Blockchain Experts Gather at KBW 2023 Side Event to Discuss Future Prospects of South Korea

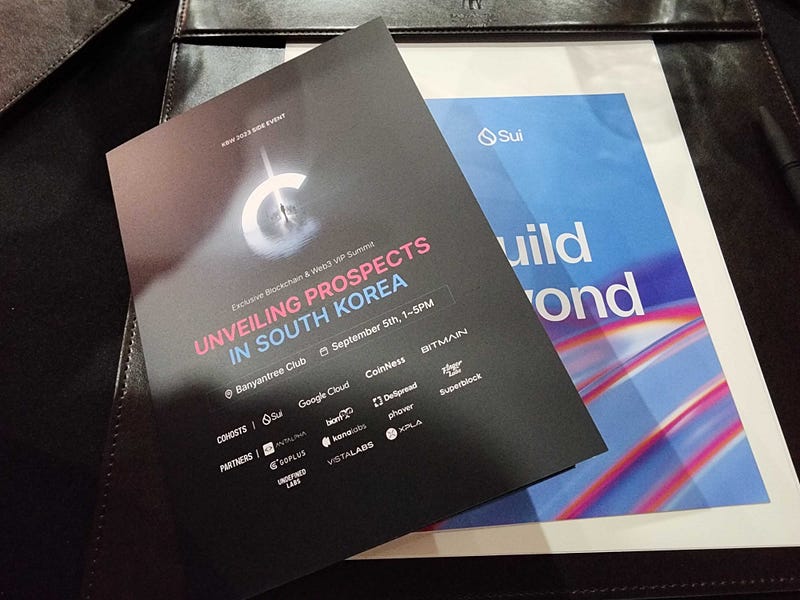

Blockchain experts from various corners of the industry converged to exchange insights on industrial and technological trends during “Unveiling Prospects in South Korea,” a side event affiliated with Korea Blockchain Week (KBW) 2023. This noteworthy gathering, co-hosted by Sui, Google Cloud, CoinNess, and Bitmain, took place on September 5 at Banyan Tree Club and Spa Seoul.

Blockchain compatibility and Web3 adoption

Among the distinguished speakers at the event, Derik Han, Head of APAC Partnerships at Mysten Labs, the team behind the layer-1 blockchain project SUI, discussed how the SUI project plans to enhance blockchain compatibility through a zero-knowledge (ZK) login feature, similar to single sign-on (SSO). SSO enables users to use a single set of login credentials to gain access to various applications.

Han underscored the significance of reducing technical barriers for the widespread adoption of Web3 in our daily lives, and he pointed out that SUI’s ZK login feature would contribute to this goal. Additionally, Han shed light on SUI’s intention to add on-chain features highly favored among Korean gamers.

Security tokens and RWAs

Jo Dong-hyeon, the CEO of Undefined Labs, a developer specializing in on-chain risk rating solutions, emphasized that the Korean decentralized finance (DeFi) market is poised for growth, driven by security tokens and real-world assets (RWAs). He highlighted the significant attention received by the Financial Services Commission’s announcement regarding guidelines for security token offerings (STOs) in February.

Jo observed that tokens backed by real-world assets (RWAs) would serve as a bridge between the DeFi space and traditional financial markets, facilitating the development of the former. He also noted that this development would follow the pattern seen in the Korean cryptocurrency market whose liquidity has been supported by young investors.

NFT ecosystems

Meanwhile, Kim Min-gu, Head of Web3 Business Development Lab at LG Uplus, a telecom company, expressed their commitment to expanding the Moono NFT ecosystem. This venture, anchored around their octopus character, intends to advance through collaborations with similar NFT projects like Lotte Homeshopping’s pink bear character, Bellygom. Kim highlighted that the company’s primary goal for this year is to make NFTs accessible even to customers who are unfamiliar with cryptocurrencies.

Kim further explained that LG Uplus aims to delve into the differences between Web3 NFT communities and their Web2 counterparts. The company’s focus lies in improving the overall usability of its services, without narrowing down its target audience. They are particularly intrigued by the potential of wallets and decentralized applications (dApps) in this pursuit.

Banks’ entry into the virtual asset landscape

Following this, Leem Min-ho, an analyst at Shinyoung Securities, predicted a strategic expansion by Korean banks, with an emphasis on offering digital asset custody services. This endeavor has been catalyzed by recent developments, including the introduction of security token guidelines in February and the passage of the Virtual Asset User Protection Act in June. These regulatory milestones are gradually shaping a more defined legal framework for virtual assets within South Korea. Leem went on to say that banks, known to favor engaging in business activities within established regulatory boundaries, are poised to concentrate their forthcoming initiatives on approved security tokens, ensuring compliance and adherence to regulatory standards.