Live Feed

Yesterday, March 3, 2026

23:17

Cryptocurrency infrastructure firm BitGo's European entity has officially launched its Crypto-as-a-Service (CaaS) across the entire European Economic Area (EEA), Cointelegraph reported. This enables European fintech companies and banks to legally offer cryptocurrency services to their customers using BitGo's infrastructure, without the need to build their own complex regulatory systems.

23:05

Bitcoin mining firm MARA Holdings (MARA), formerly Marathon Digital, has denied rumors of a large-scale sell-off of its Bitcoin holdings. According to Cointelegraph, Robert Samuels, the company's Vice President of Investor Relations, clarified that the core of its approach to its Bitcoin treasury has not changed. He acknowledged that a 10-K report included language about expanding the company's strategy to permit the sale of Bitcoin from its balance sheet. However, Samuels stated this was not an unconditional plan to sell but rather a move to secure the option to trade at its discretion based on market conditions and capital allocation priorities. MARA Holdings currently holds 53,822 BTC.

22:53

President Donald Trump has urged the passage of the crypto market structure bill known as the CLARITY Act. In a post on Truth Social, Trump criticized banks for holding the bill hostage, stressing that it must be passed as soon as possible to prevent the U.S. from losing its crypto leadership to countries like China. He also pointed to the GENIUS Act, a stablecoin law that took effect last July, accusing the banking sector of exploiting a loophole—a general ban on paying interest on stablecoins—to stifle the crypto industry.

22:53

Coinbase has announced the addition of Limitless (LMTS) to its listing roadmap.

22:45

a16z Crypto has criticized what it describes as the indiscriminate misuse of the term ZK (zero-knowledge) within the industry. The firm stated that many zkVMs (zero-knowledge virtual machines) currently on the market are not genuinely zero-knowledge. According to a16z, most of these systems are not zero-knowledge without undergoing a separate, costly "wrapping" procedure. This process, which involves recursively proving one proof within another zero-knowledge proof system, is not only computationally expensive but also often requires a trusted setup, forcing a compromise on transparency. The firm added that the industry is using "ZK" as a shorthand for systems with small proof sizes and fast verification speeds. However, a16z emphasized that the true essence of ZK lies in privacy protection, specifically in not revealing a prover's sensitive data.

22:39

Ethereum co-founder Vitalik Buterin stated that while he does not believe Ethereum will solve all the world's problems, the technology has the potential to bring fundamental change amid growing concerns about government and corporate overreach, The Block reported. He emphasized that viewing cryptocurrency and Ethereum as more than just an industry could play a crucial role in reducing the risk of a single entity completely dominating the digital world.

On X, Buterin explained that Ethereum's role is to create a digital space where different entities can cooperate and interact, adding that now is the time to focus more on this function. He cautioned against viewing crypto simply as a technology for efficiency or flashiness, in the vein of companies like Apple or Google. Instead, Buterin argued that Ethereum should be seen as part of an ecosystem building a form of safe zone technology. He described this as free, open-source technology that allows people to live, work, communicate, manage risk, build wealth, and collaborate on common goals in a way that is optimized for robustness against external pressures. Achieving this, he said, could lead to de-totalization.

21:56

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

21:54

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

21:01

The three major U.S. stock indices closed lower today.

