Conan Korea launches open beta service for decentralized storage network

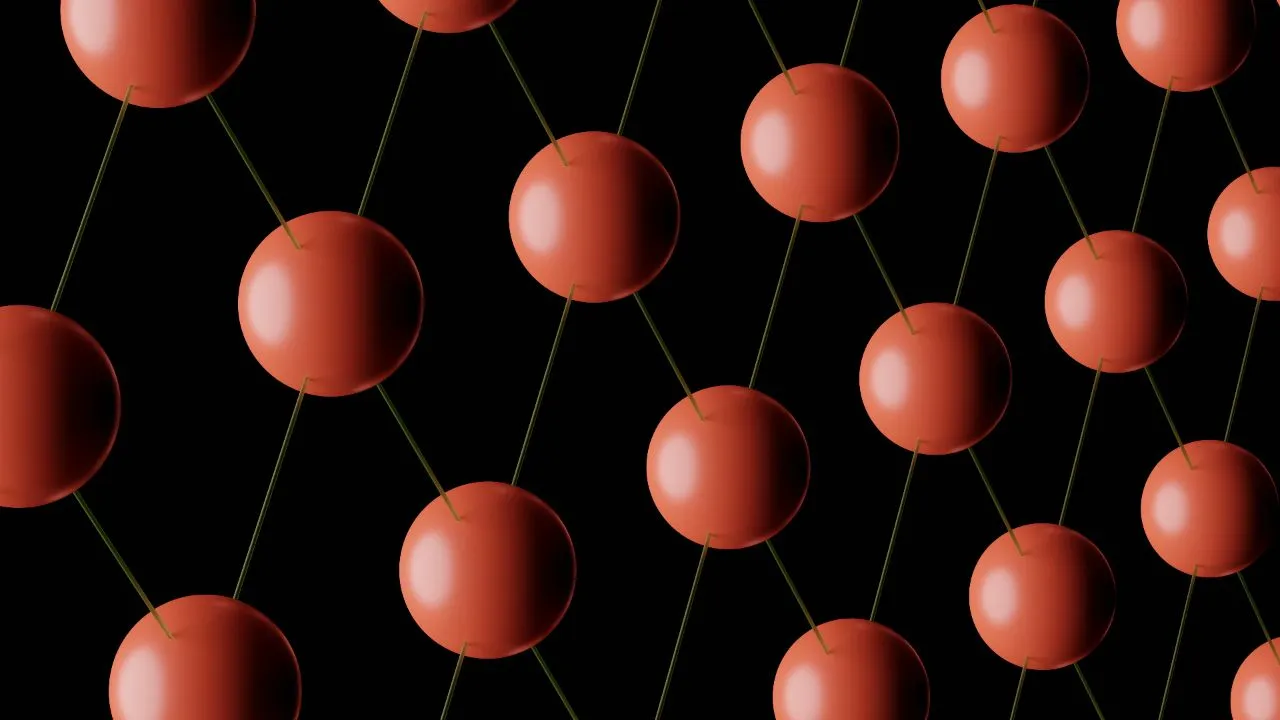

Conan Korea has launched an open beta service for OceanDrive, a desktop platform that contains a network of decentralized computer storage for users to share and explore their digital assets, according to an article published by South Korean news outlet Asia Times on Monday (KST). In comparison to cloud storage, which is subject to service provider policies, has no reward system, and relies on centralized servers, OceanDrive distributes storage across multiple nodes, is equipped with user-controlled access and encryption, and provides incentives for participation and contribution.

"The blockchain market is currently transitioning from NFTs to decentralized physical infrastructure networks (DePIN), which combines digital currency and physical infrastructure. OceanDrive is a platform optimized for the DePIN paradigm and is now making its market debut after four years in development,” explained Pyo Se-jin, CEO of Conun Korea.

Global collaboration

The project aims to create a vast network of storage resources scattered across the globe, all while providing users with cost efficiency, rewards and opportunities for collaboration and sharing of knowledge.

"We hope that this open beta service will give people a chance to experience OceanDrive’s user-friendly system and recognize its difference from cloud storage," Conun Korea said. "We are currently working on implementing OceanDrive into a popular Korean fashion boutique as well as a major online educational institution."

2024 plans

Through this open beta service, the company plans to build a blockchain network infrastructure platform of the highest quality by overcoming the shortcomings of OceanDrive and maximizing its advantages so it can be used not only domestically, but abroad as well.