Asia-Pacific leads a wider crypto uptake as legal and security risks persist

A new report indicates that the global use of cryptocurrency is not only growing but also quickening, with the Asia-Pacific (APAC) region setting the pace. According to the sixth Chainalysis Global Crypto Adoption Index, released on Sept. 2, India has emerged as the new leader in overall adoption across 151 countries. The index analyzes where value is being transferred, how new users are entering the ecosystem, and which areas are experiencing the most rapid expansion.

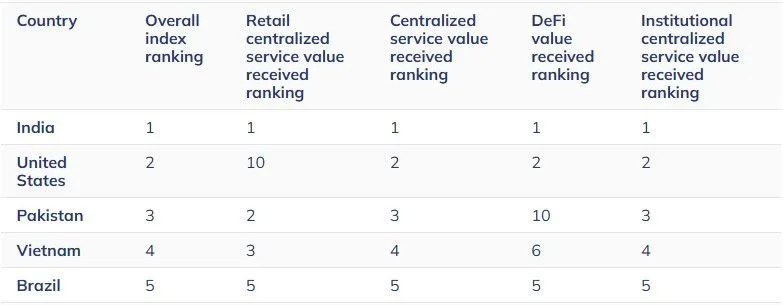

India leads global crypto adoption

India now holds the top spot in the overall index, with the U.S. following in second place. The APAC region demonstrates significant momentum, with Pakistan (3rd), Vietnam (4th), Indonesia (7th), and the Philippines (9th) all securing positions in the top ten. Further down, South Korea and Japan are ranked 15th and 19th, respectively.

The picture changes when the data is adjusted for per capita GDP, which highlights grassroots movements. By this measure, Ukraine ranks first, followed by Moldova, Georgia, and Jordan. Hong Kong comes in fifth, Vietnam sixth, while Singapore and South Korea rank 16th and 18th, respectively.

Regional transactions surge as APAC gains ground

On-chain transaction data confirms a shift in economic gravity. In the year ending June 2025, APAC's transaction value soared by 69% year-over-year, climbing from $1.4 trillion to $2.36 trillion. While Europe ($2.6 trillion) and North America ($2.2 trillion) still handle larger absolute volumes, growth is accelerating nearly everywhere. APAC's growth rate more than doubled from 27% to 69%, while Latin America's rose from 53% to 63%.

In terms of capital entering the crypto market via centralized exchanges, the U.S. leads as the largest fiat on-ramp, processing over $4.2 trillion. This is approximately four times the volume of South Korea (over $1 trillion), while the EU recorded just under $500 billion. Asset preferences also show regional variations; Bitcoin accounted for 47% of purchases in the U.K. and 45% in the EU, but just over 20% in South Korea.

India's top ranking aligns with the latest domestic developments, such as the Independence Day launch of the Bitcoin Policy Institute India, which aims to focus on sovereign mining, policy, and education.

Legal and security challenges in India

However, this rapid growth is accompanied by notable legal and security hurdles. In a high-profile case, an Indian anti-corruption court sentenced 14 individuals, including 11 police officers, to life in prison for a 2018 kidnapping and crypto extortion scheme.

In another development, creditors of India's crypto exchange WazirX approved a new restructuring plan over a year after a $234 million hack allegedly linked to North Korea’s Lazarus Group. An earlier proposal was rejected by the Singapore High Court in April. The revised plan shifts oversight of recovery tokens—representing outstanding balances—from WazirX’s Singapore entity to Zanmai India, regulated by India’s financial authority, with repayments funded by profits and recovered assets. Some 150,000 creditors, representing $206 million in claims, voted between July 30 and Aug. 6 as WazirX also moved operations to a Panama-based unit called Zensui. Separately, on April 16, India’s Supreme Court dismissed a petition from 54 hack victims, ruling it lacked authority to legislate on crypto policy.

While India’s headlines highlight the frictions of rapid growth, the broader picture is clearer. The Chainalysis index illustrates a global crypto market expanding across all income levels for varied reasons. In developed nations, clearer regulations and institutional involvement are key drivers. In many emerging economies, factors like remittances and access to U.S. dollars via stablecoins are more prominent.