Live Feed

Today, March 5, 2026

17:13

Illicit financial activity involving cryptocurrencies is expected to reach an all-time high in 2025, driven by sanctions evasion from countries such as Russia, Iran, and North Korea, according to a report by Chainalysis. Last year, entities under sanctions received at least $104.0 billion in cryptocurrency, CoinDesk reported. This figure represents a nearly eightfold increase compared to 2024. The total value of illicit crypto transactions hit a record $154.0 billion. Chainalysis highlighted the case of A7A5, a ruble-pegged stablecoin issuer, explaining that it served as a payment system enabling sanctioned Russian companies to engage in cross-border trade. The token is said to have processed $93.3 billion in transactions in less than a year.

16:55

CleanSpark (CLSK) sold most of the Bitcoin it mined last month, CoinDesk reported. The company mined 568 BTC in February and sold 553 of them for $36.65 million, at an average price of $66,279. The proceeds are believed to have been used to fund the company's pivot into high-performance computing (HPC) and artificial intelligence (AI). As of the end of last month, CleanSpark held 13,363 BTC.

16:47

Russian lawyers are finding cryptocurrency holdings to be a major hurdle in divorce proceedings, DL News reported. They noted that since the monetary value of tangible and intangible assets can only be assessed in fiat currency, experts are required to determine the value of cryptocurrencies. The lawyers anticipate that as crypto's popularity grows in Russia, the number of related disputes in divorce cases will also rise.

Anastasia Madi, a family law attorney at Kislov Law Firm, described Bitcoin, altcoins, and stock options as the most difficult assets to divide during a divorce. She explained that while Russian law recognized crypto as a form of intangible asset in 2020, the process remains complex. It involves difficult tasks such as proving actual ownership, calculating the asset's value in rubles, and compelling the disclosure of private keys and wallet information.

16:47

Prediction market traders are optimistic about Bitcoin's short-term upside but are less confident about Ethereum (ETH), Decrypt reported. Traders on Myriad Markets see a higher probability of BTC rising to $84,000 before falling to $55,000. For ETH, however, they see a greater chance of it dropping to $1,500 before rising to $3,000. On the platform Kalshi, the probability of ETH trading above $2,500 this month is seen as 39% or less. Meanwhile, some predictions on Polymarket suggest ETH could lose its spot as the second-largest cryptocurrency by market capitalization this year.

16:39

Whale Alert reported that 430,000,000 USDT has been transferred from HTX to Aave. The transaction is valued at about $430 million.

16:20

Multiple officials from Russia's Ministry of Finance are considering introducing a new bill specifically for stablecoins, DL News reported. They added that they want to propose this legislation separately from the broader cryptocurrency regulations scheduled to take effect on July 1. Meanwhile, Alexei Yakovlev, Director of the Financial Policy Department at the ministry, stressed that stablecoins hold immense and even astronomical potential.

16:20

U.S. President Donald Trump said in an interview with Axios that the United States should be directly involved in the selection of Iran's next leader.

16:15

Doppler, a token launch platform on the Ethereum Layer 2 network Base, is expanding its services to the Solana (SOL) network, The Block reported. The company explained that this move involves more than simple support, as it will optimize for Solana's architecture and programming model. Currently, the Solana network leads in new token creation, largely due to the influence of platforms like Pump.fun (PUMP), with Base ranked second.

16:08

According to CoinNess market monitoring, BTC has fallen below $71,000. BTC is trading at $70,976.3 on the Binance USDT market.

16:00

International seafarers' unions and the shipping industry have declared the Middle East Gulf region, including the Strait of Hormuz, a Warlike Operations Area. The designation gives seafarers the right to refuse to sail into the region, Walter Bloomberg reported.

15:46

The U.S. Internal Revenue Service (IRS) has proposed a plan to grant crypto exchanges like Coinbase and Kraken the authority to issue tax documents electronically, The Block reported. Previously, exchanges were required to offer users the option to receive paper copies, but this proposal would remove that obligation, allowing for electronic-only issuance. This change is in line with the cryptocurrency transaction reporting system implemented this year, which requires brokers, including exchanges, to report gross proceeds and cost basis from cryptocurrency sales to the IRS. The agency plans to use this data for taxation. The proposal will be discussed for implementation following a public comment period.

