Raon Whitehat Enables College Students to Hone Skills Through Metaverse

Raon Whitehat, a blockchain-based service provider of South Korean tech security firm RaonSecure, is set to launch Raon Metademy, a cutting-edge metaverse-powered professional training platform, for universities.

Inviting beta testers

Today, Raon Whitehat announced the successful completion of the beta version of Raon Metademy, developed in collaboration with edtech company Globepoint. The company is now inviting beta testers from university departments and educational institutions to participate.

Interested universities can apply on the Raon Metademy website, with beta testing planned until the end of August. During this period, Raon Whitehat will gather valuable feedback to further enhance the platform. The official launch is scheduled for September 1 to support university classes.

Effective remote practices

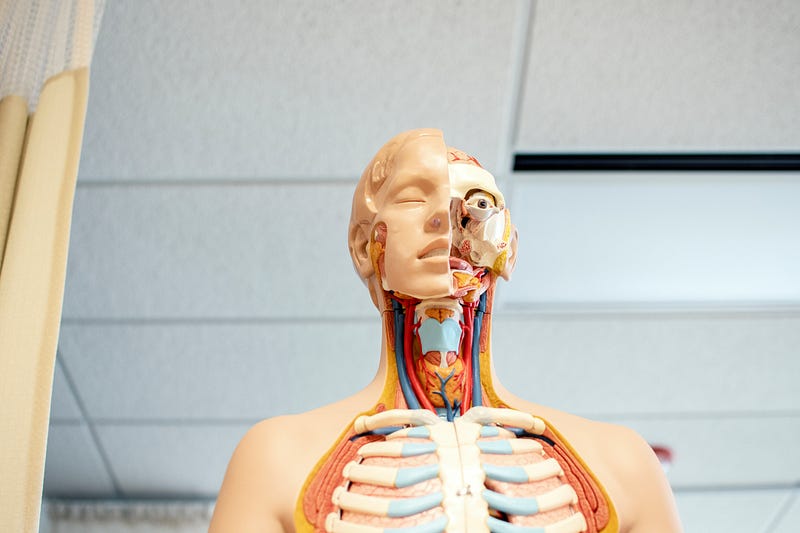

Raon Metademy boasts a metaverse-based training approach, offering users access to a virtual campus where they can attend lectures and practice essential skills. The platform’s highly immersive user experience allows students to create personalized avatars, explore the campus, access announcements, have a look at training courses, and utilize the training room. With vivid 3D visuals and realistic video-based exercises, students can effectively practice their skills from remote locations.

Additionally, users can set up private labs to address their weaknesses, engage in discussions, and build a community similar to a physical campus environment. Among the confirmed beta testers are Chung-Ang University and Seoul Women’s University, and the application window for other institutions will remain open until mid-August. The initial beta service will focus on nursing skills, physical therapy, and security practices, with plans to expand the content to include caregiving practices and more.

Digital credentials and NFTs

Raon Metademy aims to provide certificates of completion and awards of excellence in the form of digital badges, simplifying the process of submitting credentials to universities and other organizations. The platform will also introduce non-fungible tokens (NFTs) to benefit content providers, facilitating secure trading of educational materials among students.

Leveraging RaonSecure’s cutting-edge technologies, including blockchain and NFTs, Raon Metademy aims to become a versatile platform open to content providers, educational institutions, and individuals alike. This will enable students to access a diverse range of captivating lessons from anywhere and give lecturers the ability to earn income by delivering high-quality hands-on training with minimal equipment and material costs.