China Performs Well as Global Crypto Industry Employment Surpasses 190,000

According to new data, the cryptocurrency industry has seen a remarkable surge in employment, with nearly 190,000 individuals currently working in the field as of July 2023, with China fairing particularly well despite its hostile approach to crypto.

This figure represents a significant increase compared to pre-2020 employment statistics, marking the onset of the crypto frenzy. The data was produced via a report published by K33 Research, a Norway-based digital assets research and data analysis firm.

India leads in Asia

The data highlights an over-representation of crypto workers in the Western world, with more than 50% based in North America and Europe. Within this figure, the United States alone accounts for 29% of the crypto workforce. In Asia, India emerged as the leading employer in the crypto industry, employing 20% of the regional workforce, primarily in developer-related roles. Surprisingly, despite China’s historically hostile stance on the crypto industry, it stands as the second-largest employer in Asia, employing 15% of the regional workforce.

It’s also interesting that China has been found to account for such a sizable chunk of Web3-related employment when recent feedback from recruiters in Hong Kong suggest that the crypto licensing program rolled out in the autonomous Chinese territory has not yet resulted in a surge in employment. Recruiters maintain though, that this employment boost will come in due course.

Most employment via exchanges

During 2021, a period characterized by high prices and soaring company valuations, the crypto industry employed approximately 211,000 individuals, highlighting the industry’s rapid growth. Researchers from K33 found that around one-third of the crypto workforce is engaged in exchanges or brokerages, emphasizing the crucial role these entities play. Additionally, 26% of employees work for companies offering a diverse range of financial services related to cryptocurrencies.

Interestingly, the study revealed that NFTs occupy only a small portion of the workforce, with only 6% of individuals involved in this field. On the other hand, 21% contribute their skills to blockchain protocols, analytics, and mining operations. The remaining 13% hold cryptocurrency-related jobs that do not neatly fit into any specific category. The researchers employed various methods, including LinkedIn searches, AI-assisted web searches, and manual mappings, to gather this data.

Remote working

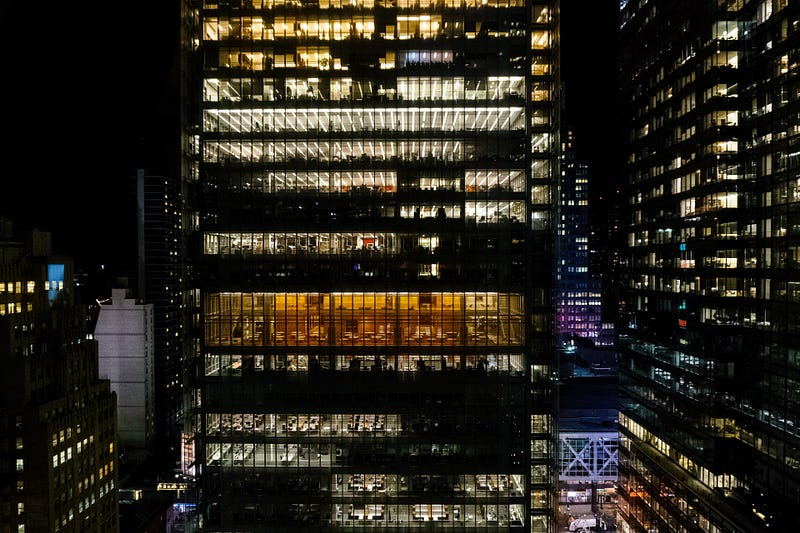

A notable trend in the crypto industry is the prevalence of remote work arrangements. Major crypto companies have opted for globally distributed workforces, capitalizing on jurisdictions with favorable regulations and lower tax rates. By establishing headquarters in these locations, but employing individuals remotely or establishing local offices worldwide, companies can reduce costs and eliminate logistical barriers.

The significant growth in crypto industry employment reflects the expanding and maturing nature of the sector. As cryptocurrencies and blockchain technology gain wider acceptance, professionals from various backgrounds are entering the industry, contributing their skills to different sectors within the crypto ecosystem. The prevalence of remote work arrangements and the global nature of the industry allow talent to be sourced from around the world, transcending geographical boundaries.

This upward trajectory in employment is likely to continue as the crypto industry evolves and continues to shape the future of finance and technology.