- S&P 500: -0.94%

- Nasdaq: -1.02%

- Dow Jones: -0.83%

20:40

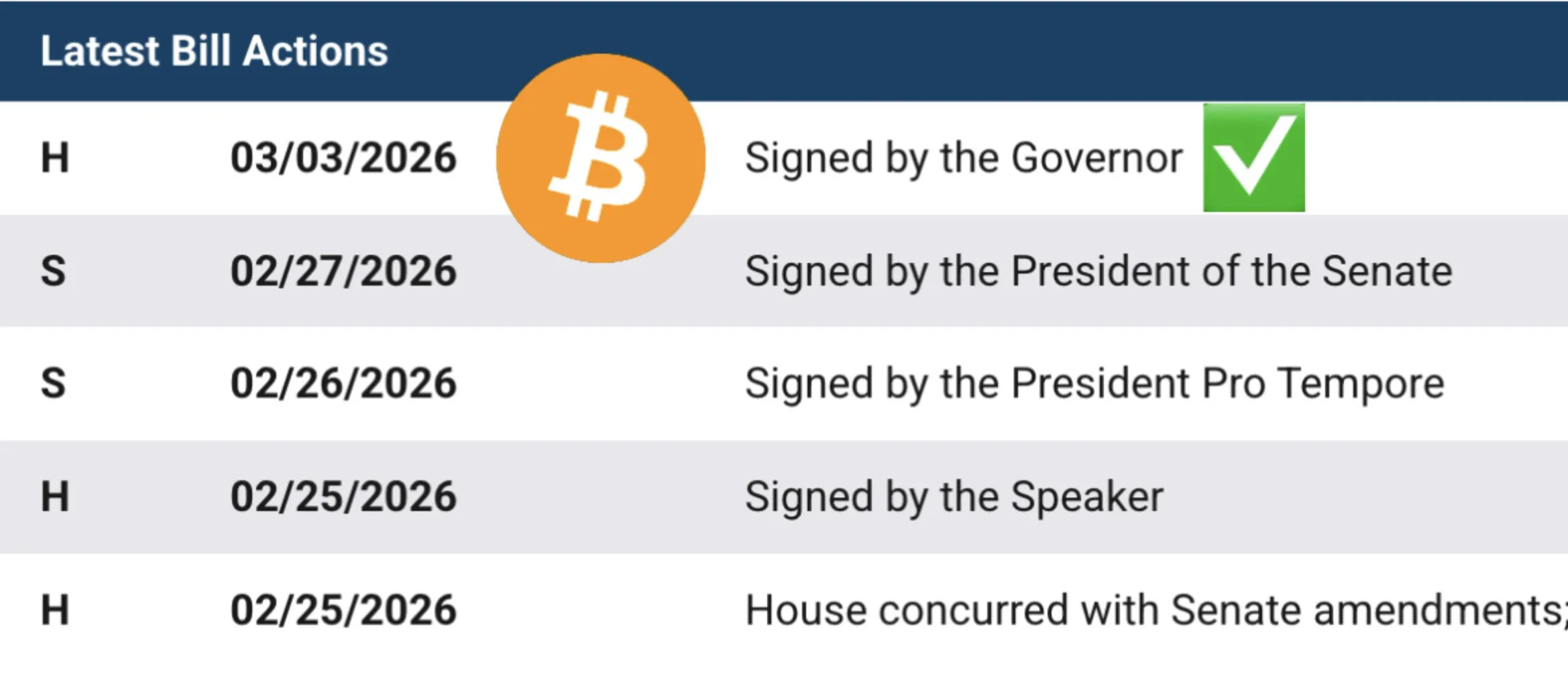

The governor of Indiana has signed Bill 1042, which gives public pensions the option to invest in cryptocurrency, Bitcoin Magazine reported via X.

19:37

U.S. hedge fund veteran Ray Dalio said on a podcast that Bitcoin cannot compete with gold due to structural flaws, including a lack of privacy and the risk of quantum computing. According to U.Today, he argued that central banks will not seek to buy and hold Bitcoin. Dalio added that the cryptocurrency is too highly correlated with tech stocks and that its scale makes it susceptible to manipulation.

18:26

Transportation blockchain solutions provider TCS Blockchain is adopting PayPal's stablecoin, PYUSD, The Block reported. The company plans to use the stablecoin to offer same-day financing and on-chain payments for freight invoices. This move is expected to cut costs by 90% and significantly reduce payment times compared to traditional remittance processes.

18:26

The Financial Action Task Force (FATF) warned in a recent report that stablecoins are increasingly being used for sanctions evasion and money laundering, CoinDesk reported. The report states that stablecoins are now the most-used virtual asset for illicit transactions by several countries, including Iran and North Korea, and account for the majority of illegal on-chain activity. The estimated scale of fraud and illicit activity involving stablecoins in 2024 is approximately $51 billion. The FATF stressed that as stablecoin adoption accelerates, regulators must move quickly to close compliance gaps.

18:03

Global investment bank Mizuho Securities has raised its price target for Circle from $90 to $100 while maintaining a neutral investment rating, CoinDesk reported. Mizuho attributed the 20% rise in Circle's stock price this week to surging oil prices amid heightened tensions in the Middle East. The firm noted that this has lowered expectations for a U.S. Fed rate cut, which is consequently expected to increase Circle's interest income from its reserves.

