providing medium- to long-term price support, pointing out that investors did not engage in large-scale sell-offs during the recent market correction. While BTC fell by about 35% from its peak, ETF outflows were only 4% of the total, and some weeks even saw net inflows. Balchunas added that major institutions such as pension funds, sovereign wealth funds, and investment advisory firms are now looking toward crypto ETFs, identifying them as a key source of capital that will have a real impact on the market.

18:07

BNB Chain will apply the Fermi hard fork to its mainnet on Jan. 14, Cointelegraph reported. The upgrade will reduce the block generation interval from 750 milliseconds to 250 milliseconds, enabling the network to process more transactions per second. Additionally, a new indexing mechanism will be introduced, allowing users to query specific data without downloading the entire block history. This change is expected to significantly reduce the computing resources required for node operation.

17:24

Mike Novogratz, CEO of cryptocurrency financial services firm Galaxy Digital, has warned that tokens relying solely on community loyalty, such as Ripple (XRP) and Cardano (ADA), could be left behind in the next market cycle if they fail to demonstrate real-world utility, Cryptobriefing reported. He explained that the cryptocurrency market is increasingly reorganizing around projects with tangible business foundations. Novogratz noted that with numerous competitors emerging each cycle, the long-term survival prospects for projects dependent only on their community are diminishing. He added that in the future, only projects that can prove a clear revenue structure and actual value will endure.

15:52

Crypto analyst Gamza Khanzadaev has warned that Bitcoin (BTC) could fall as low as $67,000 if it breaks below the $86,000 support level, U.Today reported. Khanzadaev explained that if BTC fails to reclaim $90,000 before the weekly candle closes, a dead cross pattern on its weekly chart will persist. This technical formation occurs when the 50-week moving average is at risk of crossing below the 200-week moving average. He noted that a breach of the key $86,000 support would open the door to the next major support level at $74,111, rather than $80,000. While the dead cross is not yet confirmed, the analyst believes a lack of strong buying pressure this week could initiate a medium- to long-term downtrend.

15:02

According to CoinNess market monitoring, BTC has fallen below $87,000. BTC is trading at $86,965.44 on the Binance USDT market.

14:49

According to CoinNess market monitoring, BTC has fallen below $88,000. BTC is trading at $87,978.73 on the Binance USDT market.

14:30

Bitcoin continues to see sustained buying pressure despite short-term corrections and is still trading above key support levels, according to an analysis by Negentropic, an X account managed by Glassnode co-founders Jan Happel and Yann Allemann. The analysis noted that the most significant change has been the resolution of a derivatives overhang. With the expiry of approximately $23.6 billion in BTC and ETH options today, a structural price cap resulting from hedging demand that had pressured the market for weeks has been lifted. The account added that previous attempts at a rally were consistently thwarted by these structural flows. Following this event, Bitcoin's price is now expected to move more naturally in line with supply and demand.

13:17

Next year's U.S. midterm elections will serve as a major test to prove the value of the prediction market sector, according to an analysis by The Block. The publication highlighted the rapid growth in the space this year, with platforms Polymarket and Kalshi achieving valuations of $9 billion and $11 billion, respectively. The Block suggested that the upcoming elections could be a turning point for properly assessing the value of these markets.

Separately, Leo Chan, co-founder of Sportstensor, commented that the core value of prediction markets lies in their function as a collective intelligence data infrastructure. He added that many financial institutions view these platforms as a form of data collection infrastructure.

12:31

Japanese listed company MetaPlanet, which has incorporated Bitcoin as a primary asset, aims to hold 210,000 BTC by 2027, an amount equivalent to 1% of Bitcoin's total supply, according to foreign media reports. The company plans to raise funds for the acquisitions by launching new financial products, a strategy enabled by a capital structure reorganization approved at a recent extraordinary shareholders' meeting. According to Bitcoin Treasuries, Strategy is currently the largest corporate holder with 671,268 BTC as of Dec. 26. If MetaPlanet achieves its goal, it would become the world's second-largest corporate Bitcoin holder.

11:40

BitMEX co-founder Arthur Hayes recently purchased 1.85 million LDO, worth $1.03 million, and 549,868 PENDLE, valued at $973,000, from Binance, according to Onchain Lens.

11:12

Ju Ki-young, CEO of CryptoQuant, stated on X that based on the average order size in the Bitcoin spot market, the asset is currently in a whale buying phase. He predicted that a price increase will follow this stage. Ju explained that the Bitcoin spot market typically follows a pattern: retail investors buy, whales sell, the price declines, retail investors sell, whales buy, and then the price rises. He previously emphasized that investors should not sell their Bitcoin under any circumstances.

11:11

Russian President Vladimir Putin has stated that the United States expressed interest in a cryptocurrency mining project at the Zaporizhzhia Nuclear Power Plant (ZNPP) during ceasefire negotiations between Russia and Ukraine, the Russian daily Kommersant reported. According to the report, Russia hopes to co-operate the plant with the U.S., whereas the U.S. has proposed a joint operation with equal stakes for Russia, Ukraine, and itself. The outlet added that the feasibility of the crypto mining project remains uncertain, as no concrete agreement has been reached.

10:36

Tether, the issuer of the world's largest stablecoin USDT, has frozen approximately $3.3 billion in assets linked to illicit activities between 2023 and 2025, Cointelegraph reported, citing data from AMLBot. During the same period, rival issuer Circle froze $109 million in its USDC stablecoin, making Tether's frozen amount roughly 30 times larger. The statistics reportedly only include USDT and USDC on the Ethereum blockchain, suggesting the actual total of frozen funds could be higher.

10:17

CoinGecko has released a ranking of cryptocurrency narratives based on their performance this year. The top 10 sectors by investment return are: 1. RWA (Real World Assets), 2. Layer 1, 3. Made in USA, 4. Memecoins, 5. DeFi, 6. Layer 2, 7. AI, 8. Decentralized Exchanges (DEX), 9. Solana Ecosystem, and 10. Gaming.

10:08

The Swiss city of Lugano accepts Bitcoin for a wide range of payments, from McDonald's to local taxes, Cointelegraph reported. The city has been implementing its "Plan ₿" project, a partnership with USDT issuer Tether, to build infrastructure for using Bitcoin in daily life. Cointelegraph explained that this is not merely a marketing campaign, as both Bitcoin and USDT are actively used in local commerce. The report also noted that a local currency token, LVGA, is further promoting cryptocurrency transactions. It added that Lugano presents a clear and contrasting model to the mix of curiosity and concern with which central banks around the world are viewing digital currencies.

09:50

Amid Ethereum's continued price weakness, approximately 40% of its circulating supply is now at a loss. BeInCrypto reported, citing on-chain data from Glassnode, that the share of ETH supply in profit has dropped to 59% from around 75% earlier this month. According to CoinMarketCap, ETH is currently trading at $2,970.41, up 1.52%.

09:35

Charles Hoskinson, founder of Cardano (ADA), said the privacy-focused blockchain and spin-off project Midnight will be the Manhattan Project for its sector. He stated that he is writing 80 to 100 pages of technical documents for Midnight each day and plans to hold an internal workshop in January. Hoskinson emphasized that Midnight aims to be the Manhattan Project for privacy-enhancing technologies (PET), chain abstraction, and smart compliance. PET are technologies that enable verification and computation without exposing personal information or transaction details.