15:22

The U.S. Federal Bureau of Investigation (FBI) has arrested John Daghita for allegedly stealing $46 million in cryptocurrency that had been seized and was under the management of the U.S. Marshals Service (USMS), Aggr News reported. Daghita, who operated under an online alias, is the son of the president of CMDSS, a firm contracted by the USMS to manage government assets. He is accused of transferring the cryptocurrency from USMS custody to his personal wallet and then attempting to launder it. On-chain analyst ZachXBT had previously exposed Daghita's alleged activities in a post on X this past January.

14:47

An address associated with crypto market maker Flowdesk deposited 1.61 million LINK ($15.19 million) and 6,091 ETH ($12.92 million) to Binance over the past 20 minutes, according to Onchain Lens. The total value of the deposit is approximately $28 million. Such transfers to exchanges are often interpreted as a precursor to selling.

14:43

According to CoinNess market monitoring, BTC has fallen below $72,000. BTC is trading at $71,959.47 on the Binance USDT market.

14:39

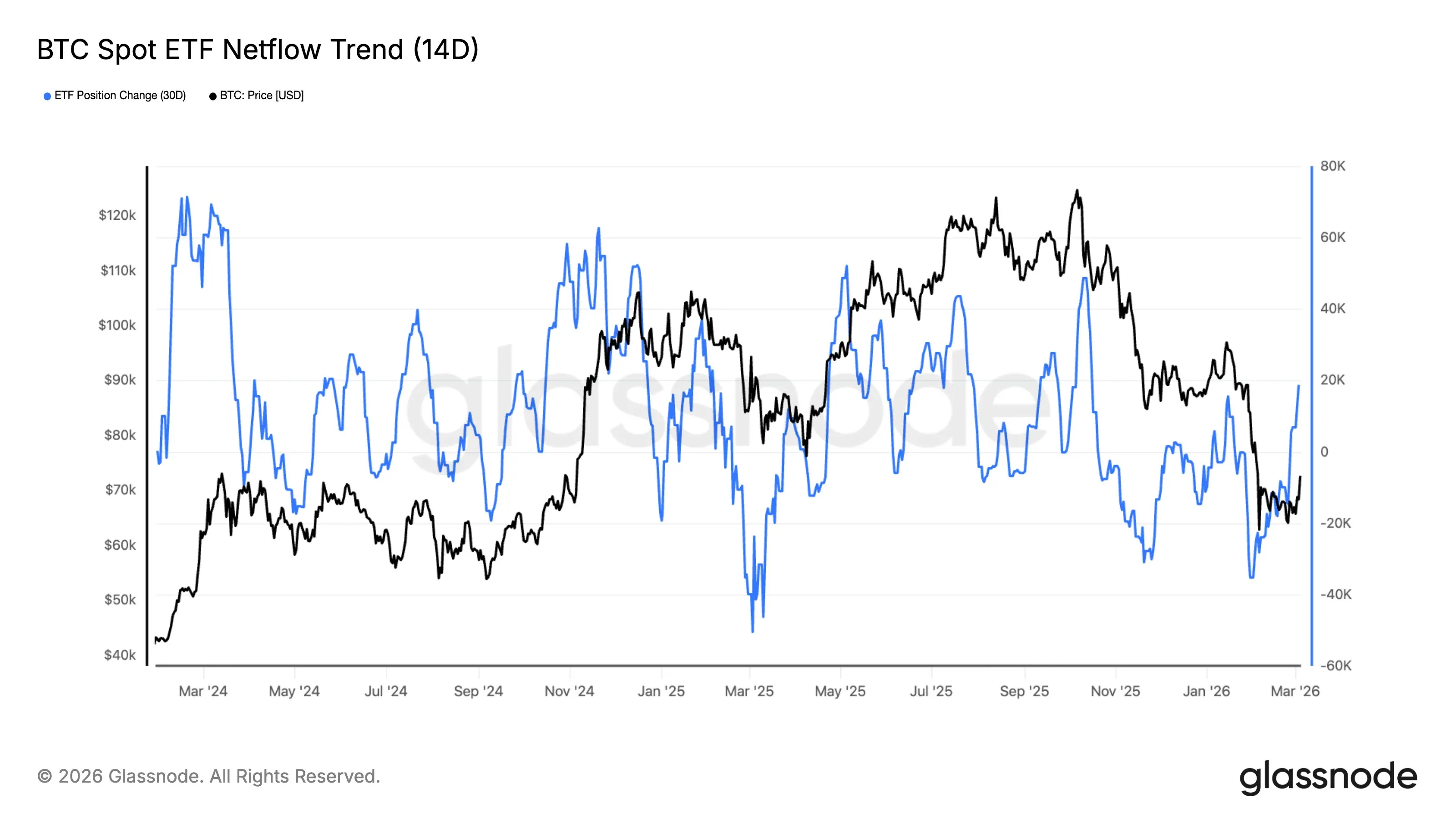

Glassnode reported that Bitcoin spot ETF fund flows are showing signs of stabilizing after a period of sustained outflows. The firm noted that netflow turned positive again on Feb. 14 as Bitcoin broke through the $70,000 mark, suggesting that selling pressure is easing. While demand from institutional investors remains uncertain, the analysis concluded that early signs of accumulation are emerging.

14:31

The three major U.S. stock indices opened lower today.

- S&P 500: -0.45%

- Nasdaq: -0.40%

- Dow Jones: -0.80%

13:59

Cryptocurrency mining firm Core Scientific (CORZ) has announced it secured up to $1 billion in strategic financing from Morgan Stanley. The agreement includes an initial 364-day loan commitment of $500 million, with an accordion option to increase the amount by an additional $500 million subject to certain conditions. Core Scientific recently announced a strategic shift to become an AI data center infrastructure company and revealed that it sold 1,900 BTC ($175 million) in January.

13:57

