South Korean crypto-only exchanges on the brink of closure

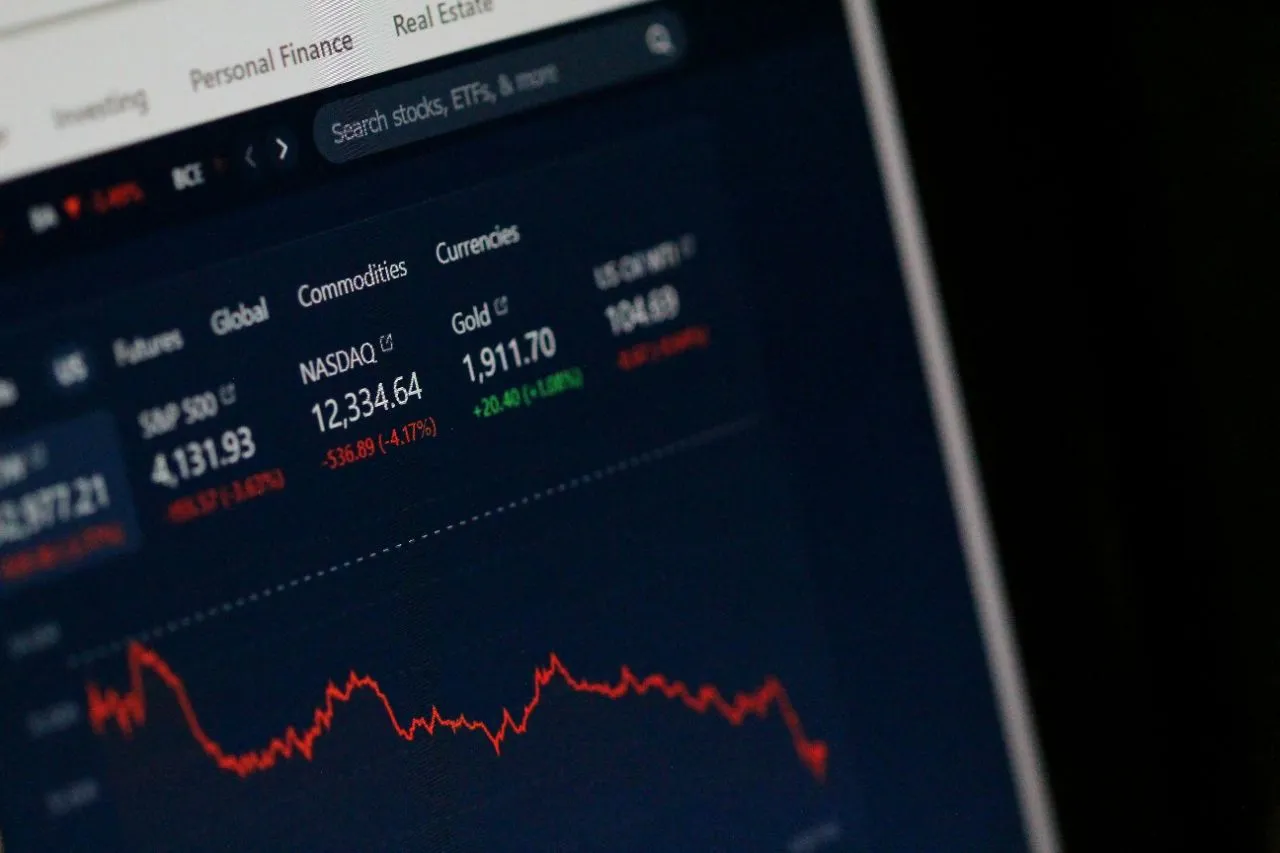

Several South Korean crypto-only exchanges have long been struggling to keep their business afloat due to their prolonged weak performances. The local news outlet Etoday reported that the persistent underperformance of these local crypto exchanges is mounting pressure on their corporate operation and management, resulting in them shutting down their businesses. The situation hinders them from meeting the requirements set by the Financial Intelligence Unit (FIU) of the Financial Services Commission (FSC).

Their inability to generate sufficient revenue, due to faltering token trading volumes, makes complying with the FIU guidelines a daunting task.

Cascading closure of crypto exchanges

According to crypto industry insiders, local crypto-only exchanges including Cashierest, Coinbit, Huobi Korea, Probit and Tennten have announced their service closure as early as the second half of last year. On Nov. 6, Cashierest announced it was shutting down its services, with Coinbit following suit in the same month. The cascading closure announcements from crypto exchanges raised concerns about their potential harm on investors.

In an effort to protect crypto investors, the FIU has released a statement that local crypto exchanges are obliged to meet the requirements of the FIU in compliance with the Virtual Asset User Protection Act, despite their closing of services. Furthermore, the regulator said finalizing business closure requires due assessment by the FIU.

"Virtual asset service providers (VASPs) must notify their users of the closure and explain how to reclaim their assets at least one month before the business closing date. They must also support users to withdraw their assets for at least three months before closing," the FIU stated.

Struggling to meet FIU requirements

However, some point out that it would be challenging for near-bankrupt crypto exchanges to run a customer service center for more than three months. Some exchanges allow users to deposit and withdraw their assets until their closure, as they would under normal conditions, but charge additional fees afterward. "It is very demanding to operate customer services when we're seeing no actual gains," one exchange official said.

It has been found that some crypto exchanges failed to register a change in their business state with the FIU, which is mandatory in the event of business location or contact changes, under the Financial Transaction Reports Act.

When Etoday reporters visited the offices of some of these crypto exchanges, they were met with empty rooms. One person who is familiar with the matter said, "The exchange has moved its office to another location and is scheduled to resume service in March."