Korean Investment Firm Partners with Open Asset to Build Security Token System

Korea Investment and Securities (KITC), one of the major securities firms in the nation, announced today that it signed a memorandum of understanding (MOU) last week with Seoul-based blockchain developer Open Asset to construct a distributed ledger system for a security token alliance led by KITC. That’s according to a report by local news outlet Dailian.

Security token group

In March, KITC initiated a security token group called “Korea Investment ST Friends” in collaboration with online banks Kakao Bank and Toss Bank, as well as Kakao Enterprise, an artificial intelligence (AI) solution provider. The primary objective of this alliance is to establish the necessary infrastructure for issuing products suitable for security tokens.

Tech expertise

Open Asset, led by its CEO Kim Kyung-up, boasts a team of tech talents. The company played a key role in the Bank of Korea’s central bank digital currency (CBDC) project and participated in the development of Kakao-backed initiatives such as the blockchain platform Klaytn and the digital wallet Klip.

Future system integration

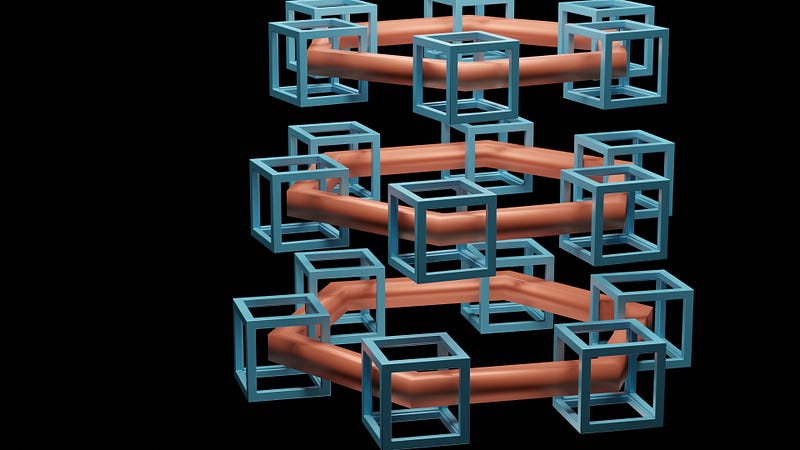

The partnership with Open Asset aims to integrate the forthcoming distributed ledger system into KITC’s existing securities trading platform, creating synergies for its business. Additionally, the two entities are exploring the possibility of connecting the new platform with the systems of other participants in the group in the future.

Choi Seo-ryong, the head of the platform division at KITC, emphasized the investment firm’s objective of establishing market standards for security tokens that offer numerous possibilities. He added that KITC will work with Open Asset to develop an innovative and efficient system.