Korean crypto exchanges list Trump-linked cryptocurrencies

Cryptocurrencies tied to the family of U.S. President Donald Trump began trading on South Korea’s major exchanges on Monday.

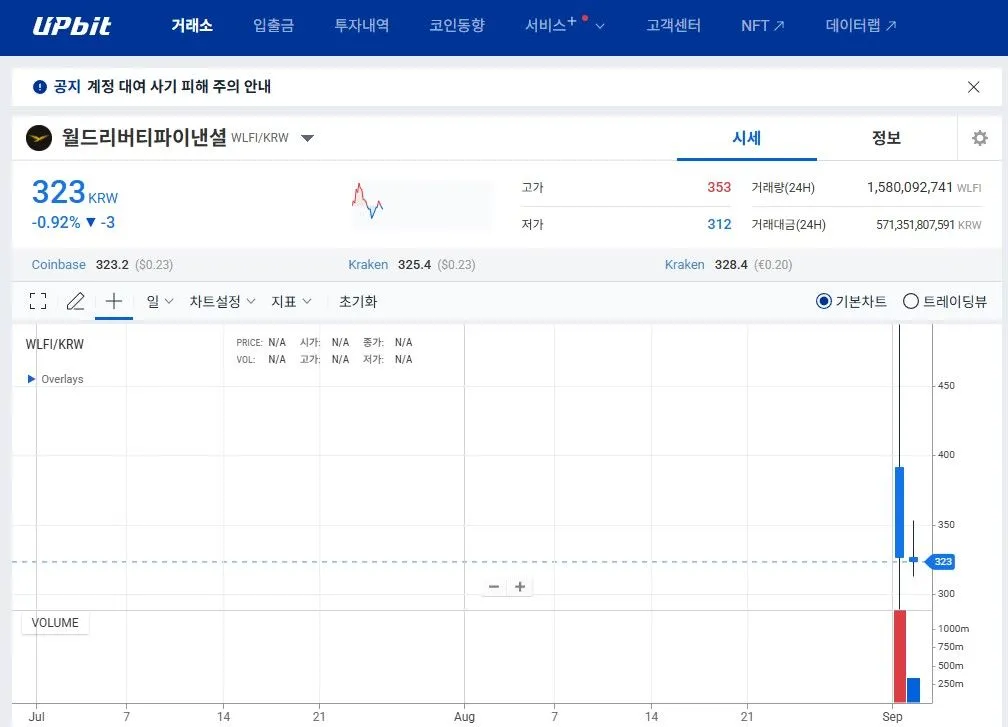

Upbit, the country’s largest exchange, listed WLFI—the native token of World Liberty Financial, a DeFi platform backed by the Trump family—and World Liberty Financial USD (USD1), a stablecoin the platform says is pegged 1:1 to the U.S. dollar and backed by dollars and government money market funds. Bithumb also listed both WLFI and USD1, while Coinone listed WLFI only.

From global listings to a volatile debut

WLFI’s first session was volatile. It opened on Upbit at a floor price of 433.76 won ($0.31) and, roughly 17 hours later, was down about 25% at 323 won ($0.23) at the time of publication.

The Korean launch comes alongside listings on major global venues, including Binance and Coinbase. Until its exchange listings, WLFI holders had been unable to trade their tokens. The Wall Street Journal estimated the Trump family’s holdings, representing less than a quarter of the supply, to be worth close to $5 billion after the listing. Trump’s three sons are named as co-founders of World Liberty, which says tokens allocated to founders and team members will remain locked. President Trump is described as the project’s “co-founder emeritus.”

Political controversy over crypto and holdings

The project has drawn criticism from those who argue it could serve as a conduit for influence, with partners and investors seeking political favor. In April, Democratic lawmakers Senator Elizabeth Warren and Representative Maxine Waters warned the U.S. Securities and Exchange Commission that the family’s stake posed “an unprecedented conflict of interest” in oversight of the crypto industry. Later, White House press secretary Karoline Leavitt said, “Neither the President nor his family have ever engaged, or will ever engage, in conflicts of interest.”

Controversy over public officials’ crypto exposure is not new. Recently, it was reported by The Chosun Ilbo that as of Aug. 14, Lee Eog-weon, nominee to chair South Korea’s Financial Services Commission (FSC), held 10 shares of Strategy, a Nasdaq-listed Bitcoin treasury company with 632,457 BTC in reserves. The disclosure indicates no legal violation because the holdings predate his nomination, but it highlights tension with his public views. In a letter to parliament ahead of his confirmation hearing, Lee questioned crypto’s intrinsic value and argued its volatility undermines its utility as a store of value or medium of exchange.

If Lee were not seeking a government post, his holdings of crypto-related stocks would hardly surprise South Koreans. According to Money Today, citing data from the Korea Securities Depository (KSD), Korean investors increased purchases of crypto-related U.S. equities amid expectations of U.S. rate cuts. Bitmine Immersion Technologies—a Bitcoin miner that also accumulates Ethereum as a treasury asset—was the second-most purchased U.S. stock by Koreans in August, with net buys of $252.77 million, or 7.6% of all purchases among the top 50 U.S. stocks. Stablecoin issuer Circle ranked 10th at $92.62 million, and the GraniteShares 2x Long COIN Daily ETF, which delivers twice the daily price movement of Coinbase, ranked 11th at $90.74 million. In total, crypto-related stocks and ETFs accounted for 30.4% of the top 50 U.S. equity holdings by value.

South Korea weighs spot ETFs amid investor surge

Policy is moving in tandem with market interest. Spot crypto ETFs have recently been elevated to South Korea’s national agenda, opening the door to potential approval. Analysts say such products could repatriate demand that has been flowing overseas. Kim Jin-young of Kiwoom Securities argues that expanded regulatory approval could reshape Korea’s capital market by widening investor access, drawing in institutional capital, stabilizing prices, and diversifying available crypto-linked products.