MUFG pushes into tokenized finance as Japan enters a new political chapter

Japan’s largest bank is stepping deeper into digital assets at a moment of political change. Mitsubishi UFJ Financial Group (MUFG) and its securities arm Mitsubishi UFJ Morgan Stanley Securities (MUMSS) have launched a blockchain-based business, according to CoinDesk Japan. The move puts the country’s biggest lender at the center of a fresh push to bring regulated finance onto distributed ledgers while retail investors gain a new way to buy and trade tokenized products.

MUMSS has begun offering bond security tokens, marking its formal entry into the security token market. At the same time, the firm introduced ASTOMO, a trading venue for retail investors built with Japanese fintech company Smartplus. The system will debut with real estate-backed security tokens. Individuals can invest from 100,000 yen (about $655) through a smartphone app. Under the partnership MUMSS will select and source the digital securities. Smartplus will run account management and build and operate the trading system using its Brokerage as a Service (BaaS) platform.

MUFG also revealed that it has started preparing a public offering of subordinated bonds in token form. The bank intends the instruments to qualify as Tier 2 capital under international rules. The offering is expected to be the first of its kind for Japan’s banking sector. MUFG has submitted an amended securities registration statement to the Director General of the Kanto Local Finance Bureau in advance of the sale.

Takaichi’s victory sparks interest in Japan’s crypto path

The corporate steps arrive as conservative lawmaker Sanae Takaichi rises to lead the ruling Liberal Democratic Party. She won the party election on Oct. 4 and is set to become Japan’s first female prime minister, with lawmakers expected to make the formal choice in the middle of this month.

Several industry voices see her leadership as supportive of digital assets, according to Cointelegraph. Elisenda Fabrega, general counsel at tokenization platform Brickken, said Takaichi’s victory might reshape how Japan perceives and regulates digital assets, reinforcing the country’s commitment to clear and reliable crypto laws.

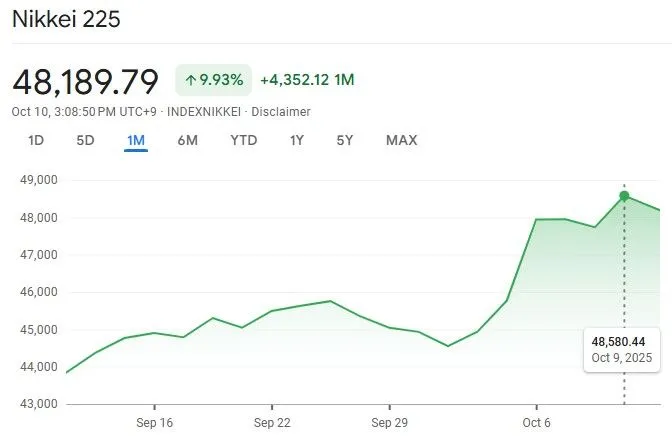

Maarten Henskens, chief operating officer at Startale Group and head of the Astar Foundation, chimed in to say that a looser monetary stance under Takaichi could keep liquidity flowing and drive greater investor interest in alternative assets such as cryptocurrencies. That optimism has already spilled into Japan’s equity markets. The Nikkei index has continued to soar since the leadership vote, reaching a record high of 48,580.44 on Oct. 9.

Not all signals point in the same direction. A BeInCrypto report published before the election noted market predictions that Takaichi might also back tighter oversight. The report cited her March proposal to build a framework that lets financial institutions, including crypto exchanges, share information on suspicious transactions. That system would support faster account freezes.

Loose fiscal tone brings new pressures for Bitcoin

From a broader economic view, the picture looks more complex. CoinDesk reported that Takaichi’s preference for easy Abenomics-style policies could weigh on Bitcoin in the short term. Expansionary fiscal measures tend to increase bond supply and drive yields higher, which often curbs risk appetite by raising borrowing costs and making assets like stocks and cryptocurrencies less appealing. Her stance has also reduced expectations for a Bank of Japan rate hike, weakening the yen and strengthening the U.S. dollar. The stronger dollar has cooled Bitcoin’s momentum, while gold has continued to attract investors seeking stability.

MUFG’s blockchain venture arrives at a turning point for Japan. The bank’s push into tokenized assets shows how traditional finance is adapting to digital change just as new leadership tests the balance between innovation and control. Whether this marks the start of a broader transformation will depend on how policy, regulation, and investor confidence evolve together in shaping Japan’s financial future.