17:46

Illia Polosukhin, co-founder of Near Protocol (NEAR), predicted that AI agents will become the primary users of blockchain in the future. In an interview with CoinDesk, he envisioned a future where AI serves as the front end and blockchain as the back end. According to Polosukhin, AI will become the main interface layer for all online activities, including crypto, by abstracting away complex elements like wallets and explorers to make them invisible to the user. The goal, he explained, is to make blockchain invisible through AI. In this model, AI agents would interact directly with protocols to handle various tasks while the blockchain operates in the background, leaving humans to simply communicate with the AI. He forecasted that within a few years, AI will function as the front end for everything, much like an operating system.

17:13

U.S. President Donald Trump stated that oil prices could fall below previous levels once the war with Iran concludes, according to Walter Bloomberg. He added that while prices might see a temporary spike, they would ultimately decline.

17:02

Michael Saylor, founder of MicroStrategy (Nasdaq: MSTR), said on X that he is currently buying BTC and asked his followers if they are doing the same.

16:51

Binance has launched its first seven AI agent skills. The new features allow AI agents to access the exchange's spot and wallet data and utilize trading functions through an integrated interface. Key capabilities include querying real-time market data, executing trades with support for OCO, OPO, and OTOCO orders, analyzing address and token information, accessing market ranking data, tracking smart money signals, and detecting contract risks.

16:49

South Korean financial authorities have significantly shortened the government's proposed Digital Asset Act, Maeil Business Newspaper reported. The draft has been reduced to 135 articles from an initial 171 prepared by the ruling party's task force.

A National Assembly official suggested that the Financial Services Commission (FSC) likely removed provisions it was reluctant to implement or found difficult to execute immediately. Notably, regulations concerning bank-led stablecoin issuance, a key point of interest for the virtual asset and financial sectors, are now expected to be delegated to an enforcement decree rather than being specified directly in the act.

The final version of the bill is scheduled for in-depth discussion at a meeting of the FSC's Virtual Asset Committee today, March 4.

16:48

An address believed to belong to the U.S. government transferred 0.3348 BTC ($22,658) to three new addresses over the past hour, Onchain Lens reported.

16:34

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

16:32

The value of cryptocurrency held by U.S. President Donald Trump has fallen by 94%, Watcher.Guru reported. According to data from Arkham, Trump's crypto portfolio was valued at $11.49 million on his inauguration day, Jan. 20, 2025, but has since declined to $700,000. His portfolio is primarily composed of meme coins themed after him, including TRUMP, TROG, and GUA.

16:17

JPMorgan CEO Jamie Dimon criticized demands for yield on stablecoins in an interview with CNBC, emphasizing that the public would pay the price. He warned that it could be a disaster for the U.S. economy if crypto companies offering returns on stablecoin holdings are not regulated while banks are. Dimon argued that the public would ultimately be harmed and the situation would worsen. He added that if crypto firms like Coinbase want to offer stablecoin rewards, they should become banks, after which they could do whatever they want.

16:07

The Central Bank of Brazil plans to hold cryptocurrency exchanges to the same standards as traditional banks, DL News reported. Under a new resolution, exchanges will be required to submit daily reports demonstrating they possess sufficient funds to cover potential costs from hacks or data breaches. The central bank also mandated that these platforms adhere to the same data protection and confidentiality standards applied to commercial banks. Additionally, the bank has issued a new accounting manual that permits crypto firms to record digital assets directly on their financial statements without first converting their value into fiat currency.

16:06

Analysts suggest that Harvard Management Company's (HMC) 21% reduction in its Bitcoin spot ETF holdings during the fourth quarter of last year was likely a risk management measure rather than a fundamental exit from the asset. According to CoinDesk, Michael Markov, co-founder and chairman of Markov Processes International, a firm that studies university endowment funds, explained that cryptocurrency is probably the most volatile component of Harvard's portfolio. He noted that Bitcoin fell by approximately 25% in the fourth quarter, and this sharp price movement likely prompted a portfolio rebalancing by the university. Markov added that this does not signify a strategic change.