Institutional investors have not engaged in panic selling during the initial stages of Bitcoin's decline, according to a report from European crypto asset manager CoinShares. CoinDesk reported that while professional investors and asset managers have slightly reduced their exposure and hedge funds have deleveraged to move into other markets, their overall positions have remained at levels similar to last year. The report added that long-term investors, including endowments, pension funds, and sovereign wealth funds, are continuing to quietly accumulate BTC.

13:43

Cryptocurrency exchange BackPack announced it has appointed Mark Wetjen, a former Commodity Futures Trading Commission (CFTC) Commissioner and Acting Chairman, as president of its U.S. entity.

13:42

Tether, the issuer of USDT, announced a strategic investment in the global payments infrastructure company Axiym. Axiym aims to build a global decentralized finance and settlement infrastructure within a regulatory framework. The company also plans to expand the circulation of USDT by natively integrating USDT-based payments.

13:40

Iran has attacked a U.S. military headquarters in Erbil, Iraq, with drones, Walter Bloomberg reported.

13:33

Whale Alert reported that 2,625,767 SOL has been unlocked from escrow at an unknown wallet.

13:32

Whale Alert reported that 2,318,449 SOL has been unlocked from escrow at an unknown wallet.

13:30

New U.S. weekly jobless claims totaled 213,000 for the week of Feb. 22–28, coming in below the forecast of 215,000. The weekly jobless claims figure is a key indicator the Federal Reserve uses to assess the labor market when making interest rate decisions. A higher-than-expected number signals an increase in layoffs, suggesting a cooling labor market and potentially providing the Fed with a reason to cut interest rates. Conversely, a lower-than-expected figure points to a robust labor market, which could support the Fed's decision to hold or raise rates to focus on curbing inflation.

13:19

London-based neobank Revolut has applied for a banking license with the U.S. Office of the Comptroller of the Currency (OCC), CoinDesk reported. If granted, the license would allow Revolut to operate in the U.S. in a manner similar to a traditional bank, giving it direct access to the Federal Reserve's (Fed) payment systems, including Fedwire and the Automated Clearing House (ACH). The company would also be able to offer lending products such as credit cards and personal loans. Revolut currently provides account and payment services in the U.S. through its partner, Lead Bank.